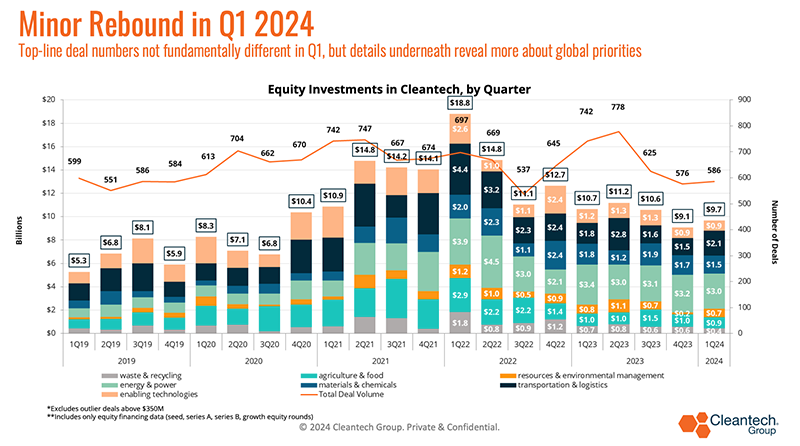

In Q1 of 2024, we noticed extra of the “new regular” in enterprise & progress investing – following the explosive years of financing in the course of the pandemic, fairness financing ranges have primarily leveled out however have settled at common ranges greater than the averages pre-pandemic.

Some issues that had been distinctive to Q1:

- Important exercise within the hard-to-abate sectors, e.g., metal and cement (extra on these later) – these had been the industries historically thought-about most tough to decarbonize and the applied sciences most dangerous to again financially, however they’ve seen constantly robust funding quarters.

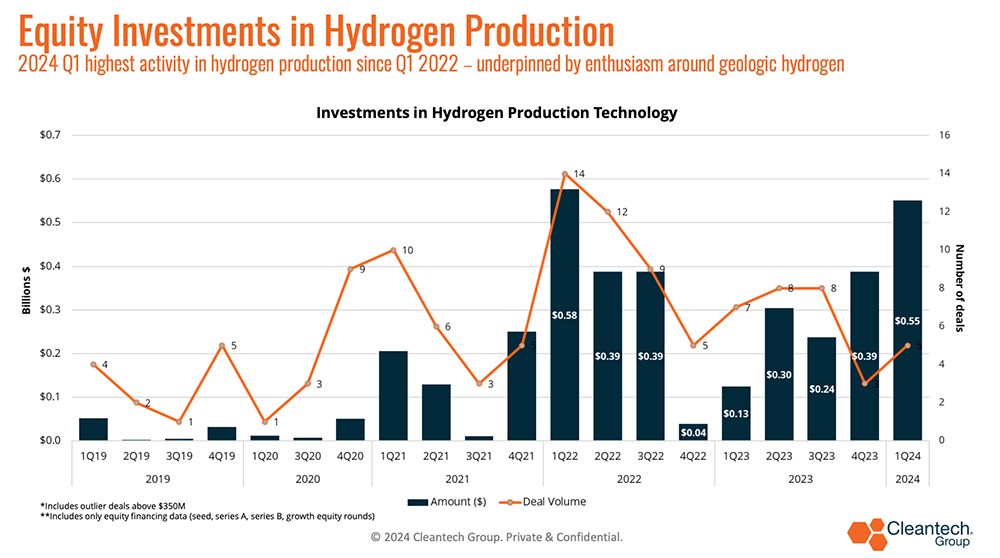

- Regardless of among the lingering doubts round transitions to hydrogen, hydrogen manufacturing applied sciences noticed a really robust enterprise quarter – underpinned largely by enthusiasm over new geologic hydrogen exploration applied sciences.

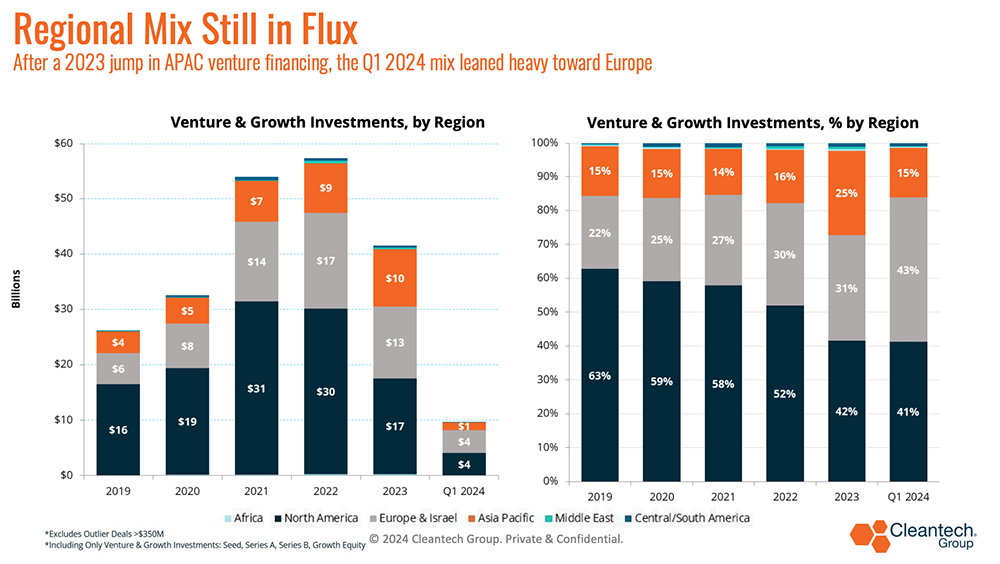

- One other quarter of a “cooling” in Asia-Pacific (continued from Q1 2023) versus the very important bounce, particularly in Power & Energy financing in most of 2023 – the combo shifted closely European in Q1 with the Europe progress case largely coming from Transportation & Logistics tech (see beneath).

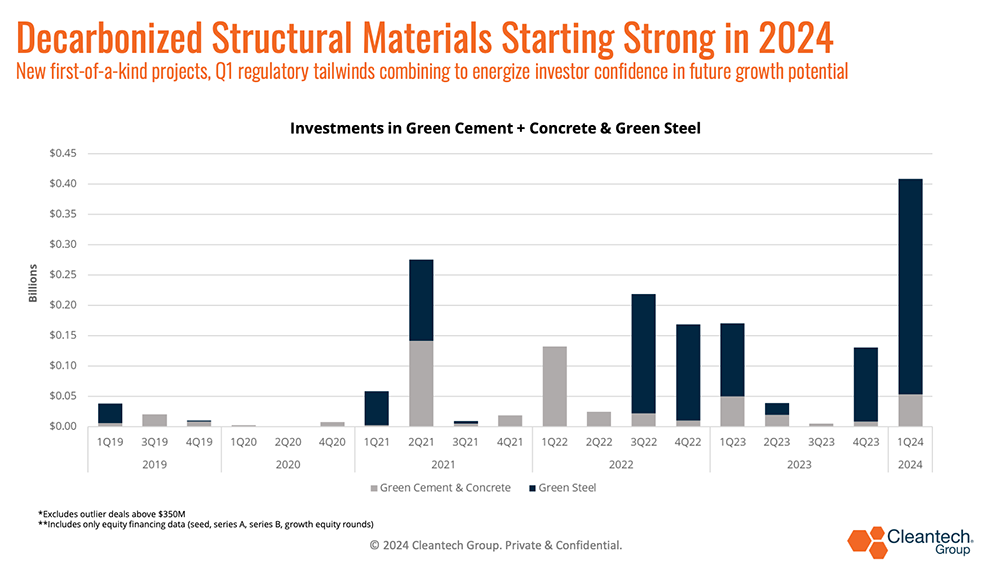

Cement and Concrete Headline Q1

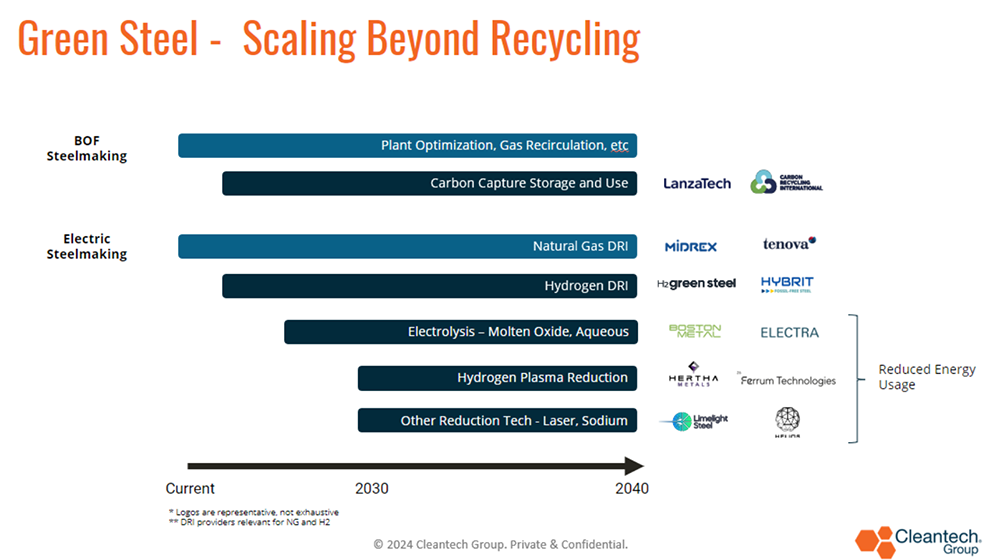

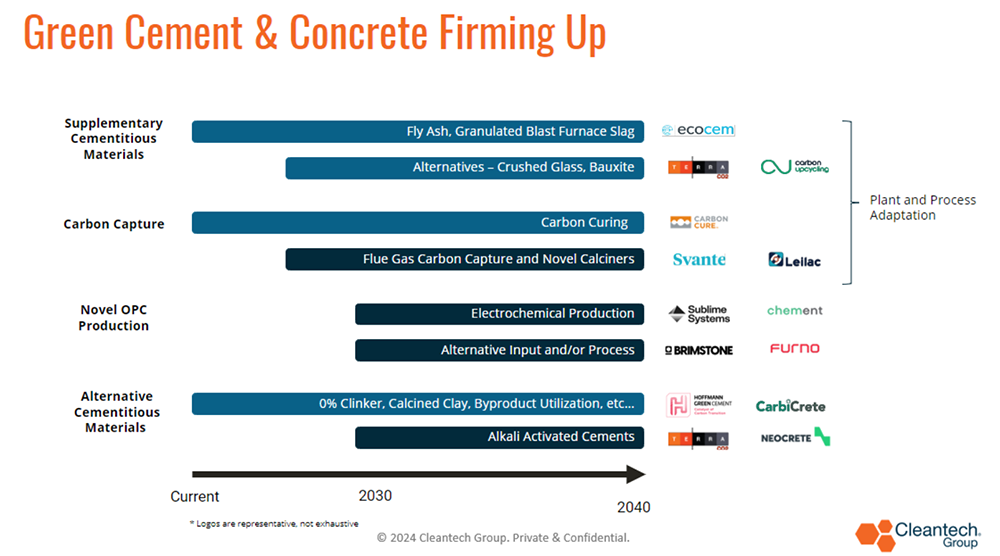

The early exercise in inexperienced metal and inexperienced cement and concrete is likely one of the headline tales of this primary quarter. These historically hard-to-abate sectors now have sufficient of a slate of progressive options to begin charting a path ahead to decarbonization.

We are actually at an fascinating stage wherein there are new inexperienced metal and cement manufacturing applied sciences which can be getting into the market (largely via demonstration vegetation, however some at industrial scale) – a primary “tranche” of applied sciences is rising whereas the extra nascent applied sciences are seeing extra enterprise help (see diagrams beneath for our tackle the “tranches” of inexperienced metal and inexperienced cement growth):

Some key offers in these areas from Q1 2024:

The Biden Administration lately introduced $6B for 33 challenges in hard-to-abate sectors, some progressive options benefitting straight embrace:

- Deeply Decarbonized Cement (as much as $189M) by Brimstone

- First Industrial Electrochemical Cement Manufacturing (as much as $86.9M) by Elegant Programs

- Steam-Producing Warmth Pumps for Cross-Sector Deep Decarbonization ($as much as $145M) by Skyven

Hydrogen Additionally Exhibits Funding

Maybe not surprising, per se, however actually the hopes round potential for geologic hydrogen turned extra palpable this previous quarter. See the chart beneath, the place Q1 was essentially the most important by way of fairness financing towards hydrogen manufacturing know-how – the over half a billion {dollars} spent consisted of funding in a number of hydrogen manufacturing pathways, however was considerably underpinned by a $245M Sequence B spherical invested in white hydrogen firm Koloma days after Koloma additionally acquired a $900K grant from the U.S. Division of Power, and fewer than a 12 months off a $91M Sequence A spherical.

The keenness round geologic hydrogen (hydrogen that happens naturally in underground reservoirs) is two-fold:

1) It’s hydrogen that’s extracted and never produced via a thermal or electrical course of

2) In consequence, it avoids carbon emissions from manufacturing processes.

Accessing geologic hydrogen in a low-cost means would scale back the necessity to construct out new renewables to supply inexperienced hydrogen and, in concept, commerce electrical energy price for price of compression, transport, and storage of hydrogen.

Wanting In the direction of Q2

- Industrial traction and offtake agreements would be the KPI for firms hoping to exit the fairness financing continuum out to bankability. This can be an apparent assertion, however firms which can be capable of finding artistic methods to entry pockets of willingness-to-pay are going to start a journey to decrease price of capital before their rivals.

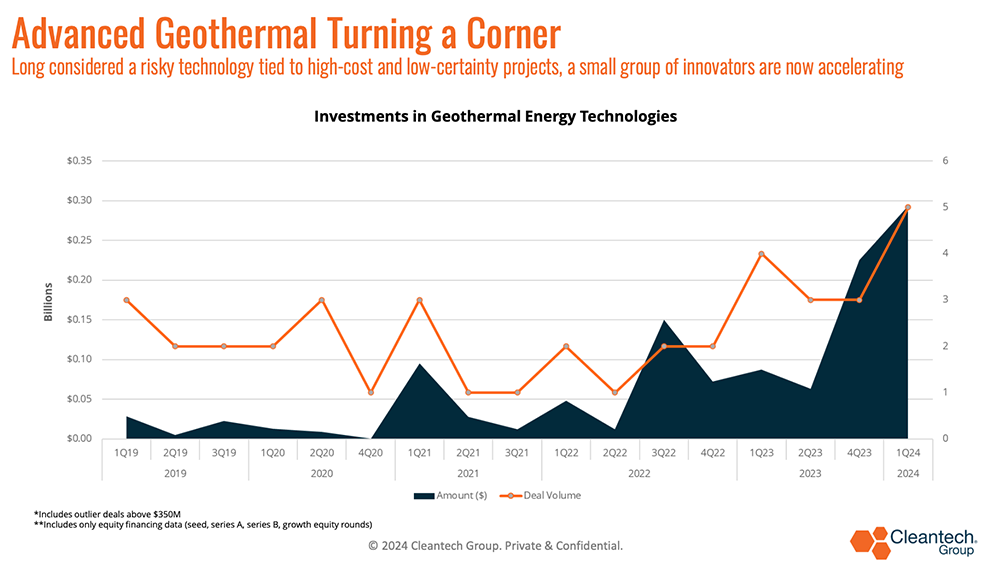

- An area to look at is enhanced geothermal – regardless of having important potential to offer 24/7 agency clear energy, difficult challenge economics have remained a barrier. New applied sciences in drilling and closed-loop programs have proven promise to raised entry the latent energy potential in sizzling, dry rock geothermal deposits.

- This previous quarter was essentially the most important in geothermal enterprise financing since we started monitoring the area, some key offers included:

- Quaise: $21M Sequence A for provide chain growth, discipline operations to advance deep geothermal drilling

- Fervo: $244M to additional operations at Cape Station to help clear electrical energy to the grid by 2026. Fervo has a number of energy buy agreements, together with with Google and East Bay Group Power

- Sage Geosystems: $17M Sequence A to help 3MW website in Texas after efficiently finishing full-scale industrial pilot that produced 200kw for greater than 18 hours and 1 MW for half-hour

How Can Local weather Innovation Proceed to Evolve?

How Can Local weather Innovation Proceed to Evolve?

- It’s all about attacking the associated fee curve: so lots of the progressive applied sciences that we’ve adopted for years are actually getting into actual initiatives and manufacturing. As soon as market forces kick in and demand pull is noticed, you’ll have extra entrants and start the financial journey to commoditization – getting previous inexperienced premiums and towards affordability will probably be essential for batteries, hydrogen manufacturing, and low-carbon industrial merchandise (metal, cement, chemical compounds).

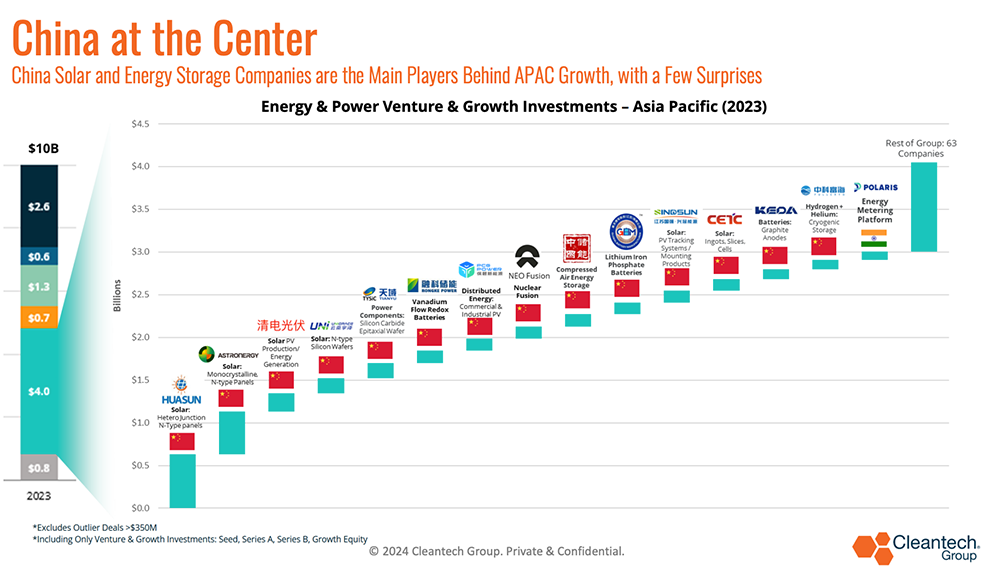

- There’s a behavior of referring to China on this regard as a siloed case for particular applied sciences – however in the end China is a proxy for the associated fee pressures that innovators have to sustain with as soon as scale manufacturing is on-line (a change from the R&D part when tech efficiency metrics are usually extra central issues).

- See the graphic beneath, the place China was the central innovation & enterprise financing for power in APAC in 2025 – if that is any indication, one can count on to see related ranges of competitors exterior of simply photo voltaic and batteries, however in all facets of power applied sciences.

Some offers this previous quarter that help power applied sciences getting into industrial phases embrace:

- Antora Power raises $150M for thermal power storage to help commercialization and a producing facility in San Jose, California

- NineDot Power raises $225M from Carlyle Group and Manulife Funding

- Ascend Parts raised a contemporary $162M Progress Fairness spherical to finalize North America’s first recycled cathode from black mass manufacturing facility

- Lohum raised a $54M Sequence B to develop their operations in EV battery-to-energy storage programs conversion whereas getting into the recycled cathode supplies market

Chinese language Affect on the Way forward for the EV Market

The subsidies to Chinese language EV producers, as well-documented in latest experiences, could be very important and has allowed for a speedy scaling of EV manufacturing and gross sales (each inside China and Chinese language-produced automobiles for export).

There’s already a excessive 27.5% import tariff on Chinese language-built automobiles within the U.S., so the onus will now be on U.S. producers to slash prices via studying results and use of know-how.

- A essential problem will probably be that Chinese language producers are already producing at important scale (close to 10M EVs bought by Chinese language producers final 12 months vs. 1.2M within the U.S.). Subsidies or not, the educational results from mass manufacturing are to not be understated – that is the place producers resolve manufacturing inefficiencies (e.g., cut back scrap), optimize manufacturing facility layouts and operations administration programs, achieve negotiating energy with suppliers, and customarily obtain economies of scale (i.e., spreading CAPEX of amenities throughout extra income).

- Passenger EVs are usually the main focus of this dialog, however buses and fleet automobiles are a frontier market that will even be essential – the educational results gained by Chinese language scale manufacturing could already be paying dividends in these markets (Automotive World, Proterra Might Not be a Bellwether for e-bus Failure within the U.S.).

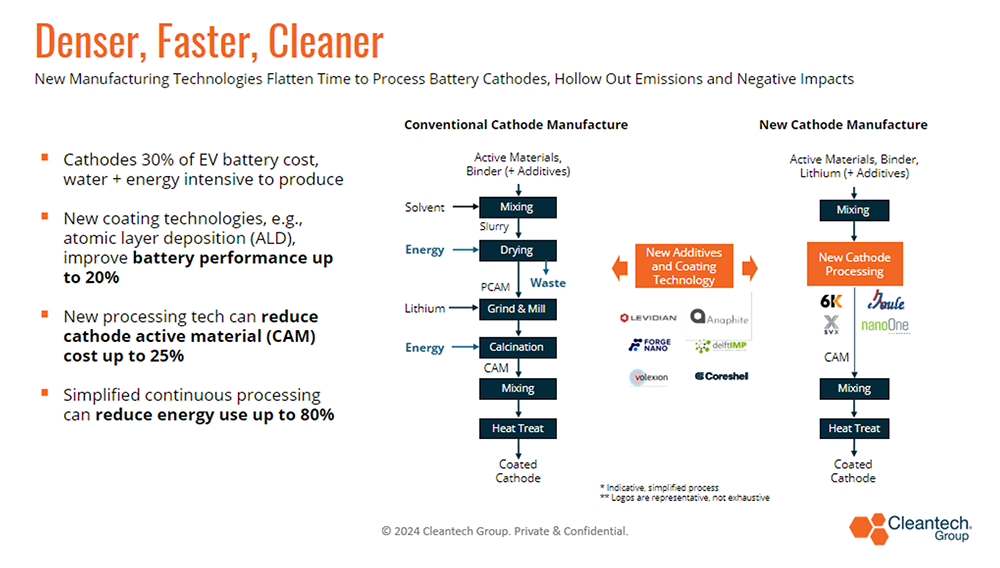

- Leveraging new know-how is likely one of the finest methods U.S. and Western EV producers can begin decreasing prices to compete higher globally. There are numerous variables to think about in price discount, however our speculation at Cleantech Group is that innovation will cut back prices of cathodes in batteries – batteries can comprise as much as 40% of car price and cathodes 30% of that battery price. Some improvements that we’re keeping track of beneath:

Europe Stays Key Supply

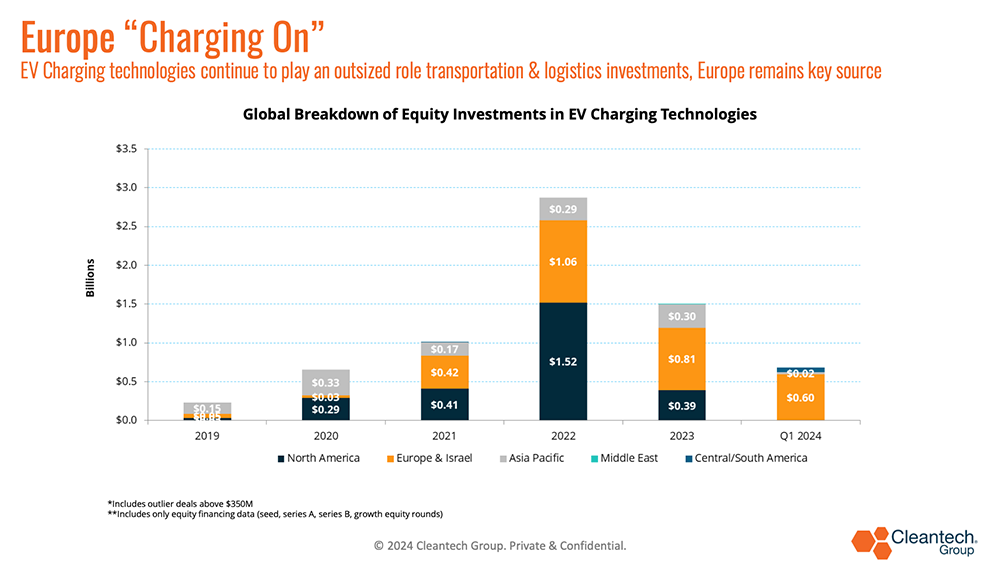

An fascinating pull-through impact of worldwide EV rollout has been the alternatives it’s creating for innovation and progress of latest applied sciences in EV charging – Europe has seen constant enterprise exercise on this regard over the previous few years (see chart beneath).

Some dynamics making the state of affairs in Europe distinctive:

- Coverage alerts on the EU degree:

-

2035 ICE ban for brand new automobiles accepted in 2023

-

Deal on decarbonization of professional quality automobiles agreed in February, with formidable targets o Deal on charging infrastructure in 2023 (AFIR)

-

Offers on the Batteries Regulation and Essential Uncooked Supplies Act – the EU’s legislative framework round EVs was primarily accomplished during the last 18 months and covers the entire worth chain

-

- The EU has a lot decrease tariffs on Chinese language EVs than the U.S. does, at a time when China has main overcapacity. Therefore, competitively priced Chinese language EVs are flooding into Europe and placing downward stress on the costs of non-Chinese language EVs

- Europe has had one single charging commonplace for some time, not like the U.S. the place there have been a number of till Tesla’s lately gained out