We’re at present ready for the UK authorities to publish its semiconductor technique. As context for such a method, my earlier two blogposts have summarised the worldwide state of the trade:

Half 1: the UK’s place within the semiconductor world

Half 2: the previous and way forward for the worldwide semiconductor trade

Right here I contemplate what a sensible and helpful UK semiconductor technique would possibly embrace.

To summarise the worldwide context, the important nations in superior semiconductor manufacturing are Taiwan, Korea and the USA for making the chips themselves. As well as, Japan and the Netherlands are important for essential components of the availability chain, significantly the gear wanted to make chips. China has been devoting important useful resource to develop its personal semiconductor trade – in consequence, it’s sturdy in all however probably the most superior applied sciences for chip manufacture, however is weak to being minimize off from essential components of the availability chain.

The know-how of chip manufacture is approaching maturity; the very speedy charges of enhance in computing energy we noticed within the Eighties and Nineties, related to a mixture of Moore’s regulation and Dennard scaling, have considerably slowed. On the know-how frontier we’re seeing diminishing returns from the ever bigger investments in capital and R&D which might be wanted to take care of advances. Additional enhancements in pc efficiency are prone to put extra premium on customized designs for chips optimised for particular purposes.

The UK’s place in semiconductor manufacturing is marginal in a world perspective, and never a relative power within the context of the general UK financial system. There may be truly a barely stronger place within the wider provide chain than in chip manufacture itself, however probably the most important power isn’t in manufacture, however design, with ARM having a globally important place and newcomers like Graphcore displaying promise.

The historical past of the worldwide semiconductor trade is a historical past of main authorities interventions coupled with very massive personal sector R&D spending, the latter pushed by dramatically growing gross sales. The UK basically opted out of the race within the 1980’s, since when Korea and Taiwan have established globally main positions, and China has turn out to be a quick increasing new entrant to the trade.

The harder geopolitical surroundings has led to a return of business technique on an enormous scale, led by the USA’s CHIPS Act, which appropriates greater than $50 billion over 5 years to reestablish its world management, together with $39 billion on direct subsidies for manufacturing.

How ought to the UK reply? What I’m speaking about right here is the core enterprise of producing semiconductor gadgets and the encircling provide chain, somewhat than info and communication know-how extra extensively. First, although, let’s be clear about what the targets of a UK semiconductor technique may very well be.

What’s a semiconductor technique for?

A nationwide technique for semiconductors might have a number of targets. The UK Science and Know-how Framework identifies semiconductors as certainly one of 5 important applied sciences, judged towards standards together with their foundational character, market potential, in addition to their significance for different nationwide priorities, together with nationwide safety.

It may be useful to tell apart two barely completely different targets for the semiconductor technique. The primary is the query of safety, within the broadest sense, prompted by the availability issues that emerged within the pandemic, and heightened by the rising realisation of the significance and vulnerability of Taiwan within the world semiconductor trade. Right here the inquiries to ask are, what industries are in danger from additional disruptions? What are the nationwide safety points that might come up from interruptions in provide?

The federal government’s newest refresh of its built-in overseas and defence technique guarantees to “make sure the UK has a transparent path to assured entry for every [critical technology], a powerful voice in influencing their growth and use internationally, a managed method to produce chain dangers, and a plan to guard our benefit as we construct it.” It reasserts as a mannequin launched within the earlier Built-in Evaluation the “personal, collaborate, entry” framework.

This framework is a welcome recognition of the the truth that the UK is a medium dimension nation which might’t do all the things, and with the intention to have entry to the know-how it wants, it should in some instances collaborate with pleasant nations, and in others entry know-how by means of open world markets. Nevertheless it’s value asking what precisely is supposed by “personal”. That is outlined within the Built-in Evaluation thus: “Personal: the place the UK has management and possession of recent developments, from discovery to large-scale manufacture and commercialisation.”

In what sense does the nation ever personal a know-how? There are nonetheless a number of instances the place wholly state owned organisations retain each a sensible and authorized monopoly on a specific know-how – nuclear weapons stay the obvious instance. However applied sciences are largely managed by personal sector corporations with a fancy, and sometimes world possession construction. We would assume that the applied sciences of semiconductor built-in circuit design that ARM developed are British, as a result of the corporate is predicated in Cambridge. Nevertheless it’s owned by a Japanese funding financial institution, who’ve quite a lot of latitude in what they do with it.

Maybe it’s extra useful to speak about management than possession. The UK state retains a certain quantity of management of applied sciences owned by corporations with a considerable UK presence – it has been ready in impact to dam the acquisition of the Newport Wafer Fab by the Chinese language owned firm Nexperia. However this new assertiveness is a really current phenomenon; till very lately UK governments have been totally relaxed concerning the acquisition of know-how corporations by abroad corporations. Certainly, in 2016 ARM’s acquisition by Softbank was welcomed by the then PM, Theresa Could, as being within the UK’s nationwide curiosity, and a vote of confidence in post-Brexit Britain. The federal government has taken new powers to dam acquisitions of corporations by means of the Nationwide Safety and Funding Act 2021, however this will solely be executed on grounds of nationwide safety.

The second purpose of a semiconductor technique is as a part of an effort to beat the UK’s persistent stagnation of financial productiveness, to “generate innovation-led financial progress” , within the phrases of a current Authorities response to a BEIS Choose Committee report. As I’ve written about at size, the UK’s productiveness drawback is critical and chronic, so there’s definitely a have to determine and help excessive worth sectors with the potential for progress. There’s a regional dimension right here, recognised within the authorities’s aspiration for the technique to create “excessive paying jobs all through the UK”. So it might be totally applicable for a method to help the prevailing cluster within the Southwest round Bristol and into South Wales, in addition to to create new clusters the place there are strengths in associated trade sectors

The economies of Taiwan and Korea have been reworked by their very efficient deployment of an lively industrial technique to reap the benefits of an trade at a time of speedy technological progress and increasing markets. There are two questions for the UK now. Has the UK state (and the broader financial consensus within the nation) overcome its ideological aversion to lively industrial technique on the East Asian mannequin to intervene on the mandatory scale? And, would such an intervention be well timed, given the place semiconductors are within the know-how cycle? Or, to place it extra provocatively, has the UK left it too late to seize a major share of a know-how that’s approaching maturity?

What, realistically, can the UK do about semiconductors?

What interventions are doable for the UK authorities in devising a semiconductor technique that addresses these two targets – of accelerating the UK’s financial and navy safety by decreasing its vulnerability to shocks within the world semiconductor provide chain, and of enhancing the UK’s financial efficiency by driving innovation-led financial progress? There’s a menu of choices, and what the federal government chooses will rely upon its urge for food for spending cash, its willingness to take property onto its steadiness sheet, and the way a lot it’s ready to intervene out there.

Might the UK set up the manufacturing of forefront silicon chips? This appears implausible. That is probably the most subtle manufacturing course of on this planet, enormously capital intensive and drawing on an enormous quantity of proprietary and tacit data. The one manner it might occur is that if one of many three corporations at present at or near the know-how frontier – Samsung, Intel or TSMC – may very well be enticed to determine a producing plant within the UK. What can be in it for them? The UK doesn’t have a giant market, it has a labour market that’s excessive price, but missing within the mandatory expertise, so its solely likelihood can be to advance massive direct subsidies.

In any case, the eye of those corporations is elsewhere. TSMC is constructing a brand new plant in Arizona, at a price of $40 billion, whereas Samsung’s new plant in Texas is costing $25 billion, with the US authorities utilizing among the CHIPS act cash to subsidise these investments. Regardless of Intel’s well-reported difficulties, it’s planning important funding in Europe, supported by inducements from EU and its member states below the EU Chips act. Intel has dedicated €12 billion to increasing its operations in Eire and €17 billion for a brand new fab within the current semiconductor cluster in Saxony, Germany.

From the perspective of safety of provide, it’s not simply chips from the forefront which might be necessary; for a lot of purposes, in cars, defence and industrial equipment, legacy chips produced by processes which might be now not at the forefront are enough. In precept establishing manufacturing amenities for such legacy chips can be much less difficult than trying to determine manufacturing at the forefront. Nevertheless, right here, the economics of creating new manufacturing amenities could be very tough. The price of producing chips is dominated by the necessity to amortise the very massive capital price of establishing a fab, however a brand new plant can be in competitors with long-established crops whose capital price is already totally depreciated. These legacy chips are a commodity product.

So in practise, our safety of provide can solely be assured by reliance on pleasant international locations. It might have been useful if the UK had been capable of take part within the growth of a European technique to safe semiconductor provide chains, as Hermann Hauser has argued for. However what does the UK need to contribute, within the creation of extra resilient provide chains extra localised in networks of reliably pleasant international locations?

The UK’s key asset is its place in chip design, with ARM because the anchor agency. However, as a agency primarily based on mental property somewhat than the massive capital investments of fabs and factories, ARM is probably footloose, and as we’ve seen, it isn’t British by possession. Fairly it’s owned and managed by a Japanese conglomerate, which must promote it to lift cash, and can search to attain the best return from such a sale. After the proposed sale to Nvidia was blocked, the possible final result now’s a floatation on the US inventory market, the place the standard valuations of tech corporations are increased than they’re within the UK.

The UK state might search to take care of management over ARM by the machine of a “Golden Share”, because it at present does with Rolls-Royce and BAE Methods. I’m undecided what the mechanism for this might be – I’d think about that the one surefire manner of doing this might be for the UK authorities to purchase ARM outright from Softbank in an agreed sale, after which subsequently float it itself with the golden share in place. I don’t suppose this might be low-cost – the agreed worth for the thwarted Nvidia take over was $66 billion. The UK authorities would then try to recoup as a lot of the acquisition worth as doable by means of a subsequent floatation, however the presence of the golden share would presumably cut back the market worth of the remaining shares. Nonetheless, the UK authorities did spend £46 billion nationalising a financial institution.

What different levers does the UK need to consolidate its place in chip design? Clever use of presidency buying energy is commonly cited as an ingredient of a profitable industrial coverage, and right here there is a chance. The federal government made the welcome announcement within the Spring Finances that it might commit £900 m to construct an exascale pc to create a sovereign functionality in synthetic intelligence. The procurement course of for this facility needs to be designed to drive innovation within the design, by UK corporations, of specialized processing items for AI with decrease power consumption.

A robust public R&D base is a mandatory – however not enough – situation for an efficient industrial technique in any R&D intensive trade. As a matter of coverage, the UK ran down its public sector analysis effort in mainstream silicon microelectronics, in response to the UK’s total weak place within the trade. The Engineering and Bodily Analysis Council pronounces on its web site that: “In 2011, EPSRC determined to not help analysis aimed toward miniaturisation of CMOS gadgets by means of gate-length discount, as massive non-UK industrial funding on this area meant such analysis would have been unlikely to have had important nationwide affect.” I don’t assume this was – or is – an unreasonable coverage given the realities of the UK’s world place. The UK maintains tutorial analysis power in areas such III-V semiconductors for optoelectronics, 2-d supplies similar to graphene, and natural semiconductors, to provide a number of examples.

Given the sophistication of cutting-edge microelectronic manufacturing know-how, for R&D to be related and translatable into business merchandise it will be significant that open entry amenities can be found to permit the prototyping of analysis gadgets, and with pilot scale gear to exhibit manufacturability and facilitate scale-up. The UK doesn’t have analysis centres on the size of Belgium’s IMEC, or Taiwan’s ITRI, and the problem is whether or not, given the self-love of the UK’s trade base, there can be a buyer base for such a facility. There are a selection of college amenities centered on supporting tutorial researchers in numerous specialisms – at Glasgow, Manchester, Sheffield and Cambridge, to provide some examples. Two centres are related to the Catapult Community – The Nationwide Printable Electronics Centre in Sedgefield, and the Compound Semiconductor Catapult in South Wales.

This current infrastructure is definitely inadequate to help an ambition to broaden the UK’s semiconductor sector. However a choice to boost this analysis infrastructure will want a cautious and lifelike analysis of what niches the UK might realistically hope to construct some presence in, constructing on areas of current UK power, and understanding the size of funding elsewhere on this planet.

To summarise, the UK should recognise that, in semiconductors, it’s at present in a comparatively weak place. For safety of provide, the main target should be on staying near like-minded international locations like our European neighbours. For the UK to develop its personal semiconductor trade additional, the emphasis should be on discovering and growing specific niches the place the UK’s does have some current power to construct on, and there may be the prospect of quickly rising markets. And the UK ought to take care of its one real space of power, in chip design.

4 classes for industrial technique

What ought to the UK do about semiconductors? One other tempting, however unhelpful, reply is “I wouldn’t begin from right here”. The UK’s present place displays previous decisions, so to conclude, maybe it’s value drawing some extra normal classes about industrial technique from the historical past of semiconductors within the UK, and globally.

1. Fundamental analysis isn’t sufficient

The historian David Edgerton has noticed that it’s a long-running behavior of the UK state to make use of analysis coverage as an alternative to industrial technique. Fundamental analysis is comparatively low-cost, in comparison with the costly and time-consuming means of growing and implementing new merchandise and processes. Within the 1980’s, it turned typical knowledge that governments mustn’t get entangled in utilized analysis and growth, which needs to be left to non-public trade, and, as I lately mentioned at size, this has profoundly formed the UK’s analysis and growth panorama. However excellence in fundamental analysis has not produced a aggressive semiconductor trade.

The final important act of presidency help for the semiconductor trade within the UK was the Alvey programme of the Eighties. The programme was not with out some technical successes, but it surely clearly failed in its strategic purpose of protecting the UK semiconductor trade globally aggressive. Because the official analysis of the programme concluded in 1991 [1]: “Help for pre-competitive R&D is a mandatory however inadequate means for enhancing the aggressive efficiency of the IT trade. The programme was not funded or outfitted to take care of the completely different phases of the innovation course of able to being addressed by authorities know-how insurance policies. If enhanced competitiveness is the purpose, both the funding or scope of motion needs to be commensurate, or expectations needs to be lowered accordingly”.

However the precise R&D establishments may be helpful; the expertise of each Japan and the USA reveals the worth of trade consortia – however this solely works if there may be already a powerful, R&D intensive trade base. The creation of TSMC reveals that it’s doable to create a world big from scratch, and this emphasises the position of translational analysis centres, like Taiwan’s ITRI and Belgium’s IMEC. However to be efficient in creating new companies, such centres have to have a concentrate on course of enchancment and manufacturing, in addition to discovery science.

2. Huge is gorgeous in deep tech.

The fashionable semiconductor trade is the epitome of “Deep Tech”: laborious innovation, often within the materials or organic domains, demanding long run R&D efforts and huge capital investments. For all of the romance of garage-based start-ups, in a enterprise that calls for up-front capital investments within the $10’s of billions and annual analysis budgets on the size of medium dimension nation states, one wants critical, massive scale organisations to succeed.

The possession and management of those organisations does matter. From a nationwide perspective, it is very important have massive corporations anchored to the territory, whether or not by possession or by important capital funding that might be laborious to undo, so making certain the permanence of such corporations is the official enterprise of presidency. Naturally, large corporations usually begin as quick rising small ones, and the UK ought to make extra effort to hold on to corporations as they scale up.

3. Getting the timing proper within the know-how cycle

Technological progress is uneven – at any given time, one trade could also be present process very dramatic technological change, whereas different sectors are comparatively stagnant. There could also be a second when the state of know-how guarantees a interval of speedy growth, and there’s a matching market with the potential for quick progress. Corporations which have the capability to take a position and exploit such “home windows of alternative”, to make use of David Sainsbury’s phrase, will be capable of generate and seize a excessive and rising stage of added worth.

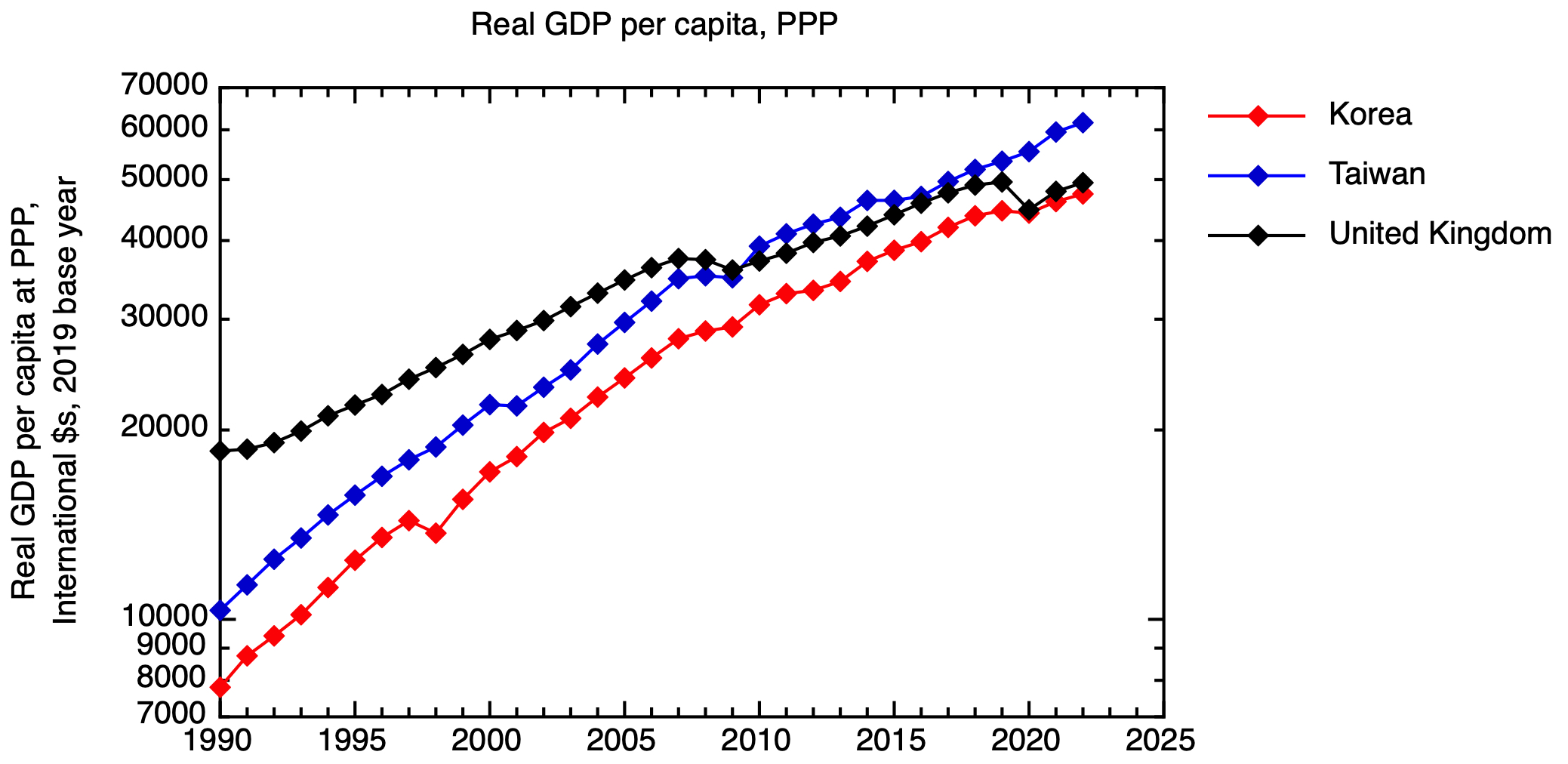

The timing of interventions to help such corporations is essential, and undoubtedly not simple, however historical past reveals us that nations which might be capable of supply important ranges of strategic help on the proper stage can see a fabric affect on their financial efficiency. The current speedy financial progress of Korea and Taiwan is a living proof. These international locations have gone past catch-up financial progress, to equal or surpass the UK, reflecting their reaching the technological frontier in excessive worth sectors similar to semiconductors. After all, in these international locations, there was a a lot nearer entanglement between the state and corporations than UK coverage makers are snug with.

Actual GDP per capita at buying energy parity for Taiwan, Korea and the UK. Based mostly on information from the IMF. GDP at PPP in worldwide {dollars} was taken for the bottom yr of 2019, and a time sequence constructed utilizing IMF actual GDP progress information, & then expressed per capita.

4. If you happen to don’t select sectors, sectors will select you

Within the UK, so-called “vertical” industrial technique, the place specific decisions are made to help particular sectors, have lengthy been out of favour. Making decisions between sectors is tough, and being perceived to have made the improper decisions damages the repute of people and establishments. However even within the absence of an explicitly articulated vertical industrial technique, coverage decisions could have the impact of favouring one sector over one other.

Within the Nineties and 2000s, UK selected oil and fuel and monetary companies over semiconductors, or certainly superior manufacturing extra typically. Our present financial scenario displays, partially, that selection.

[1] Analysis of the Alvey Programme for Superior Info Know-how. Ken Man, Luke Georghiou, et al. HMSO for DTI and SERC (1991)