Think about you are a monetary supervisor at a bustling enterprise, entrusted with the accountability of guaranteeing the accuracy and integrity of your organization’s monetary information. As you look into the labyrinth of spreadsheets and ledger entries, you bump into discrepancies in your stability sheet—a well-known situation for a lot of finance professionals. You understand that untangling this internet of numbers isn’t just about guaranteeing compliance; it is about safeguarding the monetary well being and status of your group.

In fashionable finance, the place transactions happen at breakneck velocity and fin-data volumes swell exponentially, the normal strategies of handbook reconciliation are more and more changing into insufficient. That is the place stability sheet reconciliation software program steps in to make sure velocity, effectivity and accuracy in monetary administration.

Why Do We Want Steadiness Sheet Reconciliation Software program?

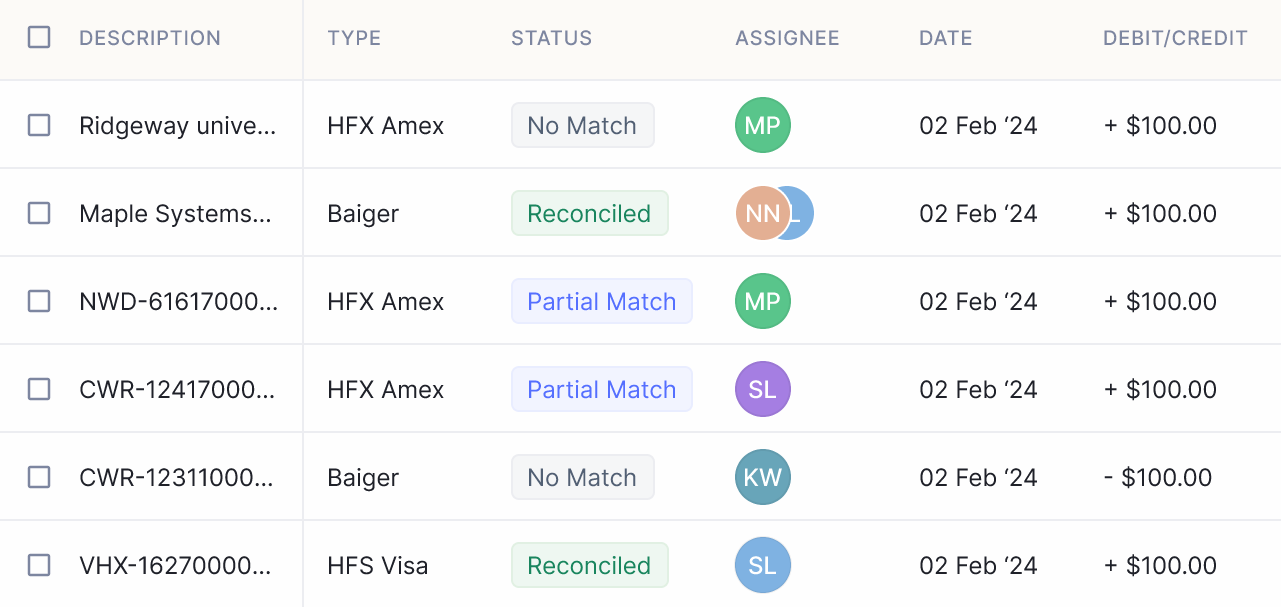

Steadiness sheet reconciliation software program, also referred to as accounts reconciliation software program, is a specialised software designed to streamline and automate the method of reconciling stability sheet accounts inside a corporation’s monetary system. This software program permits finance professionals to check and match transactions and balances recorded within the common ledger with exterior sources comparable to financial institution statements, vendor invoices, and different monetary paperwork. It leverages superior algorithms and synthetic intelligence to establish discrepancies and errors, permitting finance groups to promptly examine and resolve points.

Steadiness sheet reconciliation software program isn’t just a luxurious however a necessity in immediately’s fast-paced and extremely regulated enterprise atmosphere, for the next causes.

- Complexity of Monetary Transactions: With companies increasing globally and fascinating in a myriad of monetary transactions, the complexity of reconciling accounts has skyrocketed. From a number of currencies to numerous cost strategies, the sheer quantity and number of transactions make handbook reconciliation susceptible to errors and delays.

- Time and Useful resource Constraints: Conventional strategies of reconciling stability sheets contain intensive handbook labor, consuming beneficial time and assets. Human errors will not be unusual, and the time spent rectifying these errors could possibly be higher utilized for strategic monetary evaluation and decision-making.

- Regulatory Compliance: Compliance with regulatory requirements comparable to GAAP (Usually Accepted Accounting Ideas) and IFRS (Worldwide Monetary Reporting Requirements) is non-negotiable for companies. Steadiness sheet reconciliation software program affords built-in compliance checks and audit trails, guaranteeing adherence to regulatory necessities and mitigating the chance of non-compliance penalties.

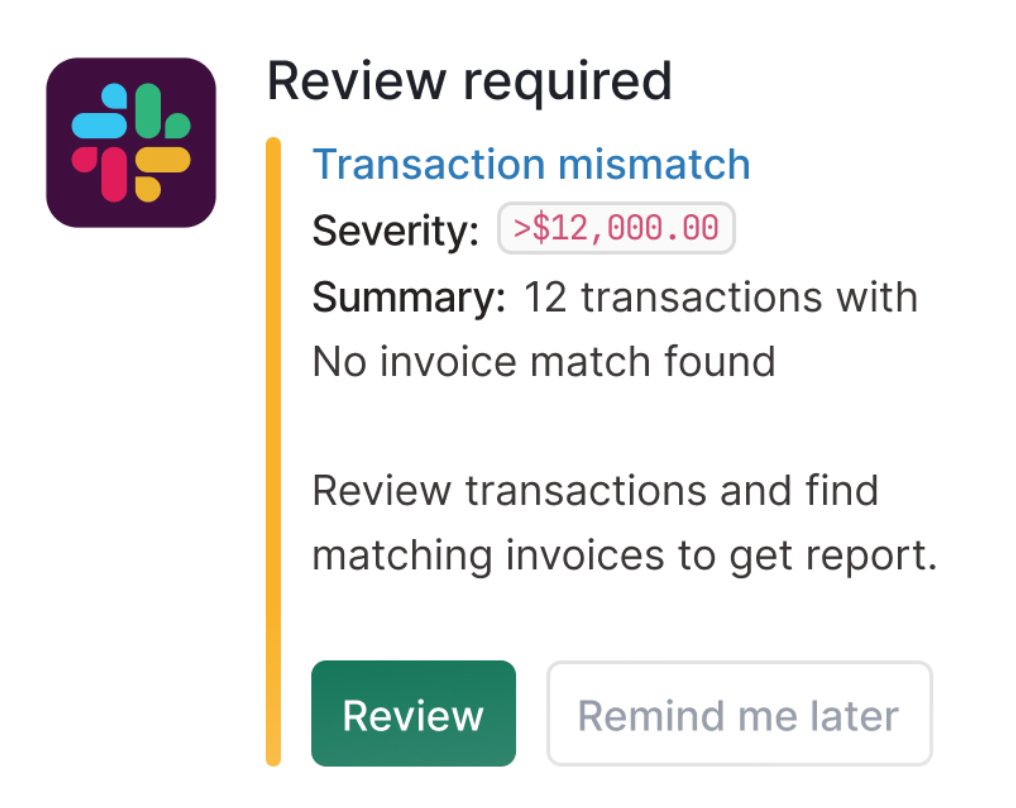

- Danger Administration: Correct and well timed reconciliation is vital for efficient threat administration. Discrepancies in stability sheets can sign underlying points comparable to fraud, mismanagement, or operational inefficiencies. By automating the reconciliation course of, software program options allow real-time identification and backbone of discrepancies, thereby enhancing threat mitigation efforts.

- Enhanced Effectivity and Accuracy: Steadiness sheet reconciliation software program leverages superior algorithms and automation capabilities to streamline the reconciliation course of. By eliminating handbook knowledge entry and automating routine duties, these software program options cut back the chance of errors and allow finance groups to concentrate on value-added actions.

Greatest Steadiness Sheet Reconciliation Software program

Discover beneath a gist of the perfect Steadiness Sheet Reconciliation Software program accessible out there immediately

What to search for in Steadiness Sheet Reconciliation Software program?

When looking for the perfect stability sheet reconciliation software program in your group, the next key elements must be thought-about:

- Automation Capabilities: Search for software program that gives superior automation options to streamline the reconciliation course of. Automated matching, knowledge extraction, and variance evaluation can considerably cut back handbook effort and errors.

- Integration with Present Programs: Make sure that the software program integrates seamlessly together with your group’s current monetary techniques, comparable to ERP (Enterprise Useful resource Planning) or accounting software program. This facilitates knowledge movement and minimizes disruptions to your present workflows.

- Customization Choices: Select an answer that enables for personalization to satisfy your particular reconciliation wants. Customizable workflows, reporting templates, and person permissions be sure that the software program aligns together with your distinctive enterprise necessities.

- Accuracy and Information Integrity: Accuracy is paramount in stability sheet reconciliation. Search for software program with built-in validation checks, audit trails, and knowledge validation options to take care of knowledge integrity and guarantee compliance with regulatory requirements.

- Ease of Use and Accessibility: Person-friendly interface and accessibility throughout units allow finance groups to simply navigate the software program and collaborate successfully. Intuitive dashboards, drag-and-drop performance, and cell entry improve person expertise.

- Scalability and Flexibility: Select a software program resolution that may scale together with your group’s development and adapt to altering enterprise wants. Scalable pricing plans, versatile deployment choices (cloud-based or on-premise), and modular options assist scalability and adaptability.

- Safety and Compliance: Prioritize software program options that adhere to industry-standard safety protocols and compliance necessities. Search for options comparable to role-based entry controls, knowledge encryption, and compliance certifications (e.g., SOC 2, GDPR) to safeguard delicate monetary knowledge.

- Buyer Help and Coaching: Consider the extent of buyer assist and coaching offered by the software program vendor. Responsive buyer assist, complete documentation, and coaching assets be sure that your group can maximize the advantages of the software program.

Along with the elements talked about above, it is essential to conduct due diligence and thorough analysis into numerous software program choices. Studying person critiques, consulting {industry} consultants, and requesting demos or trials can present beneficial insights into the strengths, weaknesses, and suitability of every software program resolution in your group’s particular necessities.

Nanonets – Your Greatest Alternative for Steadiness Sheet Reconciliation

Nanonets is a best choice for stability sheet reconciliation software program. This is why:

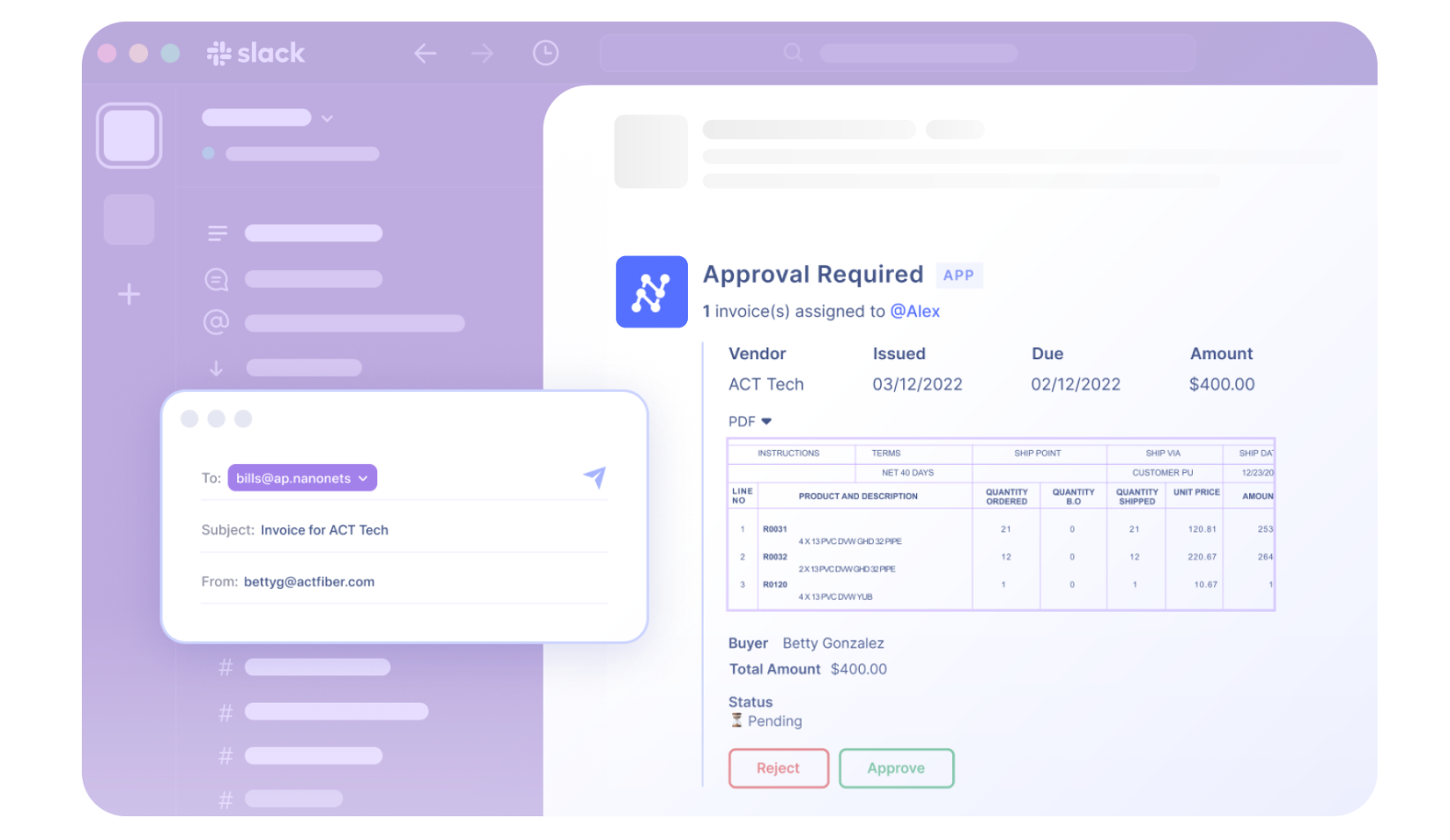

- Superior Automation: Nanonets harnesses the ability of AI and machine studying to automate the reconciliation course of effectively. Its auto-extraction capabilities guarantee seamless knowledge retrieval from numerous sources, whereas AI-driven matching algorithms precisely reconcile transactions, decreasing handbook effort and errors.

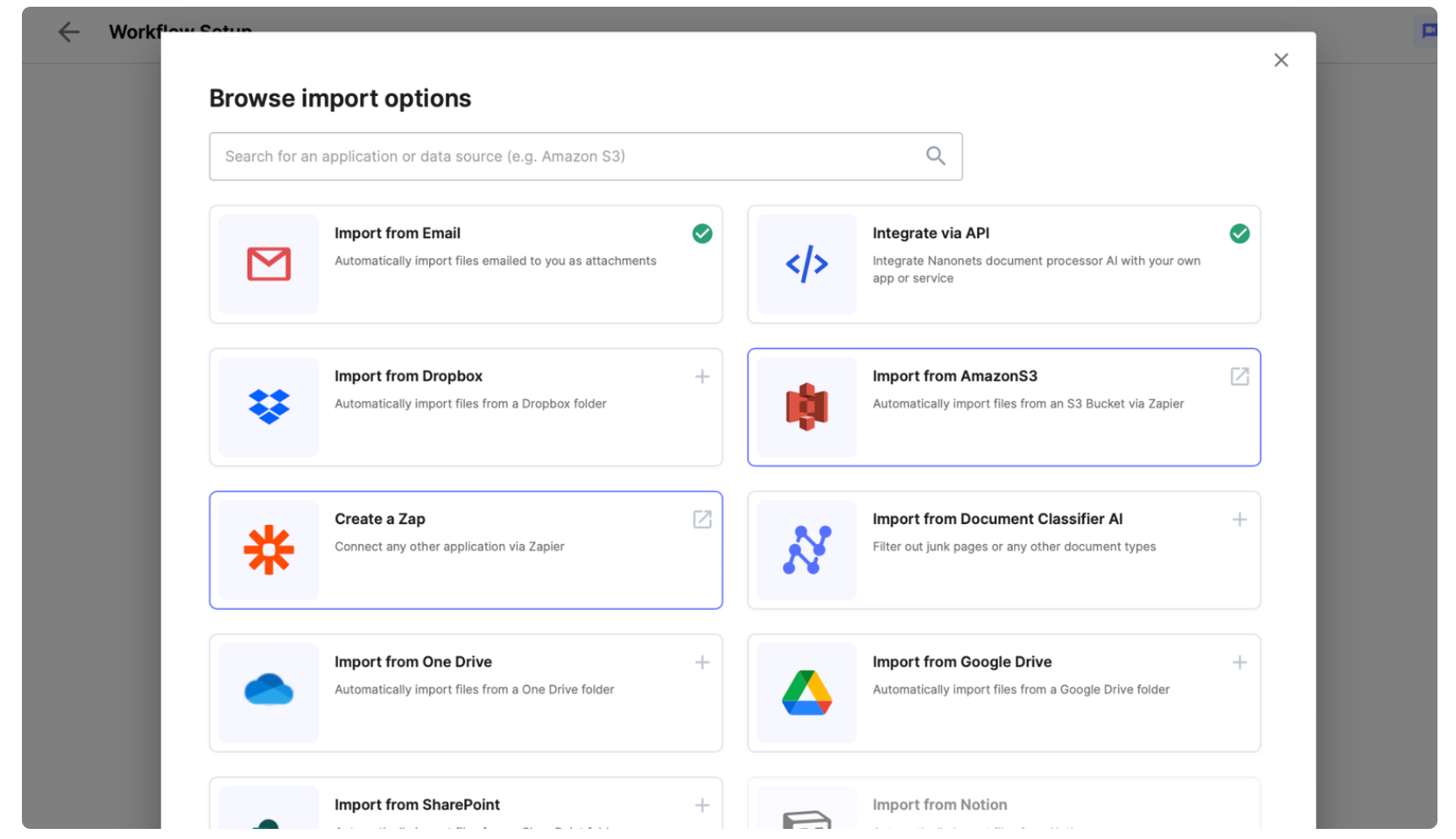

- Versatile Integration: Nanonets seamlessly integrates with current accounting techniques and knowledge sources, enabling clean knowledge movement and synchronization. Whether or not it is ACH cost processing, accounting integration, or API connections, Nanonets affords versatile integration choices to suit your group’s wants.

- Ease of Use: Nanonets boasts an intuitive interface and user-friendly design, making it simple for finance professionals to navigate and make the most of its options successfully. From customizable workflows to collaborative instruments, Nanonets prioritizes simplicity with out compromising performance.

- Scalability: Whether or not you are a small startup or a big enterprise, Nanonets scales effortlessly to accommodate your group’s development. Its versatile pricing plans and modular options guarantee scalability with out overburdening your price range or IT infrastructure.

- Accuracy and Reliability: Nanonets prioritizes accuracy and reliability in stability sheet reconciliation. With built-in audit trails, validation checks, and compliance administration options, Nanonets ensures knowledge integrity and regulatory compliance, providing you with peace of thoughts.

- Distinctive Buyer Help: Nanonets is backed by a devoted buyer assist group dedicated to offering well timed help and resolving any points promptly. From implementation to ongoing assist, Nanonets ensures a clean and seamless expertise for its customers.

- Optimistic Person Suggestions: Person critiques and rankings on platforms like Capterra persistently spotlight Nanonets’ effectiveness, ease of use, and worth for cash. With excessive scores throughout numerous classes, Nanonets earns the belief and satisfaction of its customers.

Take Away

As organizations navigate by means of the complexities of contemporary enterprise transactions, the necessity for automation, accuracy, and effectivity turns into paramount. Financial institution stability reconciliation software program streamlines the reconciliation course of and enhances knowledge integrity, regulatory compliance, and threat administration. By leveraging superior applied sciences comparable to synthetic intelligence, machine studying, and automation, these software program options empower finance professionals to reconcile accounts with velocity and precision. Seamless integration with current monetary techniques, customizable workflows, and intuitive interfaces guarantee a seamless person expertise, whatever the group’s measurement or complexity.

As demonstrated by the various vary of software program choices accessible, from Nanonets to QuickBooks, organizations have the chance to decide on an answer that greatest aligns with their particular necessities and aims. By conducting due analysis, contemplating person critiques, and evaluating options, organizations can choose the perfect financial institution stability reconciliation software program to optimize their monetary processes and obtain sustainable development.