The worldwide marketplace for mobile IoT module slipped by round two p.c by way of annual cargo volumes in 2023, in comparison with 2022. It’s the first time the mobile IoT gross sales have shrunk over a 12 month interval, in line with Counterpoint Analysis, which has a new report about it. It cited provide chain disruption and lowered demand from sure enterprise and industrial IoT sectors. However the market will stabilise in 2024, stated the agency, and see “substantial progress” in 2025 on the again of “widespread adoption” of 5G and 5G RedCap throughout all IoT classes.

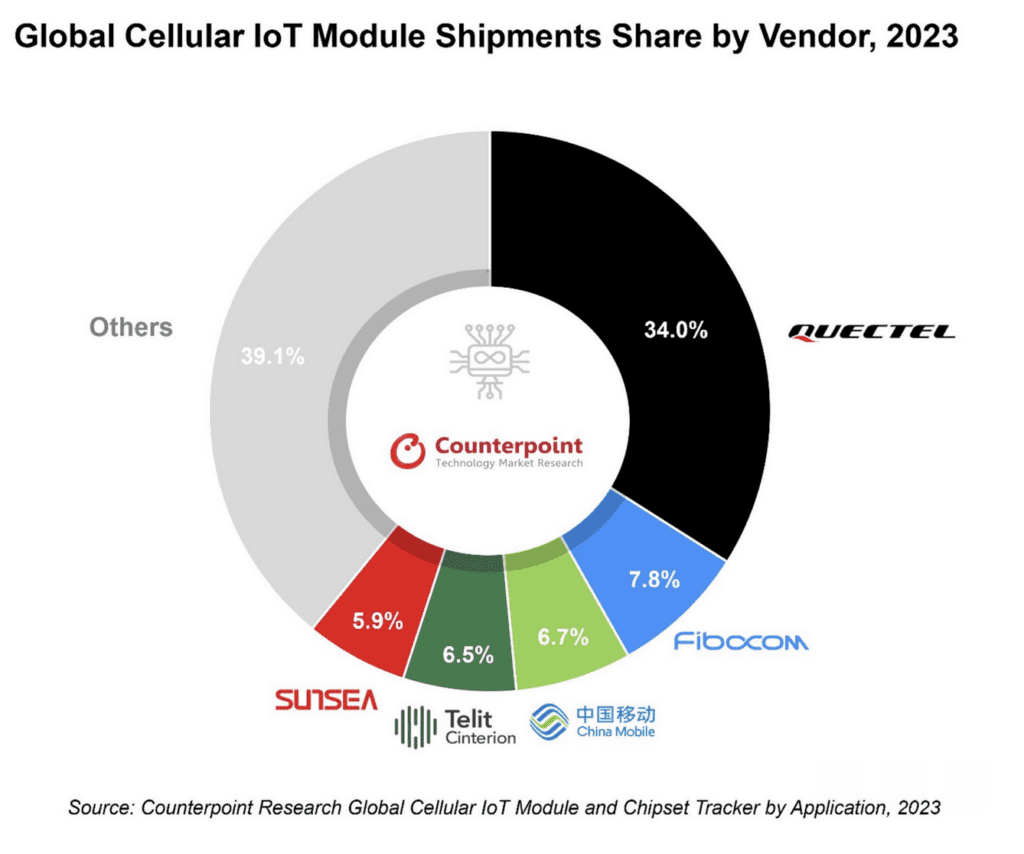

China-based Quectel maintained its lead as the most important mobile IoT module maker by quantity. However Quectel noticed a decline in its market share due to weakened demand outdoors of China; its whole share stands at 34 p.c of the market – which nonetheless fully dwarfs its rivals. Quectel was adopted within the rankings by Fibocom (7.8 p.c) and China Cellular (6.7 p.c), each additionally primarily based in China; these corporations claimed double-digit annual progress in gross sales, stated Counterpoint Analysis.

China Cellular’s progress was pushed by sensible meters, asset trackers, and POS functions; Fibocom’s progress was pushed by POS and telematics functions. The latest merger of European makers Telit and Thales propelled the mixed enterprise, Telit Cinterion, into fourth, with 6.5 p.c. Telit is partnering with VVDN for native manufacturing in India, a key progress market. Quectel, by the way, has partnered with Syrma SGS Know-how to do the identical.

In the meantime, Chinese language manufacturers like Unionman, OpenLuat, Lierda, and Neoway have seen “vital progress” in sensible metering, asset monitoring, and POS terminals. The remainder of the market, mixed, contributes to 39 p.c of whole gross sales. Counterpoint Analysis stated: “India and China have proven constructive progress resulting from growing demand within the sensible meter, POS and asset monitoring markets.”

Conversely, the remainder of the world has seen sharper decline – “indicating a scarcity of anticipated market momentum,” in line with the corporate. Anish Khajuria, analysis analyst at Counterpoint Analysis, commented: “In 2024, the IoT module market is anticipated to return to progress within the second half of the yr with normalizing stock ranges and growing demand within the sensible meter, POS and automotive segments.”

Of varied mobile IoT know-how sorts, LTE (4G) Cat 1 bis grew the quickest in 2023, capturing over 22 p.c of whole shipments, stated Counterpoint Analysis. In China, LTE Cat 1 bis has now change into the first mobile normal for POS, sensible meter, telematics, and asset monitoring – “owing to its affordability and power effectivity”, stated the agency. The market is slowly transitioning from LTE Cat 1 and NB-IoT to extra environment friendly LTE Cat 1 bis, it added.

Round 12 p.c of modules shipped in 2023 had been geared up with AI capabilities at software program or {hardware} degree. “These modules are gaining reputation in high-end markets akin to automotive, router/CPE and PC, facilitating the administration of the escalating information load in these sectors,” stated Counterpoint Analysis. It advised 5G RedCap will drive uptake of mobile IoT in 2025 in sensible meters, routers/CPE, POS programs, automotive options, and asset monitoring functions.