A couple of weeks in the past, TeleGeography headed again to São Paulo to take part within the Capability Latin America 2024 convention.

There have been few uninteresting moments, with the Latin American wholesale connectivity market filled with exercise. Among the many many dialogue factors, just a few key themes are price mentioning.

Let’s take a look.

Maintaining With the Connectivity Market

Many cable methods within the area are over 20 years previous, approaching the tip of their lifespans, and can probably be retired by the tip of the last decade. This implies there is a must refresh the cable infrastructure on many routes.

One space of specific focus this 12 months: Central America and the Caribbean.

That is the place a number of subsea methods have been activated in 2000 (Americas-II, Maya-1, South American Crossing, Pan-American Crossing, Mid-Atlantic Crossing, GlobeNet) and 2001 (ARCOS, South America-1). Every system is totally different, however typically they’re approaching the tip of their financial lifetimes.

It may be difficult for carriers to calculate precisely when to formally retire a system and substitute it with one thing new. In Central America and the Caribbean, that is particularly tough.

Demand is comparatively low for every particular person market, the price of constructing and sustaining a brand new system may exceed anticipated income, and allowing can shortly get difficult if a system impacts a number of international locations.

Excessive Makeover: Submarine Cable Version

Previous cables could also be reaching the tip of their days, however new infrastructure is on the horizon. And a whole lot of that infrastructure is headed to Mexico.

Previous cables could also be reaching the tip of their days, however new infrastructure is on the horizon. And a whole lot of that infrastructure is headed to Mexico.

Some tasks to notice are TAM-1 (anticipated to be prepared for service in 2025), TIKAL-AMX3 (2026), and Gold Information-1/Liberty Networks-1 (2026).

Amazon Net Providers can also be planning a brand new cloud area in Mexico. Mixed with the quickly rising variety of information facilities in and close to Querétaro and Mexico Metropolis, the necessity for spine connectivity in Mexico will probably maintain rising.

As subsea provide to the Mexican market grows, it must compete with very competitively priced terrestrial connectivity within the area.

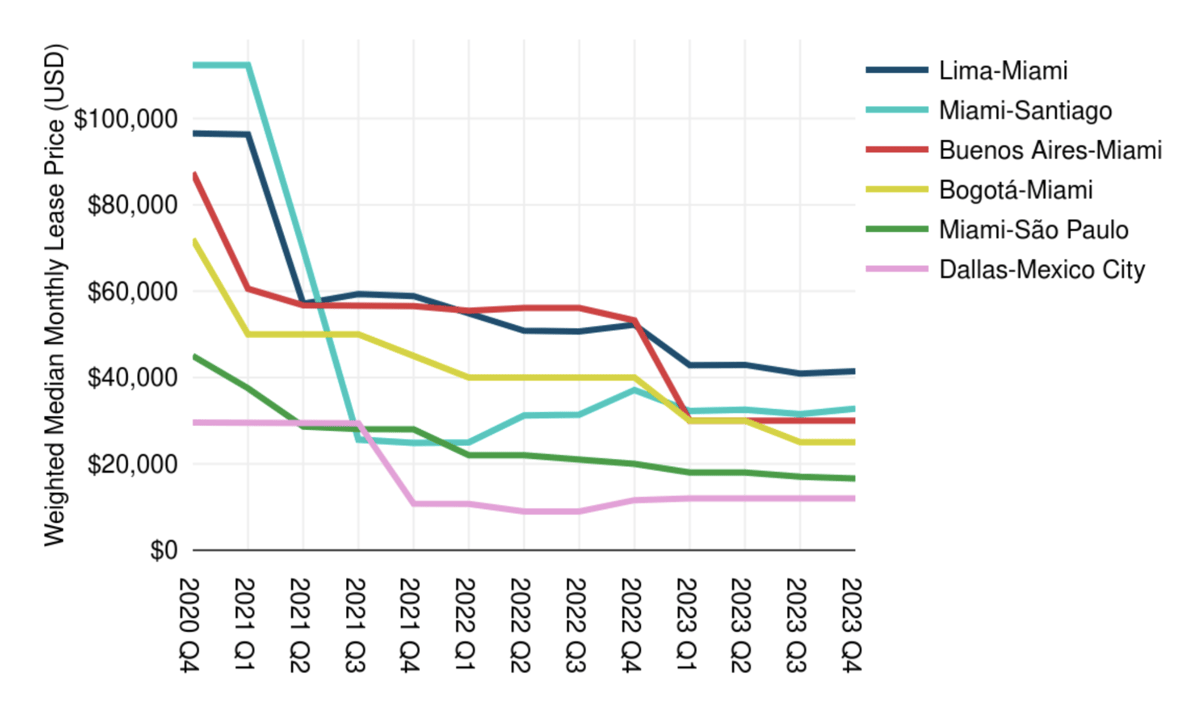

Take the Dallas–Mexico Metropolis route for example. Maybe the first route connecting Mexico to the US, we regularly hear it is among the most cost-effective in Latin America.

In This autumn 2023, the weighted median value for 100 Gbps was $12,000. As provide retains growing and the market stays aggressive, we anticipate that value to proceed falling.

Supply: © 2024 TeleGeography

The Nice Brazilian Value Erosion Present

Transferring additional south, the Brazilian market was additionally a scorching subject at Capability LATAM. Extra particularly, attendees have been keen on studying about costs for transport and IP transit in Brazil.

The transient abstract? Costs have fallen quickly. They usually appear poised to maintain doing so. Compounded yearly from 2020 to 2023 on Miami–São Paulo, the principal transport route for South America, the weighted median price of 100 Gbps fell 28% to $16,585.

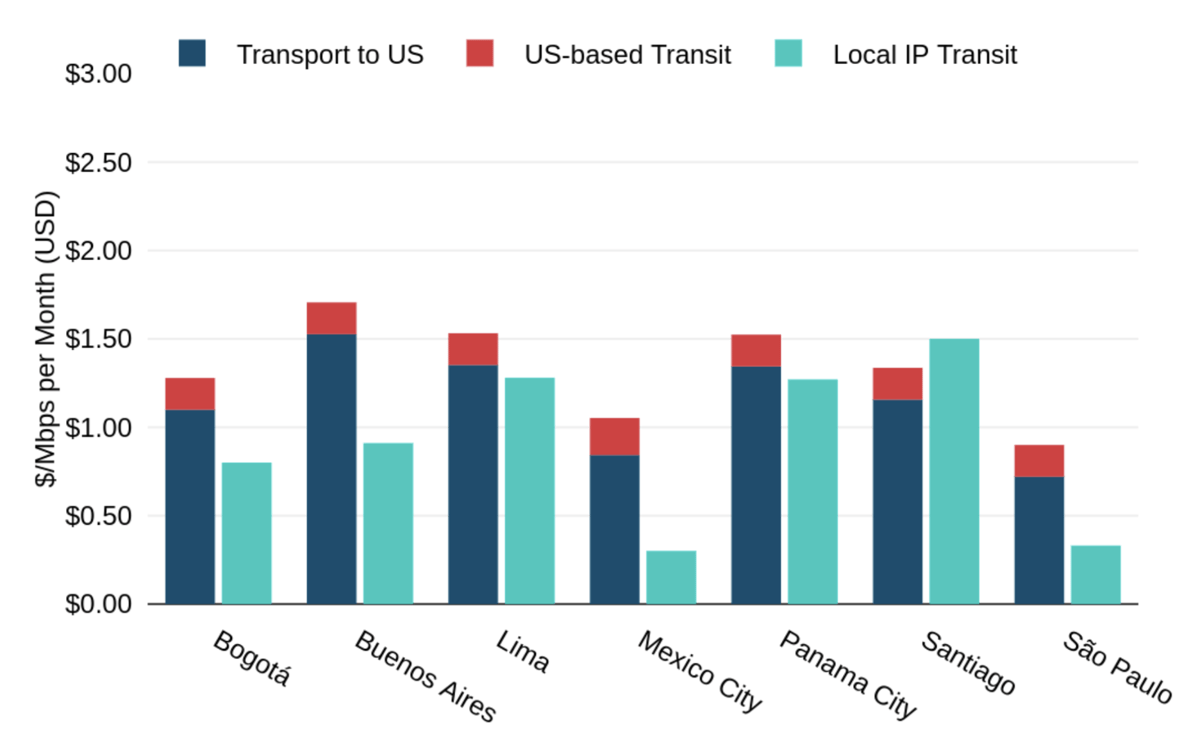

For IP transit, the state of affairs is equally spectacular. Many suppliers inform us they provide flat pricing throughout the nation’s key markets of São Paulo, Rio de Janeiro, and Fortaleza. With a This autumn 2023 10 GigE weighted median price of about $0.30 per Mbps, which means all three cities are amongst a number of the most competitively priced IP transit markets on the planet.

São Paulo, Rio de Janeiro, and Fortaleza are amongst a number of the most competitively priced IP transit markets on the planet.

For context, the weighted median value for a ten GigE port in São Paulo in 2018 was six instances dearer than a comparable port in Miami. In This autumn 2023, that very same port was only one.6 instances dearer.

Because the determine beneath reveals, IP transit is now priced competitively sufficient in markets like São Paulo to make native transit in Brazil a less expensive possibility than the normal buy of transport to the U.S. plus native IP transit in Miami.

Supply: © 2024 TeleGeography

Capability Latin America could also be over for now, however TeleGeography will proceed to investigate key traits because the worldwide telecommunications market evolves.

And with upcoming conferences like ITW in Nationwide Harbor, Maryland, there will likely be no scarcity of alternatives to debate new tasks and analyze their influence.