On this weblog, we’ll discover the important activity of filling out receipt books, a foundational factor of monetary record-keeping for each small and enormous companies. Documenting transactions in receipt books ensures accuracy in monetary administration, compliance with tax rules, and the power to resolve discrepancies with ease.

We’ll stroll you thru the fundamentals of receipt books, together with their construction and the knowledge usually discovered on a receipt. Following that, we’ll present sensible steps with examples on the way to fill out a receipt e-book appropriately, guaranteeing that each transaction is documented comprehensively and professionally.

We will even delve into the advantages of automating your receipt books and the way platforms like Nanonets can rework your method to monetary record-keeping.

Understanding Receipt Books

A receipt e-book is actually a e-book of pre-printed varieties designed to doc transactions between a vendor and a purchaser. Every type throughout the e-book serves as a standalone file that outlines the small print of a particular transaction, together with the date, objects or providers bought, quantities paid, and events concerned. The first goal of a receipt e-book is to behave as a bodily proof of buy, which could be essential for accounting, tax reporting, and resolving any discrepancies which may come up between the concerned events.

A well-crafted receipt serves as a proof of buy and a file for each the client and vendor. Whereas digital platforms have added layers of complexity with options like QR codes and digital signatures, the core components stay largely unchanged. This is what it’s best to anticipate finding on every web page in a receipt e-book:

Date of Transaction: Exhibits when the acquisition was made. Vital for conserving monitor of gross sales and for purchasers to know.

Receipt Quantity: Every sale will get a singular quantity. It is key for referencing gross sales later, dealing with returns, or fixing any points.

Vendor Data: This half lists the enterprise’s title, the way to contact them (deal with, telephone, e mail), and generally who offered the merchandise or service.

Purchaser Data: Typically wanted, particularly for enterprise gross sales. It could embody the client’s title and speak to particulars.

Description of Items and Providers Bought: A easy checklist exhibiting every merchandise or service offered, what number of, and necessary particulars like measurement or shade.

Costs of Items and Providers Bought: Subsequent to every merchandise or service, the value is proven. If wanted, it additionally exhibits per hour or per merchandise charges.

Subtotal: This seems under the desk of Items and Providers offered, indicating solely the price of the objects or providers earlier than including any taxes or additional charges.

Taxes: Right here, it exhibits all of the tax relevant to the sale. Getting the tax proper is a should.

Additional Charges: Lists any extra prices like supply or service charges.

Complete Quantity: The total value the client must pay, together with every little thing.

Fee Technique: Exhibits whether or not the client paid with money, card, test, on-line, or utilizing every other cost technique.

Return Coverage: A fast observe about returns or exchanges to assist prospects know what they will do if there’s an issue.

Signature Line: In some gross sales, particularly large ones or providers, there’s a spot for a signature for added belief.

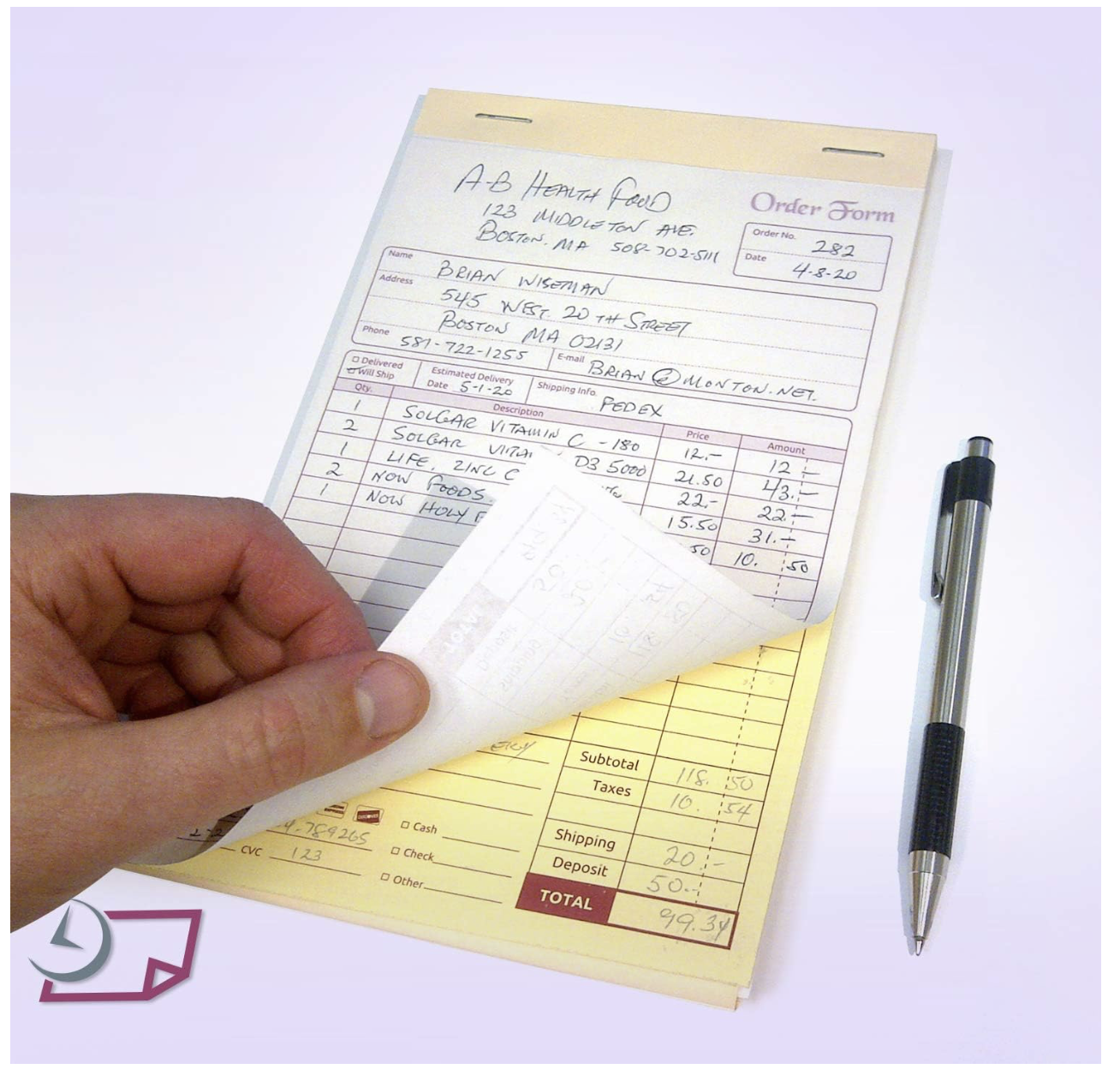

Accordingly, that is how a typical receipt e-book web page appears to be like like.

2024-02-19

#001234

XYZ Retailer

123 Enterprise Ave, Metropolis, State

(123) 456-7890

| Identify | Description | Amount | Price | Value |

|---|---|---|---|---|

| Product 1 | Product Description | 2 | $5.00 | $10.00 |

| Service 1 | Service Description | 1 | $40.00 | $40.00 |

$50.00

$4.00

$5.00

$59.00

Credit score Card

Returns accepted inside 30 days of buy with receipt.

_____________________________

💡

Specialised Receipt Books: There are additionally receipt books tailor-made for particular sorts of transactions, comparable to hire funds or service gross sales, that includes pre-printed fields related to these actions.

Digital vs. Bodily Receipt Books

The controversy between digital and bodily receipt books will not be about superiority however suitability. Every sort has its place, and the selection typically depends upon the precise wants, buyer base, and operational setup of a enterprise. The aim right here is to make an knowledgeable alternative that aligns with your enterprise goals and operational model.

| Side | Digital Receipt Books | Bodily Receipt Books |

|---|---|---|

| Accessibility | Will be accessed from a number of units wherever, anytime. | Requires bodily presence to entry and evaluation. |

| Storage | Limitless storage with out bodily area constraints; cloud storage facilitates straightforward group and retrieval. | Requires bodily area for storage; threat of loss because of injury or misplacement. |

| Safety | Enhanced security measures, together with encryption and backups, defend towards loss and unauthorized entry. | Vulnerable to bodily injury, theft, and loss. Restricted choices for safe backup. |

| Price | Preliminary setup prices for software program or platforms; ongoing prices could embody cloud storage charges. | Prices related to printing and buying books; no digital infrastructure prices. |

| Environmental Affect | Reduces paper use, contributing to environmental sustainability. | Contributes to paper waste and environmental footprint. |

| Ease of Use | Requires familiarity with digital instruments and platforms. Provides options like search and computerized calculations. | Intuitive and straightforward to make use of with out the necessity for technological proficiency. |

| Buyer Desire | Most well-liked by prospects who worth digital data and eco-friendly practices. | Favored in conditions the place a bodily receipt is required or most popular for record-keeping or reimbursements. |

| Compliance | Simpler to handle, search, and compile for tax and compliance functions. | Requires guide group and could be time-consuming to compile for reporting functions. |

In some circumstances, using a hybrid method—providing digital receipts for on-line transactions and bodily receipts for in-person gross sales—would possibly even be the very best technique. The secret is to stay versatile and conscious of the altering preferences and desires of your prospects and the evolving panorama of your business.

Choice and Preparation

Earlier than diving into the nuts and bolts of filling out receipt books, it’s essential to pick and put together in response to your enterprise wants. Listed below are some standards to think about to make sure your preparation most closely fits your enterprise necessities:

The Significance of Everlasting Ink: Go for pens that make the most of everlasting ink to make sure that the knowledge in your receipts stays free from the dangers of being smudged or erased over time.

Selecting the Proper Receipt E book: The character of your transactions performs a pivotal position in deciding on an acceptable receipt e-book. Whether or not your dealings are generic or contain particular transactions comparable to hire funds or service costs, choosing a receipt e-book with customized fields tailor-made to your wants can streamline your course of.

The Benefit of Duplicate/Triplicate Copies: Utilizing a multi-copy receipt e-book means extra than simply giving prospects their copy. The unique receipt, usually white, goes to the client, whereas the yellow one, a direct duplicate, is for the enterprise’s data. This setup can lengthen as much as 4 colours for advanced operations, permitting for a structured distribution: white for the client, yellow for gross sales, pink for finance, and blue because the grasp copy. This technique not solely streamlines record-keeping but in addition strengthens documentation, guaranteeing a complete backup system for the enterprise and its purchasers.

Incorporating Your Branding: Customizing your receipt e-book to replicate your model’s identification—via logos, model colours, and different visible components reinforces your model’s presence and professionalism in each transaction.

Pre-Printed Static Fields: Effectivity is vital in enterprise operations. By guaranteeing that static fields—comparable to vendor info, return insurance policies, and extra—are pre-printed in your receipt e-book, you get rid of the necessity for repetitive guide enter.

Portability for On-the-Go Transactions (If Required): The practicality of your receipt e-book’s design is paramount. A compact and sturdy receipt e-book presents comfort and reliability, guaranteeing you are at all times ready to conduct transactions, regardless of the place your enterprise takes you.

Safety Options (If Required): Choosing receipt books geared up with watermarks or distinctive numbering techniques could be safety measures that show instrumental in deterring fraud and instilling confidence amongst your purchasers, safeguarding the integrity of your transactions.

Taking the time to pick and customise the proper receipt e-book for your enterprise is an funding in your operational effectivity and your model’s picture.

Steps to Fill Out Receipt E book

Navigating via the method of filling out a receipt e-book meticulously ensures that every transaction is recorded precisely and professionally. This not solely aids in monetary administration but in addition builds belief along with your prospects.

Think about you are a small enterprise proprietor, Sarah, who runs an area espresso store. A daily buyer, John, is available in to buy espresso beans and a espresso mug. Let’s navigate how Sarah fills out a receipt e-book web page for this transaction.

Step 1: Date and Receipt Quantity

At all times write the date in a constant format (e.g., MM/DD/YYYY) on the high of the receipt. For the receipt quantity, think about a sequential system that begins at a particular quantity and increments with every receipt. This technique helps in sustaining order and simplifying record-keeping.

- Situation: It is February 19, 2024, and that is the primary transaction of the day.

- Motion: On the high of the receipt, Sarah writes the date as “02/19/2024”. She checks the final receipt quantity, which was #1050, so she assigns “1051” as the brand new receipt quantity and writes it subsequent to the date.

Step 2: Contact Particulars

Together with the contact particulars of each the vendor (your enterprise) and the client (your buyer) establishes a proper file of the transaction. It enhances credibility and gives important info ought to there be a necessity for future communication.

- Situation: The espresso store’s particulars are pre-printed on the receipt e-book. John, the client, is a daily, however for bigger purchases, Sarah likes to file buyer particulars.

- Motion: Since John agrees, Sarah writes down his title, “John Doe”, and his telephone quantity under the espresso store’s pre-printed particulars, leaving an area for privateness.

Step 3: Product or Service Description

An in depth description of the services or products offered is critical for readability and record-keeping. It helps in resolving disputes, managing stock, and understanding gross sales tendencies. Listing every services or products, together with related particulars comparable to amount, measurement, shade, or SKU (Inventory Conserving Unit) if relevant. Be as particular as attainable to keep away from ambiguity. For providers, a quick description of the work carried out could be included.

- Situation: John purchases 2 baggage of espresso beans and a couple of ceramic espresso mugs.

- Motion: Sarah writes down the objects bought by John:

- “Espresso Beans – Ethiopian Mix, 1lb” x2

- “Ceramic Espresso Mug – Blue” x2

Step 4: Pricing Particulars

Precisely itemizing the value per merchandise and calculating the overall value are elementary for each the client and vendor. It ensures transparency and belief within the transaction. Subsequent to every merchandise or service listed, write down the value. If a number of portions of the identical merchandise are offered, multiply the value by the amount and write the overall. If reductions apply, checklist them clearly and subtract from the overall value of things.

- Situation: The espresso beans are $15 every, and the mugs are $10 every. There is a promotion the place shopping for two espresso beans baggage will get a $5 low cost, and every mug comes with a $2 low cost when purchased along with espresso beans.

- Motion: Sarah lists the unique costs, then applies the reductions as follows:

- Espresso Beans: $15 x 2 = $30

- Low cost on Espresso Beans: -$5

- Ceramic Espresso Mugs: $10 x 2 = $20

- Low cost on Mugs (for purchasing with espresso): -$4 ($2 per mug)

Step 5: Subtotals, Taxes, and Totals

Earlier than the ultimate complete, it’s important to calculate the subtotal (complete earlier than taxes and extra costs). Then, apply any taxes and add extra costs like delivery or dealing with charges to find out the grand complete.

Sum the price of all objects for the subtotal. Calculate the tax primarily based in your native tax charge and add it to the subtotal together with every other extra costs. The sum of those figures is the grand complete, which is the quantity the client owes.

- Situation: After making use of reductions, the subtotal earlier than tax must be calculated. The native gross sales tax charge is 8%.

- Motion: Sarah calculates the subtotal by including the discounted costs:

- Subtotal for Espresso Beans: $30 – $5 = $25

- Subtotal for Mugs: $20 – $4 = $16

- Mixed Subtotal: $25 (Espresso Beans) + $16 (Mugs) = $41

Sarah then calculates the gross sales tax on the subtotal: $41 x 0.08 = $3.28. The grand complete, together with tax, is calculated: - Grand Complete = $41 (Subtotal) + $3.28 (Tax) = $44.28

Step 6: Finalizing the Receipt

Reviewing the receipt for accuracy ensures that each one particulars are appropriate and the transaction is recorded correctly. Signing the receipt validates it, and deciding which copy is given to the client and which is retained for data is essential for documentation.

- Situation: Sarah must finalize the transaction by reviewing the receipt for accuracy, signing it, and offering John together with his copy.

- Motion: Sarah evaluations the receipt for accuracy, noting the unique costs, reductions utilized, and the ultimate totals with tax. Happy, she indicators on the backside of the receipt. She then tears the highest copy (the unique) alongside the perforated line and fingers it to John. The duplicate copy stays hooked up within the e-book for Sarah’s data.

The receipt would look one thing like this.

Identify: John Doe

Cellphone: [John’s Phone Number]

Gadgets Bought

| Description | Amount | Unit Value | Complete |

|---|---|---|---|

| Espresso Beans – Ethiopian Mix, 1lb | 2 | $15 | $30 |

| Ceramic Espresso Mug – Blue | 2 | $10 | $20 |

| Low cost (If Any): | -$9 | ||

| Subtotal: | $41 | ||

| Gross sales Tax (8%): | $3.28 | ||

| Grand Complete: | $44.28 | ||

By following these steps meticulously, you create a dependable {and professional} file of every transaction. This not solely aids in efficient monetary administration but in addition enhances the general buyer expertise, reinforcing the belief and credibility of your enterprise.

Steps to Fill Out Lease Receipt E book

Navigating via the meticulous strategy of filling out a hire receipt e-book is essential for landlords and property managers. It ensures that each hire cost is documented precisely and professionally, fostering belief between the owner and the tenant. Contemplate a situation the place you, Alex, are a landlord gathering month-to-month hire out of your tenant, Jordan. Let’s discover how Alex fills out a hire receipt e-book for this transaction.

Finishing a hire receipt e-book with consideration to element is paramount for landlords and property managers. It gives a transparent paper path for monetary transactions and reassures tenants that their funds are documented. This is the way you, as a landlord named Alex, would fill out a hire receipt to your tenant, Jamie.

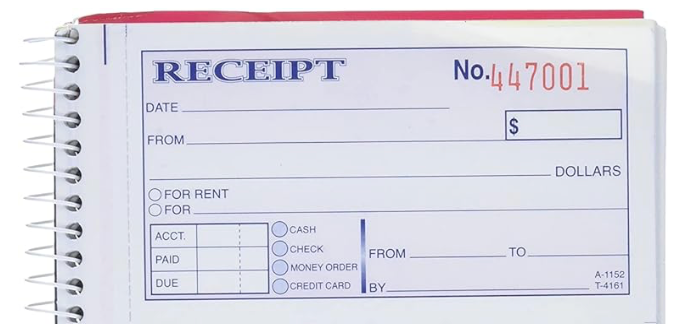

Step 1: Date and Receipt Quantity

Start by writing the date in an ordinary format, comparable to MM/DD/YYYY, to keep away from any confusion. The receipt quantity ought to observe a sequential sample, which assists in organizing your data effectively.

Situation: At the moment’s date is February 19, 2024, and the earlier receipt quantity was 447000.

Motion: Alex enters the date as “02/19/2024” on the designated line and writes “447001” as the subsequent sequential receipt quantity.

Step 2: From and To

Clearly state the title of the tenant making the cost and the recipient of the cost, normally the owner or property administration firm.

Situation: Jamie is paying this month’s hire.

Motion: Alex writes “Jamie Smith” within the “FROM” part and “Alex Johnson” within the “TO” part, establishing the events concerned within the transaction.

Step 3: Fee Particulars

Examine the suitable field to point that the cost is for hire. Specify the rental interval by writing the beginning and finish dates. If the cost is for one thing else, comparable to a safety deposit, test the opposite field and write an outline.

Situation: The cost covers hire for the month of March 2024.

Motion: Alex checks the “FOR RENT” field and writes “March 1, 2024, to March 31, 2024” within the strains offered.

Step 4: Quantity

Enter the cost quantity in each numbers and phrases to stop any misinterpretation. This reduces errors and ensures each events agree on the quantity paid.

Situation: The month-to-month hire is $1,200.

Motion: Alex writes “$1,200” within the field and “One thousand 200 {dollars}” on the road subsequent to “DOLLARS.”

Step 5: Fee Technique

Point out the tactic of cost by checking the suitable field – money, test, cash order, or bank card. If a test or cash order is used, write down the quantity for reference.

Situation: Jamie pays with a test.

Motion: Alex checks the “CHECK” field and writes the test quantity within the “ACCT. NO.” part.

Step 6: Signatures and Balances

If there’s any excellent steadiness, observe it within the “DUE” part. Then, each the owner and tenant ought to signal the receipt to acknowledge the cost. If offering a replica to the tenant, determine whether or not the unique or a reproduction is suitable for his or her data.

Situation: Jamie’s hire is paid in full, with no excellent steadiness.

Motion: Alex writes “0” within the “DUE” part, indicators the receipt, and fingers the unique to Jamie whereas conserving the duplicate for his data.

By following these steps meticulously, landlords and property managers can create a dependable {and professional} file of every hire transaction.

Managing your Receipt E book

Consistency and Readability: One of many foundations of efficient receipt e-book administration is consistency. This implies utilizing the identical format for dates, receipt numbers, and particulars throughout all entries. Consistency not solely makes it simpler to reference and set up receipts but in addition streamlines the method for reviewing and auditing monetary data.

Safe Storage and Group: In at present’s digital age, backing up your bodily data has by no means been extra necessary. Hold your receipt books in a safe, dry place to guard them from injury. Commonly photocopying or scanning your filled-out receipt books gives a security web towards loss, injury, or put on. Digital backups must be saved securely, utilizing encrypted storage options to guard delicate info. Arrange them chronologically or in a way that fits your enterprise operations, guaranteeing easy accessibility when wanted.

Embracing Automation: As your enterprise expands, guide receipt administration could turn out to be inefficient and vulnerable to errors. Leveraging know-how to automate your receipt e-book administration can save time and scale back the probability of errors. Instruments like Nanonets supply options for digitizing receipts, monitoring bills, and integrating monetary data into accounting techniques seamlessly. Automation not solely streamlines processes but in addition frees up useful time to concentrate on core enterprise actions. We’ll talk about this in additional element within the oncoming part.

Automate your Receipt Books

Automating receipt books represents a big leap ahead in monetary administration, providing unparalleled effectivity, accuracy, and integration throughout numerous enterprise techniques. The transition from guide to automated processes not solely streamlines operations but in addition gives a strong automated framework for recording and managing transactions, extending from the second of buy via to reconciliation in accounting or ERP techniques via to the ultimate ledger entry in your accounting or ERP system.

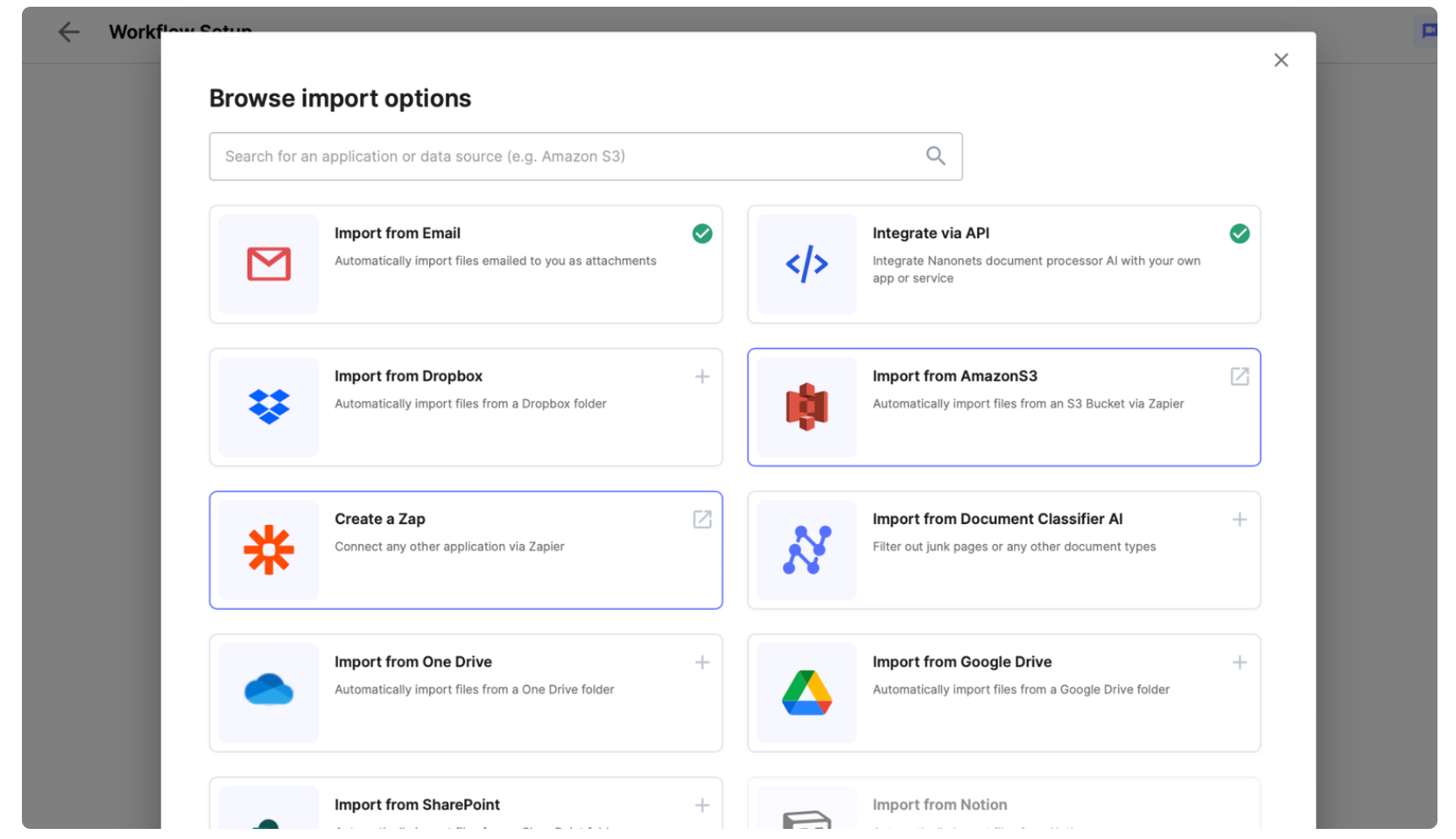

Let’s check out how Nanonets automates these processes.

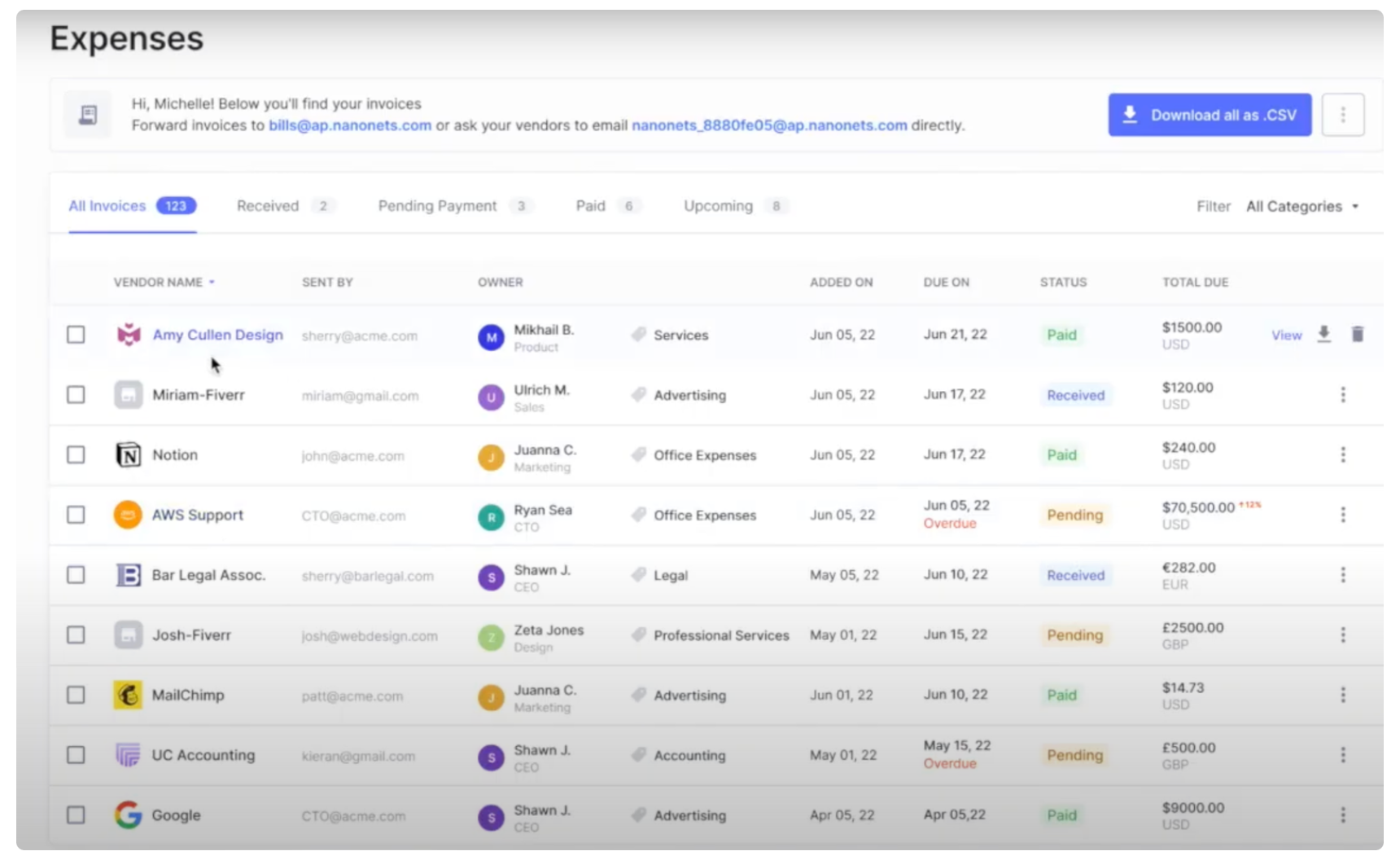

Easy Receipt Recording at Your Fingertips

All handwritten and printed receipts could be simply scanned utilizing a smartphone or instantly uploaded into the Nanonets platform.

All digital receipts can both be created and printed instantly utilizing the Nanonets platform, or imported into Nanonets out of your mail, apps and databases.

This course of ensures that each piece of knowledge, no matter its origin, finds its place in a centralized, digital repository, prepared for additional motion.

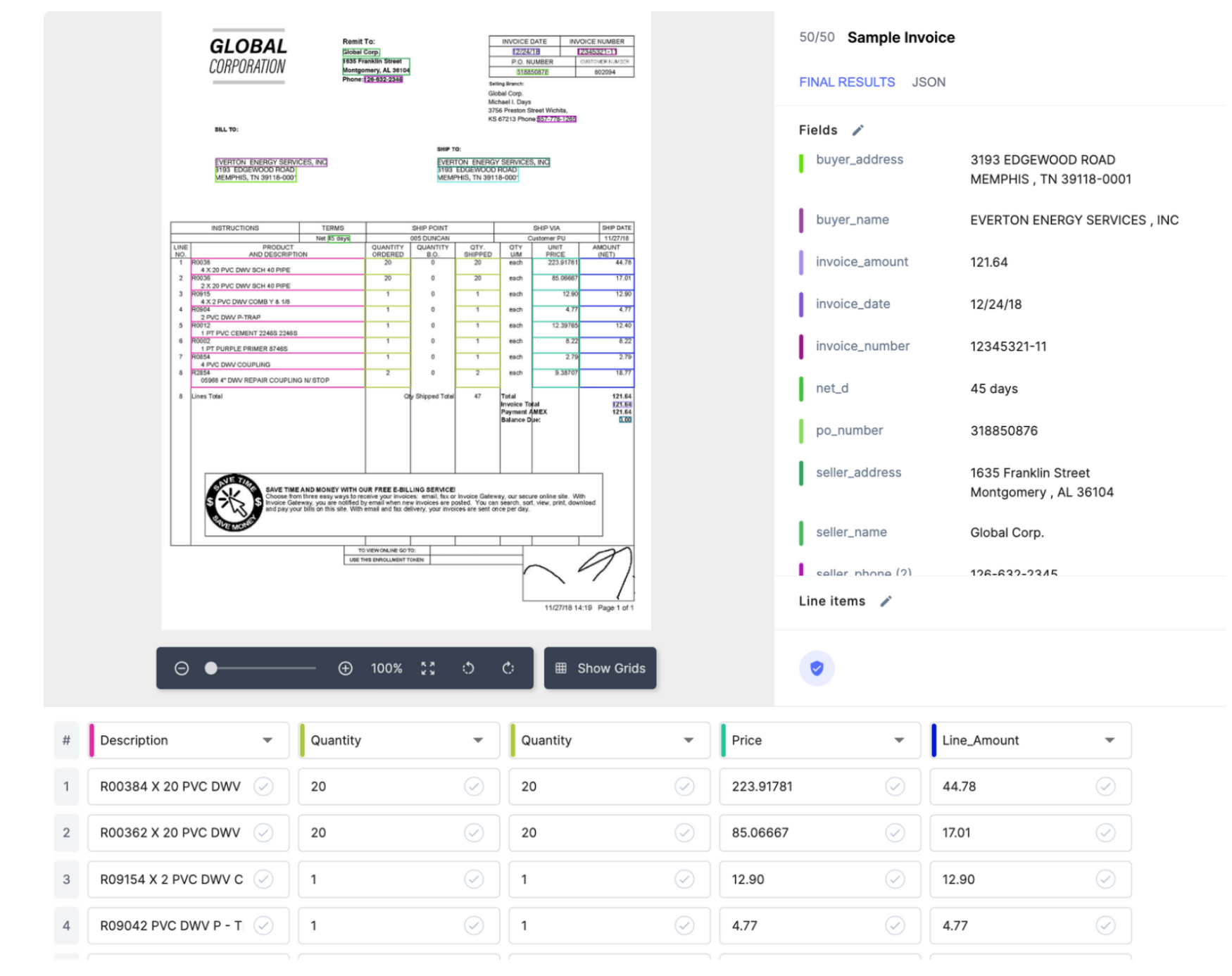

Unleashing the Energy of OCR for Seamless Digitization

Nanonets would not simply learn your receipts; it comprehends them. By extracting essential information from each sort of receipt and organizing it right into a structured digital format, Nanonets eliminates the chaos out of your monetary data. This digitization course of not solely saves time but in addition ensures that each transaction is precisely captured and saved.

Clever Categorization and GL Coding

Nanonets goes past mere information assortment. Using AI, it delves into the context of your receipts, understanding the nuances of your monetary transactions. Nanonets AI permits for computerized categorization in response to your individual framework and even assigns Normal Ledger (GL) codes, streamlining the method of monetary reporting and evaluation.

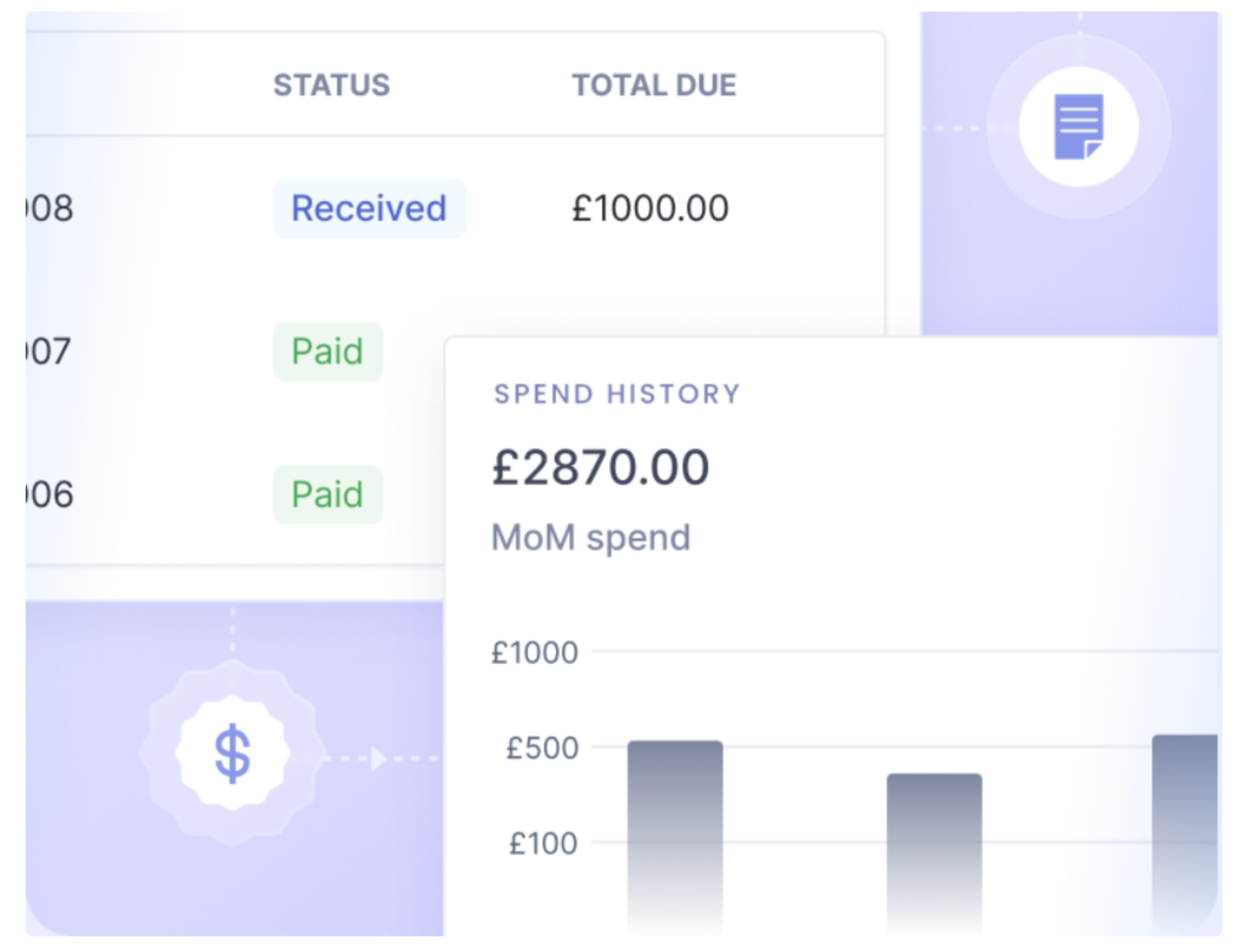

Enhanced Search Capabilities and Insightful Spend Evaluation

Along with your receipts digitized and arranged, Nanonets unlocks highly effective search performance. Now you can sift via your monetary information with ease, categorize receipts by GL codes, or different dimensions, and conduct detailed spend evaluation. This complete, real-time information offers you a transparent view of your monetary panorama, empowering you to make knowledgeable selections.

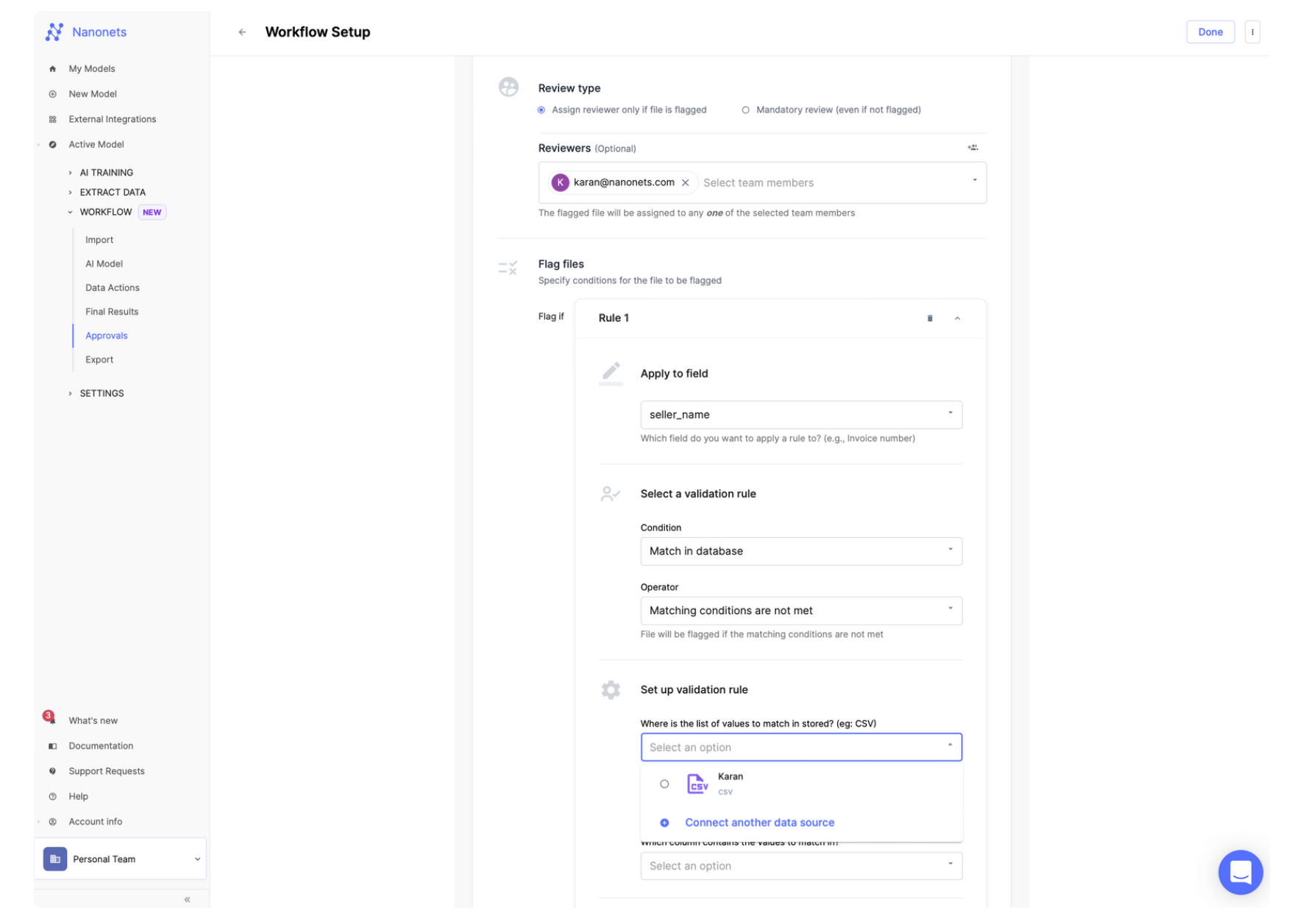

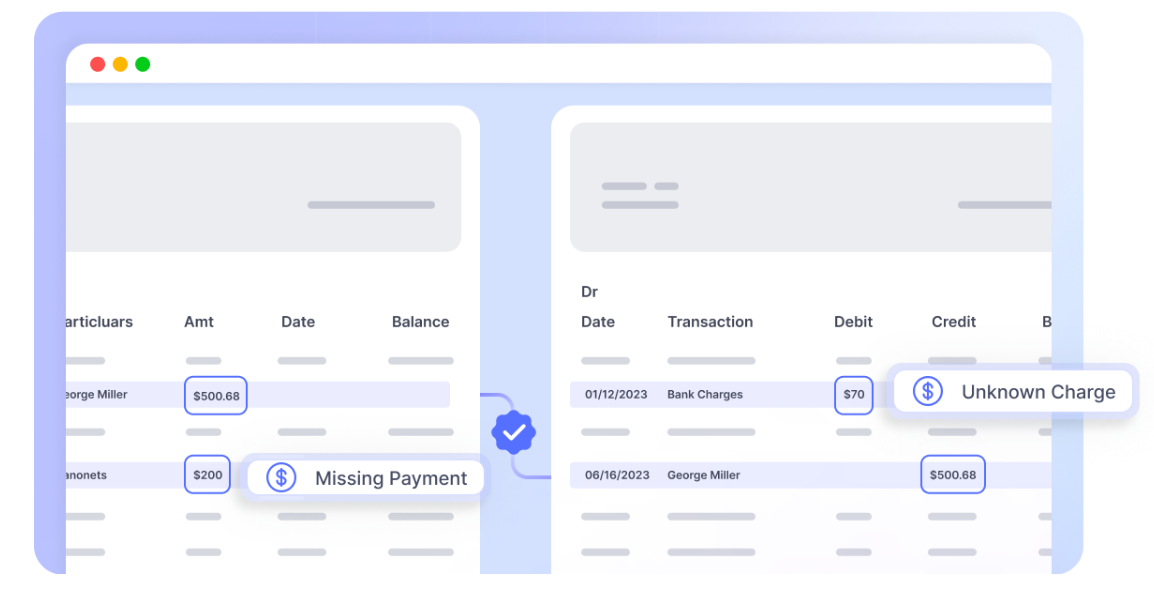

Superior Validation Checks

With Nanonets, you may configure pre-set validation guidelines to establish any discrepancies or anomalies inside your transactions, flagging points for evaluation earlier than they turn out to be problematic.

Seamless ERP Integration

Nanonets presents seamless, real-time information synchronization along with your accounting software program / ERP system / different apps. This real-time information sync is a game-changer, eliminating the necessity for guide information entry and guaranteeing that your monetary data are at all times up-to-date. We provide seamless integration with 100s of instruments, together with Gmail, Quickbooks, Xero, & Stripe.

Automated Monetary Reconciliation

By syncing financial institution statements and ERP information in just a few clicks, Nanonets facilitates a reconciliation course of that isn’t solely automated but in addition as much as 90% quicker. This implies closing your month-end books turns into a breeze, releasing up useful time and assets.

In essence, Nanonets presents a multi-faceted method for automating receipt books which ensures effectivity, accuracy, and integration, paving the way in which for a extra streamlined, insightful, and proactive monetary technique.

Able to automate filling out and managing your receipt books? Embrace the way forward for transaction documentation. Discover Nanonets and uncover how automation can rework your receipt documentation and administration course of at present.