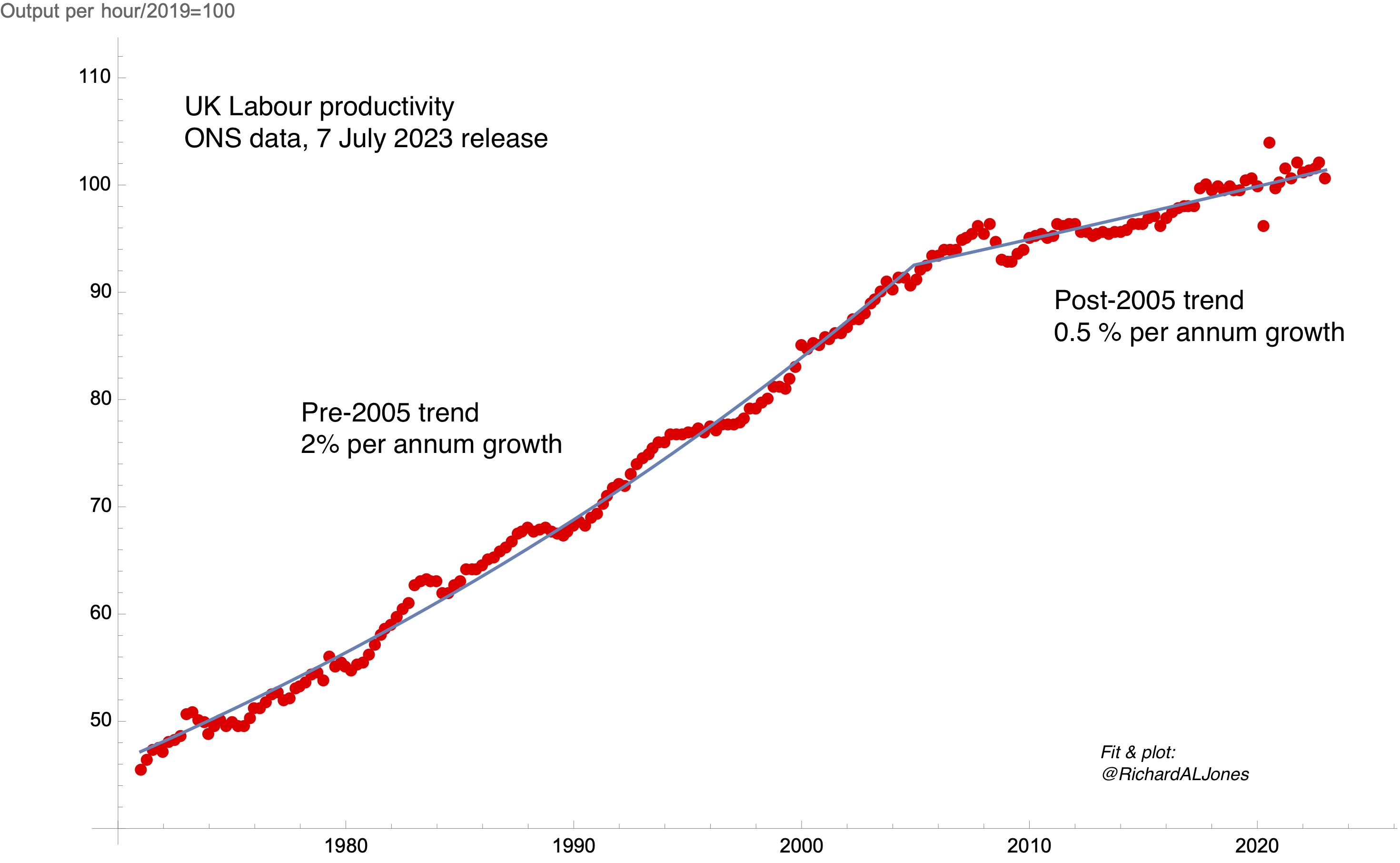

The UK is now effectively right into a second decade of sluggish productiveness development, with far-reaching penalties for folks’s way of life, for the sustainability of public companies, and (arguably) for the broader political atmosphere. It has grow to be normal up to now the start of this new interval of sluggish productiveness development to the worldwide monetary disaster round 2008, however I more and more suspect that the roots of the malaise had been already in place earlier within the 2000s.

UK Labour productiveness. Knowledge: ONS, Output per hour labored, chained quantity measure, 7 July 2023 launch. Match: non-linear least squares match to 2 exponential development capabilities, steady at break level. Finest match break level is 2004.9.

My plot exhibits the newest launch of whole-economy quarterly productiveness knowledge from the ONS. I’ve fitted the information to a perform representing two durations of exponential development, with totally different time constants, constrained to be steady at a time of break. There are 4 becoming parameters on this perform – the 2 time constants, the extent on the break level, and the time of break. My finest match exhibits a break level at 2004.9.

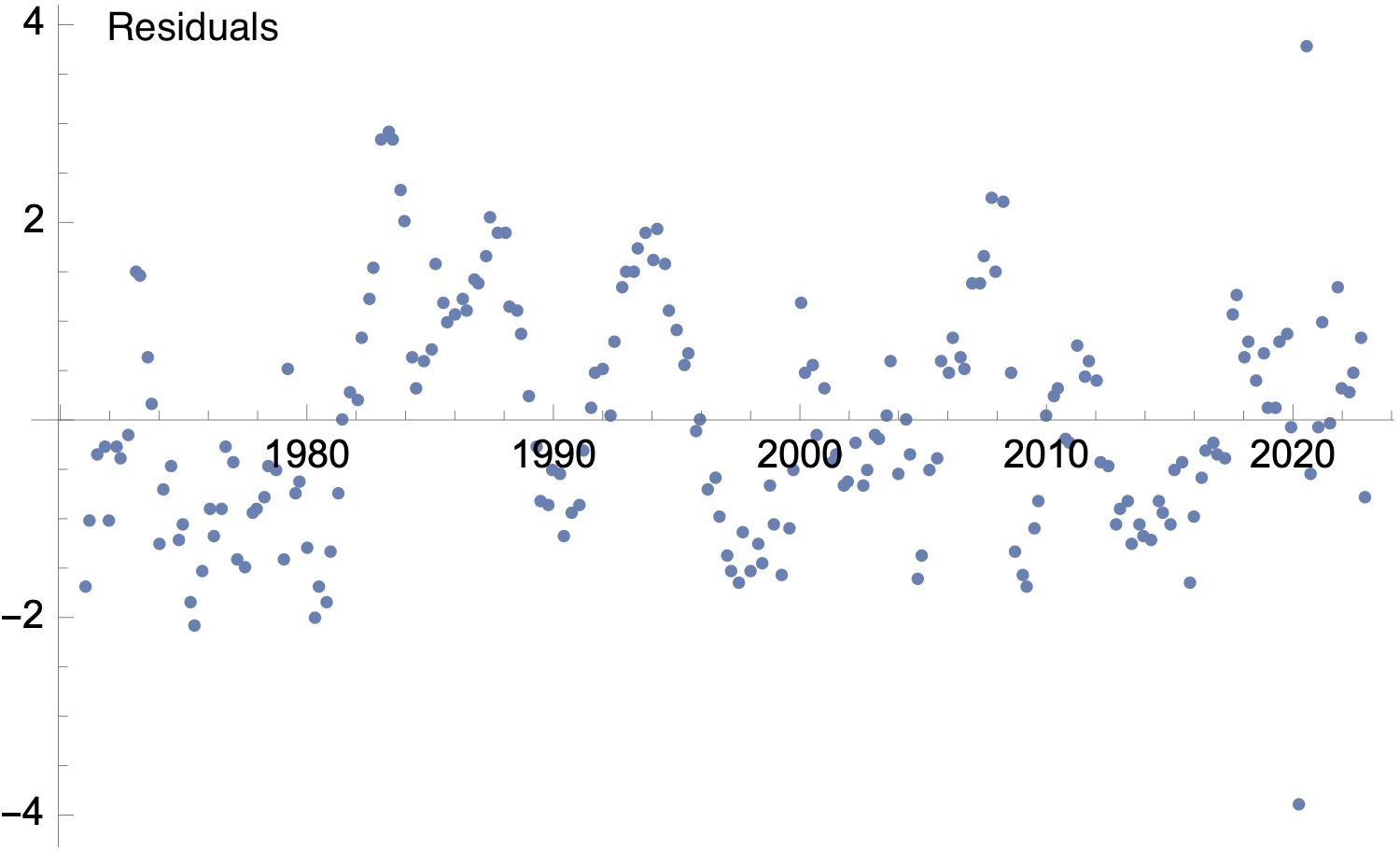

Residuals for the match to the quarterly productiveness knowledge proven above.

The plot of the residuals to the match is proven above. This exhibits that the goodness of match is comparable throughout the entire time vary (excluding the spikes representing the impact of the pandemic). There are deviations from the match equivalent to the impact of booms and recessions, however the deviations across the time of the World monetary disaster are comparable with these in earlier growth/bust cycles.

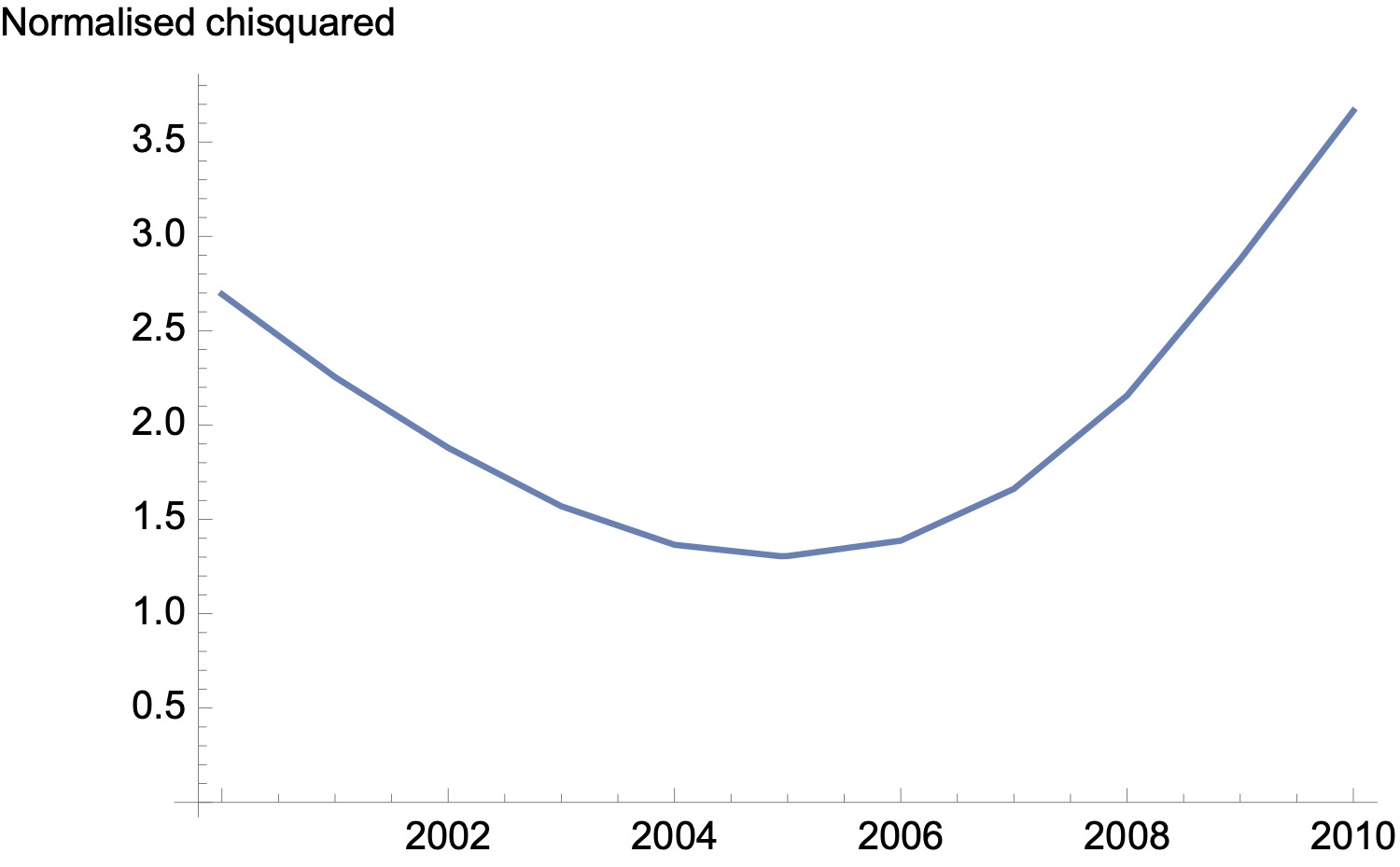

How delicate is the match to the timing of the break level? I’ve redone the matches constraining the yr of the break level, and calculated at every level the normalised chi-squares (i.e. the sum of the squared variations between knowledge and mannequin, divided by the variety of knowledge factors). That is proven beneath.

Normalised chi-squared – i.e. sum of the squares of the variations between productiveness knowledge and the 2 exponential mannequin, for matches the place the time of break is constrained.

The goodness of match varies easily round an optimum worth of the time of break close to 2005. A time of break at 2008 produces a materially worse high quality of match.

Can we quantify this additional and fix a likelihood distribution to the yr of break? I don’t suppose so utilizing this method – now we have no cause to suppose that the deviations between mannequin and match are drawn from a Gaussian, which might be the idea underlying conventional approaches to ascribing confidence limits to the becoming parameters. I imagine there are Bayesian approaches to addressing this drawback, and I’ll look into these for additional work.

However for now, this leaves us with a speculation that the character of the UK financial system, and the worldwide context during which it operated, had already made the transition to a low productiveness development state by the mid-2000’s. On this view, the monetary disaster was a symptom, not a trigger, of the productiveness slowdown.