On the earth of enterprise, holding observe of cash issues is essential, and that is the place Basic Ledger Codes, or GL Codes, come into play. Consider these codes as the key sauce that helps companies manage their funds, ensuring each greenback spent or earned is tracked precisely. GL Codes usually are not nearly holding issues neat; they’re about making smarter monetary choices, simplifying tax time, and making certain your small business runs easily. On this information, we’ll break down what GL Codes are, why they’re so essential on your firm, and easy methods to use them successfully. We’ll additionally talk about easy methods to arrange environment friendly GL coding processes in your group, and discover GL coding automation software program.

What are GL Codes?

Basic Ledger Codes, or GL Codes, are distinctive alphanumeric strings that classify and report monetary transactions inside an organization’s basic ledger. These codes function the elemental constructing blocks of a enterprise’s monetary construction, enabling the categorization of transactions into distinct accounts for revenues, bills, property, liabilities, and fairness. As an example, a GL code for workplace provides expense helps make sure that all expenditures associated to workplace provides are grouped collectively, facilitating simpler monitoring and evaluation.

💡

The Basic Ledger Defined: On the coronary heart of an organization’s monetary record-keeping lies the Basic Ledger (GL) – a complete repository that information each monetary transaction performed by the enterprise. Consider it because the monetary spine of an organization, supporting the construction of its financial actions. Every transaction entered into the GL is tagged with a GL code, appearing as a marker that categorizes each influx and outflow into its acceptable GL account.

Why use GL Codes?

Via their systematic group, GL codes empower companies to –

- Improve Monetary Accuracy and Compliance with Monetary Requirements: GL Codes enable for the exact categorization of economic transactions, which is essential for producing correct monetary experiences. For instance, a enterprise can assign a selected GL code to utility bills. This ensures that funds for electrical energy, water, and web providers are precisely recorded beneath utility bills, enabling the corporate to provide monetary statements that actually replicate its operational prices. Equally, a retail enterprise that makes use of separate GL codes for stock purchases and gross sales is ready to precisely calculate the price of items offered (COGS), a essential determine for each monetary evaluation and tax calculations.

- Simplify Tax Preparation and Maximize Deductions: Using GL Codes makes tax time much less daunting. By having bills correctly categorized, you possibly can simply establish tax-deductible bills and make sure you’re claiming all entitled deductions. As an example, a GL Code devoted to journey bills might help you rapidly compile all travel-related expenditures, making certain you do not miss out on claiming these deductions. Equally, by reviewing bills recorded beneath a GL code for gear purchases, a enterprise may understand it may well reap the benefits of accelerated depreciation strategies or Part 179 deductions, thereby decreasing its taxable earnings. This type of group can result in important tax financial savings and cut back the chance of errors in tax filings.

- Enhance Finances Administration: With GL Codes, companies can examine precise spending towards budgets at a granular degree. As an example, assigning a GL code to advertising bills permits a enterprise to trace its advertising funds efficiency intently. If a digital advertising company notices that its bills within the GL-coded advertising class are constantly over funds, it may well take focused actions to regulate its advertising methods or funds allocations.

- Improve Spend Visibility and Determination Making: By allocating a novel GL code to each transaction, a corporation can meticulously monitor spending throughout totally different departments, the dimensions of every transaction, and detailed expenditure information on the line merchandise degree. Companies can thus generate detailed monetary experiences that present insights into spending patterns, profitability, and monetary well being. A producing firm may use GL codes to trace prices related to totally different manufacturing traces. Analyzing these prices might help establish inefficiencies or areas for enchancment, main to raised strategic choices about the place to allocate sources for max return.

- Improve Effectivity of Month-Finish Shut: Correct GL coding immediately contributes to elevated effectivity inside an organization’s monetary processes, particularly throughout essential durations like month-end shut. By making certain every monetary transaction is assigned to the suitable GL code from the outset, companies considerably cut back the chance of errors that require time-consuming corrections. This precision permits for the automated consolidation of bills, minimizing guide changes and reclassifications that decelerate monetary reporting. The result’s a sooner, extra environment friendly shut course of that additionally saves up your time which might be higher spent elsewhere.

- Scale back Danger of Fraud and Obtain Audit-Readiness: The granularity offered by GL codes presents a useful layer of safety for companies. With every transaction meticulously categorized, it turns into simpler to identify anomalies or patterns indicative of points similar to fraud or mismanagement. For instance, if an organization assigns a novel GL code to worker reimbursements, it may well simply overview these transactions for any which can be unusually excessive or inconsistent with established insurance policies. Moreover, within the case of an audit, the detailed group of transactions by GL code simplifies the method of offering mandatory documentation and explanations, decreasing the chance of penalties or fines for non-compliance. This strategy ensures that companies not solely safeguard their monetary sources but in addition preserve their repute and integrity within the market.

The right way to Assign GL Codes?

On the earth of enterprise, the place each penny counts and each transaction issues, the setup of your Basic Ledger (GL) codes is not only a job—it is an artwork. The significance of laying a powerful basis on your accounting system can’t be confused sufficient. And on the coronary heart of this technique? A well-planned GL code construction. Let’s dive into how one can grasp the artwork of GL code group and task.

Earlier than you even start to assign numbers or names to your GL codes, take a step again. Why? As a result of planning your GL code construction is akin to drafting the blueprints for a constructing. You would not begin development with out a clear plan, would you? Equally, establishing GL codes with out a technique is a recipe for confusion, inefficiencies, and monetary reporting nightmares down the road.

1. Begin with the Massive Image: Start by defining the principle classes of your monetary transactions. Sometimes, these embody

- Property: These are sources owned by a enterprise which have financial worth. Examples embody money, stock, and gear.

- Liabilities: These characterize what a enterprise owes to others, similar to loans and accounts payable.

- Fairness: Fairness represents the proprietor’s declare in spite of everything liabilities have been subtracted from property. This contains retained earnings and inventory.

- Revenues: Revenues are the earnings earned from the sale of products or providers earlier than any bills are subtracted.

- Bills: Bills are the prices incurred within the technique of incomes income, similar to hire, utilities, and salaries.

These classes kind the spine of your GL code system and assist make sure that each transaction might be precisely categorised.

2. Embrace Element, However Keep away from Overcomplication: Inside every fundamental class, create subcategories that replicate the nuances of your small business operations. Beneath is an instance of a framework with potential subcategories. Click on on every class and subcategory to discover additional.

Money and Money Equivalents

Accounts Receivable

Stock

Pay as you go Bills

Property, Plant, and Gear (PP&E)

Intangible Property

Shares, bonds, or actual property

Accounts Payable

Accrued Bills

Brief-term Loans

Lengthy-term Loans

Deferred Tax Liabilities

Bonds Payable

Capital

Retained Earnings

Frequent Inventory

Most well-liked Inventory

Gross sales Income

Service Income

Curiosity Earnings

Rental Earnings

Dividend Earnings

Value of Items Bought (COGS)

Payroll

Hire

Utilities

Advertising and marketing and Promoting

Insurance coverage

Depreciation and Amortization

Curiosity Expense

Losses from Asset Gross sales

By embracing element inside every fundamental class, you create a strong system that precisely displays your small business operations. Nevertheless, keep in mind the precept of avoiding overcomplication: tailor your subcategories to match the precise wants and scale of your small business, making certain that your GL code system stays each helpful and manageable.

3. Create the GL Codes: Use a constant logic for numbering your codes. This might imply utilizing sure ranges for particular classes (e.g., 1000 collection for property, 2000 for liabilities). When designing your GL codes, think about the next:

- Stage of Element: Decide the granularity of data you want. Whereas element is effective, an excessive amount of can overwhelm your system and customers.

- Departmental Stage Codes: If your small business spans a number of departments or places, think about incorporating these distinctions into your codes for extra detailed monitoring and reporting.

- Venture Stage Codes: For companies that function on a mission foundation, project-specific codes might help in monitoring prices and revenues precisely.

4. Set up a Complete Chart of Accounts: As soon as your classes, subcategories and GL codes are arrange, you might have successfully constructed your chart of accounts. This is an snippet of what a Chart of Accounts may ultimately appear to be.

XYZ Manufacturing Co.

Chart of Accounts

| ID | Title | ID | Title | Sort | Facet |

|---|---|---|---|---|---|

| 1010 | Gross sales – Client Electronics | 10 | Gross sales | Earnings | Cr |

| 1020 | Gross sales – Residence Home equipment | 10 | Gross sales | Earnings | Cr |

| 1030 | Gross sales – Workplace Gear | 10 | Gross sales | Earnings | Cr |

| 1040 | Gross sales – Cellular Units | 10 | Gross sales | Earnings | Cr |

| 1050 | Gross sales – IT Options | 10 | Gross sales | Earnings | Cr |

| 1060 | Gross sales – Wearable Tech | 10 | Gross sales | Earnings | Cr |

| 1070 | Gross sales – Software program Options | 11 | Gross sales | Earnings | Cr |

| 1080 | Gross sales – Service Contracts | 10 | Gross sales | Earnings | Cr |

| 1090 | Gross sales – Technical Assist | 10 | Gross sales | Earnings | Cr |

| 2000 | Curiosity Acquired | 15 | Curiosity | Earnings | Cr |

| 2010 | Consulting Earnings | 16 | Companies | Earnings | Cr |

| 2020 | Miscellaneous Earnings | 17 | Different Earnings | Earnings | Cr |

| 2030 | Dividend Earnings | 17 | Different Earnings | Earnings | Cr |

| 2040 | Acquire on Funding Sale | 17 | Different Earnings | Earnings | Cr |

| 3000 | COGS – Client Electronics | 20 | Value of Gross sales | Value of Items | Dr |

| 3010 | COGS – Residence Home equipment | 20 | Value of Gross sales | Value of Items | Dr |

| 3020 | COGS – Workplace Gear | 20 | Value of Gross sales | Value of Items | Dr |

| 3030 | COGS – Cellular Units | 20 | Value of Gross sales | Value of Items | Dr |

| 3040 | COGS – IT Options | 20 | Value of Gross sales | Value of Items | Dr |

| 3050 | COGS – Wearable Tech | 20 | Value of Gross sales | Value of Items | Dr |

| 3060 | COGS – Software program Options | 21 | Direct Prices | Value of Items | Dr |

| 3070 | COGS – Service Contracts | 20 | Value of Gross sales | Value of Items | Dr |

| 3080 | COGS – Technical Assist | 20 | Value of Gross sales | Value of Items | Dr |

| 4000 | Wages – Manufacturing Employees | 22 | Wages | Different Prices | Dr |

| 4010 | Wages – Gross sales Staff | 22 | Wages | Different Prices | Dr |

| 4020 | Wages – Administrative Employees | 22 | Wages | Different Prices | Dr |

| 4030 | Wages – Analysis & Growth | 22 | Wages | Different Prices | Dr |

| 4040 | Wages – IT Assist Employees | 22 | Wages | Different Prices | Dr |

| 4050 | Wages – Government Salaries | 22 | Wages | Different Prices | Dr |

A well-thought-out GL code system allows you to observe each monetary transaction with precision, facilitates seamless audits, and supplies actionable insights to information your small business choices. It is not nearly holding your books so as; it is about gaining a strategic benefit by superior monetary intelligence.

💡

Consulting with an Accounting Skilled: Even with the most effective plans, the complexities of economic accounting can generally be daunting. That is the place a seasoned accounting skilled turns into invaluable. They’ll present knowledgeable steerage on establishing your GL code system, making certain it aligns with business requirements, regulatory necessities, and finest practices. Furthermore, they’ll supply insights tailor-made to your particular enterprise wants, serving to you keep away from frequent pitfalls and capitalize on alternatives for monetary optimization.

Setting Up GL Codes in Accounting Software program

Relating to integrating GL codes into your accounting software program, consider it as programming the DNA of your monetary system. Most trendy accounting software program presents a user-friendly interface to simplify this course of. Right here’s easy methods to go about it:

- Entry the Chart of Accounts Function: Start by navigating to the chart of accounts part of your software program. That is sometimes discovered inside the settings or system setup menu. Right here, you can view, add, edit, or delete accounts and their corresponding GL codes.

- Add New GL Codes: Relying on the construction you have deliberate, begin including new GL codes. Be sure that every code is exclusive and aligns with the numbering logic you have determined upon. For instance, all asset accounts may begin with the number one (e.g., 1010 for Money, 1020 for Accounts Receivable, and so forth.).

- Enter Descriptions: For every GL code, present a transparent and concise description. This description ought to replicate the character of the transactions that the code will characterize. This step is significant for making certain readability and consistency throughout your monetary group.

- Assign Account Sorts: Accurately categorize every GL code in response to the principle account varieties (property, liabilities, fairness, revenues, and bills). This classification is essential for correct monetary reporting and evaluation.

- Take a look at Your Setup: Earlier than going dwell, carry out a take a look at by coming into a number of transactions and making certain they’re precisely mirrored within the appropriate GL accounts. This step helps establish any points in your GL code setup, permitting you to make mandatory changes.

Assigning GL Codes to Transactions

As soon as your GL codes are arrange in your accounting software program, the subsequent step is to assign these codes to transactions as they happen. This course of is on the core of sustaining an organized and environment friendly accounting system. Right here’s how to make sure accuracy and consistency on this job:

- Educate Your Staff: Be sure that all group members concerned in monetary transactions perceive the significance of GL codes and easy methods to use them. This may contain coaching periods or making a reference information.

- Evaluation Supply Paperwork: For each transaction, overview the supply doc (invoices, receipts, financial institution statements, and so forth.) to find out the suitable GL code. The character of the transaction will information which GL code to make use of.

- Enter Transactions: When coming into transactions into your accounting software program, choose the suitable GL code from the drop-down menu or enter it manually, relying in your system’s setup. Be sure that the small print of the transaction align with the GL code’s description.

- Common Audits: Conduct common audits of transactions to make sure GL codes are getting used appropriately. This might help establish errors or inconsistencies early, making them simpler to rectify.

GL Code Project Workflow

Let’s illustrate the workflow with a real-world instance to carry all of it collectively:

- Transaction Identification: Your enterprise purchases $5,000 value of workplace provides on credit score.

- Evaluation Supply Doc: You obtain an bill in your mail inbox from the provider detailing the acquisition.

- Decide Acceptable GL Code: Based mostly in your GL code construction, you establish that workplace provides must be recorded beneath the GL code for workplace bills (e.g., 5060 – Workplace Provides Expense).

- Enter Transaction in Accounting Software program:

- Entry the transaction entry web page in your software program.

- Enter the transaction date, the quantity ($5,000), and the provider’s particulars.

- Choose or enter the GL code 5060 for Workplace Provides Expense.

- For the reason that buy was made on credit score, additionally choose the GL code for Accounts Payable (e.g., 2010 – Accounts Payable) to characterize the legal responsibility created by this transaction.

- Evaluation and Affirm: Double-check the transaction particulars and GL codes for accuracy, then verify or save the transaction within the system.

- Common Reconciliation: At month-end, reconcile the accounts payable to make sure that all purchases, together with the workplace provides, are precisely accounted for and that the fee liabilities are clear.

Automate GL Coding with Nanonets

Within the digital age, automation is essential to enhancing effectivity and accuracy in monetary processes. By leveraging a software like Nanonets for automating the Basic Ledger (GL) code task workflow, companies can considerably cut back guide effort and reduce errors & delays.

Let’s revisit the workplace provides buy instance in an automatic workflow:

- Bill Receipt and Seize: Upon receiving the digital bill for the $5,000 workplace provides buy in your mail inbox, Nanonets routinely captures the doc from the e-mail.

.webp)

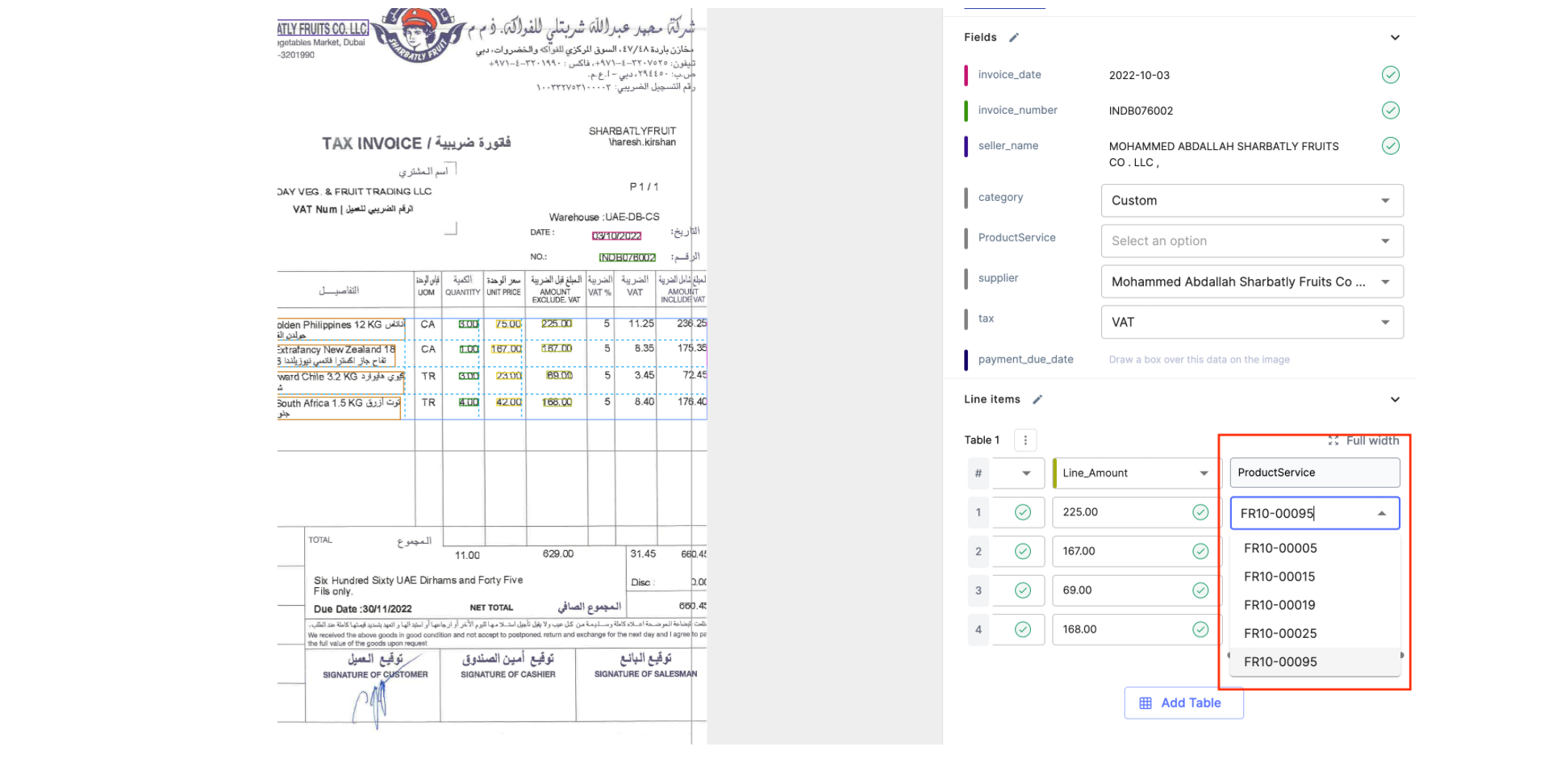

- Information Extraction: Utilizing OCR (Optical Character Recognition) and AI, Nanonets extracts related transaction particulars from the bill.

- GL Code Project: GL code task might be successfully executed by –

- Coaching on previous information: With Nanonets, you possibly can prepare a machine studying mannequin to acknowledge and categorize monetary transactions. This entails importing historic monetary paperwork and transactions tagged with traditionally appropriate GL codes. The mannequin learns from these examples to precisely predict GL codes for brand new transactions.

- Out of the Field Gen AI: Through the use of Nanonets GenAI, our software program can interpret the textual content on monetary paperwork in a means that mimics human understanding. This permits it to extract related data, context and semantics as a way to apply complicated reasoning to assign GL codes precisely, even in circumstances the place transaction particulars are ambiguous or sparse.

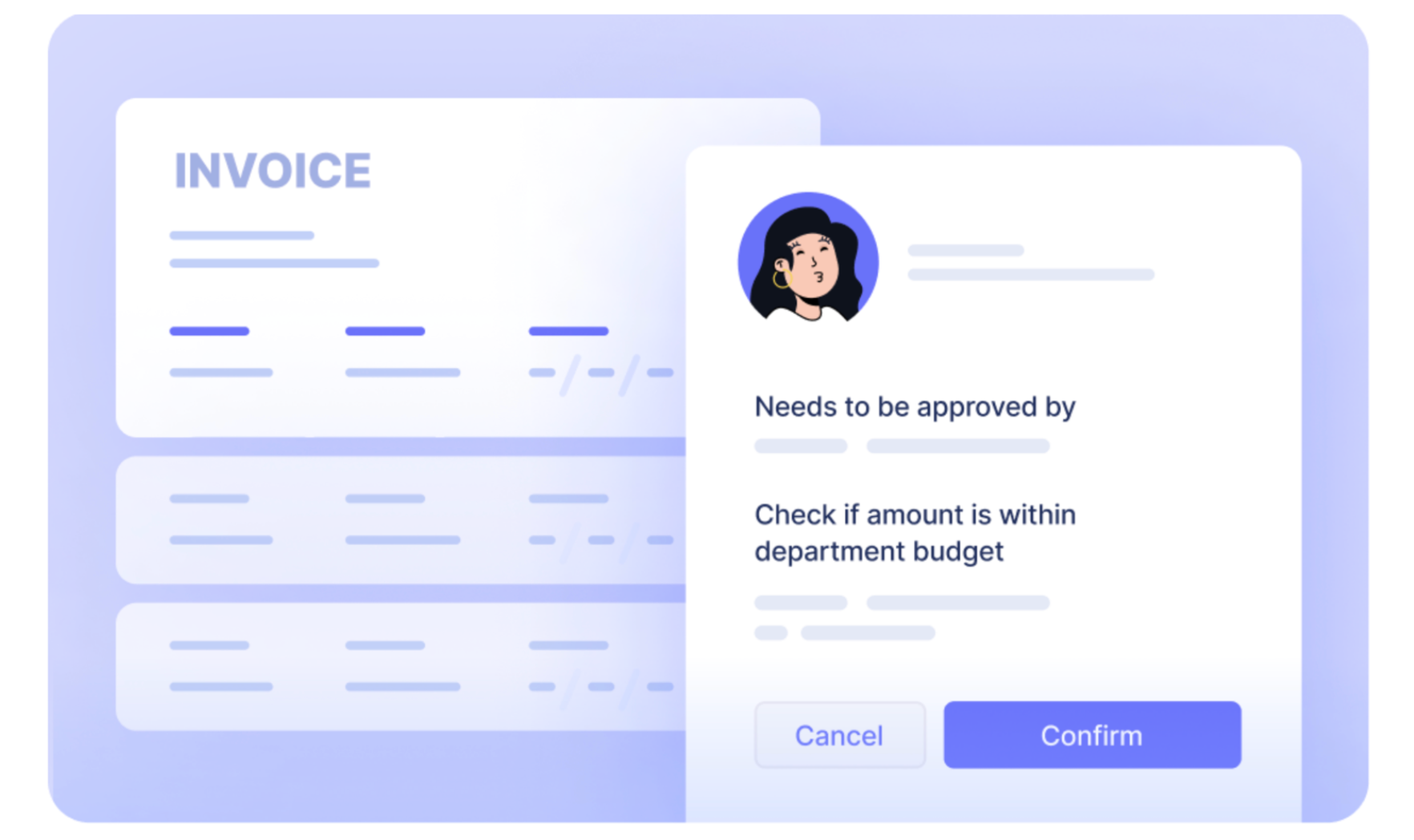

- Evaluation and Validation: The transaction is flagged for a fast overview as a result of the quantity exceeds a predefined threshold. After verifying the small print, the finance group approves the GL code task.

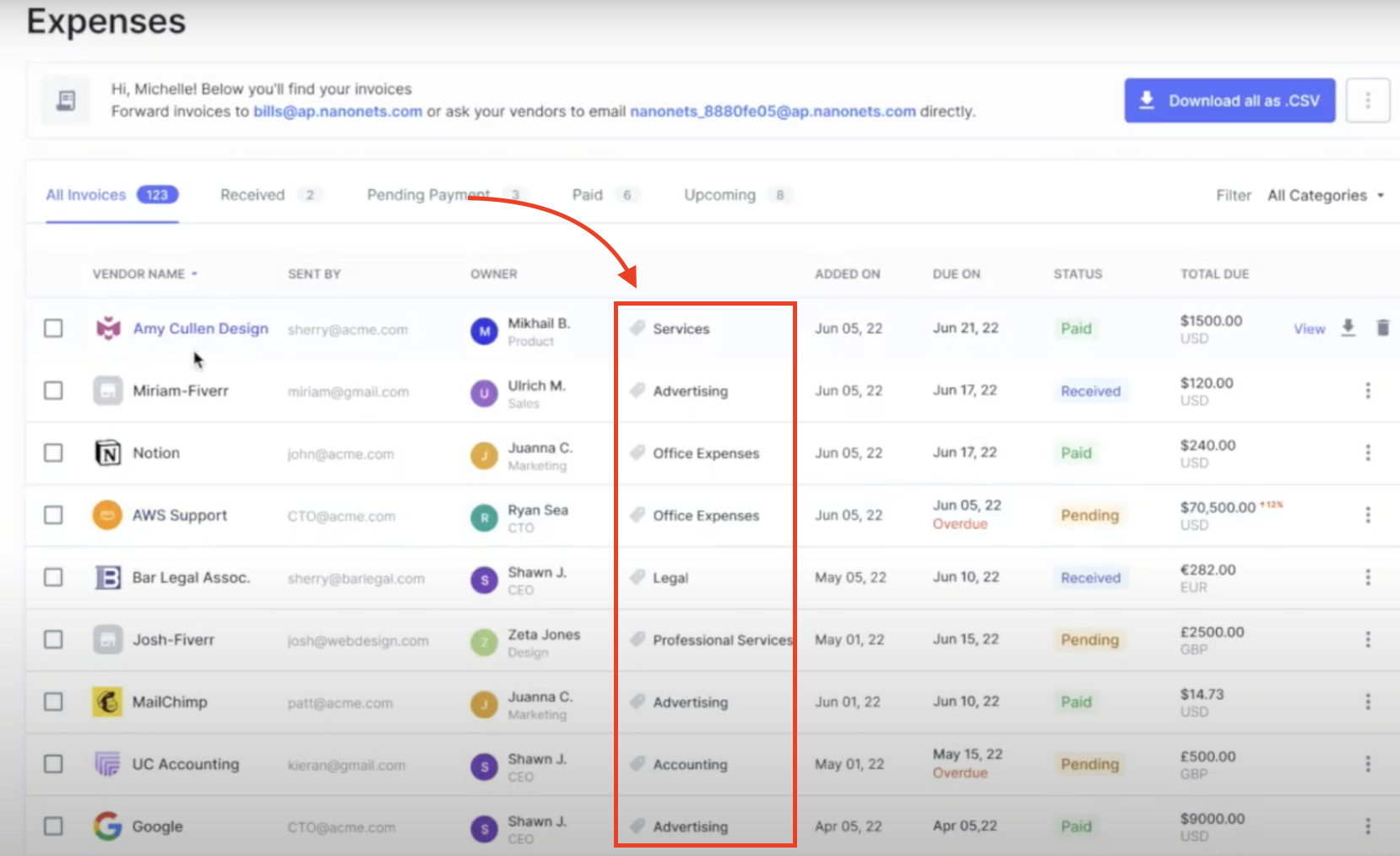

- Posting to Accounting Software program and Syncing Information with different apps: The validated transaction, full with assigned GL codes, is routinely uploaded to the accounting software program. The accounts payable and workplace provides expense accounts are up to date accordingly with out guide information entry.

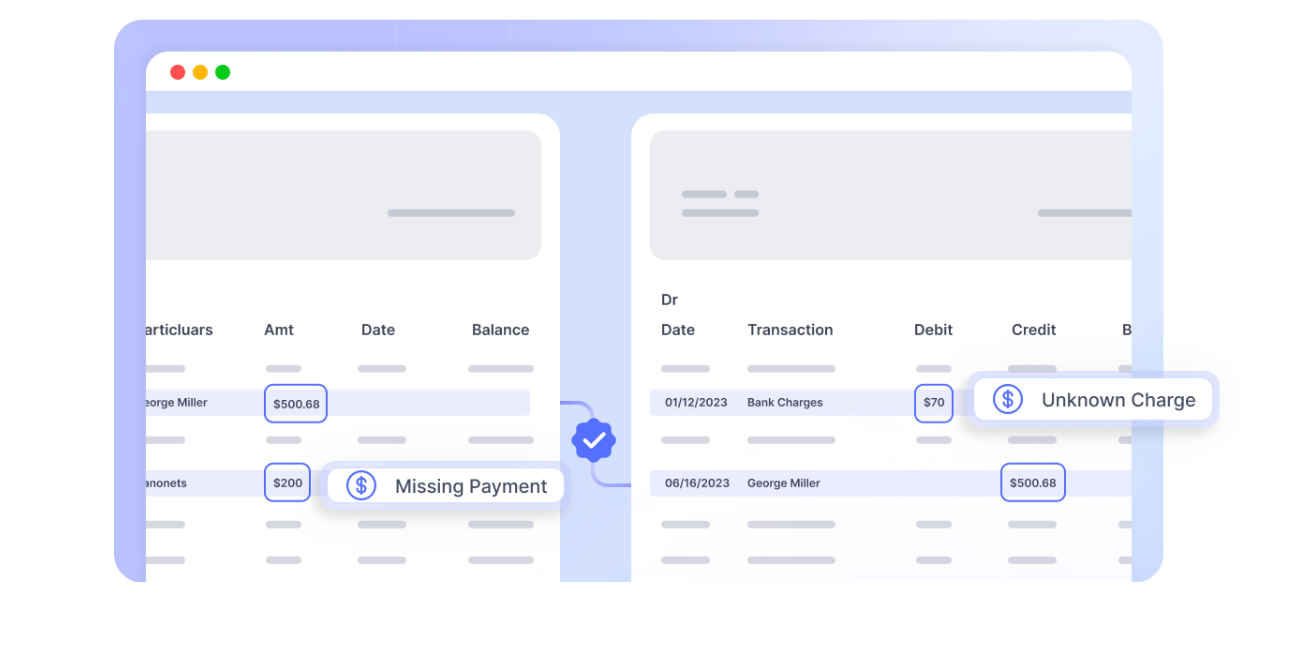

- Automated Reconciliation: Combine Nanonets along with your financial institution statements and Basic Ledger information to immediately match your books and establish discrepancies, and cut back the time taken to shut your books at month-end by 90%.

Conclusion

Within the intricate dance of enterprise finance, Basic Ledger Codes (GL Codes) emerge not simply as a methodical step however as a transformative leap in the direction of monetary readability and strategic perception. These alphanumeric keys unlock the potential for companies to navigate the complexities of economic transactions with precision, making certain that each penny’s journey is tracked, categorized, and analyzed for the betterment of the corporate’s monetary well being.

The essence of GL Codes transcends mere group; it is about embedding a layer of intelligence into the monetary cloth of a enterprise. By meticulously assigning these codes to each transaction, firms can illuminate the trail to enhanced monetary accuracy, streamlined tax preparation, and strong funds administration. This readability fosters an atmosphere the place strategic choices are knowledgeable by information, not guesswork, enabling companies to pivot with agility within the face of economic challenges and alternatives.

Furthermore, the mixing of GL Codes into accounting software program, complemented by the ability of automation instruments like Nanonets, represents a leap in the direction of a future the place monetary processes usually are not solely environment friendly however resilient. This digital transformation reduces the guide pressure on groups, permitting them to give attention to strategic duties that propel the enterprise ahead, whereas additionally safeguarding towards errors and fraud.

Able to revolutionize your monetary processes with unparalleled effectivity and accuracy? Embrace the way forward for finance with Nanonets. Our cutting-edge automation platform transforms the way in which you deal with Basic Ledger (GL) coding together with streamlining your monetary workflows like by no means earlier than.