Everybody now agrees that the UK has a major problem of financial progress – or lack of it – even when opinions differ about its causes, and what we must always do about it. Right here I’d prefer to set out the size of the issue with plots of the important thing knowledge.

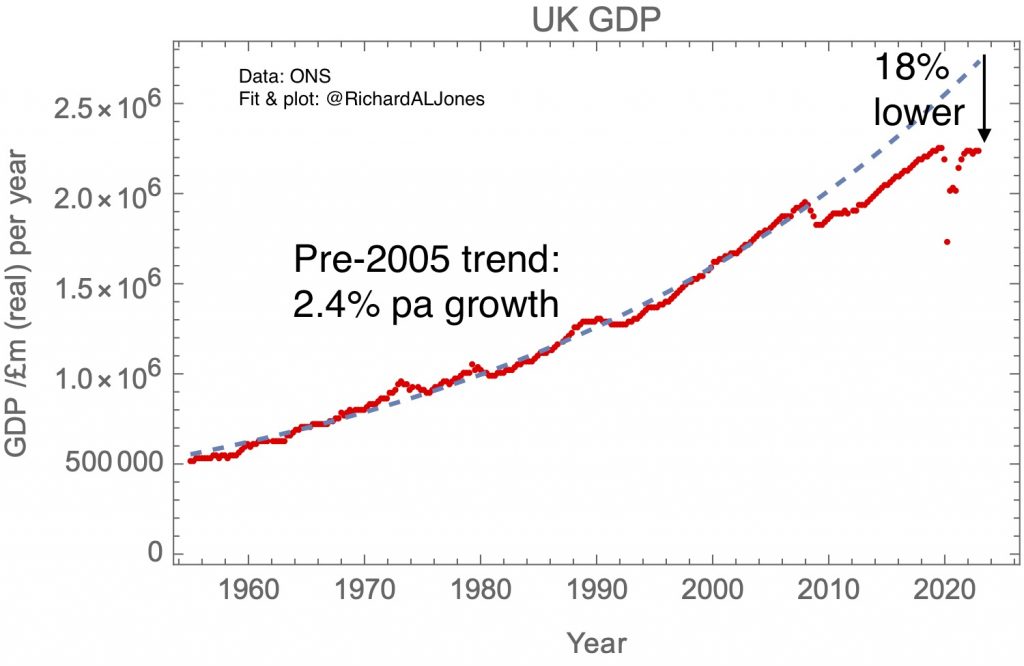

My first plot reveals actual GDP since 1955. The break within the curve on the international monetary disaster round 2007 is apparent. Earlier than 2007 there have been booms and busts – however the entire curve is properly match by a development line representing 2.4% a yr actual progress. However after the 2008 recession, there was no return to the development line. Development was additional interrupted by the covid pandemic, and the restoration from the pandemic has been gradual. The UK’s GDP is now about 18% decrease than it will have been if the financial system had returned to its pre-recession development line.

UK actual GDP. Chained quantity measure, base yr 2019. ONS: 30 June 2023 launch.

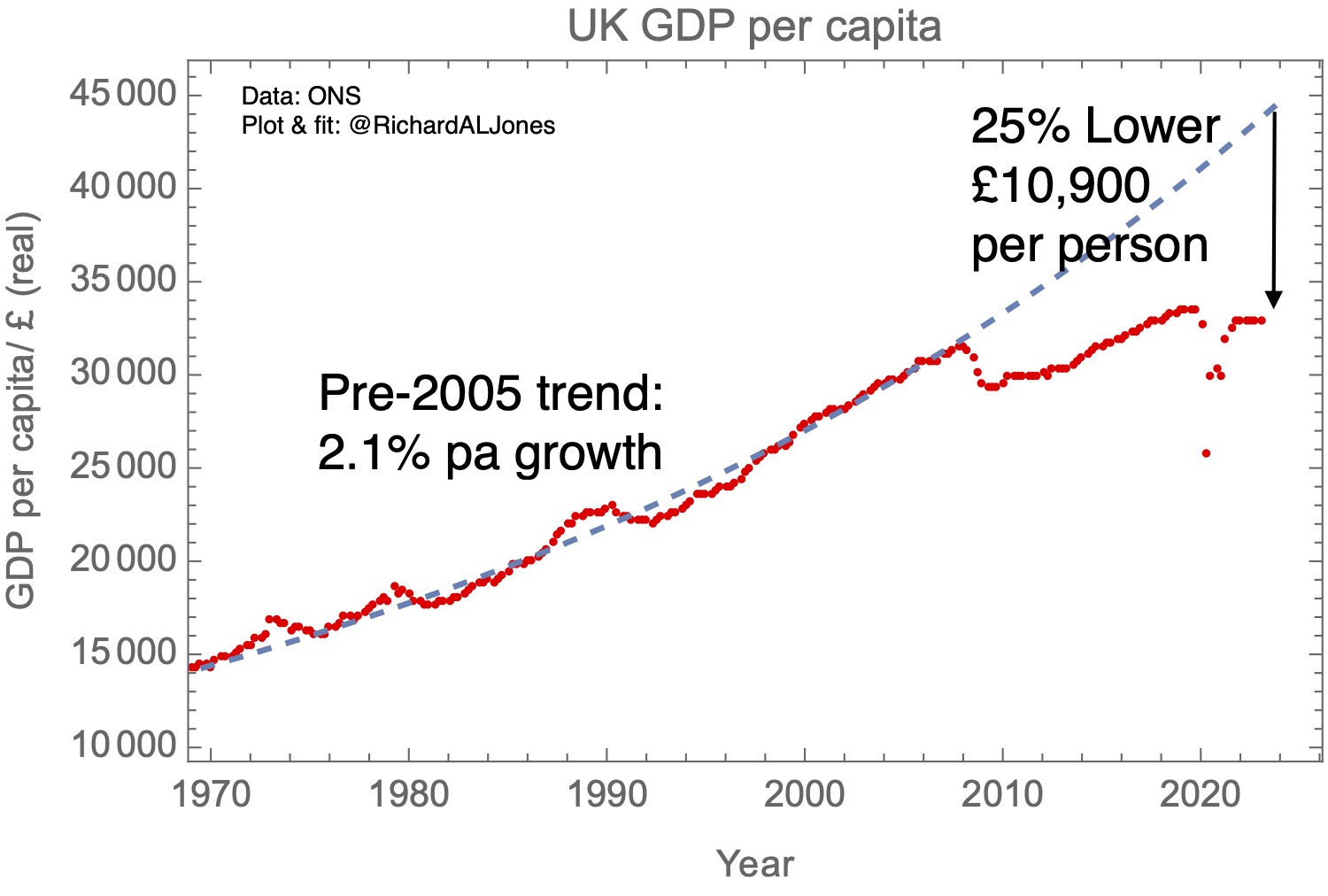

Complete GDP is of specific curiosity to HM Treasury, as it’s the total measurement of the financial system that determines the sustainability of the nationwide debt. However you may develop an financial system by rising the scale of the inhabitants, and, from the viewpoint of the sustainability of public providers and a wider sense of prosperity, GDP per capita is a greater measure.

My second plot reveals actual GDP capita. GDP per individual has risen much less quick than whole GDP, each earlier than and after the worldwide monetary disaster, reflecting the truth that the UK’s inhabitants has been rising. Pattern progress earlier than the break was 2.1% every year; as soon as once more, opposite to all earlier expertise within the post-war interval, per capita GDP progress has by no means recovered to the pre-crisis development line. The hole with the earlier development, 25%, or £10,900 per individual, is probably the very best measure of the UK’s misplaced prosperity.

UK actual GDP per capita. Chained quantity measure, base yr 2019. ONS: 12 Might 2023 launch.

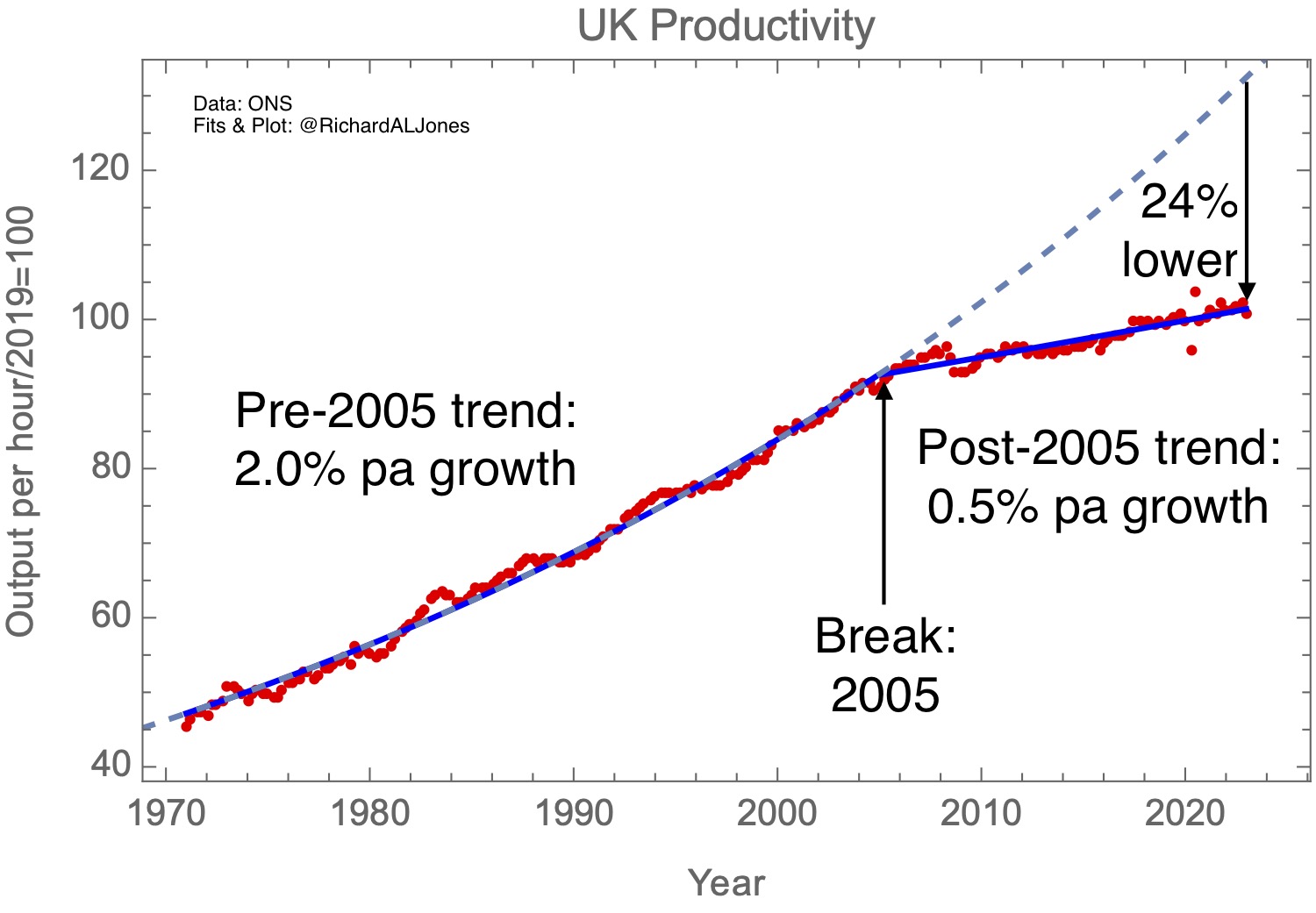

Essentially the most basic measure of the productive capability of the financial system is, maybe, labour productiveness, outlined because the GDP per hour labored. One could make GDP per capita develop by individuals working extra hours, or by having extra individuals enter the labour market. Within the late 2010s, this was a big issue within the progress of GDP per capita, however because the pandemic this impact has gone into reverse, with extra individuals leaving the labour market, usually because of long-term ill-health.

My third plot reveals UK labour productiveness. This reveals the elemental and apparent break in productiveness efficiency that, in my opinion, underlies just about every little thing that’s incorrect with the UK’s financial system – and certainly its politics. As I mentioned in additional element in my earlier publish,“When did the UK’s productiveness slowdown start?”, I more and more suspect that this break predates the monetary disaster – and certainly that disaster might be higher thought as an impact, somewhat than a trigger, of a extra basic downward shift within the UK’s capability to generate financial progress.

UK labour productiveness, entire financial system. Chained quantity measure, index (2019=100). ONS: 7 July 2023 launch.

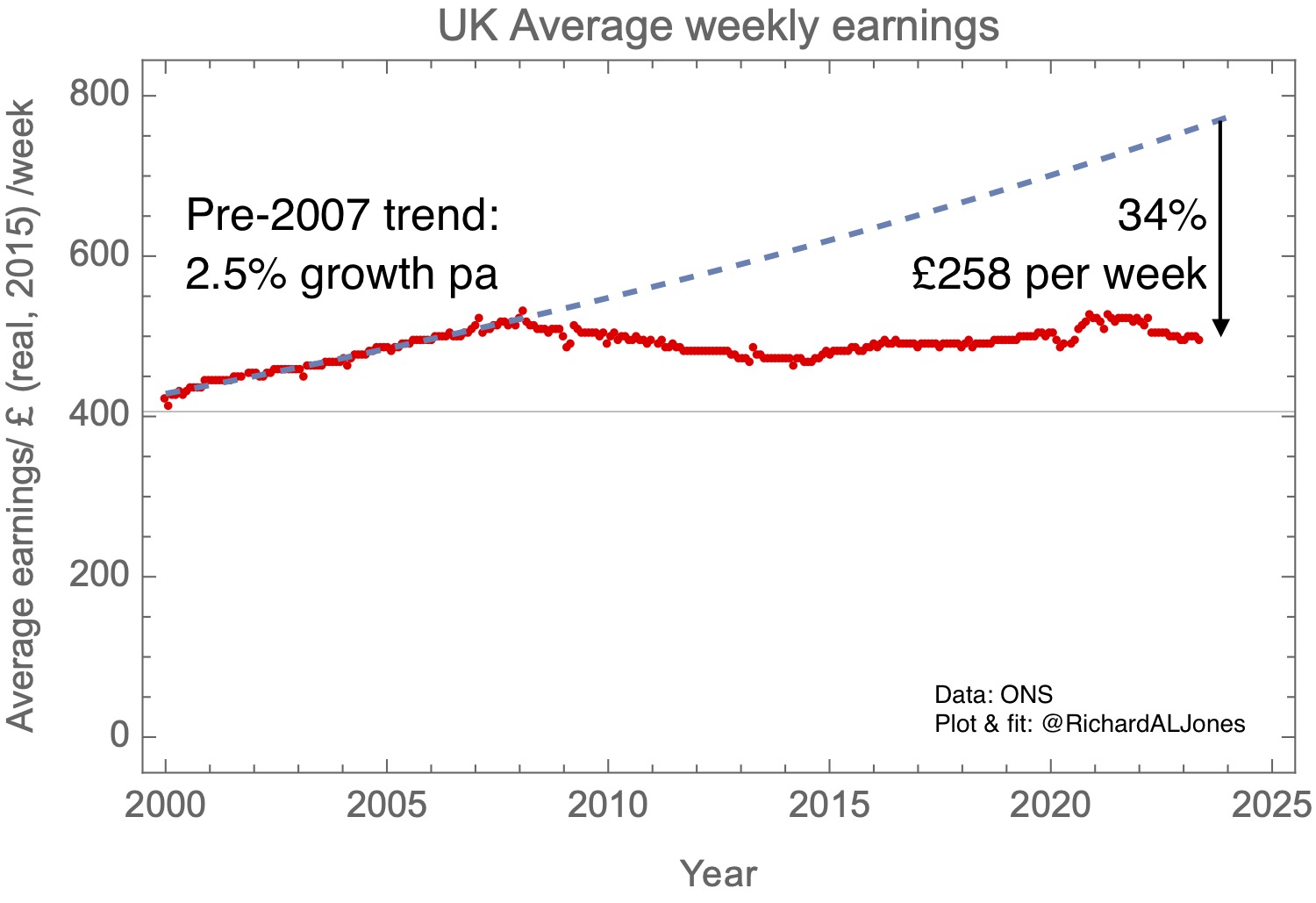

Discuss of GDP progress and labour productiveness could seem distant to many citizens, however this financial stagnation has direct results, not simply on the affordability of public providers, however on individuals’s wages. My last plot reveals common weekly earnings, corrected for inflation. The image is dismal – there has basically been no rise in actual wages for greater than a decade. This, at root, is why the UK”s lack of financial progress is simply going to develop in political salience.

UK Common weekly earnings, 2015 £s, corrected for inflation with CPI. ONS: 11 July 2023 launch.

I’ve written loads in regards to the causes of the productiveness slowdown and potential coverage choices to deal with it, reflecting my very own views on the significance of innovation and on redressing the UK’s regional financial imbalances. Right here I simply make two factors.

On prognosis, I feel it’s actually vital to notice the mid-2000s timing of the break within the productiveness curve. Undoubtedly subsequent coverage errors have made issues worse, however I consider a basic evaluation of the UK’s issues should recognise that the roots of the disaster return a few many years.

On treatments, I feel it needs to be apparent that if we feature on doing the identical kinds of issues in the identical method, we will anticipate the identical outcomes. Token, sub-scale interventions will make no distinction with out a severe rethinking of the UK’s basic financial mannequin.