At this 12 months’s Pacific Telecommunications Council convention, I spent a while speaking by TeleGeography’s newest pricing analysis findings and tackling the commonest questions we have acquired over the previous 12 months.

In case you missed it, here is a recap of my Taylor Swift-themed presentation: International Pricing Traits in a New Period.

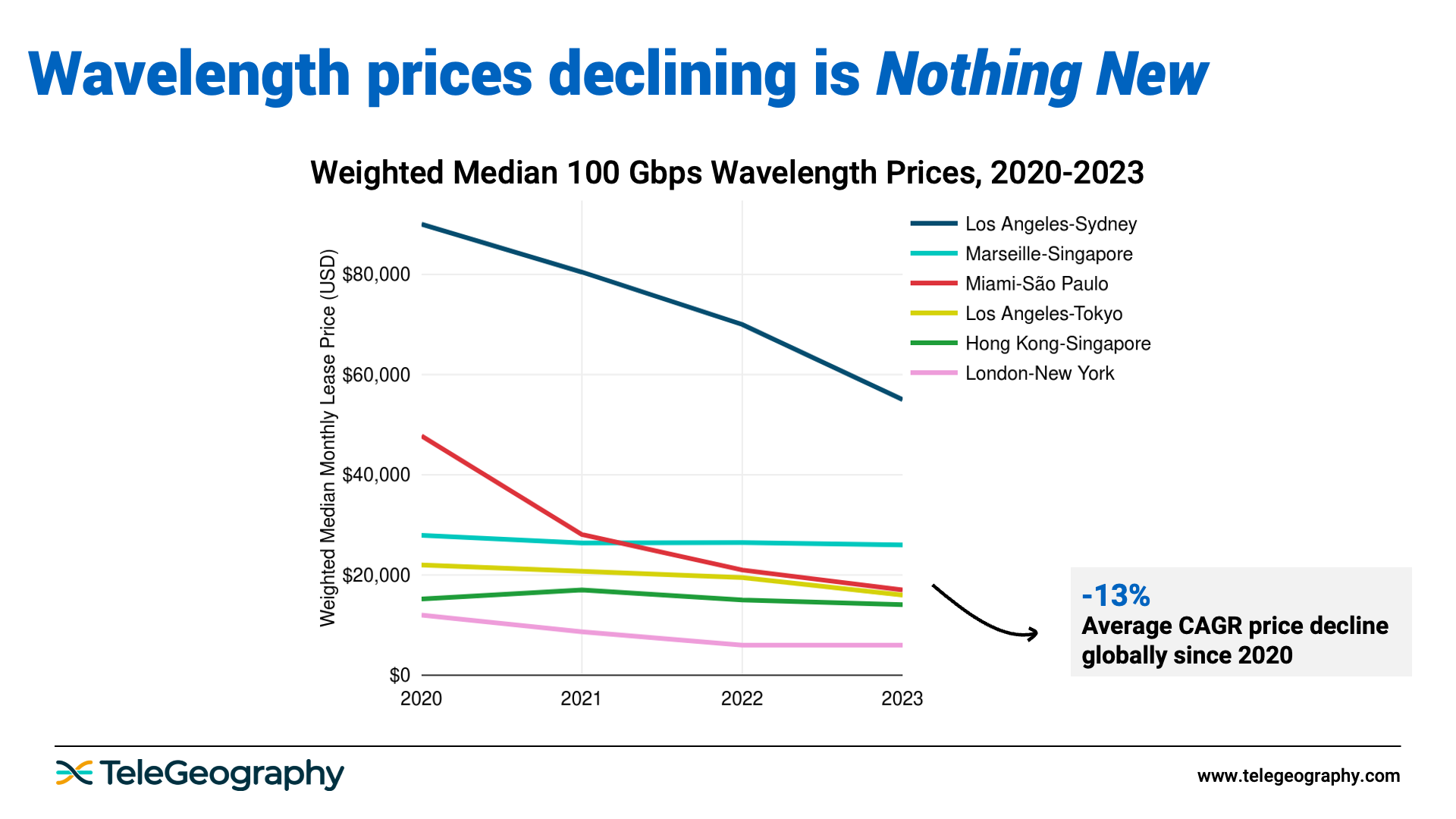

Final 12 months, we discovered ourselves in uncharted territory. Delays in new provide had dramatically slowed value erosion all over the world, leaving us to marvel if costs have been truly growing.

Are we out of the woods but? Not fully.

Over the previous three years, 100 Gbps costs throughout six key world routes continued to lower about 13% on common.

In fact, we noticed a variety in value erosion tendencies—costs decreased simply 2% on Marseille-Singapore vs. 29% on Miami-São Paulo—however that is not the massive story right here.

Regardless of these declines, value erosion is going on at a a lot slower tempo than we’re used to seeing out there.

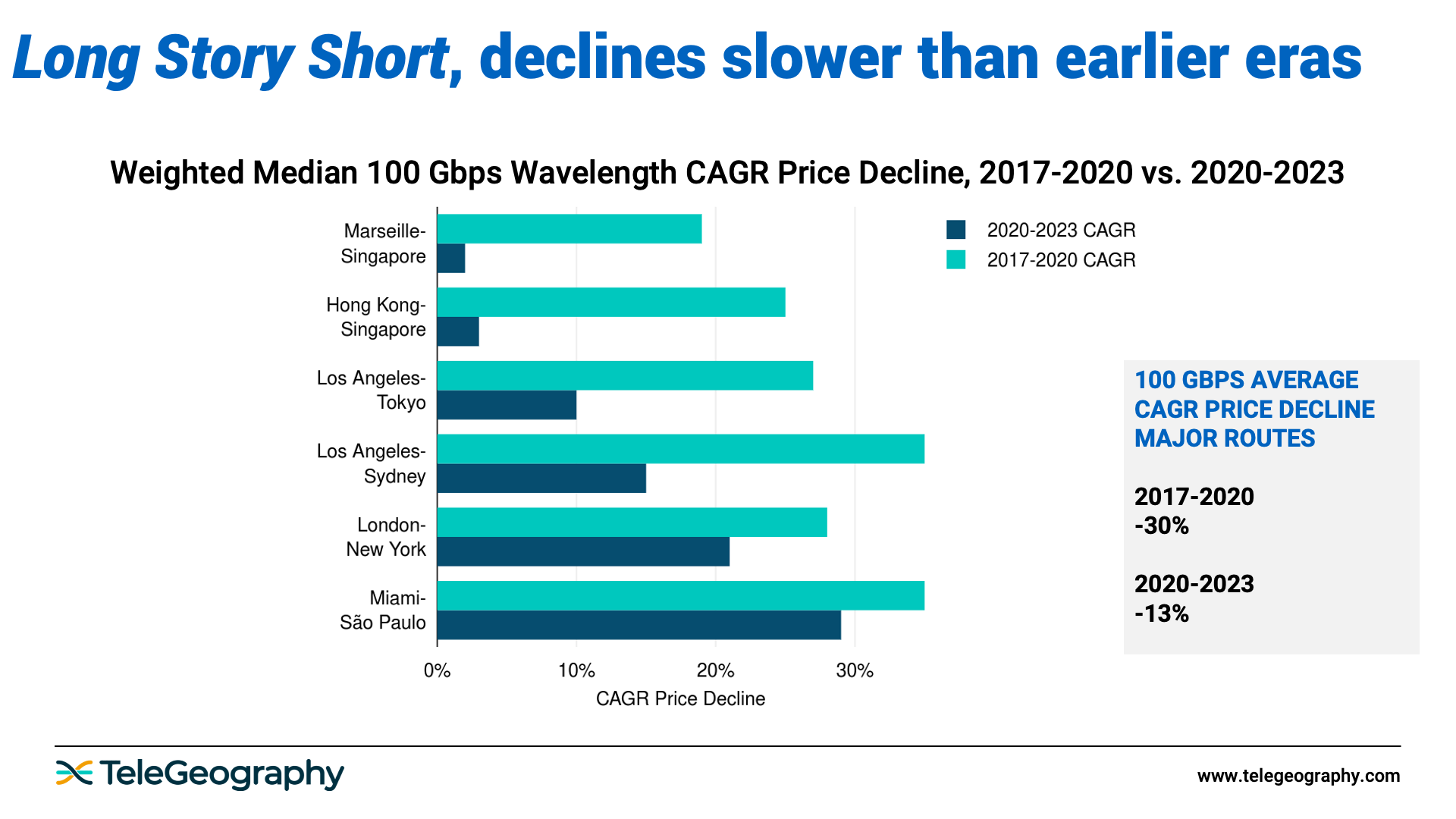

Within the determine under, we have mapped out 100 Gbps wavelength CAGR value declines from 2017-2020 (turquoise) and 2020-2023 (darkish blue).

As you possibly can see, value declines have dramatically slowed throughout all six of those routes. From 2017-2020, we noticed a 30% common decline. That quantity decreased to simply 13% from 2020-2023.

There are a couple of elements at play right here.

These are very aggressive submarine cable routes, and 100 Gbps costs are already low. Plus, we’re nonetheless seeing delays in new community provide on a variety of these routes.

Sure, card shortages and provide chain disruptions have resolved themselves, however geopolitical points—equivalent to within the Purple Sea and South China Sea—are delaying community initiatives.

Fewer cables with stock at one time has led to much less aggressive value stress. Nevertheless, on routes with current upgrades, new provide, and pre-sales on new techniques, value erosion is returning to greater ranges.

On routes with current upgrades, new provide, and pre-sales on new techniques, value erosion is returning to greater ranges.

Within the meantime, uncertainty on the timeline of future provide on some routes has modified buyer buying patterns.

Provide is being snatched up earlier than it turns into accessible or purchased in bulk, so even when upgrades are occurring, that capability could already be spoken for. Prospects are taking capability on the value that’s provided, and that is serving to to take care of value factors.

What about 400 Gbps? How is demand for this service shaping up, and what are pricing fashions wanting like worldwide?

How have these transport tendencies impacted the transit market?

Final 12 months, our knowledge urged that the provision shortage and inflationary stress on community tools prices had additionally muted IP transit value erosion. That is now not the case.

To study extra, obtain my full slide deck.

Along with what we have already lined right here, these slides present the affect of transport on transit pricing and the place we’re headed in our subsequent period.