Information

Rewheel figures present that T-Cellular’s buy of Dash has helped maintain US cellular costs excessive

In accordance with a brand new report from Rewheel, T-Cellular’s acquisition of Dash in 2020 has contributed to the exorbitant cellular costs within the US.

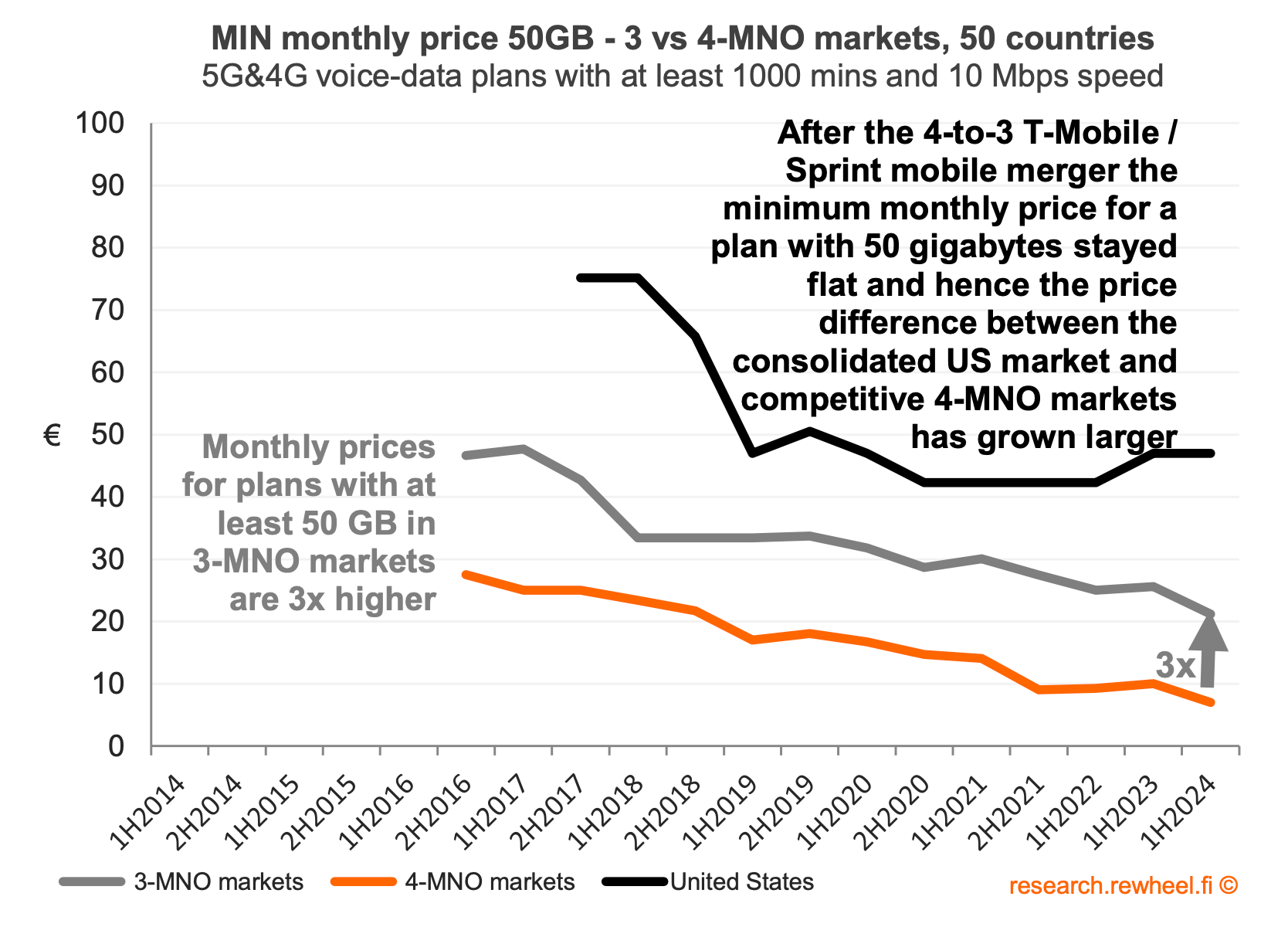

“5 years on, the Dash / T-Cellular 4-to-3 cellular merger made the US some of the costly cellular markets on the planet,” the agency wrote in the report. “Whereas month-to-month costs have been falling and proceed to fall throughout cellular markets and whereas the identical was true within the US cellular market previous to the merger, after the merger costs within the US both stopped falling altogether or fell at a a lot slower charge. The 4-to-3 cellular merger within the US led to larger costs and shopper hurt.”

Usually, Rewheel reported, “month-to-month costs are 2-3x larger and gigabyte costs are 5-6x larger in markets with solely 3 cellular operators,” as in comparison with markets with 4 cellular operators. The findings have been based mostly on the month-to-month worth of 50GB in voice and information plans with no less than 1000 minutes and 10 Mbit/s speeds.

In contrast, the CTIA, the US wi-fi business’s principal commerce affiliation, present in its newest annual report that “the fee per megabyte of information decreased by 98% from 2012 to 2022.” The CTIA’s report additionally famous that 5G’s entrance into the house broadband market has elevated competitors and offered financial savings, even for non-subscribers.

For years, Rewheel has tracked international wi-fi business costs. Its newest report echoes predictions the agency made in anticipation of T-Cellular’s $26 billion buy of Dash, which was then the fourth-largest wi-fi community operator within the US. Whereas T-Cellular petitioned for regulatory approval of the acquisition in 2018, Rewheel reported that cellular costs for customers sometimes fall at a quicker charge in markets with 4 gamers.

As a part of T-Cellular’s efforts to safe federal approvals for the acquisition of Dash, T-Cellular assured regulators that the cellular market would nonetheless have 4 cellular gamers. To realize this, T-Cellular and the US Division of Justice (DoJ) struck an settlement with Dish Community to place Dish because the nation’s fourth nationwide supplier.

Whereas Dish has, up to now, met its federal obligations underneath this deal, it continues to battle within the US wi-fi market. Dish confirmed in June 2023 that its 5G community lined 70% of the US inhabitants, satisfying Federal Communications Fee (FCC) necessities. Nevertheless, Dish has confronted challenges within the postpaid wi-fi enterprise and is presently struggling to finance its 5G community buildout.

When T-Cellular acquired Dash, each corporations argued the merger would create a extra environment friendly firm with low costs. Now, T-Cellular, together with Verizon and AT&T, is seeking to increase costs for patrons.

There are rumblings about additional consolidation plans. T-Cellular and Verizon are reportedly in discussions to amass elements of US Mobile. The information comes scorching on the heels of T-Cellular’s acquisition of Ka’ena Company, the proprietor of Mint Cellular, and of its acquisition of Lumos by way of a three way partnership with EQT.

The Wall Road Journal has steered that one motive for the piecemeal sale of US Mobile, versus a wholesale takeover, is to keep away from the ire of US competitors authorities and the kind of scrutiny the T-Cellular/Dash merger has attracted.

Additionally within the information:

Spanish regulators clear Zegona’s acquisition of Vodafone Spain

UK’s quickest supercomputer switched on

EXA Infrastructure continues growth in North America with new route between Ashburn and Atlanta