Accounts receivable reconciliation is a vital course of inside accounting and monetary administration practices undertaken commonly by a enterprise. As transactions with prospects and purchasers happen, companies generate accounts receivable, which characterize quantities owed to them for items and companies bought or rendered.

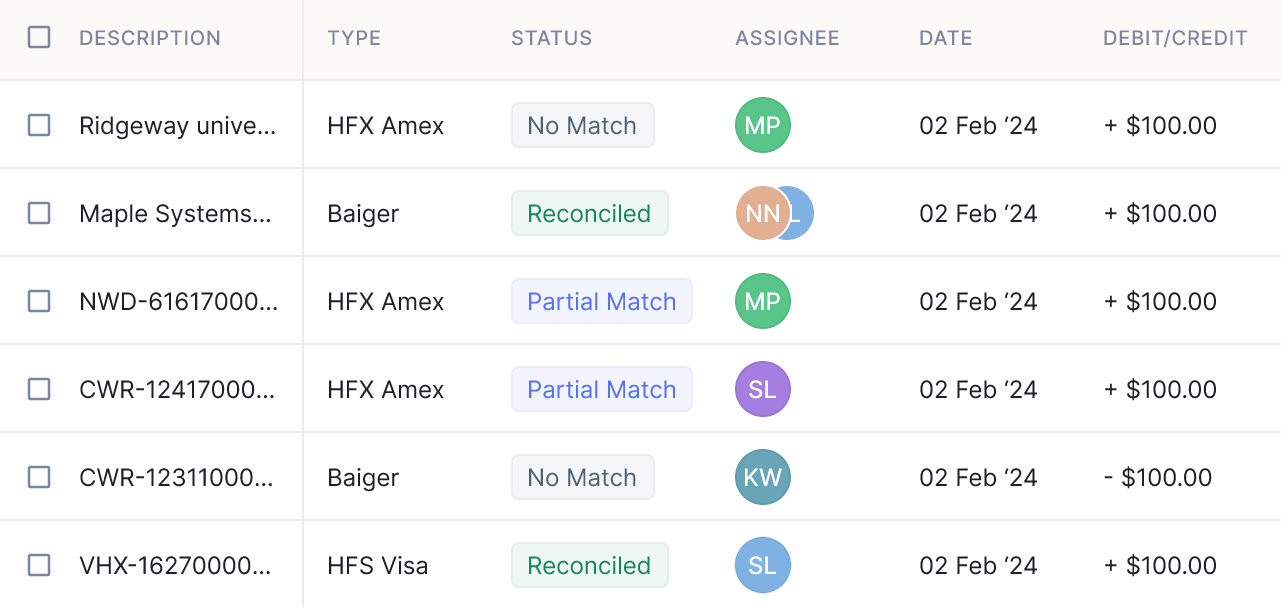

Reconciling accounts receivable entails evaluating the balances within the accounts receivable ledger with supporting documentation, reminiscent of invoices, receipts, and buyer funds. This course of helps determine discrepancies, resolve excellent balances, and keep a transparent understanding of the corporate’s monetary place.

On this article, we’ll get into the intricacies of accounts receivable reconciliation, exploring its objective, key steps within the reconciliation course of, and the position of automation in streamlining this important monetary process. Whether or not you are a seasoned accounting skilled or new to the sphere, understanding how one can successfully reconcile accounts receivable is significant for guaranteeing correct monetary reporting and optimising enterprise operations.

What’s Accounts Receivable Reconciliation?

Accounts receivable reconciliation is a elementary accounting course of that entails evaluating and verifying the balances within the accounts receivable ledger in opposition to supporting documentation and exterior data. This reconciliation goals to make sure the accuracy and completeness of accounts receivable transactions recorded within the firm’s monetary data.

The method of accounts receivable reconciliation is, at its core, about confirming the sum of money owed to the corporate by its prospects or purchasers, and matching with the figures recorded within the accounting system. This entails cross-referencing varied sources of knowledge, reminiscent of invoices, gross sales receipts, buyer funds, and ageing studies.

Throughout accounts receivable reconciliation, accounting professionals meticulously assessment every transaction to determine discrepancies, errors, or inconsistencies between the ledger balances and the supporting documentation. Any discrepancies discovered are investigated and resolved to keep up the integrity of the monetary data.

Accounts receivable reconciliation is important for a number of causes:

- Guaranteeing the accuracy of economic statements: By reconciling accounts receivable, companies can confirm the reliability of their monetary studies, together with the steadiness sheet and earnings assertion.

- Figuring out and addressing discrepancies: Reconciliation helps uncover discrepancies between the quantities recorded within the ledger and the precise transactions, permitting companies to rectify errors and stop monetary misstatements.

- Enhancing money movement administration: Correct accounts receivable balances allow companies to higher handle their money movement by guaranteeing well timed assortment of excellent funds from prospects.

- Facilitating decision-making: Dependable accounts receivable knowledge supplies precious insights into buyer fee traits, creditworthiness, and assortment efforts, empowering companies to make knowledgeable choices about credit score insurance policies, gross sales methods, and debt administration.

In abstract, accounts receivable reconciliation is a vital course of that ensures the accuracy, integrity, and reliability of an organization’s monetary data associated to buyer transactions. By systematically reviewing and verifying accounts receivable balances, companies can keep monetary transparency, mitigate dangers, and optimise their monetary efficiency.

Step-by-Step Information to Accounts Receivable Reconciliation

The method of reconciling accounts receivable entails a number of steps to make sure the accuracy and completeness of the accounts receivable ledger. What follows is an in depth information to performing accounts receivable reconciliation:

- Collect Documentation: Begin by accumulating all related documentation associated to accounts receivable transactions. This will likely embody gross sales invoices, credit score memos, buyer funds, financial institution statements, and ageing studies.

- Assessment Gross sales Transactions: Evaluate the gross sales transactions recorded within the accounts receivable ledger with the corresponding gross sales invoices or gross sales orders. Confirm that every transaction is precisely recorded, together with the quantity, date, buyer identify, and bill quantity.

- Confirm Buyer Funds: Cross-reference the shopper funds recorded within the accounts receivable ledger with the financial institution statements or fee receipts. Be sure that every fee is accurately utilized to the corresponding buyer account and bill.

- Reconcile Ageing Experiences: Assessment ageing studies to determine overdue invoices and excellent balances. Evaluate the ageing report totals with the accounts receivable ledger balances to substantiate accuracy.

- Examine Discrepancies: If any discrepancies or inconsistencies are recognized throughout the reconciliation course of, examine the foundation trigger. Frequent discrepancies might embody unapplied funds, duplicate entries, or incorrect buyer balances.

- Regulate Ledger Balances: Make crucial changes to the accounts receivable ledger to right any errors or discrepancies. This will likely contain reversing incorrect entries, reclassifying transactions, or updating buyer account balances.

- Doc Reconciliation: Keep detailed data of the reconciliation course of, together with any changes made and the explanations for these changes. Documentation is important for audit functions and guaranteeing transparency in monetary reporting.

- Finalise Reconciliation: As soon as all discrepancies have been resolved and changes have been made, finalise the reconciliation course of. Be sure that the accounts receivable ledger balances match the supporting documentation and exterior data.

- Carry out Periodic Opinions: Repeatedly assessment and reconcile accounts receivable balances to make sure ongoing accuracy and completeness. Month-to-month or quarterly reconciliations are advisable to remain up-to-date with buyer transactions and reduce discrepancies.

By following these steps, companies can successfully reconcile their accounts receivable balances, determine and handle discrepancies, and keep correct monetary data. This course of helps make sure the integrity of the accounts receivable ledger and permits companies to make knowledgeable choices primarily based on dependable monetary data.

Accounts Receivable Reconciliation

-

Collect Documentation: Accumulate all related paperwork (invoices, credit score memos, funds).

-

Assessment Gross sales: Confirm gross sales transactions within the ledger with gross sales invoices/orders.

-

Confirm Funds: Cross-reference funds with financial institution statements/receipts.

-

Reconcile Ageing Experiences: Examine overdue invoices and examine totals with the ledger.

-

Examine Discrepancies: Determine and resolve unapplied funds, duplicates, or errors.

-

Regulate Ledger: Appropriate errors by updating entries and balances.

-

Doc Course of: Maintain detailed data of all reconciliations and changes.

-

Finalise: Guarantee ledger balances match documentation and exterior data.

-

Periodic Opinions: Conduct month-to-month/quarterly reconciliations for accuracy.

When to Carry out Accounts Receivable Reconciliation

Performing accounts receivable reconciliation on the proper time is essential to sustaining correct monetary data and guaranteeing the well timed assortment of excellent funds. There are some key milestones and intervals at which accounts receivable reconciliation ought to ideally be carried out:

Month-to-month Reconciliation: Conducting month-to-month accounts receivable reconciliation is important for staying on high of buyer transactions and figuring out any discrepancies or overdue invoices. By reconciling accounts receivable balances on the finish of every month, companies can promptly handle points and keep up-to-date monetary data.

Quarterly Opinions: Along with month-to-month reconciliations, performing quarterly critiques of accounts receivable balances supplies a possibility to evaluate total efficiency and determine traits or patterns in buyer funds. Quarterly reconciliation helps companies monitor their progress in direction of income targets and handle any underlying points affecting money movement.

Yr-Finish Reconciliation: Yr-end accounts receivable reconciliation is especially vital for making ready monetary statements and assessing the monetary well being of the enterprise. By reconciling accounts receivable balances on the finish of the fiscal 12 months, companies can guarantee compliance with regulatory necessities and precisely report their monetary place to stakeholders.

Earlier than Monetary Reporting: Accounts receivable reconciliation also needs to be carried out earlier than producing monetary studies or statements, reminiscent of earnings statements or steadiness sheets. Verifying the accuracy of accounts receivable balances ensures that monetary studies mirror the true monetary standing of the enterprise and supply stakeholders with dependable data for decision-making.

Following Vital Occasions: Accounts receivable reconciliation needs to be performed following vital occasions which will affect buyer transactions, reminiscent of mergers, acquisitions, or adjustments in enterprise operations. Reconciling accounts receivable balances after such occasions helps companies assess the affect on their monetary place and determine any changes wanted.

By performing accounts receivable reconciliation at these key intervals and milestones, companies can keep correct monetary data, enhance money movement administration, and successfully monitor buyer funds. Common reconciliation helps determine discrepancies early, handle points promptly, and make sure the integrity of economic reporting.

Examples of Accounts Receivable Reconciliation

Accounts receivable reconciliation entails evaluating the data of excellent buyer balances with the corresponding entries within the normal ledger. Listed below are some examples of frequent accounts receivable reconciliation situations:

- Matching Invoices with Funds: One frequent reconciliation process is matching buyer funds with the corresponding invoices. Companies obtain funds from prospects for items or companies rendered, and these funds should be precisely recorded and matched with the invoices they relate to. Accounts receivable reconciliation ensures that every fee is correctly allotted to the right bill, stopping discrepancies in buyer account balances.

- Figuring out Overdue Invoices: Accounts receivable reconciliation additionally entails figuring out overdue invoices that haven’t been paid by prospects throughout the specified credit score phrases. By evaluating the ageing report of accounts receivable with the final ledger, companies can determine excellent invoices that require follow-up or assortment efforts. Reconciliation helps companies prioritise assortment efforts and cut back the danger of dangerous money owed.

- Resolving Discrepancies: Accounts receivable reconciliation might uncover discrepancies between the quantities recorded within the normal ledger and the precise buyer balances. These discrepancies might come up attributable to errors in recording transactions, posting errors, or buyer disputes. Reconciliation entails investigating and resolving such discrepancies to make sure the accuracy of economic data and buyer account balances.

- Adjusting for Returns or Allowances: Companies may have to regulate accounts receivable balances to account for returns, allowances, or reductions granted to prospects. Reconciliation entails figuring out such changes and guaranteeing that they’re correctly recorded within the normal ledger. Changes for returns or allowances assist companies precisely mirror the web quantity owed by prospects and keep the integrity of economic reporting.

- Reviewing Unhealthy Debt Provisions: Accounts receivable reconciliation might also contain reviewing provisions for dangerous money owed or uncollectible accounts. Companies have to assess the chance of non-payment by sure prospects and make provisions for potential losses. Reconciliation helps companies assessment and modify dangerous debt provisions primarily based on the ageing of accounts receivable and historic assortment patterns.

General, accounts receivable reconciliation ensures the accuracy and completeness of buyer account balances, facilitates efficient money movement administration, and helps knowledgeable decision-making concerning credit score and assortment insurance policies. By reconciling accounts receivables commonly, companies can keep monetary stability and mitigate dangers related to excellent buyer balances.

Here is an instance of accounts receivable reconciliation utilizing a simplified desk format:

On this instance, to reconcile accounts receivable, we begin with the whole bill quantity and deduct the funds acquired to calculate the remaining steadiness. Here is how the reconciliation course of is completed for every bill:

- INV-001: $500 – $0 = $500

- INV-002: $750 – $500 = $250

- INV-003: $1,000 – $1,000 = $0

- INV-004: $600 – $400 = $200

- INV-005: $900 – $0 = $900

After reconciling all invoices, we calculate the whole quantities:

- Whole Bill Quantity: $3,750

- Whole Fee Acquired: $1,900

- Whole Remaining Stability: $1,850

This reconciliation course of ensures that the whole bill quantity matches the sum of funds acquired plus the remaining steadiness, thereby verifying the accuracy of accounts receivable data. Any discrepancies might be recognized and investigated additional to keep up correct monetary data.

How Automation Improves Accounts Receivable Reconciliation

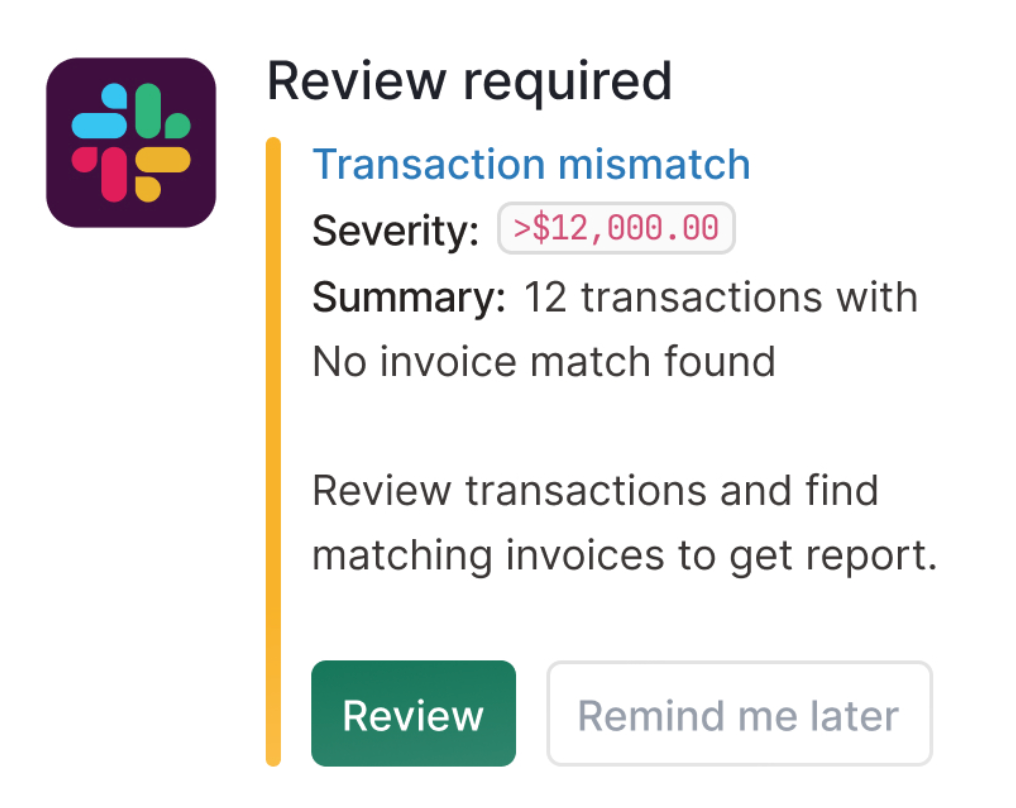

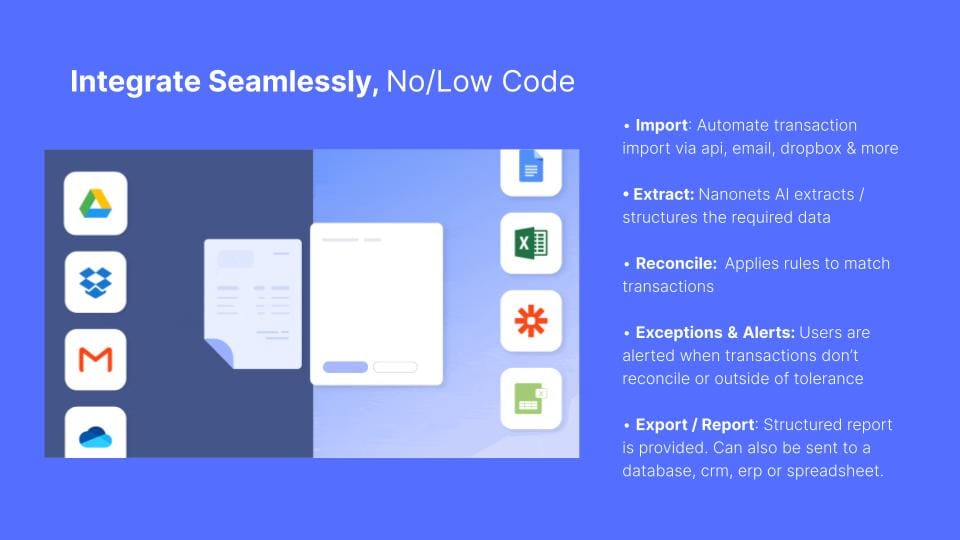

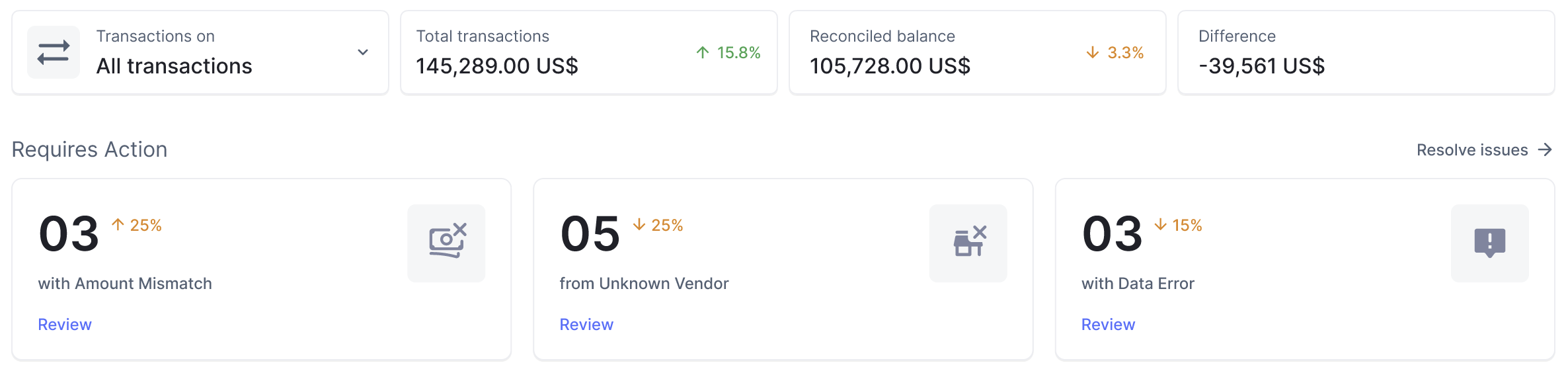

Automation instruments like AI/ML-enabled Nanonets can considerably streamline the accounts receivable reconciliation course of by automating repetitive duties and lowering handbook errors. Here is how:

- Automated Information Extraction: Nanonets can extract knowledge from invoices, receipts, and fee paperwork with excessive accuracy AI/ML-enabled OCR (Optical Character Recognition) expertise. This eliminates the necessity for handbook knowledge entry, saving time and lowering errors.

- Matching and Reconciliation: Nanonets can routinely match funds acquired with corresponding invoices utilizing superior algorithms. This ensures that each one transactions are precisely reconciled with out the necessity for handbook intervention.

- Exception Dealing with: Nanonets can flag and prioritise exceptions, reminiscent of discrepancies between invoices and funds or lacking paperwork, for assessment by finance groups. This enables groups to focus their consideration on resolving vital points whereas lowering the danger of overlooking vital discrepancies.

- Integration with Accounting Programs: Nanonets seamlessly integrates with accounting techniques and ERP (Enterprise Useful resource Planning) software program, permitting for real-time updates and synchronisation of reconciled knowledge. This ensures that monetary data are at all times up-to-date and correct.

- Reporting and Analytics: Nanonets supplies complete reporting and analytics capabilities, permitting finance groups to realize insights into accounts receivable efficiency, determine traits, and make data-driven choices. This helps enhance total monetary administration and forecasting.

By leveraging automation instruments like Nanonets, companies can streamline the accounts receivable reconciliation course of, cut back handbook effort, and guarantee better accuracy and effectivity in monetary operations.

Conclusion

Accounts receivable reconciliation is a vital course of for companies to make sure the accuracy and integrity of their monetary data. By reconciling invoices and funds commonly, companies can determine discrepancies, monitor excellent balances, and keep wholesome money movement.

On this article, we have explored the idea of accounts receivable reconciliation, its significance, and the steps concerned within the reconciliation course of. We have additionally mentioned how automation instruments like Nanonets can streamline the reconciliation course of, saving time and lowering errors.

By adopting greatest practices and leveraging automation expertise, companies can optimise their accounts receivable reconciliation course of, enhance monetary effectivity, and make extra knowledgeable enterprise choices.