QuickBooks is the accounting software program of alternative for tens of millions of customers, most of those being small to medium-sized enterprises. It affords a complete accounting suite that guarantees not simply to maintain the books so as however to propel companies ahead with good monetary insights.

But, the leap from conventional bookkeeping to a streamlined, automated monetary ecosystem is one which many QuickBooks customers are but to completely embrace.

The Challenges of Conventional Bill Processing in QuickBooks

Even with QuickBooks’ sturdy capabilities, the guide dealing with of invoices and accounts payable presents a bottleneck fraught with challenges:

- Time-Consuming Information Entry: Guide entry isn’t just gradual; it is a drain on sources, pulling workers away from extra value-added actions.

- Error-Inclined Transactions: The human issue introduces a margin for error in knowledge entry, resulting in discrepancies that may cascade via monetary reporting.

- Inefficient Approval Workflows: Conventional processes usually contain cumbersome approval chains that delay funds and complicate money circulation administration.

In essence, whereas QuickBooks supplies the inspiration for stable monetary administration, the guide processing of invoices acts as a brake on potential effectivity positive aspects.

The Resolution

Companies are always in search of methods to streamline these vital operations. At this time, AP automation know-how can automate what was as soon as a laborious course of. When paired with Quickbooks accounting software program suites available on the market, the combination of AP Automation software program, this know-how transcends the mere digitization of paper paperwork, providing a collection of capabilities designed to automate and optimize each side of bill processing:

- Automated Information Seize: Leveraging OCR, bill particulars are extracted with precision, from vendor data and bill numbers to line objects and quantities, remodeling paper paperwork into actionable digital knowledge.

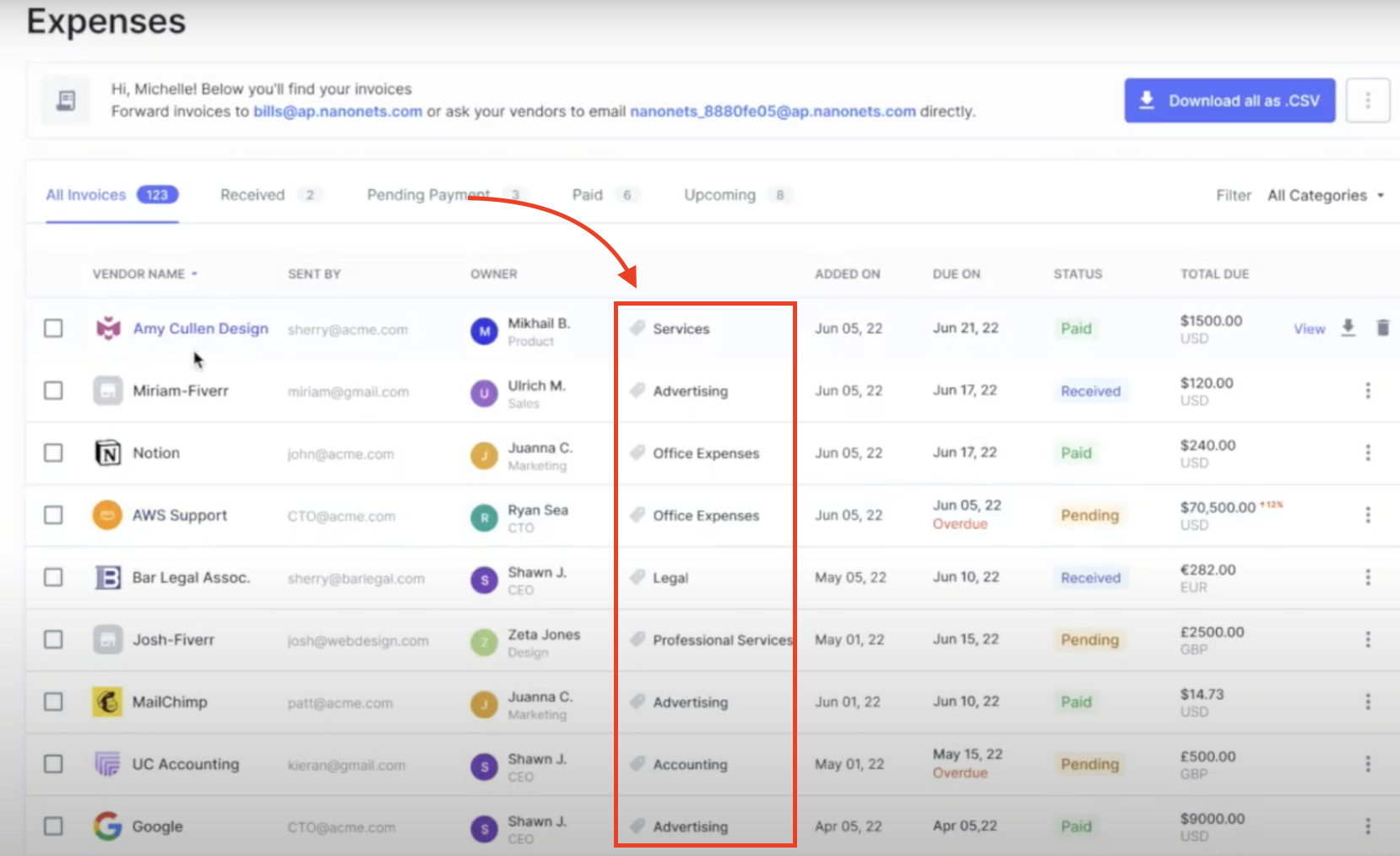

- Clever Information Interpretation: Past mere extraction, superior AI algorithms interpret bill knowledge, automating duties equivalent to basic ledger coding and expense categorization primarily based on historic knowledge and contextual understanding.

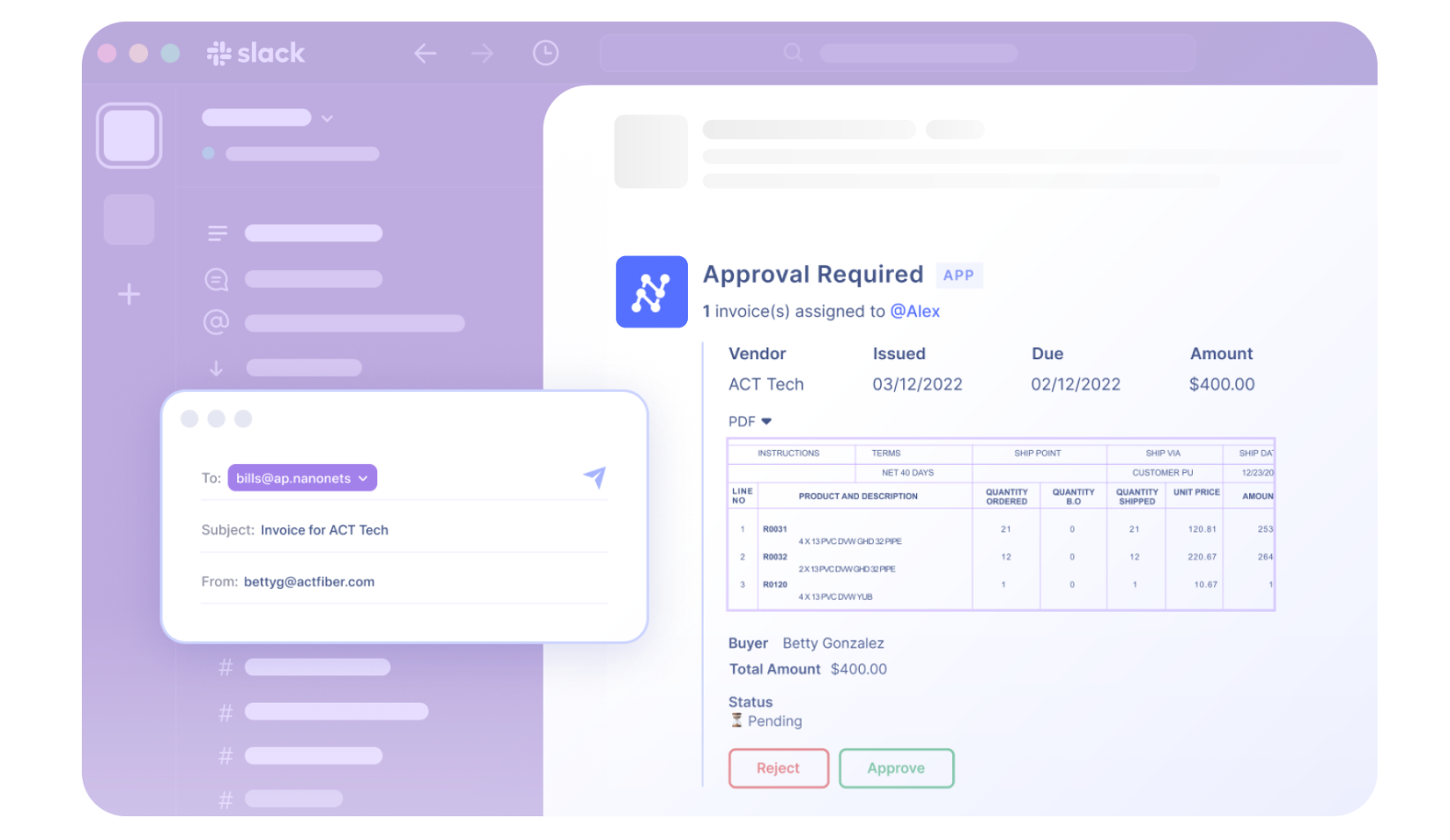

- Streamlined Approvals and Cost Processing: With knowledge precisely captured and entered into QuickBooks, the software program can streamline the approval course of and produce it the place your group lives—whether or not that is on e mail, Slack, or Groups.

- Actual-Time Information Sync with Workflow Automation: OCR and bill scanning software program as we speak synchronize knowledge with QuickBooks and different apps (Slack, E-mail, Stripe, and so forth.) in actual time. This ensures that each piece of knowledge is the place it must be, when it must be there, with out guide intervention.

Nanonets integration with Quickbooks represents a leap ahead in managing monetary transactions, setting a brand new customary for operational effectivity within the digital age. Let’s have a look at how this works, and how one can set this up in your groups.

The Evolution of Bill Processing

The journey of bill processing from its conventional, guide roots to the digital frontier is a story of technological evolution.

- Pre Eighties – Guide Accounts Payable: Accounts payable processes have been completely guide, involving bodily invoices, paper checks, and ledger books.

- Eighties-Nineties – Digital Ledgers: Early software program options supplied fundamental digital ledger capabilities, streamlining some elements of the method.

- 2000s – Digital Invoicing Unlocked : The web revolutionized accounts payable, introducing digital invoicing, on-line transactions, and e mail communications. This period noticed a major discount in paper-based processes.

- 2010s – Simple-to-use Cloud Options: Cloud-based options allowed for extra scalable, versatile, and accessible monetary operations, whereas cellular know-how enabled on-the-go bill administration and approvals.

- Late 2010s-Current – Automated Accounts Payable Options: The newest evolution entails the usage of automation and synthetic intelligence to automate all the course of together with –

- Accounting and AP Intelligence: The appearance of AI-based accounting techniques has ushered in a brand new period of effectivity. Able to performing repetitive duties equivalent to knowledge entry, bill matching, and transaction processing, these techniques function with a velocity and accuracy past human capabilities.

- Linked Workflow Throughout Apps: In as we speak’s interconnected digital panorama, seamless communication between purposes is essential. Emails, AP instruments, accounting software program, ERPs, and different databases now function in live performance, automating knowledge seize and synchronization throughout platforms.

- Clever Information Seize: Leveraging AI applied sciences like pure language processing and optical character recognition (OCR), as we speak’s techniques automate the extraction and interpretation of information from varied bill codecs. This contains dealing with unstructured and scanned knowledge with unprecedented effectivity, making the accounts payable course of smoother and extra correct than ever earlier than.

OCR Expertise for Bill Scanning

OCR know-how has reworked doc administration throughout varied industries, and its utility in bill processing for QuickBooks customers is not any exception. By changing paper invoices and digital paperwork into editable and searchable knowledge, OCR allows companies to automate knowledge entry, decrease errors, and enhance effectivity.

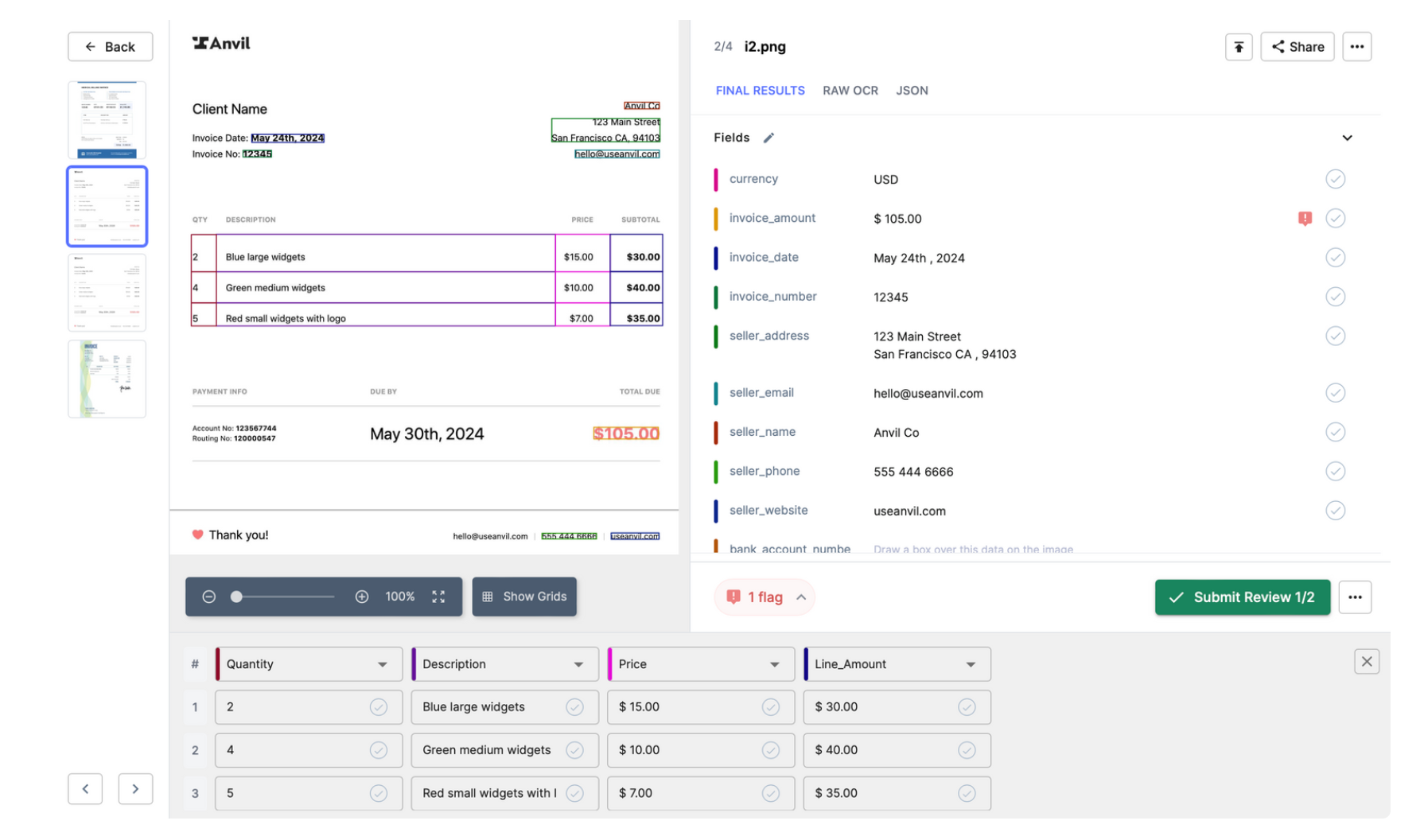

OCR scans invoices and different paper paperwork, turning them into digital textual content. The digital textual content is interpreted utilizing AI and bill particulars are extracted –

- Fields (bill date, bill quantity, quantity, vendor particulars, purchaser particulars, and so forth)

- Line Objects (descriptions and prices of the Items and Companies Offered).

- GL Codes (robotically assigned by AI primarily based on previous knowledge).

- Different dimensions primarily based on context (expense categorization, and so forth.)

The extracted knowledge is then mapped and synced to Quickbooks.

Nanonets for OCR and Bill Scanning in Quickbooks

For firms using Quickbooks for his or her accounting wants, the guide strategy of dealing with invoices isn’t just a check of endurance but in addition a major drain on sources. An OCR and Bill Scanning Software program for Quickbooks transforms this vital but cumbersome course of right into a streamlined, environment friendly workflow.

Let’s check out how accounting groups can use an OCR-based AP automation software program like Nanonets and combine it with Quickbooks to streamline their accounting workflow.

Guide AP Workflow in Quickbooks

First, Let’s revisit the everyday guide AP course of for an organization utilizing Quickbooks:

Bill Receipt: Invoices arrive in varied codecs, together with paper and digital. Workers should manually acquire and arrange these paperwork to make sure they’re processed appropriately.

Guide Sorting and GL Coding: Every bill is then sorted primarily based on standards equivalent to vendor, quantity, or due date, requiring important effort and time. Subsequently, every bill should be precisely coded to the proper Common Ledger (GL) accounts, a vital step for sustaining organized monetary data.

Information Entry: The subsequent part entails the guide entry of essential bill particulars into QuickBooks. This contains data like vendor names, billed quantities, and cost due dates. Correct knowledge entry is important to make sure monetary data are dependable and updated.

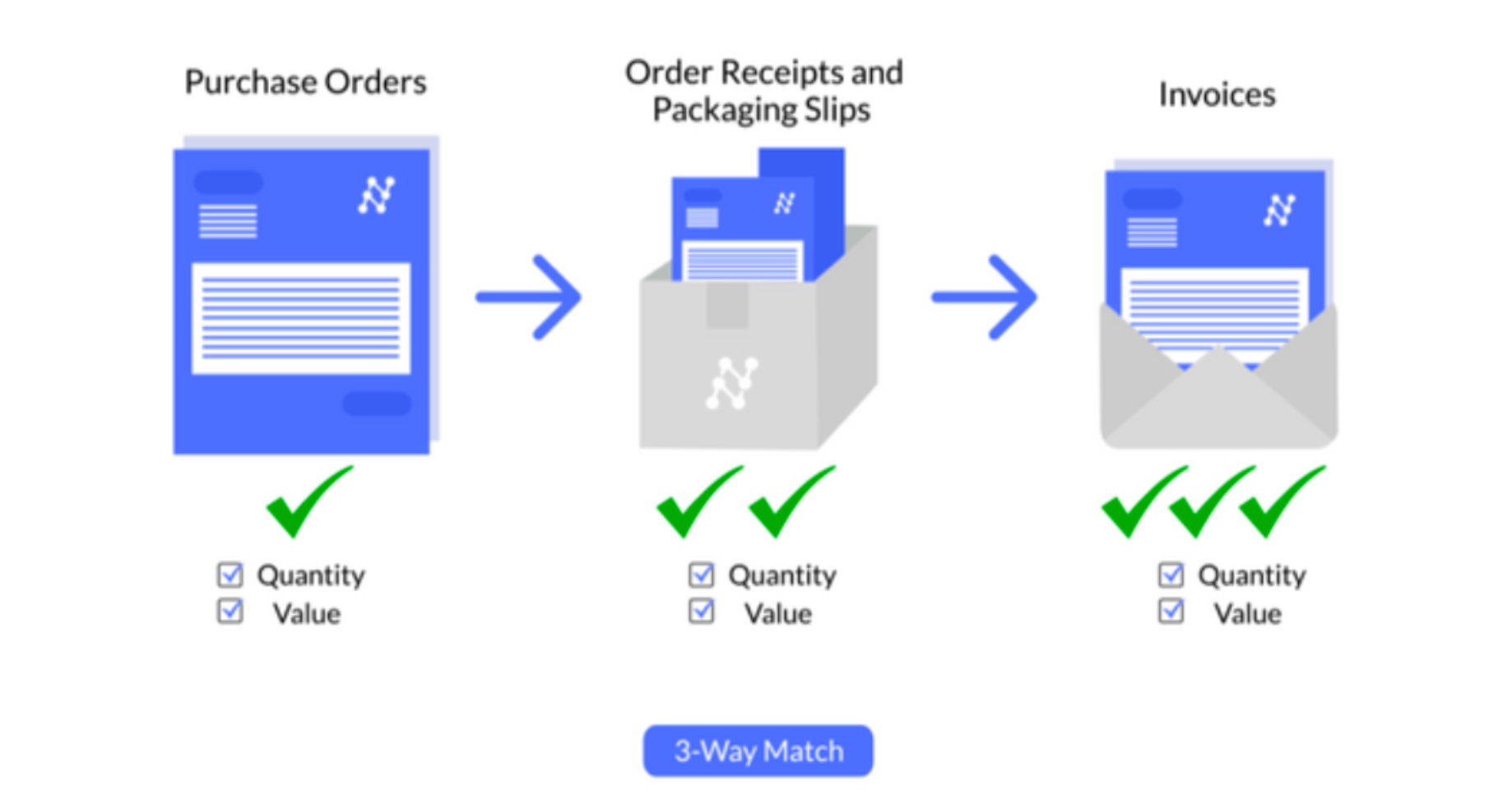

Bill Verification: Relying on the corporate’s insurance policies, invoices might bear two-way (bill and PO), three-way (bill, PO, and receiving report), or four-way (bill, PO, receiving report, and inspection report) matching to confirm transactions. This step is important for confirming the accuracy of transactions and stopping fraud.

Approval: As soon as verified, invoices are routed for approval. This course of usually entails a number of departments or ranges of authority inside the firm, every with its personal set of standards for approval. It is a safeguard to make sure that expenditures are licensed and crucial.

Cost Processing: Accepted invoices are scheduled for cost primarily based on phrases and money circulation issues. It is very important keep good relationships with distributors via well timed funds.

Reconciliation: Lastly, funds are reconciled in Quickbooks, making certain that each one transactions are precisely mirrored in monetary data. Reconciliation is essential for sustaining correct monetary data and for the preparation of economic studies.

Automated AP Workflow with Nanonets

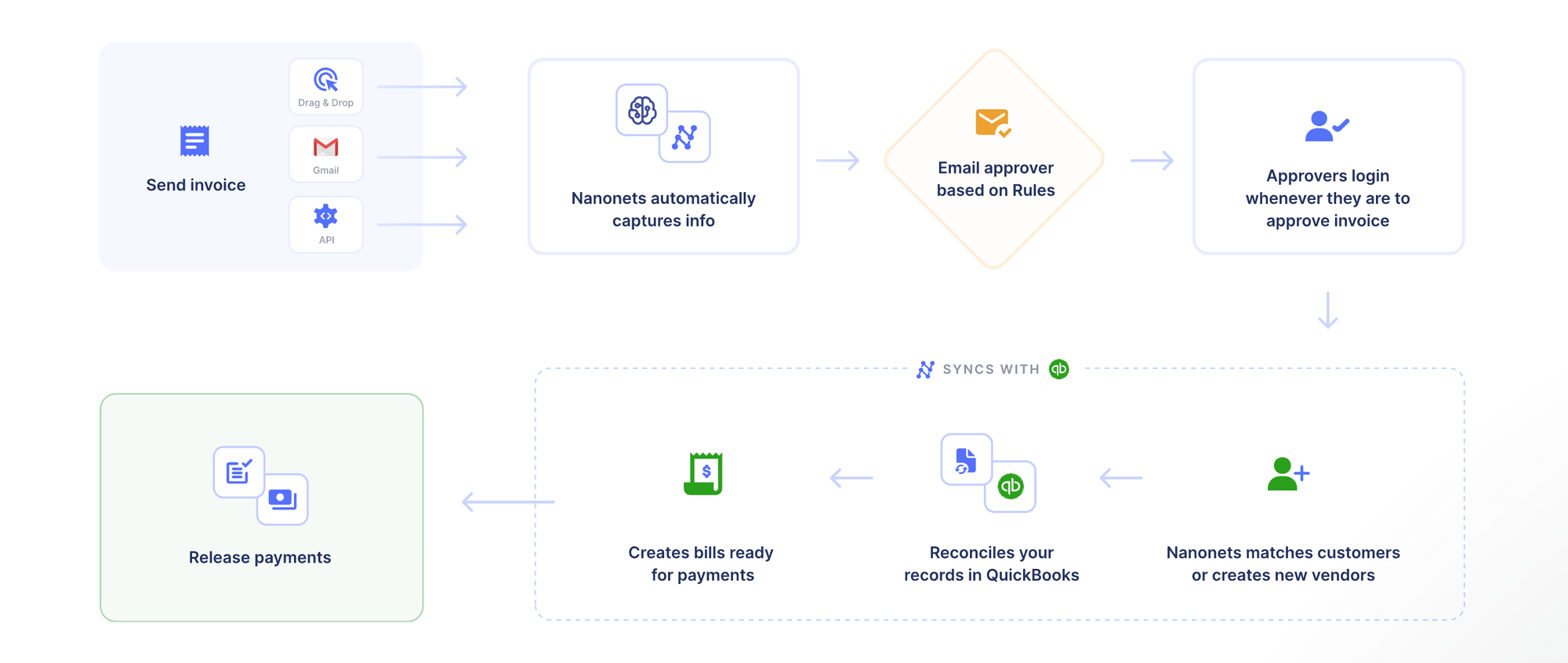

Now, let’s discover how integrating Nanonets into QuickBooks can remodel the Accounts Payable (AP) workflow from guide to automated, streamlining processes and enhancing effectivity:

Bill Receipt: Image this- each bill your enterprise receives, no matter its supply, lands neatly in a single digital spot. Invoices are robotically imported from the mess of emails, drives, and databases as quickly as they arrive, saving you time and decreasing errors.

Nanonets robotically reads emailed invoices from e mail physique and attachments.

All handwritten and printed invoices may be simply scanned utilizing a smartphone or immediately uploaded into the platform.

Digital receipts can both be created and printed immediately utilizing the Nanonets platform, or imported into Nanonets out of your mail, apps and databases.

This course of ensures that each piece of information, no matter its origin, finds its place in a centralized, digital repository, prepared for additional motion.

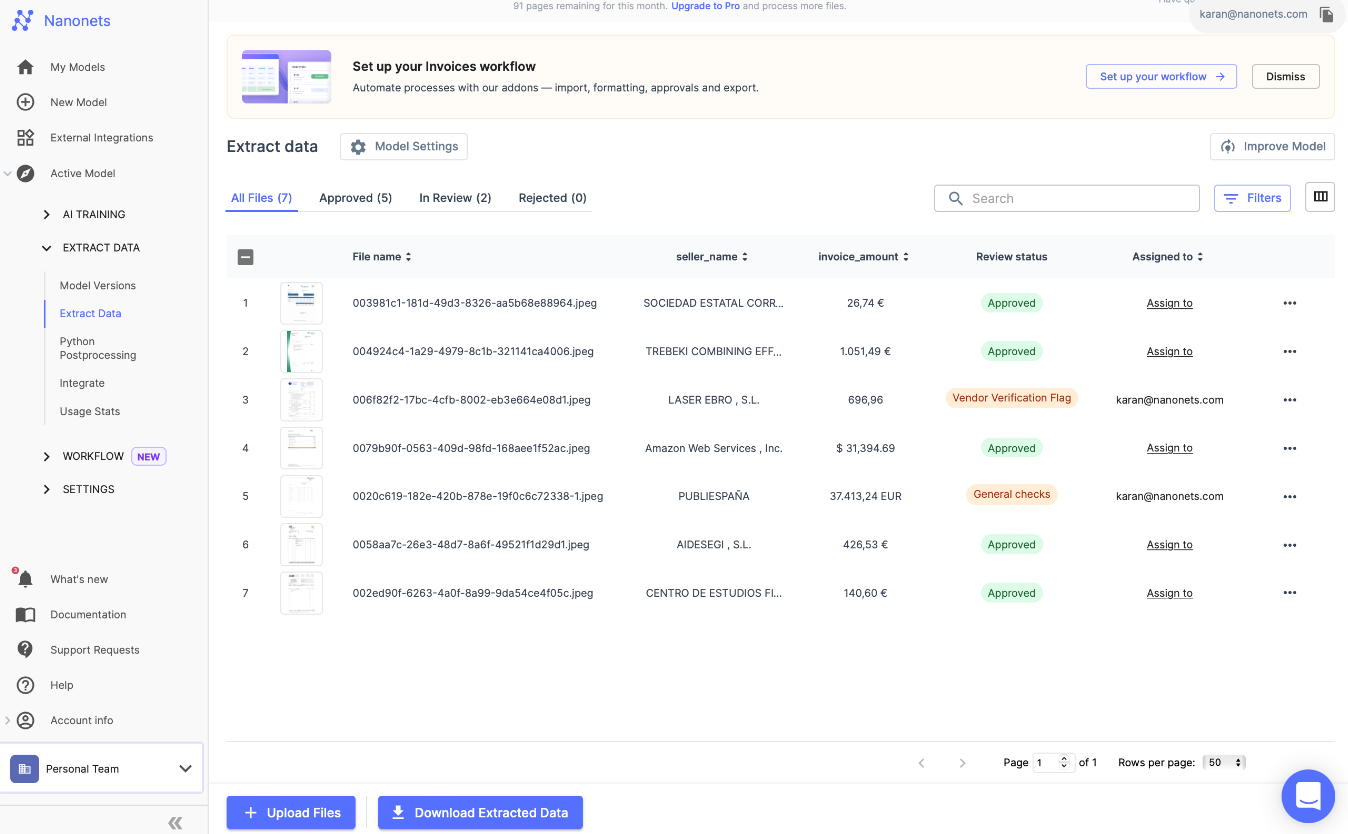

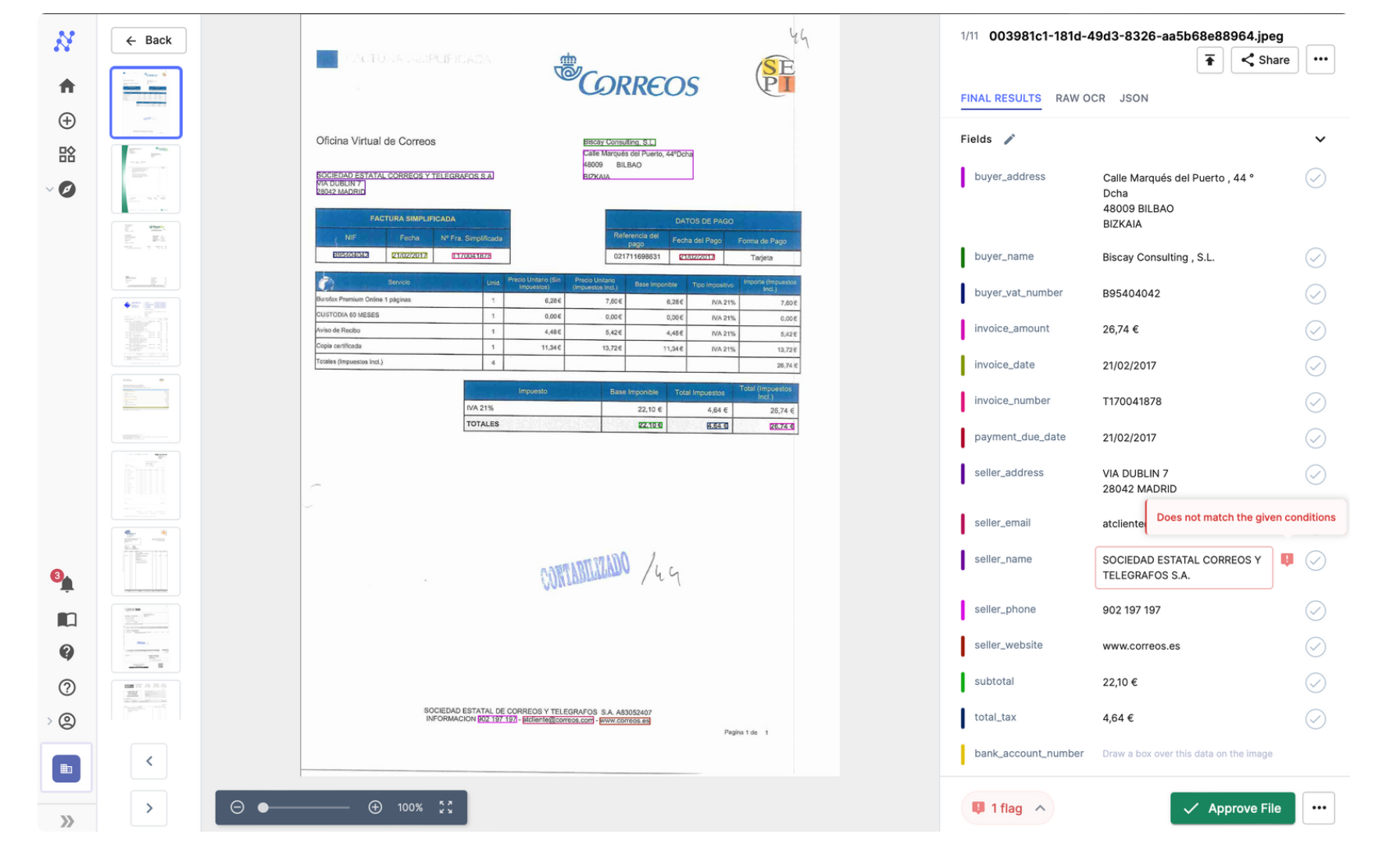

Automated Information Entry: Nanonets leverages AI to realize over 99% accuracy in studying invoices, remodeling hours of guide work into mere moments. This automation permits your group to concentrate on extra significant duties, as knowledge extracted from invoices is immediately inputted into QuickBooks with none guide intervention.

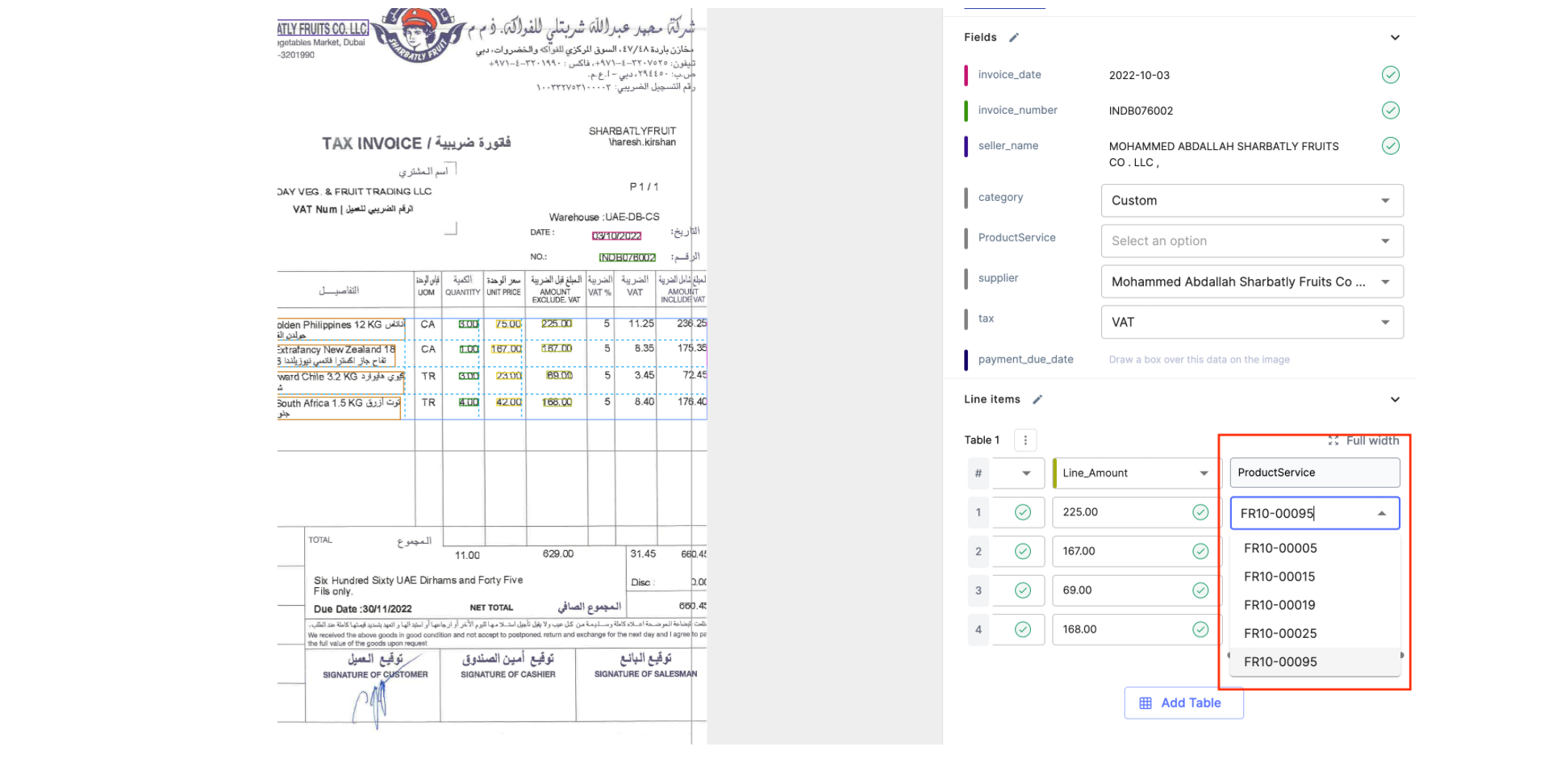

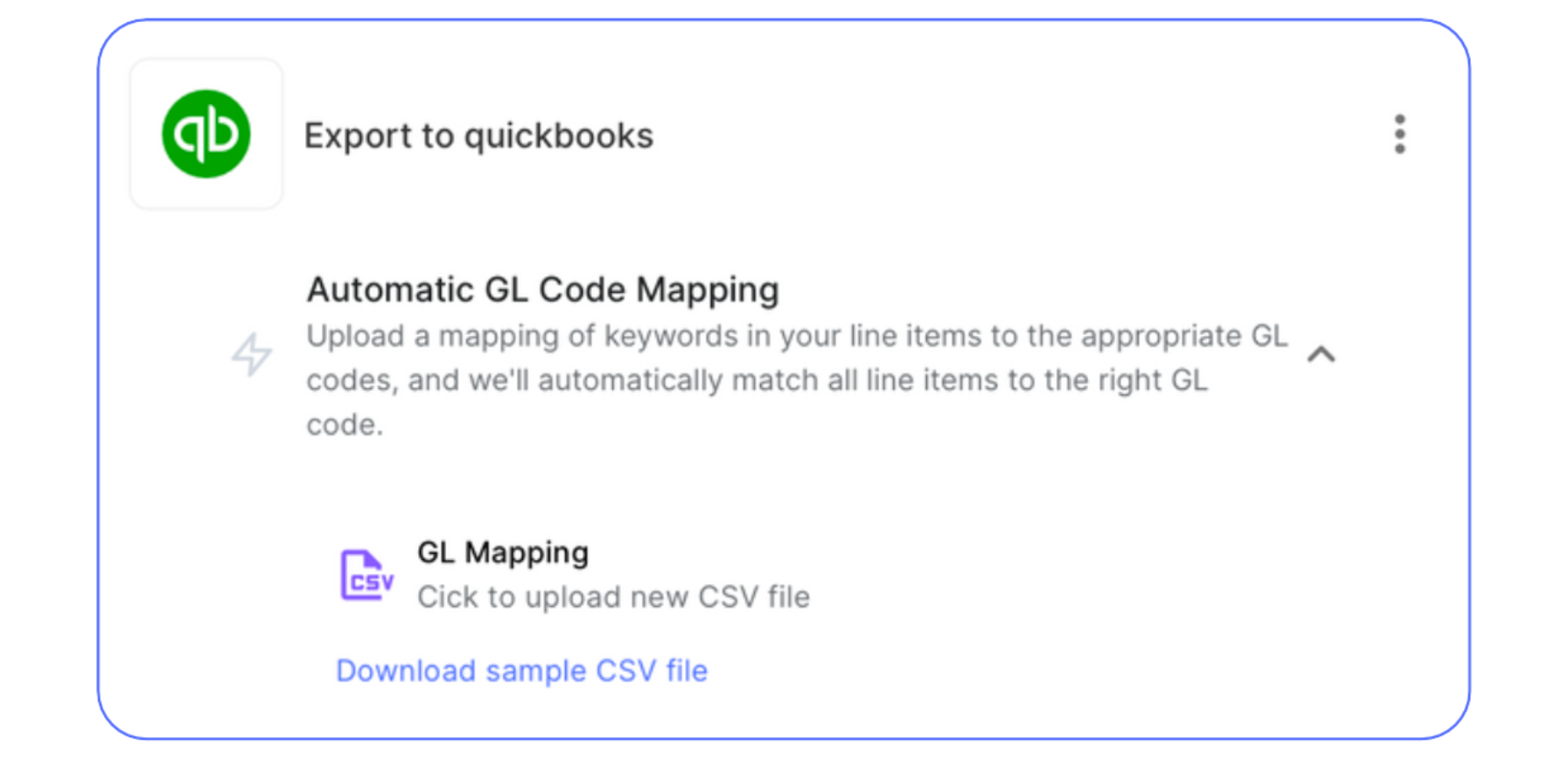

Automated Sorting and GL Coding: Using OCR know-how, Nanonets robotically acknowledges and categorizes invoices by varied standards equivalent to vendor, date, and quantity. It additionally automates the project of GL codes via:

- Coaching on previous knowledge: This entails importing historic monetary paperwork and transactions tagged with traditionally right GL codes. The mannequin learns from these examples to precisely predict GL codes for brand spanking new transactions.

- Out of the Field Gen AI: By utilizing Nanonets GenAI, our software program can interpret the textual content on monetary paperwork in a approach that mimics human understanding. This permits it to extract related data, context and semantics with a view to apply advanced reasoning to assign GL codes precisely, even in instances the place transaction particulars are ambiguous or sparse.

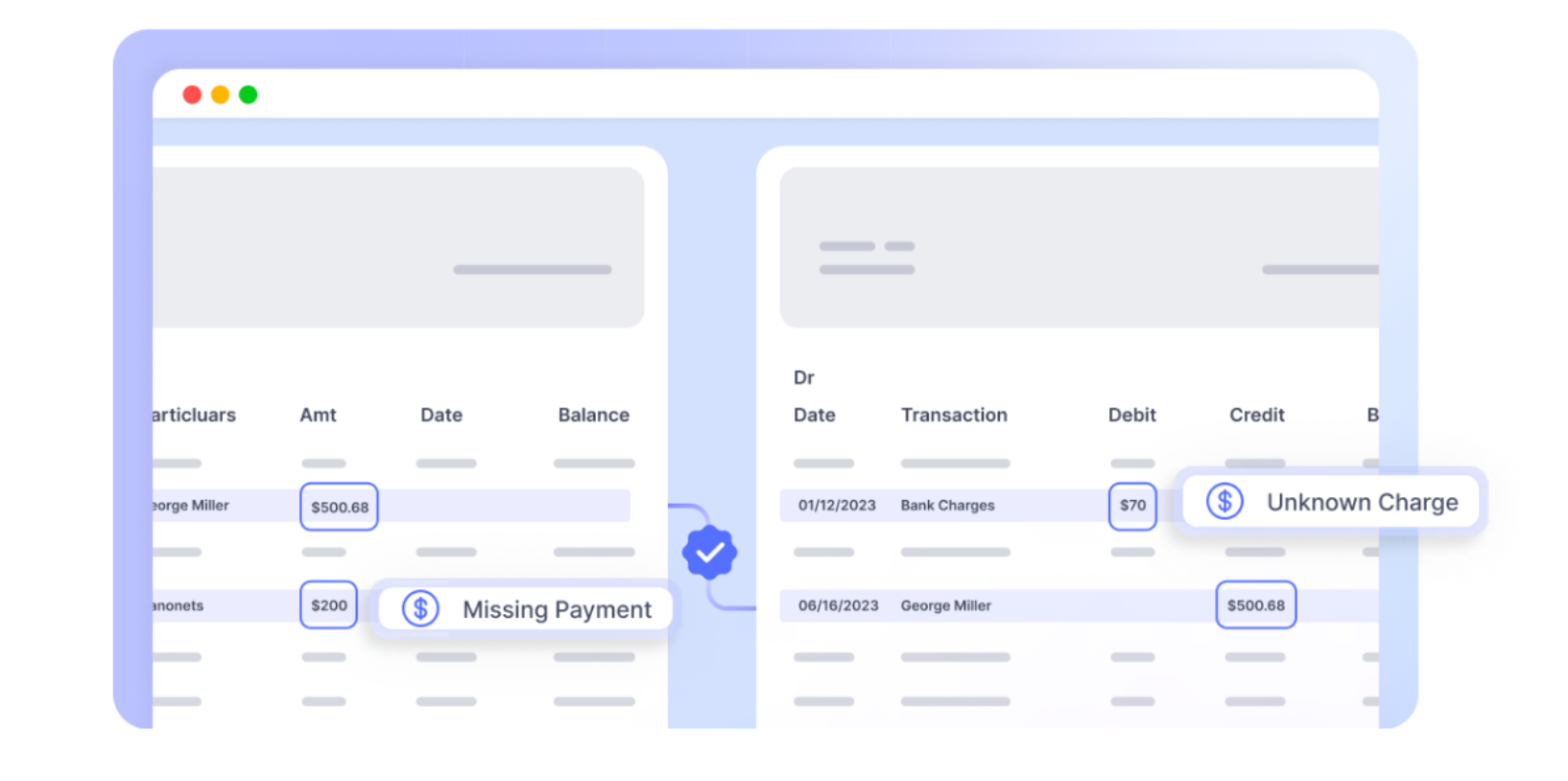

Clever Bill Verification: Leveraging AI, Nanonets robotically performs two-way, three-way, or four-way matching by studying and cross-referencing the extracted bill knowledge with buy orders, receiving studies, and inspection studies current in QuickBooks.

Validation and Routing: The system identifies discrepancies for human evaluate, however robotically routes or approves invoices matching pre-defined standards, considerably decreasing guide oversight.

Approval: Approvals with Nanonets are now not a bottleneck. They develop into versatile and stay the place your group does—whether or not that is on e mail, Slack, or Groups. This eliminates the necessity for disruptive cellphone calls and the all-too-familiar barrage of reminders.

Cost Processing: As soon as invoices have been coded and accepted in Nanonets, the combination will robotically create ready-to-send payments for funds. With all this in place, firms can now optimize their cost timings to take full benefit of early cost reductions or keep away from late charges, immediately contributing to price financial savings.

Reconciliation: You possibly can import your financial institution statements, and Nanonets reconciles the funds robotically with the information in Quickbooks, making certain that monetary statements are up-to-date and correct, and your books shut 90% sooner.

We mentioned the tangible advantages of utilizing OCR and Bill Scanning Software program for Xero earlier. However on prime of that, the transition from a guide to an automatic AP course of represents not only a shift in how duties are carried out however a elementary transformation within the function of the finance division. With instruments like Nanonets, finance groups transfer from back-office features to strategic contributors, leveraging real-time knowledge and analytics to drive enterprise selections. That is the way forward for finance, and it is out there now for Xero customers via the facility of automation with Nanonets.

What impression does OCR and Bill Scanning Software program have?

Numerous reported statistics underscore the impression of automation software program. These numbers characterize a story of the sort of success that you just and your group can stay up for experiencing.

Dramatic Price Reductions in Processing

Let’s begin with the monetary well being of your division. AP Automation has been proven to slash processing prices by a staggering 70%. This is not nearly saving pennies; it is about reallocating your finances in the direction of development, coaching, and possibly even that workplace espresso machine everybody’s been eyeing. Consider this as an funding in each your group’s effectivity and their well-being.

Time is of the Essence

Now, think about decreasing your bill processing time by 384%. This dramatic lower means your group can course of extra invoices sooner than ever earlier than, releasing up time to concentrate on strategic initiatives that actually matter. With AP Automation, “I haven’t got time for that” turns into “What’s subsequent on the agenda?”

Error Discount for Peace of Thoughts

We all know errors may be extra than simply annoying—they are often expensive. With a 37% discount in bill processing errors, AP Automation brings peace of thoughts to your operations. Fewer errors imply fewer hours spent in correction cycles and extra confidence in your knowledge integrity. This additionally interprets into much less friction with distributors and stakeholders, smoothing the best way for smoother relationships and operations.

Cultivating Vendor Relationships

Talking of relationships, let’s speak in regards to the 76% of organizations reporting elevated vendor satisfaction. That is key. Joyful distributors imply a dependable provide chain and alternatives for negotiations and reductions down the street. Your distributors will discover and respect the punctuality and accuracy of your funds, because of AP Automation.

Money Move Optimization via Early Cost Reductions

A 3% financial savings via early cost reductions provides your group a monetary facelift, enhancing your money circulation, and offering you with extra leverage and adaptability in your monetary operations.

Compliance With out the Problems

Lastly, the crown jewel of AP Automation: 100% stress-free compliance. In an age the place regulatory calls for are ever-increasing, attaining full compliance with out the stress is nothing wanting miraculous.

💡

We mentioned the tangible advantages of utilizing OCR and Bill Scanning Software program for Quickbooks earlier. However on prime of that, the transition from a guide to an automatic AP course of represents not only a shift in how duties are carried out however a elementary transformation within the function of the finance division. With instruments like Nanonets, finance groups transfer from back-office features to strategic contributors, leveraging real-time knowledge and analytics to drive enterprise selections. That is the way forward for finance, and it is out there now for QuickBooks customers via the facility of automation with Nanonets!

Able to revolutionize your bill processing with Nanonets for QuickBooks? Schedule a name as we speak to discover how our cutting-edge resolution can streamline your monetary operations.

Steps to Combine Nanonets for Quickbooks

You possibly can combine Nanonets with QuickBooks inside minutes, and begin utilizing the platform to automate your bill processing and AP workflows.

A totally automated bill processing Nanonets workflow built-in with QuickBooks seems as follows.

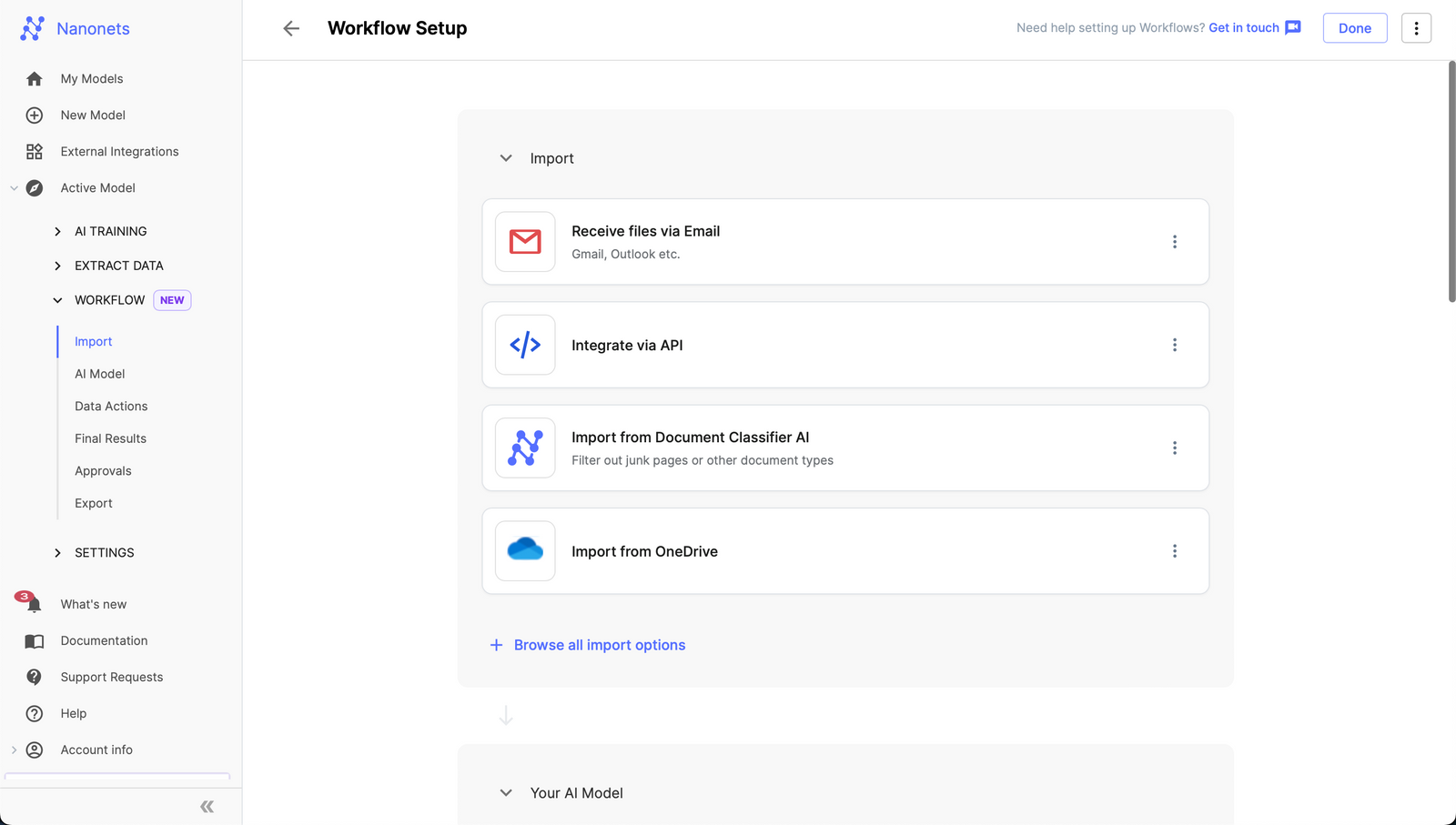

Here is an entire step-by-step information on arrange your Nanonets integration with QuickBooks inside minutes –

1. Setting Up Your Account

- Select the Invoices pre-trained mannequin.

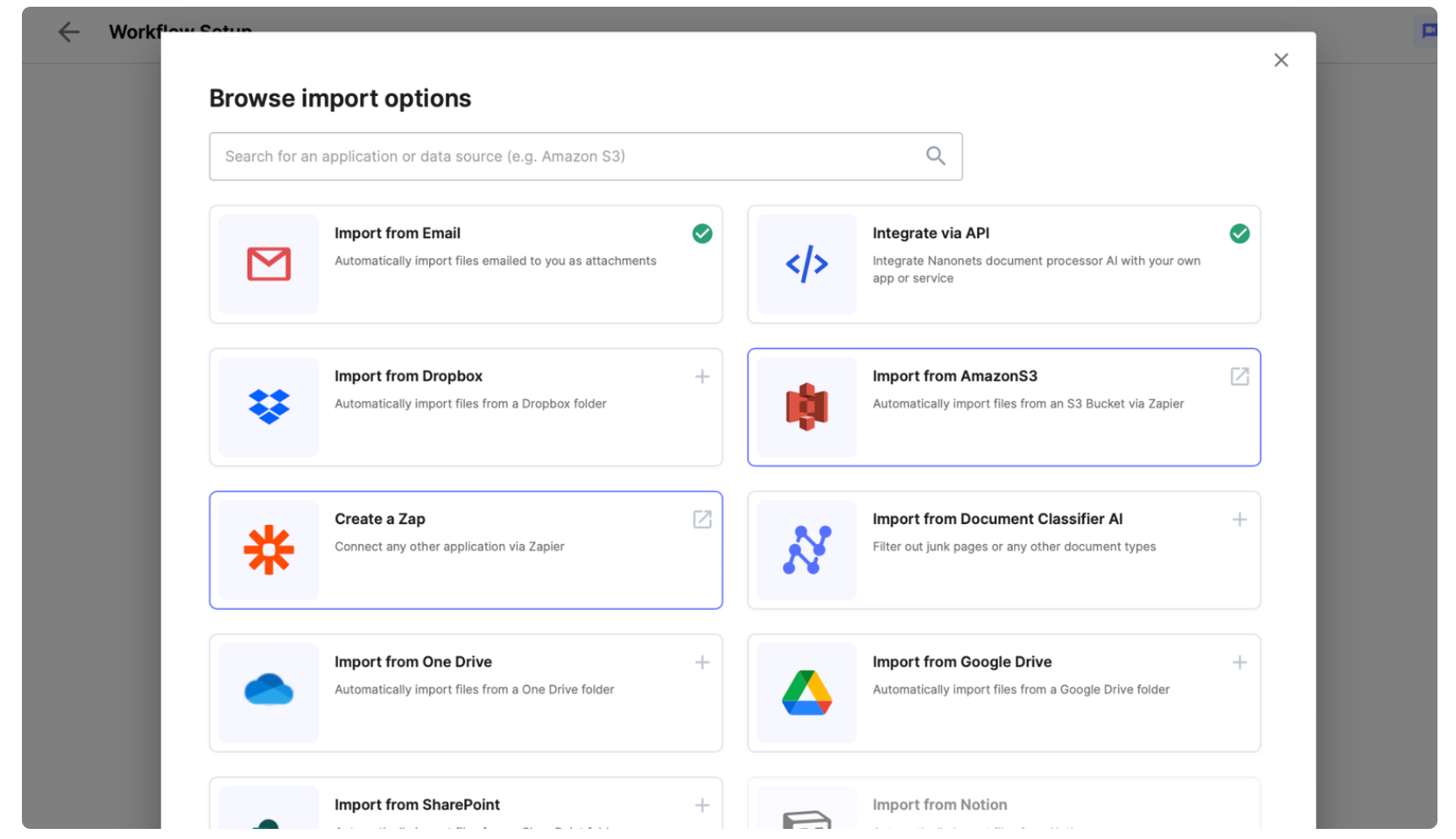

2. Configuring Automated Bill Assortment

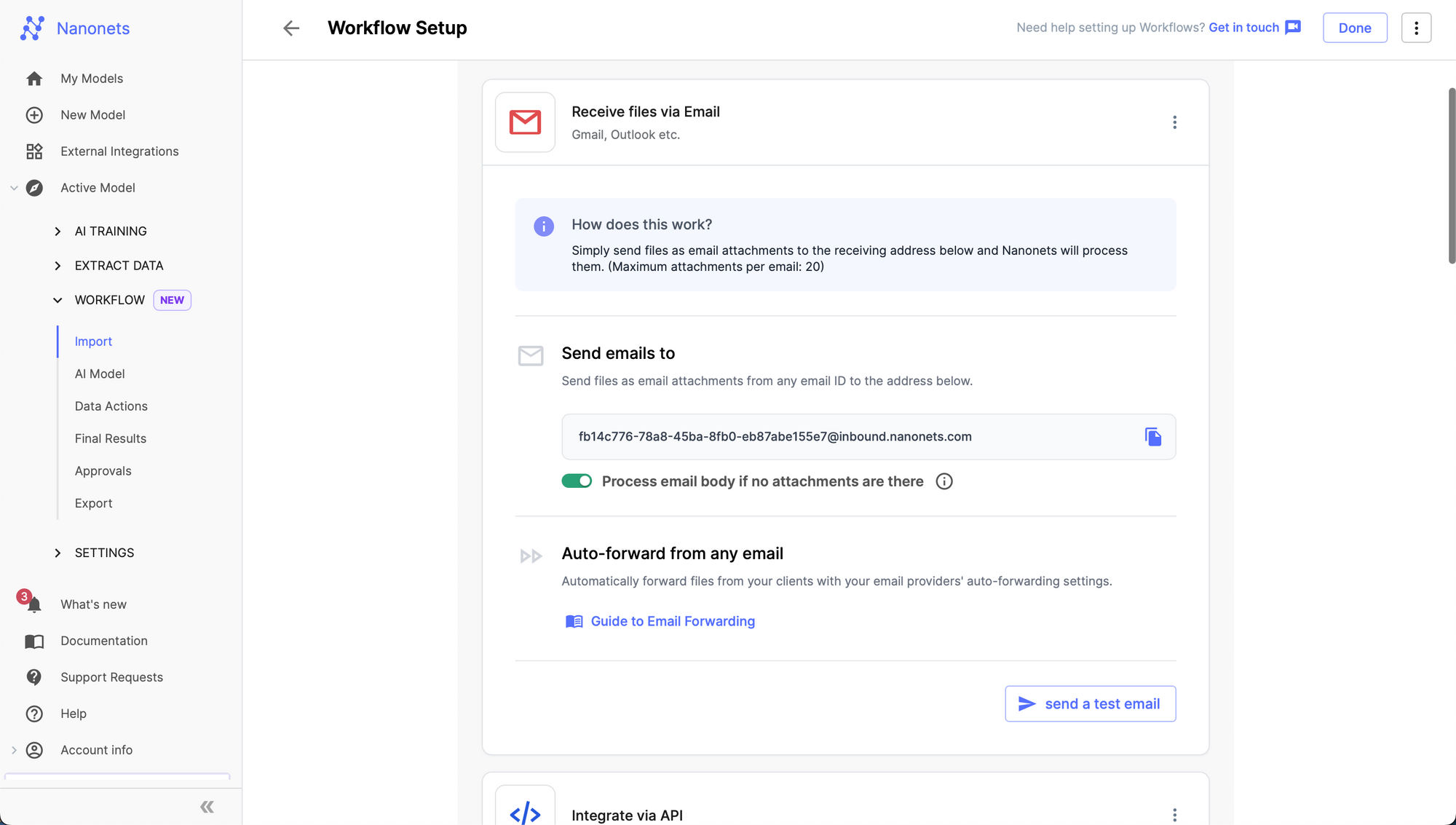

- Upon getting created the mannequin, navigate to the Workflow part within the left navigation pane.

- Go to the import tab and configure your import choices –

- 1. E-mail :

- Go to the import tab and click on on “Obtain recordsdata through E-mail”.

- Within the expanded view, it is possible for you to to seek out an auto generated e mail deal with created by Nanonets.

- 1. E-mail :

- Any E-mail despatched to this deal with will probably be ingested by the Nanonets mannequin you created and structured knowledge will probably be extracted from it. You possibly can arrange e mail forwarding to robotically ahead incoming emails from any e mail deal with to the Nanonets e mail deal with to automate e mail ingestion and knowledge extraction.

- Learn to arrange E-mail Forwarding from any e mail

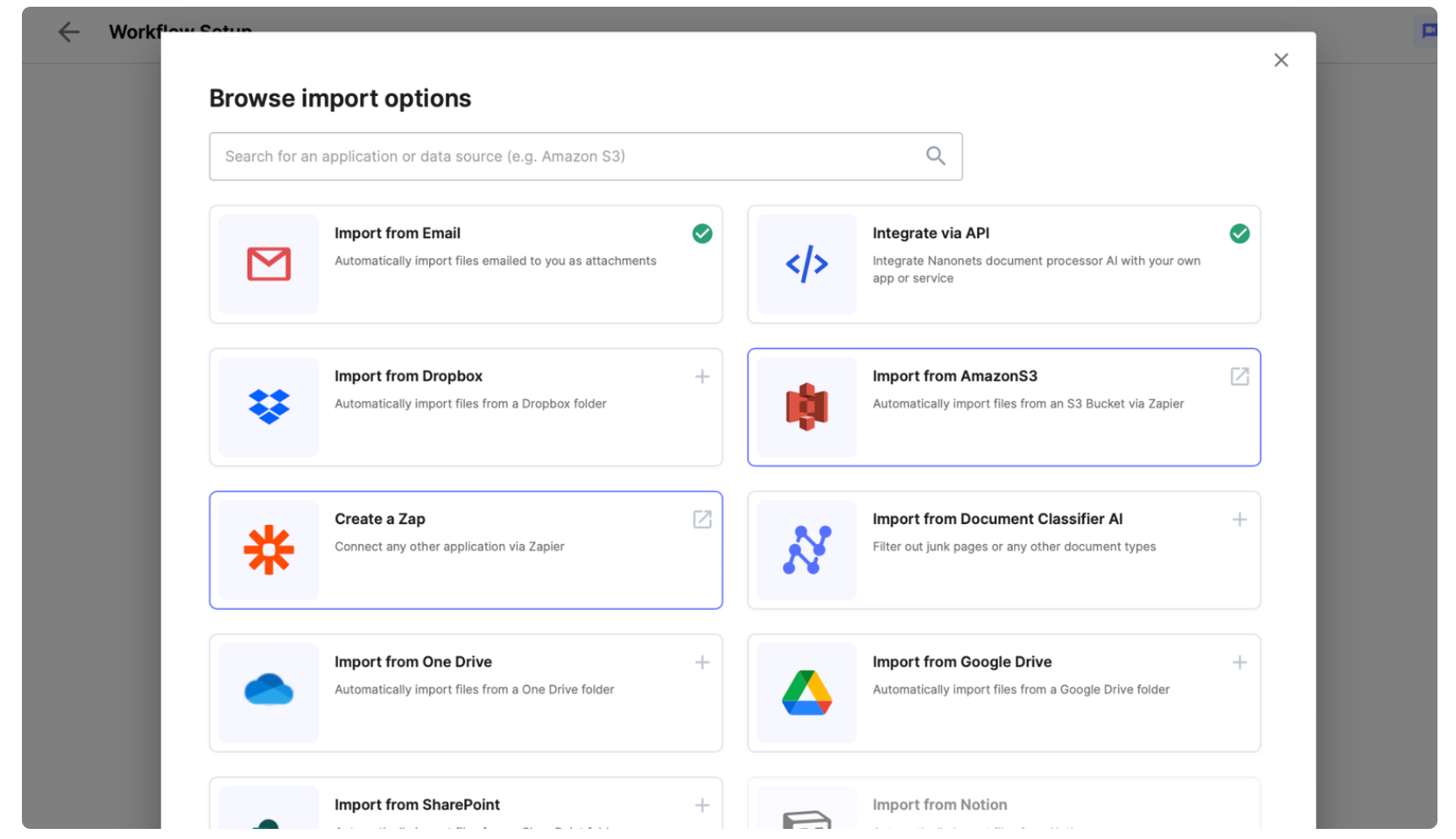

- 2. Automated Import from Apps and Databases

- Arrange your imports from the “Browse all import choices” modal.

- 3. Direct Add

- You can too select to immediately take photographs and add invoices utilizing the Nanonets platform or cellular app.

- Check Information Extraction: Add a check bill and Nanonets works on the imported doc and extracts fields, line objects and tables.

4. Add post-processing steps

- After testing the information extraction with a check bill, you may automate additional processing of the extracted knowledge utilizing Actions. Go to the Actions part within the Workflow web page.

- Click on on Add an motion.

- Choose and configure an motion. Here’s a checklist of actions you may add –

| Convert to Date format | Change textual content to a specific date format. |

| Forex detector | Extracts foreign money discipline as a 3-character code (e.g., USD). |

| Discover and Substitute | Substitute situations of any character or phrase. |

| Take away characters | Take away alphabets, numbers, or particular characters. |

| Mix situations | Concatenate separated values of information right into a single string. |

| Change to closest match | Change textual content to a price that could be a shut match of captured knowledge. |

| Change case | Change textual content to uppercase/lowercase or all caps. |

| Convert to integer | Take away decimal locations from numbers. |

| Convert to drift | Add decimal locations to numbers. |

| Take away Forex symbols | Maintain solely numbers, decimals, and commas in quantities. |

| Convert to ASCII | Convert a string into American Customary Code for Info Interchange encoding. |

| Match Regex | Extract the substring matching the common expression. |

| Create a brand new discipline with Regex | Derive fields from captured regex teams and assign to variables. |

| Add/Substitute worth | Add new label or change worth of a label with a mix of strings and different labels. |

| Delete worth | Delete values(contents) of the desired discipline whereas retaining the label within the last outcomes/output. |

| Barcode Scanner | Scan barcodes. |

| QR Code Scanner | Scan QR codes. |

| Checkbox Detector | Get all generic checkbox fields. |

| Particular Checkbox Detector | Get particular checkbox fields. |

| Math Capabilities | Carry out math operations on labels and values. |

| LLM knowledge motion | Use Giant Language Fashions and prompts to course of knowledge. |

| Lookup in varied databases | PostgreSQL, MySQL, MariaDB, MSSQL, Salesforce, Quickbooks, Microsoft Dynamics-365, Sage Intacct, Nanonets DB, CSV recordsdata. |

| Lookup in CSV | Discover and get extra knowledge from .csv recordsdata. |

| Common Ledger Classes | Add Common Ledger accounts, automate categorization primarily based on any captured discipline. |

| Python code | Create a customized step with Python code block. |

| Gmail – Ship E-mail | Ship e mail to anybody with extracted knowledge. |

| Slack – Ship Channel Message | Ship message to a public channel with extracted knowledge. |

| Google Sheets – Replace Spreadsheet | Mechanically replace a Google Sheets spreadsheet with bill particulars. |

| Twilio – Ship SMS | Ship SMS to any cellphone quantity with extracted knowledge. |

| Zapier – Set off Occasion | Set off an occasion in Zapier with extracted knowledge. |

| Salesforce – Replace Information | Replace Salesforce data with bill data. |

| Microsoft Dynamics 365 – Replace Entity | Replace entities in Dynamics 365 with bill particulars. |

| Webhooks – Customized Integration | Ship extracted bill knowledge to any endpoint as a webhook. |

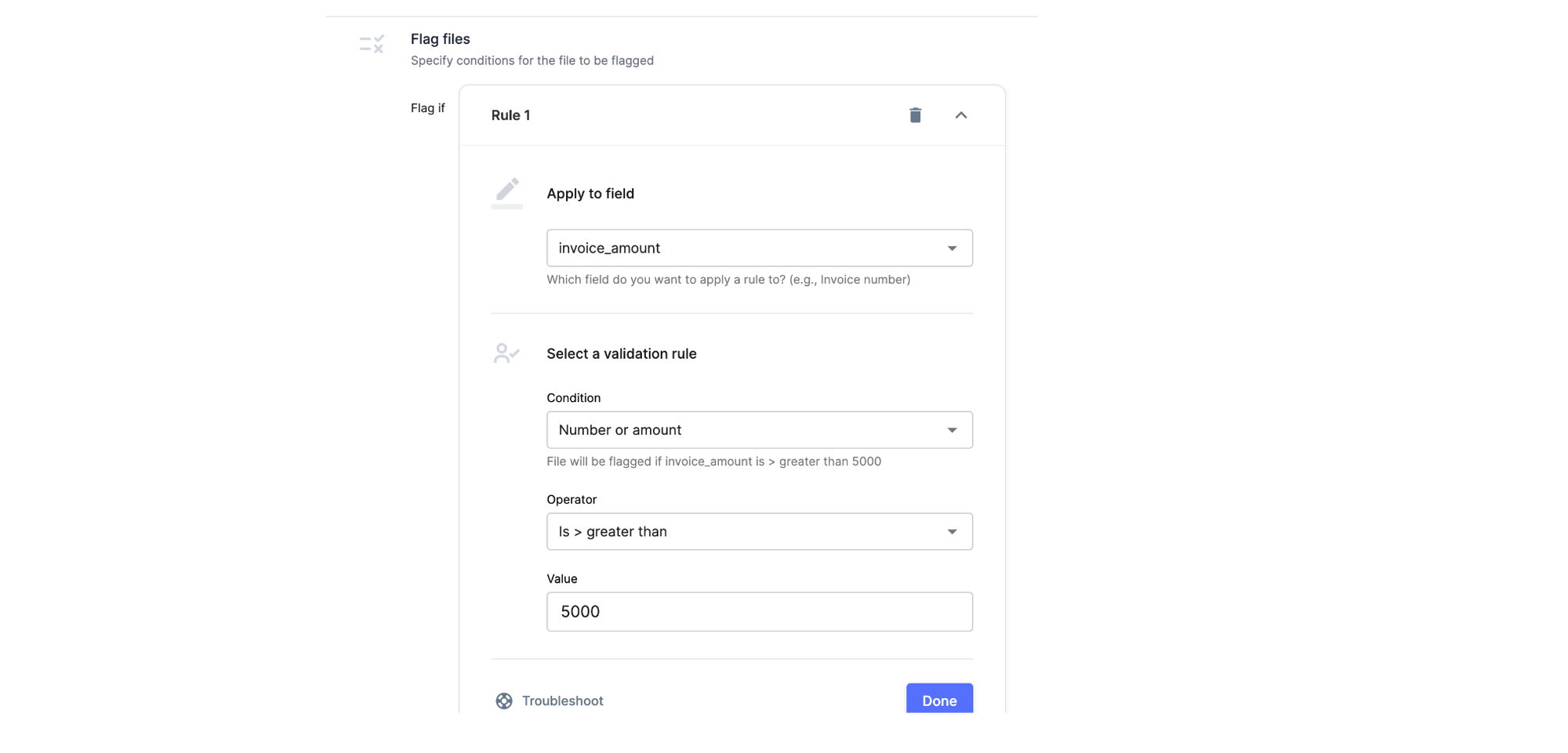

4. Arrange your Approval Course of

- Go to the Approval part within the Workflow web page.

- Click on on Add a Assessment stage.

- A Stage block will probably be added to your Workflow.

- Choose a Assessment Kind.

- Assign Reviewer provided that Flagged – use this if you wish to skip guide evaluate for recordsdata with none errors flagged and assign a reviewer solely to the recordsdata with errors.

- Obligatory Assessment – use this if you wish to ship all recordsdata to the chosen member for guide evaluate whether or not or not they’re flagged.

- Add Reviewers

- You possibly can add a number of member right here. If a number of members are added, the file will probably be assigned to any one among them.

- Choose the discipline to use the situation to.

- Choose the situation to flag the sector. Guidelines are utilized on this Format: If <situation> is True, Then <discipline> will probably be flagged.

- Arrange the situation. Based mostly on the chosen situation, you might want to pick out an operator or fill in extra particulars to arrange the rule.

- Add Guidelines to flag the recordsdata. Instance: Arrange a rule to flag recordsdata if Invoice_amount is > 5000.

- Choose the discipline to use the situation to

- Choose the situation to flag the sector. Guidelines are utilized on this Format: If <situation> is True, Then <discipline> will probably be flagged.

- Arrange the situation. Based mostly on the chosen situation, you might want to pick out an operator or fill in extra particulars to arrange the rule.

- You possibly can add extra Guidelines if required. The operators between guidelines may be both ‘AND’ or ‘OR’.

- AND: If a number of guidelines are added with AND operator, a file will probably be flagged provided that all the principles in that stage fail.

- OR: If a number of guidelines are added with OR operator, a file will probably be flagged if any one of many guidelines in that stage fail.

- Click on on Achieved.

5. Exporting Information to QuickBooks

- Go to Workflows -> Exports -> Browse All Export Choices.

- Click on on the QuickBooks card so as to add it to your workflow.

- As soon as added to your workflow, click on on the cardboard to open it.

- Click on on Check in to QuickBooks. You may be redirected to QuickBooks.

- Enter your QuickBooks credentials. You may be requested for the related permissions, after which redirected again to Nanonets.

- Again on the Nanonets QuickBooks card, choose the kind of object that you just wish to create inside QuickBooks:

- Account-based Payments (that is normally the default whenever you’re making an attempt to export payable invoices to QuickBooks)

- Merchandise-based Payments

- Expense entries

- Choose the suitable AP account / Expense account to submit to.

- Map the Nanonets fields to the corresponding columns in QuickBooks.

Eg: The Invoice_number captured in Nanonets ought to be populated underneath ‘Doc Quantity’ in QuickBooks. To hyperlink these two entities, they must be mapped within the QuickBooks export block.

- Add your chart of accounts and arrange automated GL coding inside the QuickBooks export card.

- Choose an Export Set off:

– The file may be exported as quickly as it’s processed by the mannequin, or

– The file may be exported provided that marked “Accepted” (that is the advisable setting)

- Choose an Export Motion:

– The file may be upserted a brand new entry will probably be created provided that there is not an current one with the identical knowledge)

– The file may be inserted (a brand new entry will at all times be created)

- Choose an Export Kind:

– You possibly can export every web page of the uploaded file individually, or

– You possibly can export every file as a whole doc

- Check Motion – You possibly can choose a pattern file out of your mannequin and check the export on it

- From this web page, you may confirm the standing of your export on the Workflow Run Historical past display.

- As soon as you might be glad along with your workflow check run, click on on Achieved to save lots of your workflow.

And voila, your Nanonets workflow is now stay, streamlining the as soon as cumbersome strategy of bill processing and accounts payable workflows right into a seamless, automated system. With Nanonets seeamlessly built-in with Quickbooks, every bill is robotically ingested as quickly because it arrives, its particulars meticulously extracted, after which, primarily based on predefined guidelines, categorized, accepted, and cleared for cost with guide intervention solely required to approve/reject invoices despatched for guide evaluate.

Able to revolutionize your bill processing with Nanonets for QuickBooks? Schedule a name as we speak to discover how our cutting-edge resolution can streamline your monetary operations.

Case Research

As we discover the tangible advantages of OCR and Bill Scanning Software program for QuickBooks, let’s dive right into a real-world utility that demonstrates the transformative energy of this know-how. One compelling success story comes from Professional Companions Wealth, a agency that has harnessed the capabilities of Nanonets to revolutionize its accounting knowledge entry course of.

Shopper: Professional Companions Wealth

Professional Companions Wealth is an accounting and wealth administration agency headquartered in Columbia, Missouri. They’ve provided complete wealth administration options to veterinary house owners for over twenty years. Their experience is amassing and analyzing important monetary paperwork, equivalent to tax returns, funding prospectuses, authorized papers, and private monetary statements, to offer tailor-made recommendation to their purchasers.

Professional Companions Wealth additionally handles shopper bookkeeping providers, making certain their funds are up-to-date and arranged. Their monetary advisors, Kale Flaspohler and James Michael, are devoted to serving to purchasers streamline their monetary operations and handle their accounting.

The Problem: Guide Information Entry and Its Limitations

As bookkeepers, they perceive the significance of excessive accuracy and error-free accounting to keep away from unwarranted losses for his or her purchasers. Nevertheless, their course of of information extraction, validation, and updating it in QuickBooks was time-consuming. This concern posed a scalability drawback, making it tough to tackle new purchasers as a major period of time was spent on creating an error-free accounts payable course of.

Professional Companions Wealth used automation providers however confronted a number of challenges, equivalent to:

- Regardless of implementing automation software program, their staff nonetheless needed to spend important time correcting bill knowledge entries manually.

- The Straight By way of Processing (STP) price was very low, with practically each bill requiring guide evaluate or enhancing.

- The present resolution lacked automation and adaptability, requiring extra guide work for important processes equivalent to validating bill totals and line objects.

Kale and James knew a extra environment friendly and streamlined resolution was wanted to deal with these points. They wanted an organization that might present them customization and help to tailor an answer match for his or her enterprise.

The Resolution: Implementing Nanonets for a streamlined accounting course of

With conventional automation instruments, Professional Companions Wealth noticed a excessive error price which required them to manually test every bill and validate them primarily based on their enterprise guidelines. They needed to additional do guide processing in feeding this validated knowledge to their accounting software program – Quickbooks.

To beat these challenges, Kale and James sought an answer to seize invoices precisely, carry out sure knowledge validation checks, and feed knowledge immediately into QuickBooks on the required stage. This is the reason they selected Move, by Nanonets, which provided customizations that enabled them to streamline their invoicing course of and automate their whole circulation.

With Nanonets, they might add shopper photographs or arrange auto-forwarding, and guarantee knowledge extraction with a excessive diploma of accuracy. Additionally they arrange validation steps primarily based on enterprise logic to flag out faulty invoices, making figuring out and resolving points rapidly simpler.

Utilizing Nanonets, Professional Companions Wealth gained higher visibility into their income and prices, permitting them to calculate revenue margins and advocate knowledgeable enterprise selections to their purchasers. The lowered turnaround instances and elevated accuracy of their invoicing course of improved the consumer expertise of their present purchasers and allowed them to scale their enterprise by onboarding new purchasers.

Impactful Outcomes: Effectivity, Accuracy, and Price Financial savings

Professional Companions Wealth is in a development part, in order that they wanted to take away bottlenecks that have been decreasing their effectivity. Their conventional OCR device couldn’t present a long-term resolution resulting from gradual processing instances and an absence of customizations and help. With the implementation of Nanonets, they instantly acquired the help wanted to deal with points rapidly and customise the product to scale back turnaround instances additional.

Earlier than Nanonets, their OCR had an accuracy price of solely 80%, and Nanonets supplied an accuracy price higher than 95%. By primarily performing spot checks as an alternative of manually validating each bill, Professional Companions Wealth has been in a position to save 40% in time when in comparison with their earlier device. Shifting ahead, they plan to proceed working with Nanonets to enhance accuracy additional and implement extra instruments that may assist save much more time. This permits them to streamline Accounts Payable and concentrate on scaling their core enterprise.

Check out what they needed to say about Nanonets.

Conclusion

The combination of Nanonets with QuickBooks transforms the arduous activity of guide bill processing right into a seamless, automated workflow, empowering companies to transcend conventional limitations. By leveraging superior OCR know-how and AI-driven insights, firms can now take pleasure in accelerated bill processing, minimized errors, and enhanced decision-making capabilities. The automated synchronization with QuickBooks not solely streamlines monetary operations but in addition positions finance groups as strategic companions in enterprise development.

Able to revolutionize your bill processing with Nanonets for QuickBooks? Schedule a name as we speak to discover how our cutting-edge resolution can streamline your monetary operations.