Think about discovering {that a} easy oversight in managing enterprise bills led to a small fortune being unwittingly spent on avoidable prices.

This is not only a hypothetical situation; it is a actuality for organizations that overlook the strategic significance of a meticulously designed expense coverage.

On this piece, we’ll present an expense coverage template designed to function reference for crafting your personal expense coverage for your corporation.

The framework is designed for each empowering workers and safeguarding the group’s monetary well being.

We’ll journey by the essence of an expense coverage, unveil a flexible template, and supply steering on its sensible utility and automation.

Recap: The Expense Coverage

An expense coverage is a algorithm that dictates workers

- how they will spend firm cash on bills.

- how they will reimburse the bills.

- what occurs in circumstances of non-compliance.

The principle objectives of an expense coverage are twofold.

Firstly, this coverage performs an important position in managing the corporate’s funds and ensuring workers know what’s anticipated once they’re incurring bills on behalf of the group.

Secondly, it helps the corporate keep consistent with monetary legal guidelines and laws, avoiding authorized points and fines. This twin objective makes the expense coverage an important instrument for each the staff and the corporate’s monetary well being.

Implementing a transparent expense coverage brings a number of key advantages:

- Prevents Fraud: By setting strict tips on spending, it reduces the possibilities of dishonest claims.

- Ensures Equity: Everybody is aware of what’s allowed and what’s not, making expense claims extra easy and truthful.

- Controls Price range: Helps preserve spending in verify, making certain that bills align with the corporate’s budgetary constraints.

Expense Coverage Template

Creating an efficient expense coverage doc is crucial for sustaining monetary management, making certain compliance, and offering readability to your workers.

Right here is the expense coverage template doc to information you in crafting your personal expense coverage:

Phrase Format:

You may as well save a replica of the template as a Google Doc:

Nanonets_Expense_Policy_Template

Expense Coverage Template (Preview)

[Company Name] Expense Coverage Doc

[Company Name]

[Date]

Model Quantity

This doc is topic to vary and could also be up to date periodically to replicate the evolving wants of [Company Name] and its workers.

This Expense Coverage doc is designed to information the staff of [Company Name] in making knowledgeable and accountable selections about incurring and reporting work-related bills. Our intention is to make sure that all expenditures are crucial, affordable, and aligned with our firm’s targets and values. By adhering to this coverage, we foster transparency, accountability, and effectivity in our monetary practices.

Bills

To facilitate the correct and constant dealing with of bills, it’s essential to obviously outline what constitutes a reimbursable expense inside [Company Name]. Under are the classes of bills which can be thought of reimbursable, together with examples for every class to remove any ambiguity:

- Journey: Bills associated to enterprise journey, together with airfare, floor transportation, and lodging. For example, a return flight ticket for a enterprise convention or a prepare ticket for a shopper assembly.

- Lodging: Prices incurred throughout enterprise journey for resort stays or different lodging preparations. An instance may very well be a two-night keep in a resort for a enterprise seminar.

- Meals: Affordable bills for meals throughout enterprise journey or shopper conferences. This consists of breakfast, lunch, and dinner, with an instance being a dinner assembly with a possible shopper.

- Consumer Leisure: Bills for entertaining purchasers, similar to meal prices or occasion tickets, offered they’re immediately associated to enterprise improvement or retention. An instance is internet hosting a shopper at a sporting occasion to debate future enterprise alternatives.

- Workplace Provides: Prices for objects crucial for the each day operations of the workplace, together with stationery, printing supplies, and small workplace gear. For instance, buying pens, paper, and ink cartridges for workplace use.

- Know-how: Bills associated to know-how that helps work productiveness, together with software program subscriptions, and emergency {hardware} purchases. An instance may very well be a subscription to a challenge administration instrument or the acquisition of a brand new keyboard on account of an sudden malfunction.

Non-Bills

It’s equally essential to specify bills that [Company Name] is not going to reimburse. These embody, however are usually not restricted to:

- Private bills unrelated to enterprise actions.

- Fines or penalties, similar to visitors violations or late charges.

- Bills exceeding predetermined limits for particular classes with out prior approval.

Spending Limits

We’ve established clear spending limits for every class of reimbursable bills. These limits are designed to information workers in making even handed spending selections that align with firm budgetary issues and monetary targets. Moreover, department-specific exemptions are included to handle the distinctive wants and spending patterns of various areas inside the firm.

Basic Spending Limits

Under is a desk outlining the utmost allowable spending limits for every class of expense, supposed to make sure that all expenditures are each crucial and affordable:

| Expense Class | Most Restrict | Notes |

|---|---|---|

| Journey (Airfare) | $500 | Economic system class for home flights |

| Journey (Lodging) | $150 per night time | Commonplace room price |

| Meals | $25 per meal | Excludes alcoholic drinks |

| Consumer Leisure | $100 | Per individual, requires prior approval for exceptions |

| Workplace Provides | $50 per order | Important objects solely |

| Know-how | $300 | Pre-approval required for objects above this restrict |

Division-Particular Spending Limits

To accommodate the specialised wants of various departments inside [Company Name], we additionally set up department-specific spending limits as follows:

- Gross sales Division:

- Consumer Leisure: Elevated restrict to $150 per individual to accommodate potential high-value shopper conferences.

- Journey: Further flexibility in airfare as much as $700 for worldwide journey with prior approval.

- IT Division:

- Know-how: Elevated restrict to $500 to assist the acquisition of specialised software program or {hardware} important for departmental operations.

Any bills anticipated to exceed these limits should be submitted for pre-approval to make sure alignment with budgetary constraints and operational targets.

Approval Procedures

The effectivity and accountability of [Company Name]’s expense administration course of are paramount. To make sure this, the next detailed procedures and documentation necessities are established, guiding workers by the expense approval and reimbursement course of.

Journey and Lodging

- Pre-Journey Approval:

- Staff planning enterprise journey should submit an itinerary and estimated funds for approval by our designated on-line portal.

- This submission ought to happen a minimum of two weeks previous to the deliberate departure date to permit enough time for overview and approval.

- Publish-Journey Documentation:

- Upon return, workers are required to submit all receipts associated to journey and lodging bills inside one week.

- This consists of flights, lodges, and different travel-related bills, which should be uploaded to our digital expense administration platform.

Enterprise Bills

- For bills incurred throughout shopper conferences, buying workplace provides, or every other business-related wants, workers should present a receipt and a quick description of the enterprise objective.

- These submissions ought to be made by our expense reporting instrument inside three days of the incurred expense.

Massive Bills

- Massive bills are outlined as any single expense exceeding $2500 or a sequence of associated bills that collectively exceed $2500 inside a month.

- An in depth proposal, together with the rationale, anticipated advantages, and complete price, should be submitted to and accredited by higher-level administration earlier than incurring the expense.

Documentation and Receipts

To facilitate environment friendly expense processing, the next documentation is required to be submitted whereas making a reimbursement request by the portal:

- Receipts for all expenditures, demonstrating proof of fee.

- A quick description of every expense’s enterprise objective, enhancing transparency and justification.

- For travel-related bills, full itineraries and proof of expenditure are crucial to finish the submission.

Timelines

- Expense experiences for travel-related bills should be submitted inside one week following the journey.

- Reviews for different enterprise bills are due inside three days of the expense prevalence.

- Approval or suggestions on submitted bills can be offered inside three working days, making certain immediate reimbursement and readability for workers.

Digital Submission and Processing

[Company Name] makes use of a digital expense administration platform [Link] for all expense submissions and approvals.

This part offers step-by-step directions on entry and make the most of the portal successfully.

- Login URL: Navigate to [Portal Link] utilizing any internet browser. This hyperlink can be out there on the corporate intranet underneath the ‘Worker Sources’ part.

- Username and Password: Your login credentials are your organization electronic mail deal with and a password initially offered by the IT division. In case you are logging in for the primary time, you may be prompted to vary your password.

- Two-Issue Authentication (2FA): For added safety, the portal requires two-factor authentication. You’ll obtain a code by way of SMS or electronic mail, which you have to enter on the login display screen.

As soon as logged in, one can find the next important sections:

- Dashboard: View your latest expense submissions and their standing (pending, accredited, or rejected).

- Submit New Expense: Enter a brand new expense declare, together with importing receipts and including expense particulars.

- Reviews: Generate experiences of your submitted bills over chosen time durations.

- Settings: Replace your private data, change your password, and configure your 2FA settings.

To submit a brand new expense:

- Go to ‘Submit New Expense’: Click on on this selection from the dashboard.

- Expense Particulars: Fill within the expense type with particulars similar to date, class (e.g., Journey, Meals), quantity, and a quick description.

- Add Receipts: Connect digital copies of your receipts by clicking the ‘Add’ button. The portal accepts JPG, PNG, and PDF recordsdata.

- Submit for Approval: Evaluation your entry for accuracy, then click on ‘Submit’. You’ll obtain an electronic mail affirmation of your submission.

For checking standing and experiences,

- To verify the standing of your submitted bills, go to the ‘Dashboard’. Every entry will present its present standing.

- For detailed experiences in your bills, go to the ‘Reviews’ part and customise the report standards based mostly on date vary, class, or standing.

If you happen to encounter any points or have questions on utilizing the portal:

- FAQs and Person Information: Seek the advice of the excellent FAQs and consumer information out there within the ‘Assist’ part of the portal.

- Contact IT Assist Desk: For technical assist, together with login issues or points importing paperwork, contact the IT Assist Desk at ithelp@[companyname].com or (123) 456-7892.

Particular Concerns

In conditions the place adhering to the coverage presents challenges, workers are inspired to have interaction in proactive communication with their direct supervisor or the finance group. This method is meant to hunt steering or focus on potential exceptions, making certain that operational wants are met with out compromising coverage integrity.

Greatest Practices, Sources, and Partnerships

To assist [Company Name]’s workers in managing bills successfully and to leverage potential financial savings by strategic partnerships, this part offers priceless assets, greatest practices, and particulars on helpful partnerships.

Greatest Practices and Ideas

- Guide in Advance: Planning and reserving journey and lodging as early as attainable can considerably scale back prices. Goal to e book these a minimum of three weeks prematurely.

- Use Most well-liked Distributors: Each time attainable, make the most of most well-liked distributors for journey, lodging, workplace provides, and know-how. These distributors have been vetted for worth and repair high quality.

- Digital Receipts: Maintain digital copies of all receipts. Most distributors provide e-receipts, that are simpler to handle and submit along with your expense experiences.

- Expense Report Timeliness: Submit expense experiences promptly to make sure swift processing and reimbursement. Delayed submissions can result in delays in reimbursement and complicate funds monitoring.

Sources

- Digital Expense Administration Platform: [Company Name] provides an internet platform for monitoring and submitting bills, accessible by way of the corporate intranet. Coaching periods on utilizing this platform can be found quarterly.

- Finance Division Slack Channel: For questions or clarifications on expense insurance policies, workers can contact the Finance Division Slack Channel, out there throughout enterprise hours at #expense-queries.

Strategic Partnerships

[Company Name] has established partnerships with a number of exterior distributors to supply workers with reductions and particular phrases, enhancing the worth and effectivity of business-related expenditures.

- Journey Partnership: With TravelCo, workers can avail of discounted charges for flights and resort bookings. Use the company code [TC123] when reserving by the TravelCo platform or app. [Link]

- Know-how Provides: TechSolutions provides particular pricing on laptop equipment and software program to [Company Name] workers. Entry this by the hyperlink offered on our intranet, utilizing the corporate’s account. [Link]

- Workplace Provides Low cost: OfficeMax has partnered with us to supply reductions on workplace provides. Orders could be positioned immediately by our procurement system, with reductions routinely utilized. [Link]

To make the most of these partnerships, workers ought to check with the particular codes and hyperlinks offered on the corporate intranet. For first-time entry or if encountering difficulties, the procurement group is offered to help and guarantee workers can take full benefit of those provides.

Non-Compliance Coverage

Guaranteeing adherence to the expense coverage of [Company Name] is essential for sustaining monetary integrity and accountability inside the group. This part outlines the implications of failing to adjust to the expense coverage and the method for reviewing and contesting non-compliance points.

Non-compliance with the expense coverage can lead to a spread of actions, relying on the character and frequency of the violations:

- First Offense: Staff who fail to adjust to the expense coverage for the primary time will obtain a written warning and could also be required to attend a coaching session on expense coverage compliance.

- Repeated Offenses: Continued non-compliance will end in extra extreme actions, together with the denial of reimbursement for non-compliant bills, a proper overview with the division head, and potential disciplinary actions as much as and together with termination.

- Severe Violations: Fraudulent or deliberately deceptive expense claims can be topic to quick disciplinary motion, which can embody termination of employment and authorized proceedings.

The overview and contestation course of is documented as follows –

- Preliminary Evaluation: If an worker’s expense report is flagged for non-compliance, the worker will obtain a notification detailing the particular difficulty. The worker may have the chance to supply extra documentation or clarification to resolve the problem.

- Formal Enchantment: Ought to the worker disagree with the choice made following the preliminary overview, they’ve the proper to formally enchantment the choice. The enchantment should be submitted in writing to the Finance Division inside 10 enterprise days of the preliminary choice.

- Enchantment Evaluation Committee: An Enchantment Evaluation Committee, consisting of representatives from the Finance, HR, and the worker’s division, will overview the enchantment. This committee will think about all submitted documentation and arguments to make a remaining choice.

- Remaining Determination: The committee’s choice is remaining and can be communicated to the worker inside 10 enterprise days of the enchantment submission. The choice will define any actions to be taken or verify the decision of the problem.

[Company Name]’s non-compliance coverage is designed to advertise understanding and adherence to the expense coverage whereas offering a good course of for addressing and resolving points. This method ensures that workers are conscious of the significance of compliance and the implications of failing to stick to established tips, thereby sustaining the group’s monetary well being and moral requirements.

Contacts and Help

To make sure that all workers of [Company Name] have entry to steering and assist concerning the expense coverage, this part offers detailed contact data for people and departments liable for overseeing and aiding with expense-related inquiries and processes.

- Expense Coverage Queries and Clarifications: For questions associated to expense coverage tips, allowable bills, or reimbursement processes.

- Contact: Jane Doe, Expense Coverage Supervisor

- E-mail: jane.doe@[companyname].com

- Cellphone: (123) 456-7890

- Coaching and Compliance: For inquiries about expense coverage coaching periods, compliance points, or to report considerations associated to expense reimbursements.

- Contact: John Smith, HR Compliance Officer

- E-mail: john.smith@[companyname].com

- Cellphone: (123) 456-7891

- Digital Expense Administration Platform Help: For technical assist with the net expense submission platform, together with login points, submission errors, or add documentation.

- Contact: IT Assist Desk

- E-mail: ithelp@[companyname].com

- Cellphone: (123) 456-7892

- Vendor Partnerships and Reductions: For help accessing most well-liked vendor reductions, ordering by firm accounts, or inquiries about accredited distributors.

- Contact: Lisa Inexperienced, Procurement Specialist

- E-mail: lisa.inexperienced@[companyname].com

- Cellphone: (123) 456-7893

- Basic Inquiries: For every other questions or help not particularly listed above, workers can contact the overall assist line or electronic mail, the place queries can be directed to the suitable division or particular person.

- Basic Help E-mail: assist@[companyname].com

- Basic Help Cellphone: (123) 456-7894

This Expense Coverage doc, designed for [Company Name], serves as a complete information to managing work-related bills in a fashion that aligns with our group’s values of integrity, accountability, and financial accountability.

We encourage all workers to familiarize themselves with this coverage, make the most of the assets and contacts offered, and decide to upholding the best requirements of monetary stewardship.

Common critiques and updates to this coverage can be communicated to replicate modifications in our enterprise setting, regulatory necessities, or firm wants.

Ought to you have got any questions or require additional clarification, please don’t hesitate to achieve out to the suitable contacts listed within the earlier part.

Your understanding, cooperation, and proactive engagement with this coverage are invaluable to sustaining [Company Name]’s repute and success.

Thanks on your dedication to upholding these requirements and contributing to our firm’s tradition of excellence and integrity.

Finish of Doc

Tips on how to implement the Expense Coverage Template on your Enterprise?

As soon as you might be completed crafting your expense coverage in response to your corporation wants, the following step is to implement it into the each day operations of the enterprise.

We are going to now discover handle bills effectively with a simple handbook workflow, together with steps from sharing the coverage to updating procedures.

Shifting on, we can even check out how expense administration software program like Nanonets can simplify the method additional by automated expense administration, providing options like on-line submissions, receipt scanning and direct approvals.

Handbook Workflow: Simplified and Sensible Steps

- Share the Coverage: E-mail the expense coverage to everybody and submit it on the corporate intranet. Be certain that new hires get it too.

- Practice Everybody: Maintain periods to elucidate the coverage. Embrace a particular session for managers on oversee their group’s bills.

- Submitting Bills: Staff fill out a typical expense type each time they incur a enterprise expense. They need to embody what the expense was for, how a lot it price, and the date it occurred.

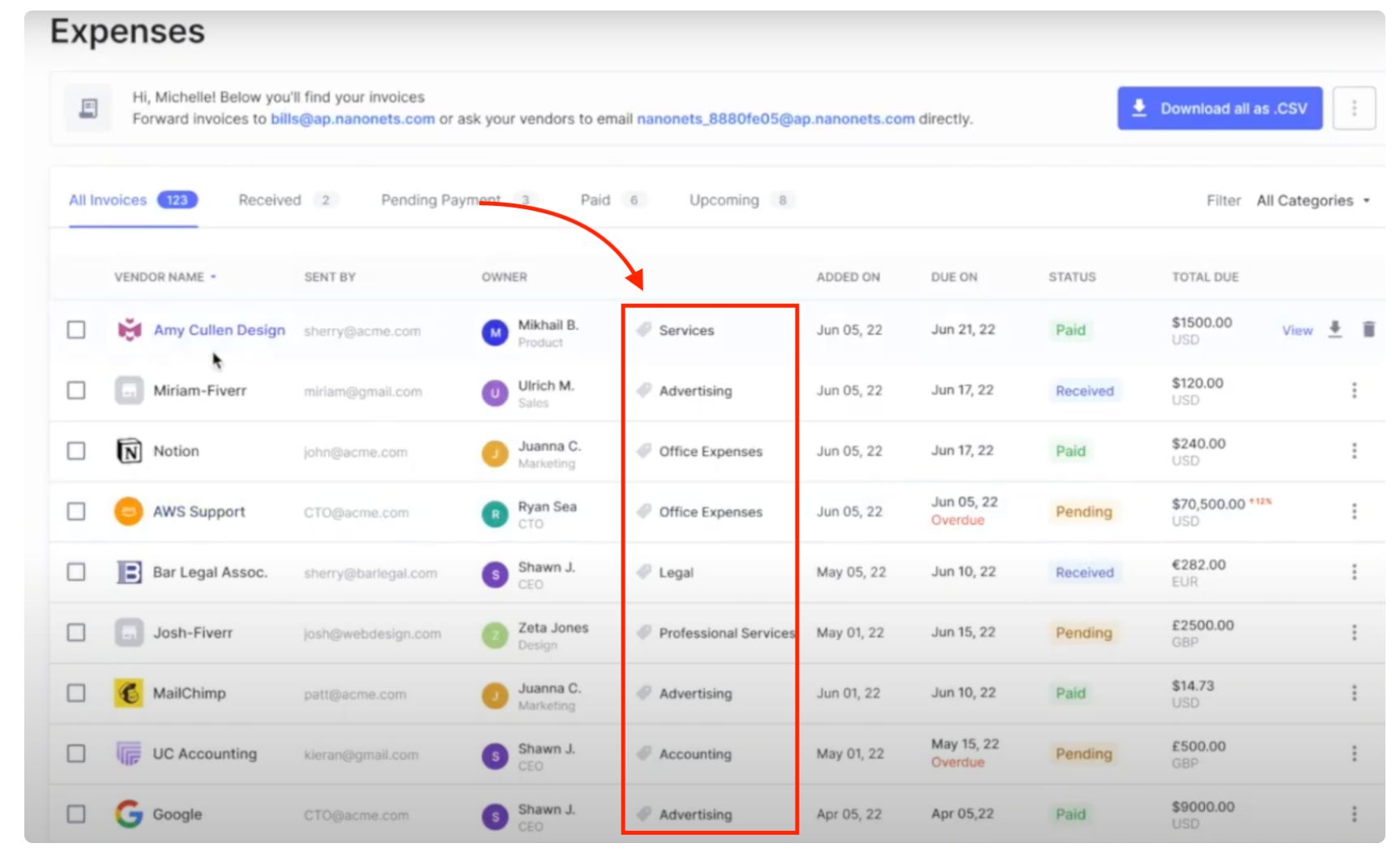

- Categorizing Bills: After coming into the small print, the finance individual kinds every expense into classes like journey or meals. This helps preserve issues organized and makes reporting simpler.

- Attaching Receipts: Staff want to supply receipts with their kinds. If the receipts are paper, they need to take a transparent image or make a scan.

- Getting into Information: Somebody in finance enters the small print from connected receipts into the corporate’s expense monitoring system. This makes certain all bills are correct and recorded in a single place.

- Evaluation and Approve: Bills undergo a overview course of, often first by the worker’s supervisor after which by the finance division, to ensure they observe the coverage.

- Difficulty Reimbursements: As soon as accredited, the finance division arranges for the expense to be reimbursed on the following payroll or in response to the corporate’s reimbursement schedule.

- Test and Audit: Periodically, the finance group checks expense experiences towards the coverage to catch any points or fraud.

- Replace and Suggestions: Acquire suggestions from workers on the expense course of and replace the coverage or procedures as wanted to maintain issues operating easily.

Automated Workflow with Expense Administration Software program

An automatic expense administration software program like Nanonets implements the expense coverage in a streamlined workflow.

Let’s examine how.

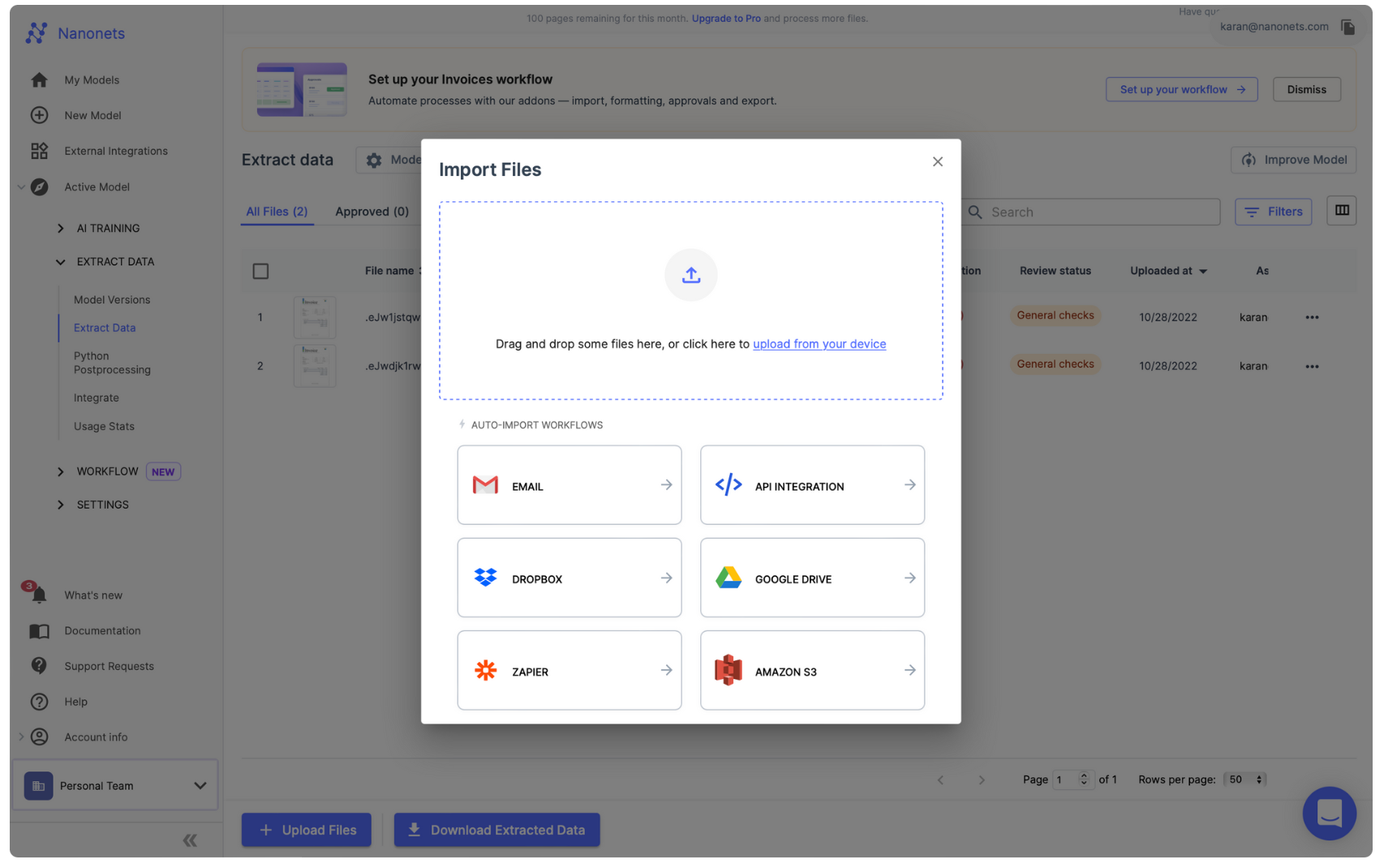

- Get Began: Join on app.nanonets.com.

- Set Up: Configure your expense coverage in your NanoNets account. Add validation checks and approval routing.

- On-line Submission: Staff log their bills in NanoNets immediately, by merely importing a scanned or digital copy of their receipt!

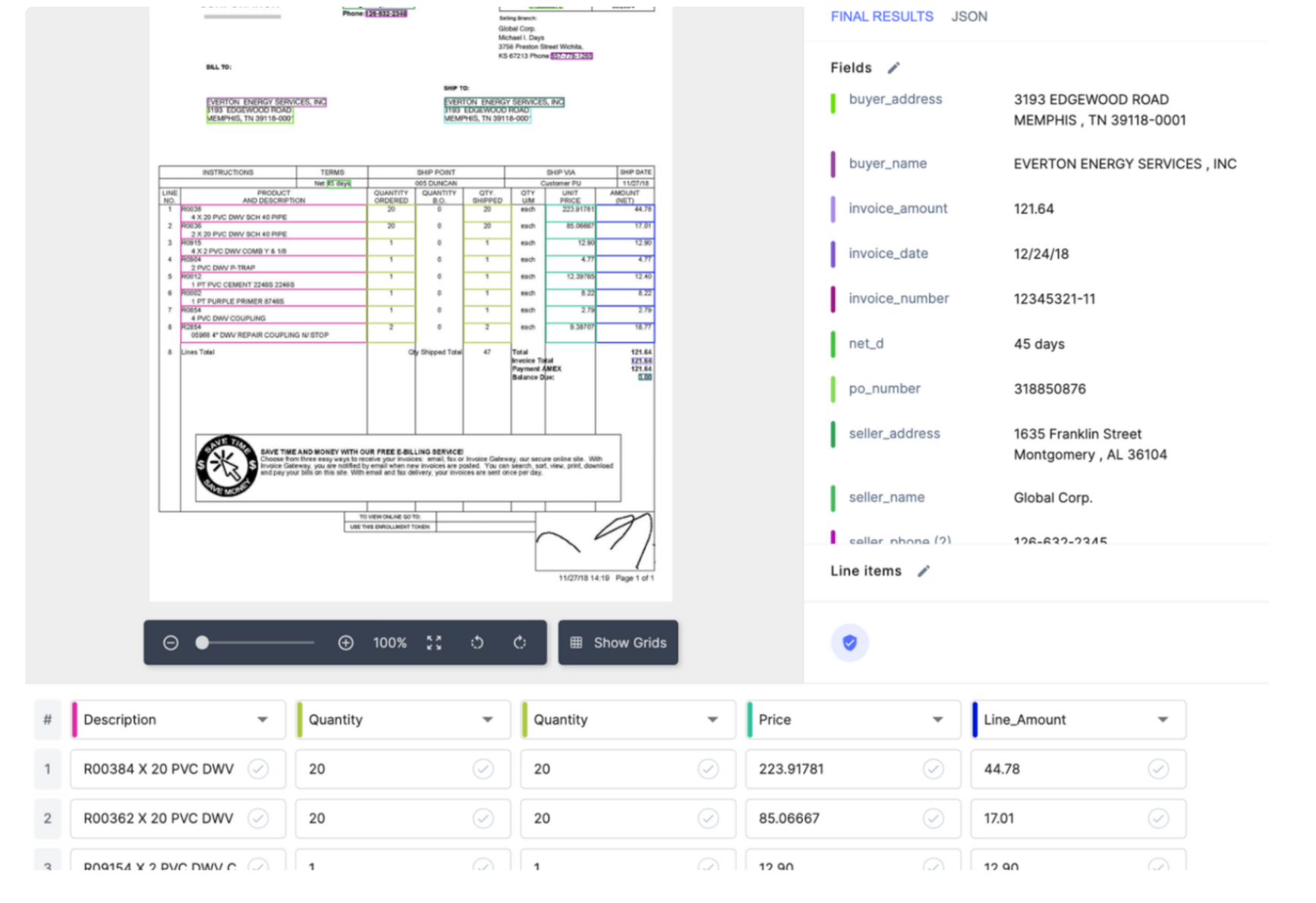

- Information Extraction: NanoNets routinely pulls information from the submitted receipts, similar to date, quantity, and service provider, thus eliminating the necessity for handbook information entry and ensuring your expense information is at all times correct.

- Automated Sorting: NanoNets then kinds every expense into the proper class in response to your coverage’s context and categorization framework, like journey or meals.

- Coverage Checks: Because it categorizes, NanoNets checks every expense towards your coverage guidelines. It routinely flags any that do not match for overview.

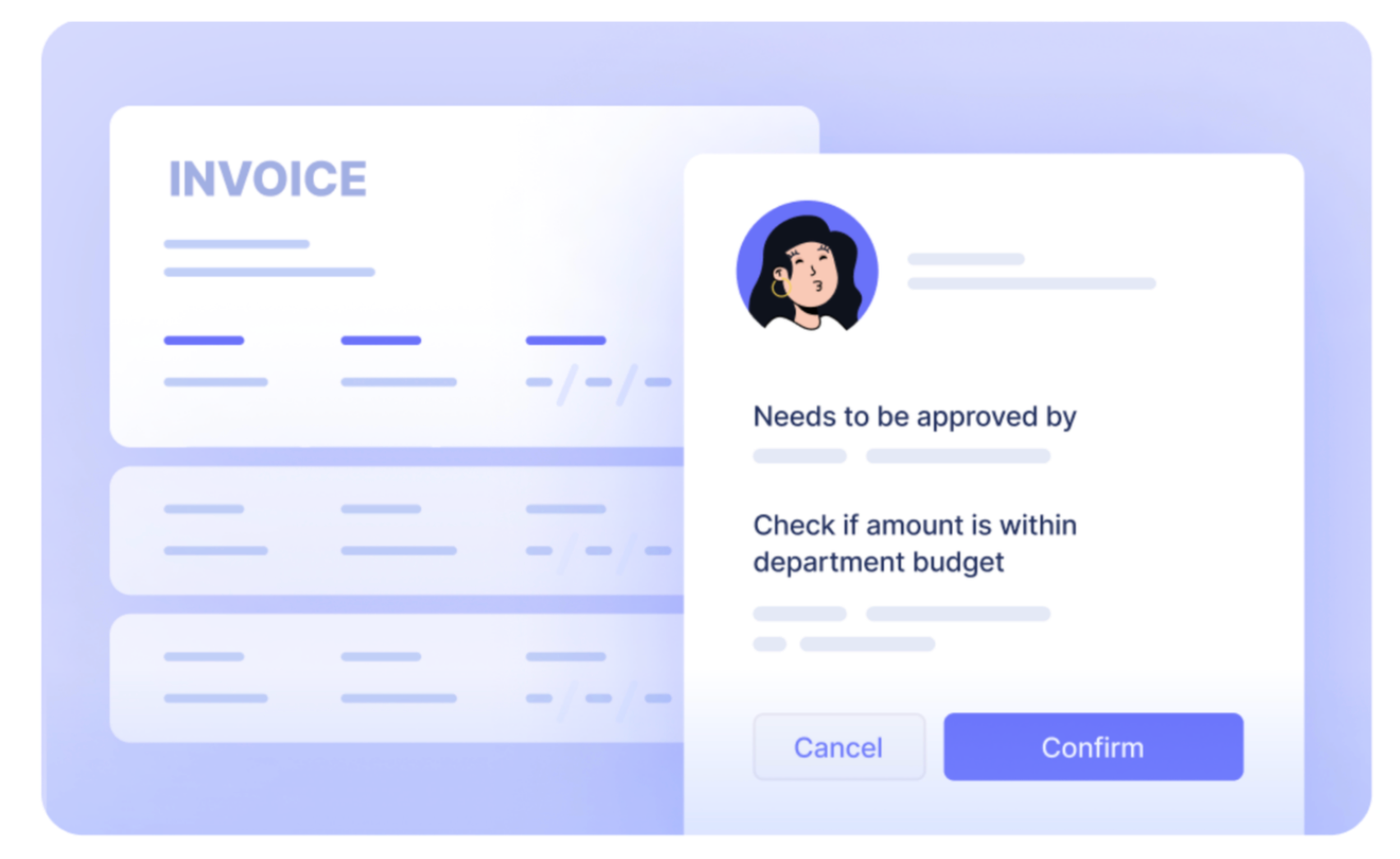

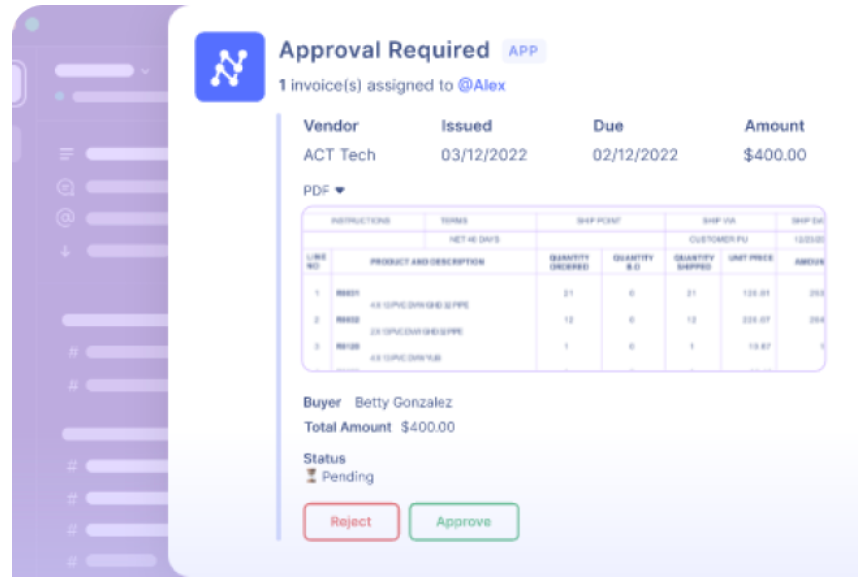

- Direct Approval: The system routes every expense to the proper supervisor for approval based mostly on guidelines you’ve got set, like expense quantity or division. This quickens the approval course of.

- Fast Reimbursement: As soon as accredited, bills are routinely lined up for reimbursement. NanoNets can hyperlink to your accounting software program to make this occur with out additional steps.

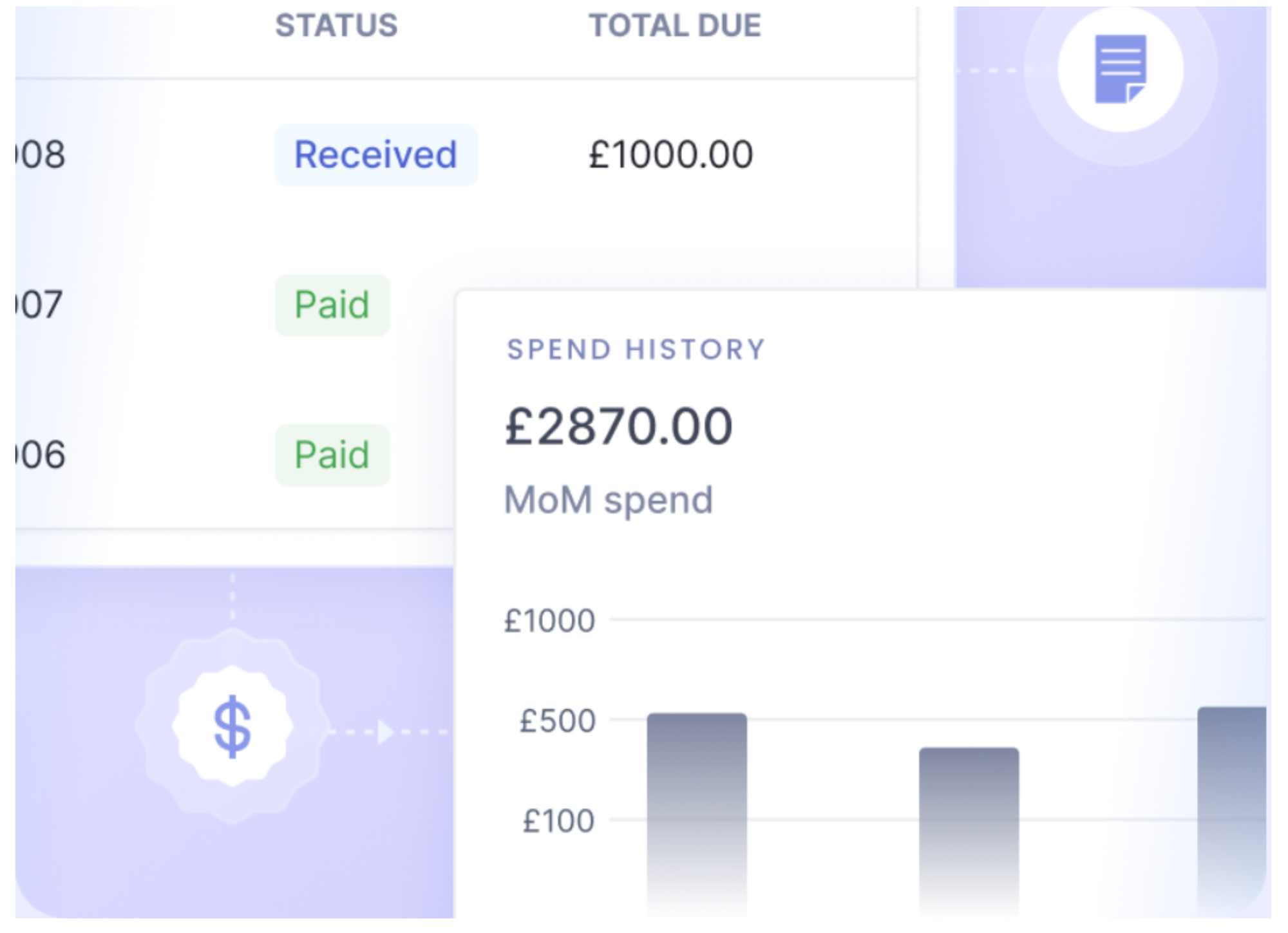

- Insights and Reviews: NanoNets provides experiences and analytics on spending patterns and coverage compliance, providing you with a transparent image of the place cash goes.

For additional studying, here’s a record of the very best expense administration software program out there that might make it easier to implement your expense coverage with ease.

15 Greatest Spend Administration Software program Options in 2024

Discover the world of spend administration software program in 2024. Uncover the very best options and learn to select the proper one for your corporation.