Enterprise expense classes are a scientific classification of prices incurred in the course of the operation of a enterprise, designed to prepare and observe monetary outflows for functions similar to tax preparation, budgeting, and monetary evaluation. This categorization helps companies handle their funds extra effectively by offering insights into spending patterns and figuring out potential tax deductions.

Sensible entrepreneurs and enterprise leaders know the satan is within the particulars—notably on the subject of monetary readability. This monetary readability begins with a meticulous method to categorizing enterprise bills. By doing so, companies not solely pave the best way for sturdy monetary well being but additionally guarantee they’re strategically positioned to capitalize on alternatives and navigate challenges.

Why Categorize Enterprise Bills?

The method of categorizing enterprise bills includes creating a complete listing of expense classes, after which making certain that every transaction your organization makes is neatly assigned to its rightful place. Why is all this vital, you might ask?

- Tax Preparation and Deductions:

Categorizing enterprise bills meticulously aids in streamlining the tax preparation course of, making certain that no deductible expense is neglected. This cautious group can considerably scale back taxable revenue, resulting in substantial financial savings. It simplifies the method of figuring out which bills are deductible and by how a lot, making tax time much less daunting and extra environment friendly. - Analytics and Budgeting:

A well-structured categorization of bills supplies invaluable insights into spending patterns, serving to companies determine areas the place they will minimize prices and allocate sources extra successfully. This granular view into expenditures permits entrepreneurs to craft budgets which can be each lifelike and strategic, enhancing monetary stability and fostering progress. - Day-to-Day Money Stream Administration:

Understanding the place and the way funds are being spent each day is essential for sustaining wholesome money movement. Categorizing bills permits companies to trace their monetary commitments and regulate operations as wanted to make sure liquidity. Efficient money movement administration is the lifeline of any enterprise, stopping money crunches and enabling easy operational movement.

45 Enterprise Expense Classes for Companies and Startups

Creating an exhaustive listing of enterprise expense classes might help companies and startups higher observe their funds, funds extra successfully, and make the most of tax deductions to scale back their taxable revenue. Beneath is a listing of 45 enterprise expense classes generally encountered by companies in the US. This categorization is structured to optimize tax positions.

- Promoting and Advertising: Contains on-line advertisements, print supplies, and advertising campaigns. These bills are usually absolutely deductible.

- Salaries and Wages: Compensation to staff, together with salaries, wages, bonuses, or commissions. Absolutely deductible.

- Contract Labor: Funds to unbiased contractors. Absolutely deductible, however companies should challenge Kind 1099-NEC in the event that they pay greater than $600 in a yr.

- Lease on Enterprise Property: Lease funds for workplace house, storefronts, and different enterprise properties. Absolutely deductible.

- Utilities: Electrical energy, water, gasoline, web, and telephone providers for enterprise operations. Absolutely deductible.

- Workplace Provides and Bills: Price of workplace gadgets like pens, paper, and printer ink. Absolutely deductible.

- Repairs and Upkeep: Prices for repairs of enterprise property and tools, not together with main enhancements. Absolutely deductible.

- Depreciation: Deduction for the loss in worth of belongings (e.g., automobiles, buildings, tools) over time. Calculated primarily based on IRS pointers.

- Skilled Charges: Charges for authorized, accounting, and different skilled providers. Absolutely deductible.

- Insurance coverage: Enterprise insurance coverage premiums, similar to legal responsibility, malpractice, and property insurance coverage. Absolutely deductible.

- Taxes and Licenses: Sure state, native, and federal taxes; licenses and regulatory charges. Typically deductible.

- Curiosity: Curiosity on enterprise loans, credit score traces, and mortgages for enterprise property. Absolutely deductible.

- Journey Bills: Prices for enterprise journey, together with lodging, transportation, and meals (topic to limitations). Deductible inside IRS pointers.

- Meals and Leisure: 50% deductible for enterprise meals; leisure prices are not deductible as of the Tax Cuts and Jobs Act (TCJA).

- Schooling and Coaching: Prices for workshops, seminars, and academic supplies for you or your staff. Absolutely deductible.

- Software program and Subscriptions: Enterprise-related software program, on-line providers, and publication subscriptions. Absolutely deductible.

- Membership Dues: Charges for skilled associations and enterprise organizations. Deductible, excluding these for golf equipment organized for enterprise, pleasure, recreation, or different social functions.

- Dwelling Workplace Bills: For these utilizing a part of their dwelling repeatedly and completely for enterprise. Deductible primarily based on the share of the house’s use for enterprise.

- Automobile Bills: Enterprise use of a car, both by deducting precise bills or utilizing the usual mileage price. Deductible inside IRS pointers.

- Telecommunications: Prices for business-related cellphones and web providers. Absolutely deductible.

- Postage and Transport: Prices for mailing, courier providers, and transport for enterprise operations. Absolutely deductible.

- Financial institution Charges: Charges associated to enterprise financial institution accounts and bank cards. Absolutely deductible.

- Worker Advantages: Medical insurance, retirement plan contributions, and different worker profit prices. Typically deductible.

- Authorized and Regulatory Prices: Charges for patents, logos, and regulatory compliance. Absolutely deductible.

- Analysis and Growth: Prices related to creating new services or products. Probably eligible for R&D tax credit.

- Unhealthy Money owed: Quantities owed to you that you just’re unable to gather. Deductible underneath sure circumstances.

- Charitable Contributions: Donations made to certified charitable organizations. Deductible inside limits primarily based on enterprise construction.

- Transferring Bills: Prices of transferring enterprise tools, stock, and provides. Deductible if associated to a change in enterprise location.

- Curiosity on Taxes Paid Late: Curiosity paid on late tax funds. Deductible.

- Stock for Resale: Price of products or uncooked supplies, together with freight. Deductible on the time the stock is offered.

- Actual Property Taxes: Taxes on enterprise property. Absolutely deductible.

- Private Property Taxes: Taxes on property utilized in enterprise, like automobiles and tools. Absolutely deductible.

- Casualty and Theft Losses: Losses from theft, vandalism, hearth, storm, or comparable occasions. Deductible within the yr the loss occurred.

- Well being Insurance coverage Premiums: For self-employed people, doubtlessly deductible towards their revenue.

- Retirement Plans: Contributions to worker retirement plans. Deductible inside limits.

- Presents: Enterprise items are deductible as much as $25 per particular person per yr.

- International-Earned Revenue: Bills associated to incomes revenue abroad. Topic to particular deductions and exclusions.

- Environmental Bills: Prices for air pollution management, environmental remediation. Sure bills could qualify for particular credit or deductions.

- Power Effectivity Enhancements: Prices for sure energy-efficient enhancements to industrial properties. Could qualify for deductions or credit.

- Work Alternative Tax Credit score: Hiring people from sure teams who face vital boundaries to employment. Credit score primarily based on a proportion of wages paid.

- Disabled Entry Credit score: Making your small business extra accessible to individuals with disabilities. A credit score is obtainable for small companies.

- Startup Prices: Bills to start out or purchase a enterprise. You’ll be able to elect to deduct as much as $5,000 within the first yr and amortize the rest.

- Organizational Prices: Prices for the authorized creation of an organization or partnership. Comparable deduction guidelines as startup prices.

- Credit score Card Processing Charges: Charges paid for accepting bank card funds. Absolutely deductible.

- Security Gear: Prices for security tools required for enterprise operation. Absolutely deductible.

💡

It is important for companies to take care of detailed data of all bills to substantiate deductions in case of an IRS audit. Tax legal guidelines can change, so consulting with a tax skilled for essentially the most present recommendation and to make sure compliance with IRS guidelines is all the time advisable.

Learn how to Categorize Bills in your small business?

Let’s dive into the nuances of categorizing enterprise bills.

1. Create Classes

Step one in mastering your small business’s monetary panorama is to determine clear and complete classes in your bills.

Listed below are the important classes that each small enterprise ought to think about:

- Working Bills

- Personnel Prices

- Expertise and Software program

- Advertising and Promoting

- Journey and Leisure

- Skilled Charges

- Insurance coverage

- Taxes and Licenses

- Analysis and Growth (R&D)

2. Subcategories

Drilling down into subcategories permits for extra exact monitoring and evaluation of bills, offering deeper insights into the place your cash goes and figuring out potential areas for price financial savings. For example train, let’s refine the classes talked about above:

- Working Bills

- Utilities (electrical energy, water, web)

- Lease or Mortgage

- Upkeep and Repairs

- Workplace Provides and Gear

- Personnel Prices

- Salaries and Wages

- Advantages (medical insurance, retirement plans)

- Payroll Taxes

- Expertise and Software program

- Software program Subscriptions

- {Hardware} Purchases

- IT Assist Companies

- Advertising and Promoting

- Digital Advertising

- Print Promoting

- Promotional Supplies

- Journey and Leisure

- Transportation (flights, automobile leases)

- Lodging

- Meals and Leisure

- Skilled Charges

- Authorized Companies

- Accounting Companies

- Consulting Charges

- Insurance coverage

- Legal responsibility Insurance coverage

- Property Insurance coverage

- Staff’ Compensation

- Taxes and Licenses

- Revenue Taxes

- Gross sales Taxes

- Licenses and Permits

- Analysis and Growth (R&D)

- Product Growth

- Market Analysis

- Patent and Trademark Charges

3. Monitor Bills

The cornerstone of stable monetary administration is the meticulous monitoring of each penny that flows out and in of your small business. In right this moment’s digital world, leveraging know-how to automate this course of is not only a comfort; it’s a necessity for staying aggressive and knowledgeable. Right here’s find out how to do it successfully:

- Use Accounting Software program: Implement a dependable accounting software program answer that matches the wants of your small business. Platforms like Nanonets, QuickBooks, Xero, or FreshBooks can automate the monitoring of bills, invoicing, and payroll, considerably lowering the potential for human error and saving time.

- Digital Receipts and Invoices: Encourage digital record-keeping by storing scans or images of receipts and invoices. This follow not solely helps the setting but additionally simplifies retrieval and auditing processes.

- Combine Financial institution Accounts and Credit score Playing cards: Many accounting software program options supply the power to hyperlink your small business financial institution accounts and bank cards instantly, permitting for real-time monitoring of bills and seamless reconciliation.

- Categorize Transactions Instantly: Make it a behavior to categorize every expense because it happens. Delaying this process can result in inaccuracies and neglected bills.

4. Common Assessment

The dynamic nature of enterprise necessitates common critiques of your monetary actions. This follow helps in figuring out developments, managing money movement, and making knowledgeable selections:

- Month-to-month Critiques: Dedicate time every month to evaluate your categorized bills. Search for developments, similar to surprising will increase in sure classes, and examine any anomalies.

- Benchmarking: Examine your expense ratios to trade requirements or comparable companies. This benchmarking can spotlight areas of effectivity or concern, guiding future monetary methods.

5. Contemplate Tax Implications

Understanding and planning for the tax implications of enterprise bills is essential. Not all bills are handled equally underneath tax legal guidelines, and correct categorization can result in vital tax financial savings:

- Keep Knowledgeable on Tax Legal guidelines: Tax rules regularly change, and staying knowledgeable might help you maximize deductions and credit. Contemplate consulting with a tax skilled to make sure compliance and optimization of tax advantages.

- Distinguish Between Enterprise and Private Bills: Preserve enterprise and private funds separate to simplify tax preparation and help claims for enterprise bills.

- Doc The whole lot: Preserve meticulous data of all bills, together with receipts and invoices. Documentation is essential for substantiating deductions and might be invaluable within the occasion of an audit.

- Plan for Deductions: Be proactive in understanding which bills are absolutely deductible, partially deductible, or not deductible in any respect. This information can affect spending selections and tax methods all year long.

Expense Administration Software program for Expense Categorization

Within the aggressive enterprise world, automation is vital for effectivity and staying forward. Expense categorization, essential but tedious, is made easy with Expense Administration Software program like Nanonets.

15 Finest Spend Administration Software program Options in 2024

Discover the world of spend administration software program in 2024. Uncover the very best options and discover ways to select the best one for your small business.

Allow us to check out how an expense administration software program like Nanonets automates expense categorization and administration.

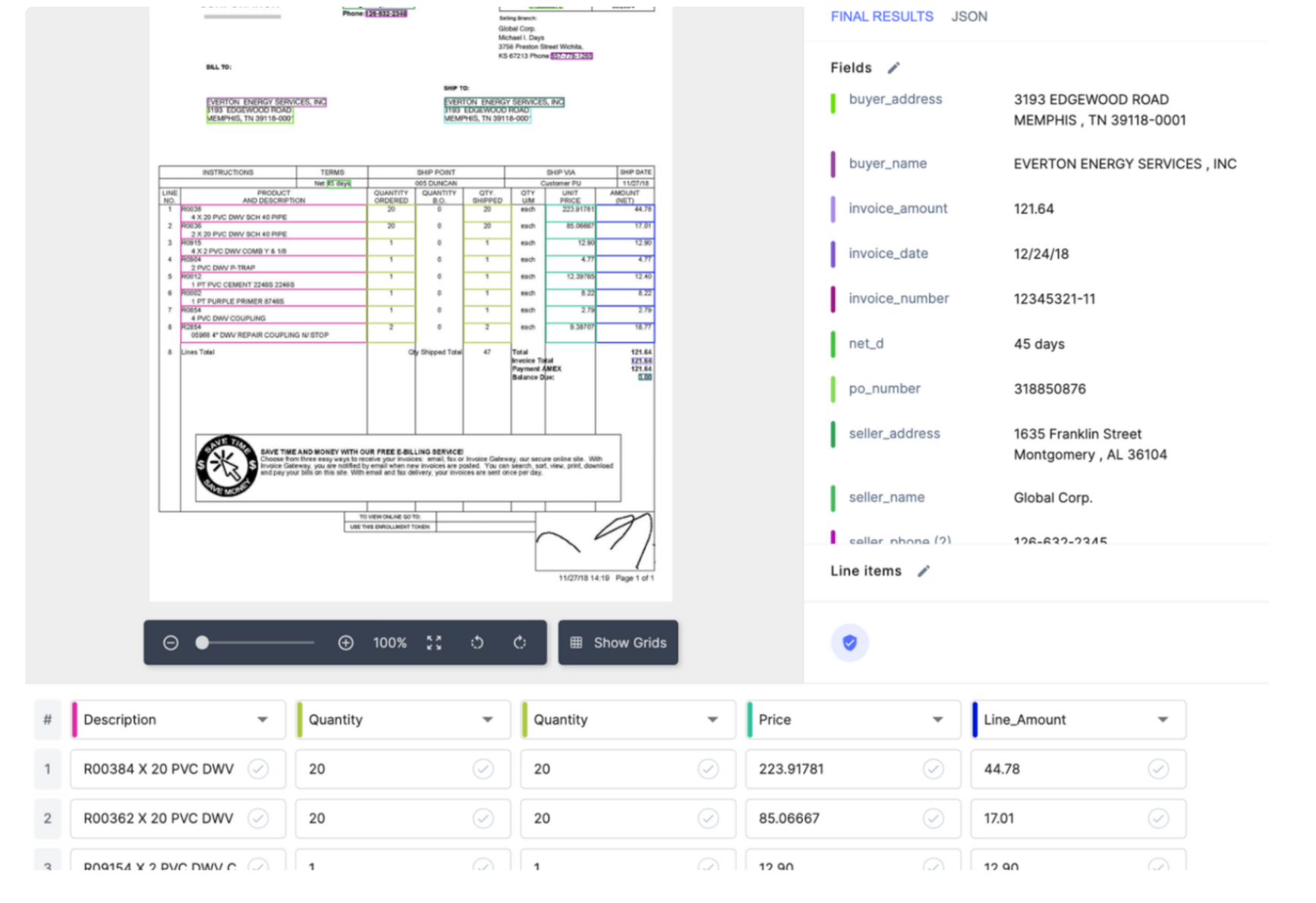

Expense Seize

An worker captures a receipt utilizing a cellular app or uploads an expense doc in any format. The app’s OCR know-how extracts key particulars like date, quantity, and service provider from the receipt.

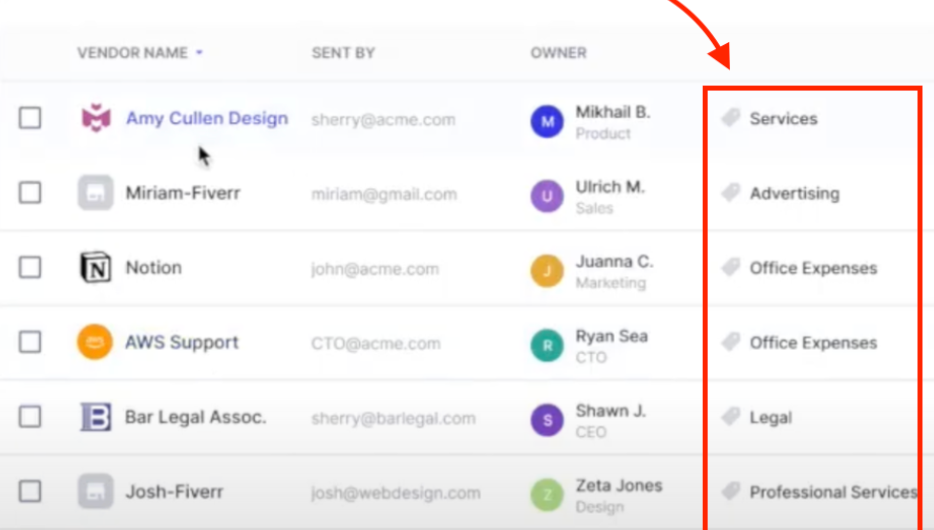

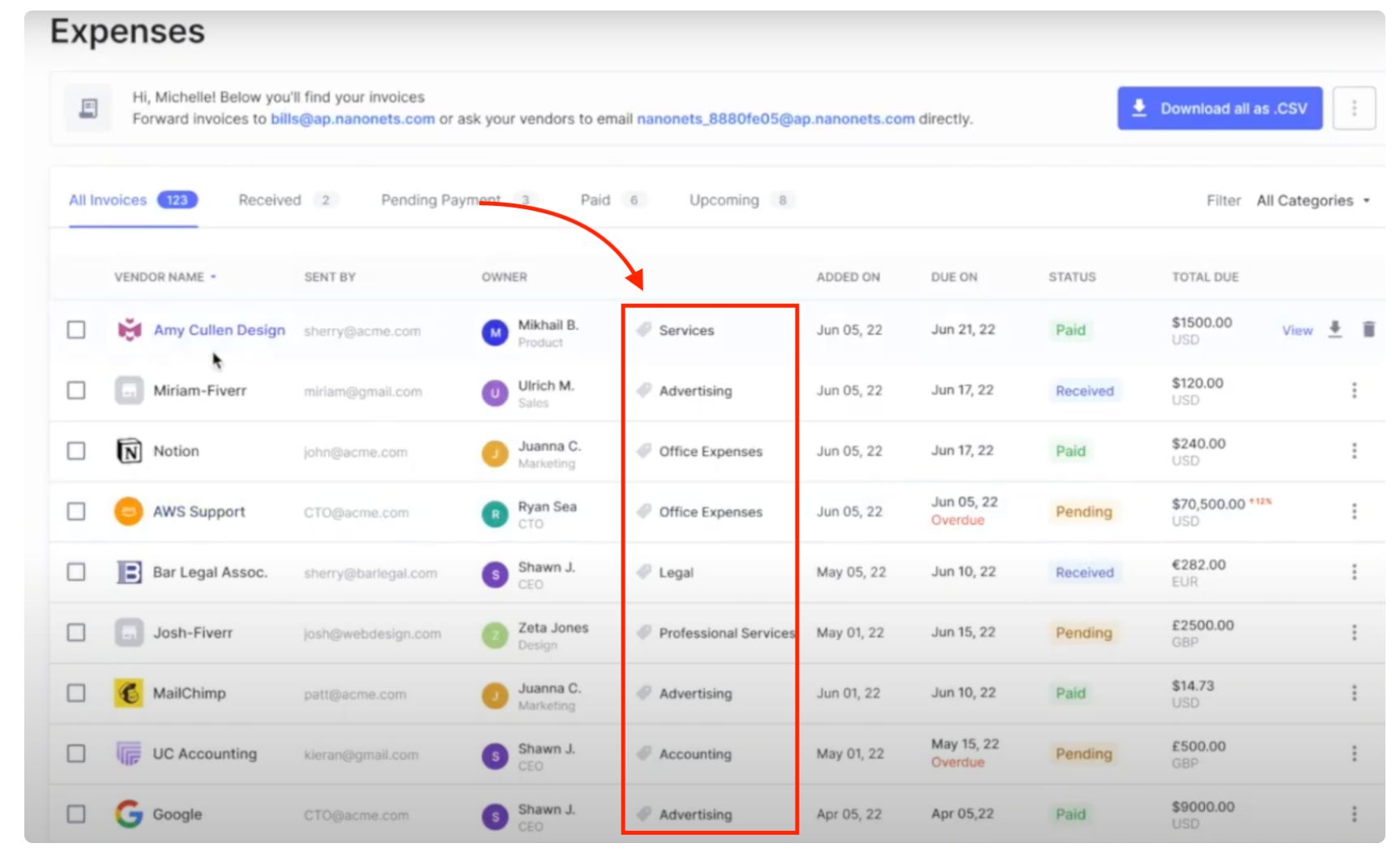

Computerized Categorization

The system robotically categorizes the expense into predefined firm classes, lowering the necessity for guide sorting and enhancing organizational effectivity.

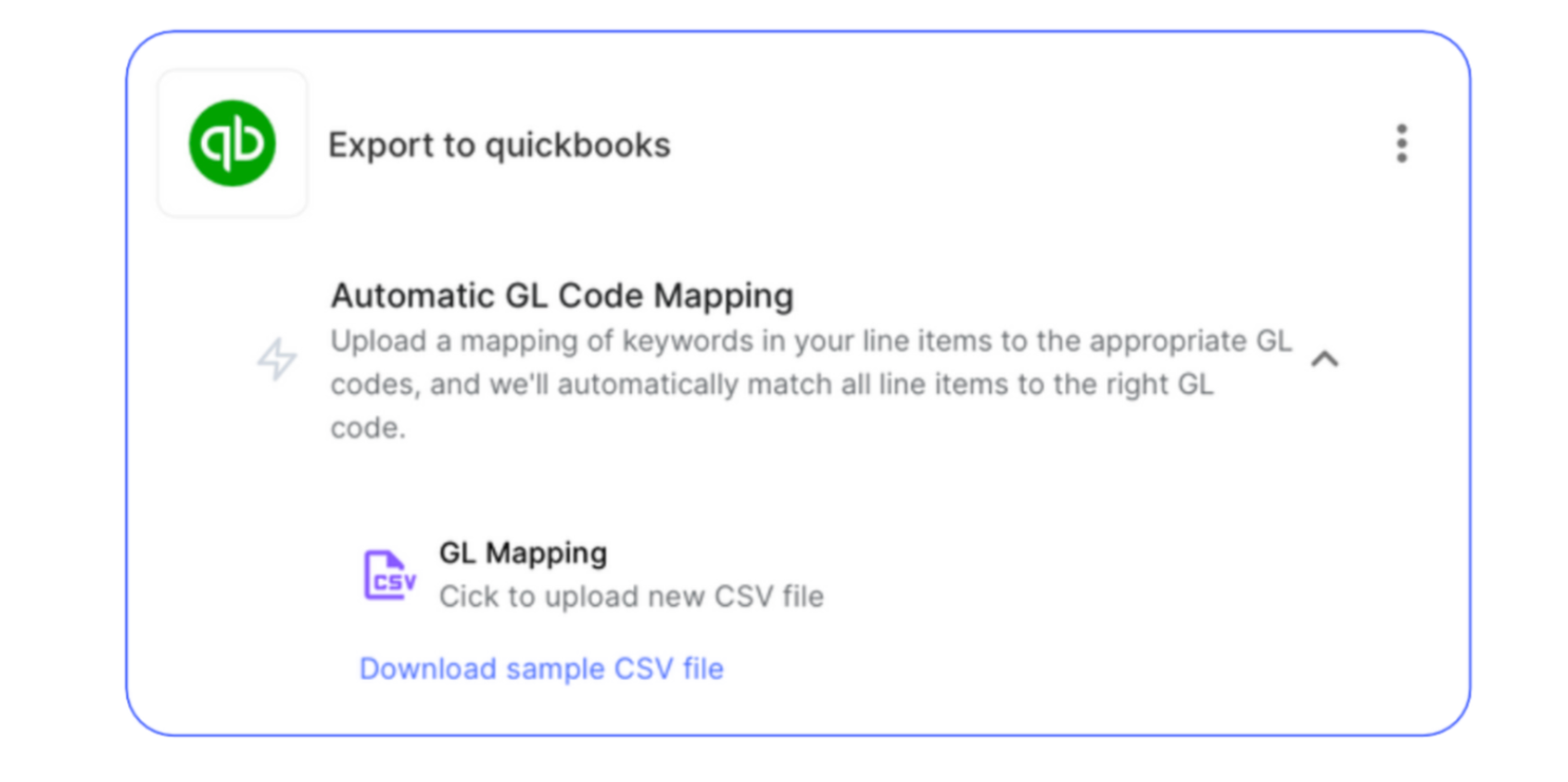

GL Coding

After categorization, the expense is assigned the proper Basic Ledger (GL) code, minimizing guide work and potential coding errors.

Digital Expense Reporting

Bills are added to a digital report robotically, eliminating guide entry. Workers can evaluate and regulate particulars if needed.

Approval Workflow

Managers obtain notifications of their digital workspace (e.g., Slack, Groups, E mail) to evaluate and might approve or reject bills with a single click on, making the method quicker.

Reimbursement Automation

Authorized bills are processed for reimbursement robotically, integrating with payroll techniques to challenge funds with out guide intervention.

ERP Synchronization

The platform seamlessly exports expense information to the corporate’s ERP software program, eliminating guide information entry and enhancing information accuracy.

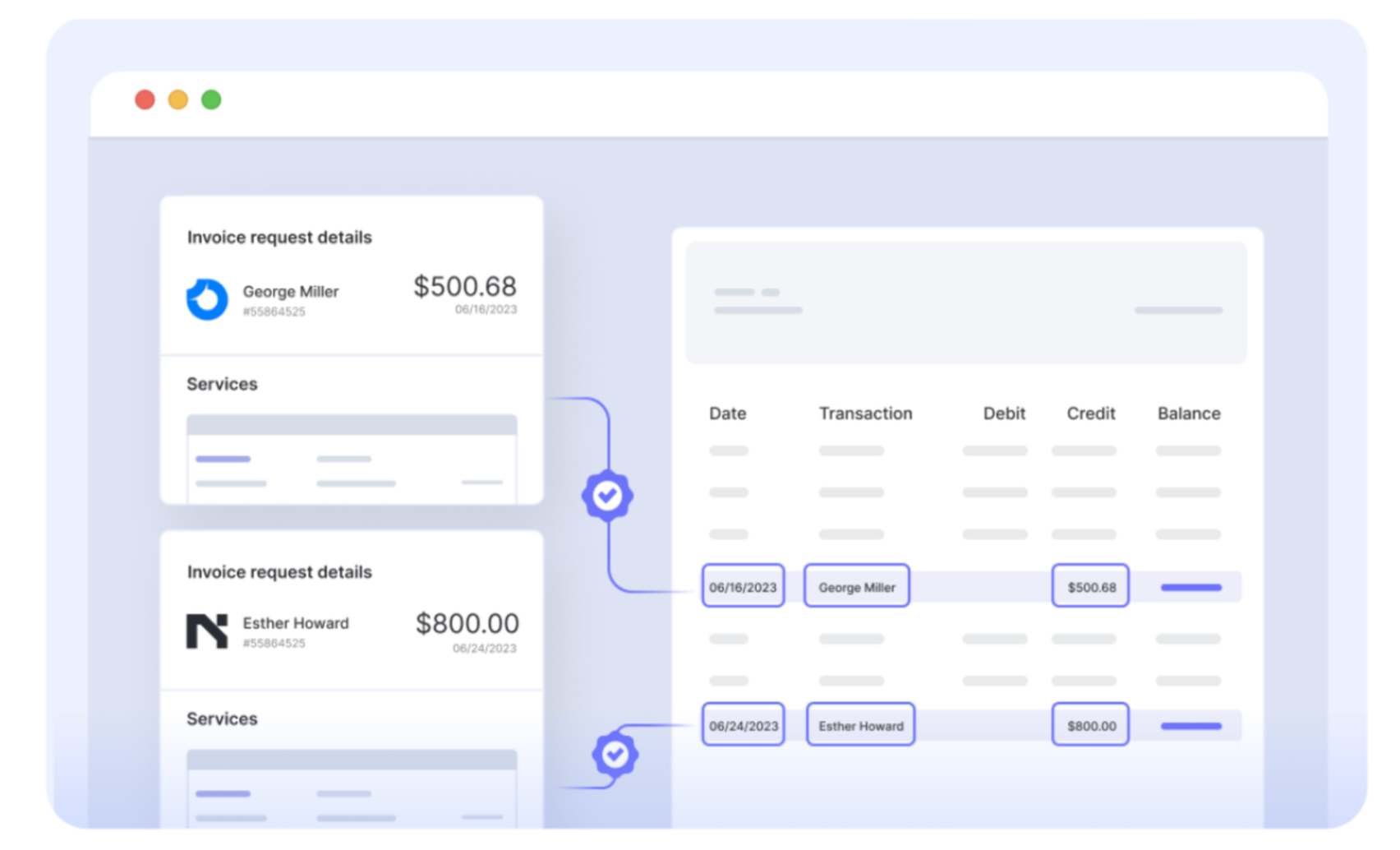

Steady Reconciliation

The system presents real-time reconciliation, robotically matching bills with financial institution transactions and highlighting discrepancies to make sure monetary accuracy and compliance.

Conclusion

As mentioned, categorizing bills aids in tax preparation, enhances analytics for budgeting, and is important for efficient money movement administration.

The offered listing of enterprise expense classes presents a reference framework for companies to optimize their tax positions and acquire deeper insights into their monetary operations.

Furthermore, the mixing of know-how, particularly by expense administration software program like Nanonets, has revolutionized how companies method expense categorization. Such platforms automate the method, making certain accuracy, effectivity, and compliance, that are important for companies in right this moment’s fast-paced world. This automation not solely saves time but additionally supplies real-time monetary insights which can be essential for making knowledgeable enterprise selections.

We recommendation companies to –

- undertake a structured method to categorizing bills,

- leverage know-how to streamline processes,

- maintain abreast of tax legal guidelines,

- consulting with professionals will additional improve technique,

- and repeatedly evaluate to determine alternatives for progress and financial savings.

By doing so, companies can guarantee they don’t seem to be solely financially wholesome but additionally primed for fulfillment within the aggressive market.