What Is a Financial institution Reconciliation Assertion?

A financial institution reconciliation assertion is a monetary doc that compares an organization”s checking account stability to the transactions recorded on its basic ledger, typically known as the “money books.” The aim of performing the financial institution reconciliation is to determine discrepancies and alter entries in order that the transactions are aligned with one another. They make sure the monetary accuracy of the statements and are an important course of for the accounting groups concerned in money circulate administration.

carry out a Financial institution Reconciliation?

Listed here are the steps concerned in performing financial institution reconciliation.

Step #1

Gather your financial institution assertion for the present interval and evaluate it to your bookkeeping information or your organization’s money account information from the accounting system. The money stability reported in opposition to each information is likely to be totally different. We have to determine why these variations exist and make changes accordingly.

Step #2

Establish gadgets that match each information. We are able to single out the unreconciled transactions by eliminating the entries that may be traced on each information.

Step #3

Establish gadgets which have hit the corporate information however are missed on the financial institution assertion. Money that has been obtained and recorded by the corporate however has not but been recorded on the financial institution assertion is known as “deposits in transit.” We have to add these to the financial institution assertion.

“Excellent Checks” are checks issued by the corporate however have not but been cleared by the financial institution, that means the funds haven’t but been deducted from the corporate’s checking account stability. We have to deduct these from the financial institution assertion.

Step #4

Now, search for gadgets which can be mirrored on the financial institution assertion however don’t present up on the corporate’s bookkeeping information. These are typically points like financial institution service charges, the place banks deduct prices for companies rendered, or financial institution errors and different points. We have to deduct these prices from the accounting information.

Establish any curiosity earned by the corporate. These might be added to the accounting information.

Step #5

After adjusting each information, the financial institution assertion stability ought to equal the adjusted money report stability. File the reconciliation by categorizing every discrepancy into one of many above varieties recognized in steps 3 and 4 and grouping every class by mixture values. Mainly, you’re recording a change to the money accounts in your basic ledger.

After noting the discrepancies flagged by the final ledger and the financial institution assertion, observe how the checking account stability adjustments over the following few days. Verify the impression and observe any unnoticed entries that hit the checking account.

Reconciliations are carried out on the finish of the month, with companies with extra transactions performing the method extra steadily. Common financial institution reconciliation is a key inside management measure that measures the accuracy of the corporate’s money information and identifies any points and discrepancies in a well timed vogue.

Financial institution Reconciliation Instance

Think about you might be working for a corporation, ABC, within the retail business. You might want to carry out financial institution reconciliation on the finish of the month (which may be daunting). Nonetheless, when you take the steps listed within the financial institution reconciliation instance, you may make sure the monetary accuracy of the information.

File the balances registered for the checking account stability and the corporate’s money account.

- Financial institution Assertion Stability on the finish of June 2024: $15,000

- Firm’s Money Account Stability in Data: $14,500

The corporate’s financial institution assertion reveals $15,000, however the firm’s information present $14,500. This discrepancy must be resolved.

Step 1: Examine Financial institution Assertion and Firm Data

| Financial institution Assertion | Firm Data |

|---|---|

| $15,000 | $14,500 |

Gadgets that match each information are highlighted. For instance, a deposit of $5,000 on June 1st and a verify #123 for $1,000 on June third.

Step 2: Establish Matching Gadgets

| Date | Description | Financial institution Assertion Quantity | Firm Data Quantity |

|---|---|---|---|

| 01/06/2024 | Deposit | $5,000 | $5,000 |

| 03/06/2024 | Verify #123 | -$1,000 | -$1,000 |

Gadgets just like the deposit in transit and excellent checks are recognized. These must be adjusted within the financial institution assertion.

Step 3: Establish Gadgets in Firm Data however Not in Financial institution Assertion

| Date | Description | Quantity | Motion |

|---|---|---|---|

| 04/06/2024 | Deposit in Transit | $1,500 | Add to Financial institution Assertion |

| 05/06/2024 | Excellent Verify #124 | -$500 | Deduct from Financial institution Assertion |

Gadgets like financial institution service charges and curiosity earned are recognized. These must be adjusted within the firm’s information.

Step 4: Establish Gadgets in Financial institution Assertion however Not in Firm Data

| Date | Description | Quantity | Motion |

|---|---|---|---|

| 06/06/2024 | Financial institution Service Charge | -$50 | Deduct from Firm Data |

| 07/06/2024 | Curiosity Earned | $25 | Add to Firm Data |

After changes, the financial institution assertion and firm information must be reconciled and match.

Step 5: Adjusted Balances

| Class | Quantity |

|---|---|

| Adjusted Financial institution Assertion Stability | $16,000 |

| Adjusted Firm Data Stability | $16,000 |

By following these steps and utilizing the offered tables, Firm ABC can precisely carry out a financial institution reconciliation, guaranteeing its information are up-to-date and mirror the true monetary standing. Common reconciliation helps determine discrepancies, forestall fraud, and guarantee monetary accuracy.

Why is Financial institution Reconciliation Essential ?

Financial institution reconciliation is vital for companies for a number of causes:

Error Detection:

Financial institution reconciliation helps determine errors in an organization’s monetary information. Points like duplicate funds, missed funds, or incorrect transaction quantities could cause these errors. This ensures that buyer funds have been made, which is essential when working a profitable enterprise.

Fraud Detection:

After intently scrutinizing each information, reconciliation can reveal unauthorized transactions and fraudulent exercise. This permits companies to take proactive measures, cease fraud, and get better any misplaced funds instantly.

Insights into money circulate:

With well timed reconciliations in place, enterprise can spot issues with money circulate by noticing how the inflows and outflows of money are altering with time. This helps with money circulate administration and higher forecasting of the companies’ funds.

Correct Monetary Reporting:

By guaranteeing the integrity of the corporate’s stability sheets, revenue statements, and different monetary paperwork by common reconciliations, companies will help depend on the information and make knowledgeable enterprise selections.

Audit Compliance protocols:

Correctly reconciled financial institution statements are required for correct tax reporting and will help keep away from penalties or points throughout audits.

In abstract, common and thorough financial institution reconciliations are important for companies to detect errors, forestall fraud, handle money circulate, guarantee correct monetary reporting, adjust to tax necessities, and strengthen inside controls. It’s a essential part of sound monetary administration.

Challenges confronted With Financial institution Reconciliations

Companies can achieve many benefits by guaranteeing their accounting course of’s monetary integrity by common financial institution reconciliations. Financial institution reconciliations assist companies detect anticipated funds that have not been made but, detect fraud, and correctly handle money circulate.

Nevertheless the character of financial institution reconciliation is extraordinarily guide. Accounting groups can encounter a number of erros and inconsistencies dirung the guide comparision between the final ledger and the financial institution assertion. Human made errors, managing a number of currencies and sophisticated relationships between disaparte knowledge sources can result in extra time being consumed and error susceptible monetary reporting;.

Lets checklist down a number of the frequent mismatches that accountants come throughout whereas attempting to do guide financial institution reconciliation:

“Excellent Checks”:

These are funds that the corporate has despatched out and recorded however has not but cleared by way of the financial institution. Equally checks which have been recieved by the enterprise however have not but hit the account need to be adjusted accordingly.

“Money-In Transit”:

The money may not instantly mirror within the checking account when funds are transferred by way of bank card funds or wire transfers. We have to make the correct changes right here as properly.

“Financial institution curiosity and repair charges“:

Banks deduct prices for companies rendered (usually comparatively small), however they have to be adjusted accordingly for correct reconciliation. Equally, banks pay curiosity in financial institution accounts, which have to be accommodated accordingly.

“Acquiring vital knowledge“:

Managing excessive quantity of transactions may be daunting and problematic on account of disparate knowledge sources that must be recognized and consolidated throughout the reconciliation course of. As soon as an bill is obtained we have to verify whether or not the mentioned items have arrived in opposition to the related buy order. As soon as confirmed, there must be an entry within the accounting system which must be reconciled in opposition to the acquisition receipt. To consolidate all these paper receipts and nobody place for digitising and a central database to checklist, it may be very time consuming to do the method in opposition to every entry within the accounting system.

“Quite a few financial institution accounts and currencies”:

Firms typically use a number of banks and accounts in several currencies. Reconciling transactions throughout these numerous accounts and currencies provides complexity to the method.

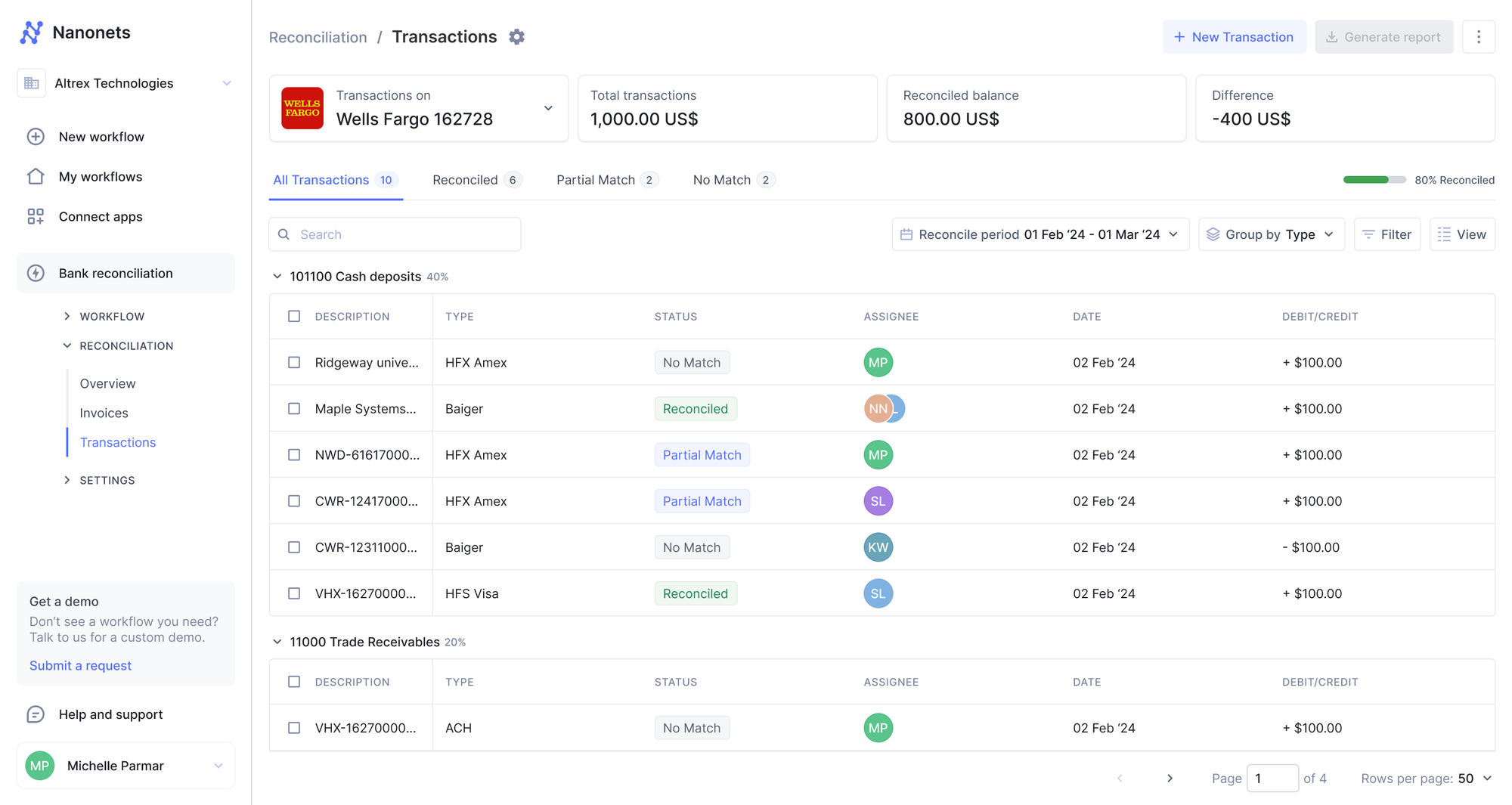

Handle Financial institution Reconciliations With Nanonets

Utilizing Nanonets on your financial institution reconciliation duties will help streamline the method by eliminating time-consuming, error-prone, and resource-intensive duties when completed manually. Nanonets gives an automatic reconciliation software program resolution to method this important job.

“Automated knowledge extraction”:

Nanonets’ Pretrained OCR fashions are higher than huge knowledge generative AI fashions for knowledge extraction. Generative AI options usually are not skilled on labeled knowledge, whereas Nanonets AI is continually being skilled on annotated knowledge to extract knowledge with increased accuracy. Nanonets AI learns the way to map enter options (just like the fields you wish to extract) to the output labels (identify, date, stability) to realize increased accuracy and scale with increased volumes of transformation knowledge with ease.

.png)

“Clever transaction matching”:

Nanonets AI leverages superior algorithms, reminiscent of NLP methods and fuzzy matching, to quickly evaluate transactions between financial institution statements and accounting information. This reduces time taken for guide reconciliation from hours to simply minutes.

“Centralised Information Repository“:

By consolidating all reconciliation knowledge, supporting paperwork, approvals, and reporting right into a single platform, Nanonets creates a complete, auditable report of the financial institution reconciliation course of. This centralized repository streamlines the reconciliation workflow, improves visibility, and enhances compliance.

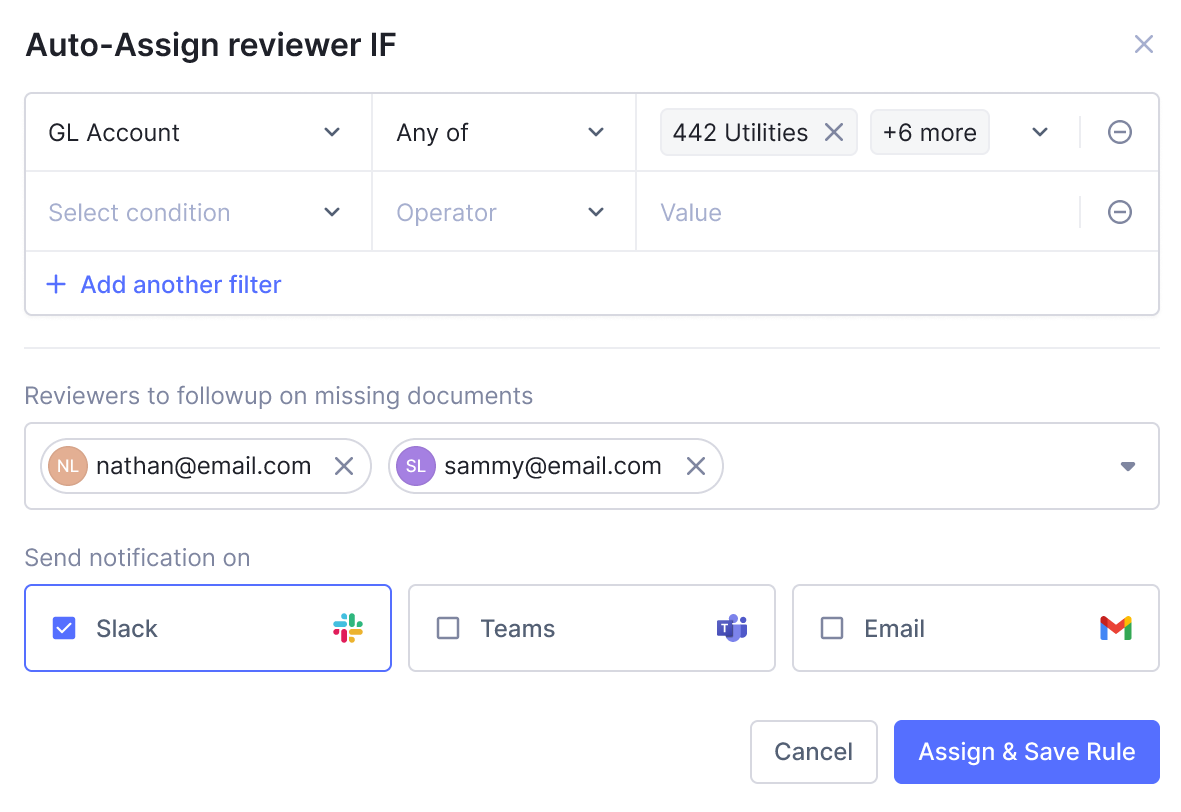

“Exception Administration“:

Nanonets Reconciliation software program can flag any unmatched and suspicious transactions, alerting the related members of the accounting crew to analyze. Utilizing Nanonets workflow automation capabilities, customers can set off and assign motion gadgets to the remainder of the crew for proactive decision and obtain transparancy within the course of.

“Scalability with excessive transaction volumes“:

Nanonets can deal with excessive transaction volumens with velocity and precision. Organizations attempting to do guide reconciliation on the finish of the month may want to rent extra personals to take care of the excessive and fluctuating volumes of transactions. Nanonets frees up finance professionals to give attention to extra strategic duties.

“Reporting and audit trails“:

Detailed reconciliation studies are generated robotically, offering a full course of audit path. This improves compliance and visibility.

.png)

By adopting Nanonets, companies can save vital money and time, enhance knowledge accuracy, strengthen inside controls, and improve total monetary administration. It’s a highly effective instrument for streamlining the essential financial institution reconciliation course of.