Within the quickly evolving enterprise panorama, the effectivity of Accounts Payable (AP) processes is not only a back-office concern however a strategic crucial. The complexity and resource-intensive nature of conventional AP work is changing into unsustainable, notably within the face of rising calls for for velocity and accuracy.

Accounts Payable (AP) automation is using know-how to streamline and enhance the method of managing an organization’s payments and funds owed to others. As a substitute of manually dealing with invoices, checking them, and making funds, AP automation makes use of software program to do these duties extra shortly, precisely, and with much less human effort. This may help firms pay their payments on time, keep away from errors, and save money and time.

Our weblog cuts by means of the complexity of AP processes, presenting a transparent pathway to AP automation. This narrative is closely pushed by changing the guide duties related to accounts payable utilizing software program; nevertheless it’s additionally a bigger story about how on the planet of enterprise, probably the most impactful revolutions typically occur quietly, behind the scenes, altering the material of company life in profound methods.

Why is Accounts Payable so difficult?

It is a query that has lengthy plagued the perfect of finance professionals. Accounts Payable is often seen as a value operate inside firms, and the reason being easy – nobody desires to spend time paying payments and coming into knowledge about invoice funds!

Nevertheless, it’s nonetheless (very a lot) a necessary enterprise operate.

The rationale AP is difficult to optimise is de facto as a result of nature of the beast.

The important thing actions in an AP course of (Information extraction, bill coding, ERP sync) are basically knowledge transformation actions. Automating these can be easy with right now’s know-how.

Nevertheless, extra importantly, AP work additionally includes human intervention – for evaluate, approvals and monetary controls.

It’s this combine of information transformation and human enter, that makes AP a notoriously advanced and tough course of to optimize.

What precisely are these challenges?

Right here’s an in depth have a look at every step of the AP course of. By studying alongside, we will see the place the inherent challenges lie inside every a part of the accounts payable workflow.

- Bill Assortment: Inefficiencies in managing a mixture of digital and paper invoices, resulting in misplaced paperwork and delayed processing.

- Information Entry: Guide knowledge entry causes inaccuracies and delays in monetary data and reporting.

- Verification: Time-consuming technique of cross-checking invoices in opposition to POs and supply notes, typically resulting in delayed funds.

- Approval: Cumbersome approval course of with challenges in offering context to approvers, monitoring bill standing and making certain well timed authorizations.

- Funds: Issue in managing a number of cost phrases, schedules and currencies whereas making certain well timed funds.

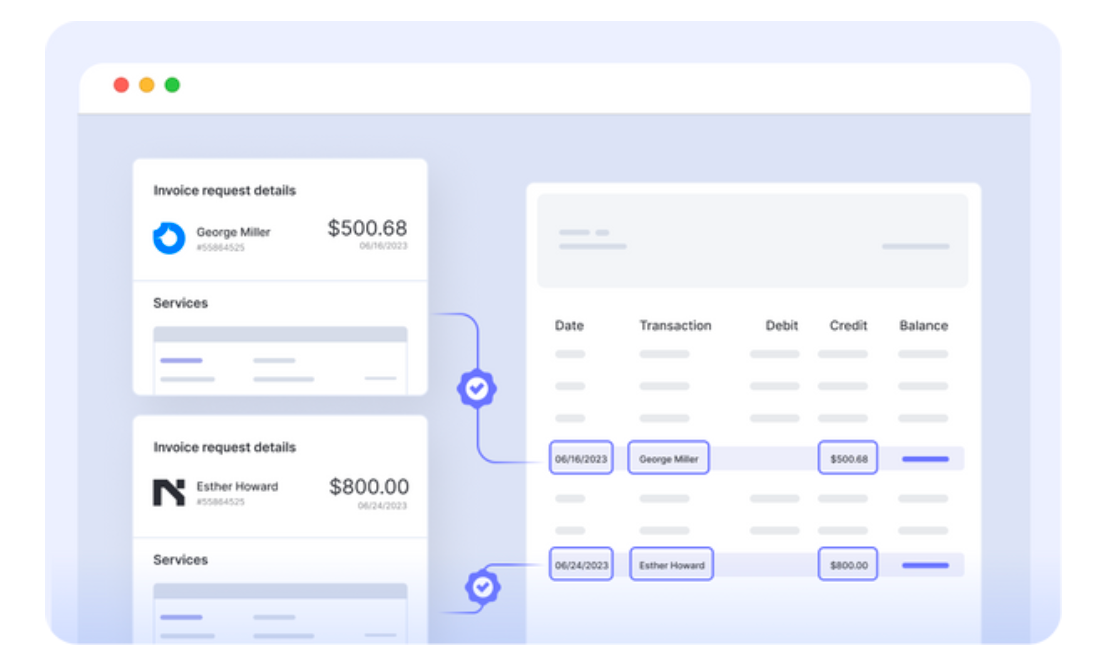

- Reconciliation: Labor-intensive technique of matching financial institution transactions with ledger entries.

- Dispute Decision: Time-consuming and sophisticated decision course of for disputes, affecting vendor relationships and operational effectivity.

Inefficient Accounts Payable: A Confirmed Impediment to Organizational Progress

Using a guide accounts course of for what you are promoting slows its development by straight impacting the accuracy, effectivity and bills related to the AP course of –

- Pointless Operational Prices: Guide bill processing prices escalate from $13 to $50, prolonging accounts payable for as much as three weeks.

- Penalties and Strained Provider Relations: Almost half of suppliers face late funds, straining vendor relations and incurring late charges or penalties.

- Money Movement Chaos: 74% of mid-market and early-enterprise CFOs acknowledge that digitization of AP cost processes improves stability sheets.

- Fraud and Compliance Threat: A examine by the ACFE discovered that 14% of fraud cases originated in accounting departments, with a median lack of $200,000 per occasion.

- Misplaced Productiveness: The common bill processing time in a guide setting can attain as excessive as 45 days. This represents misplaced time and helpful human sources higher spent on extra impactful initiatives.

Trying to combine AI into your AP operate? Ebook a 30-min dwell demo to see how Nanonets may help your crew implement end-to-end AP automation.

Now let’s have a look at how AP Automation streamlines the accounts payable course of and solves these issues.

What’s Accounts Payable Automation?

Accounts Payable (AP) automation refers back to the technological technique of digitizing, streamlining, automating and optimizing the administration of an organization’s accounts payable operations – enhancing effectivity, accuracy, and compliance.

AP Automation seems at answering one explicit query – how can every step of the accounts payable course of be 10x higher?

Let’s undergo every step one after the other and perceive this.

Embracing Automated Bill Assortment

Think about a world the place all of your bill assortment efforts converge harmoniously into one central hub. This isn’t a distant dream—it is a actuality with AP Automation. You may bid farewell to the times of sifting by means of emails, shared drives, vendor portals, and outdated databases. As a substitute, welcome a streamlined vacation spot the place each bill, no matter its origin, is collected routinely. Simply take into consideration the time you will save and the discount in errors!

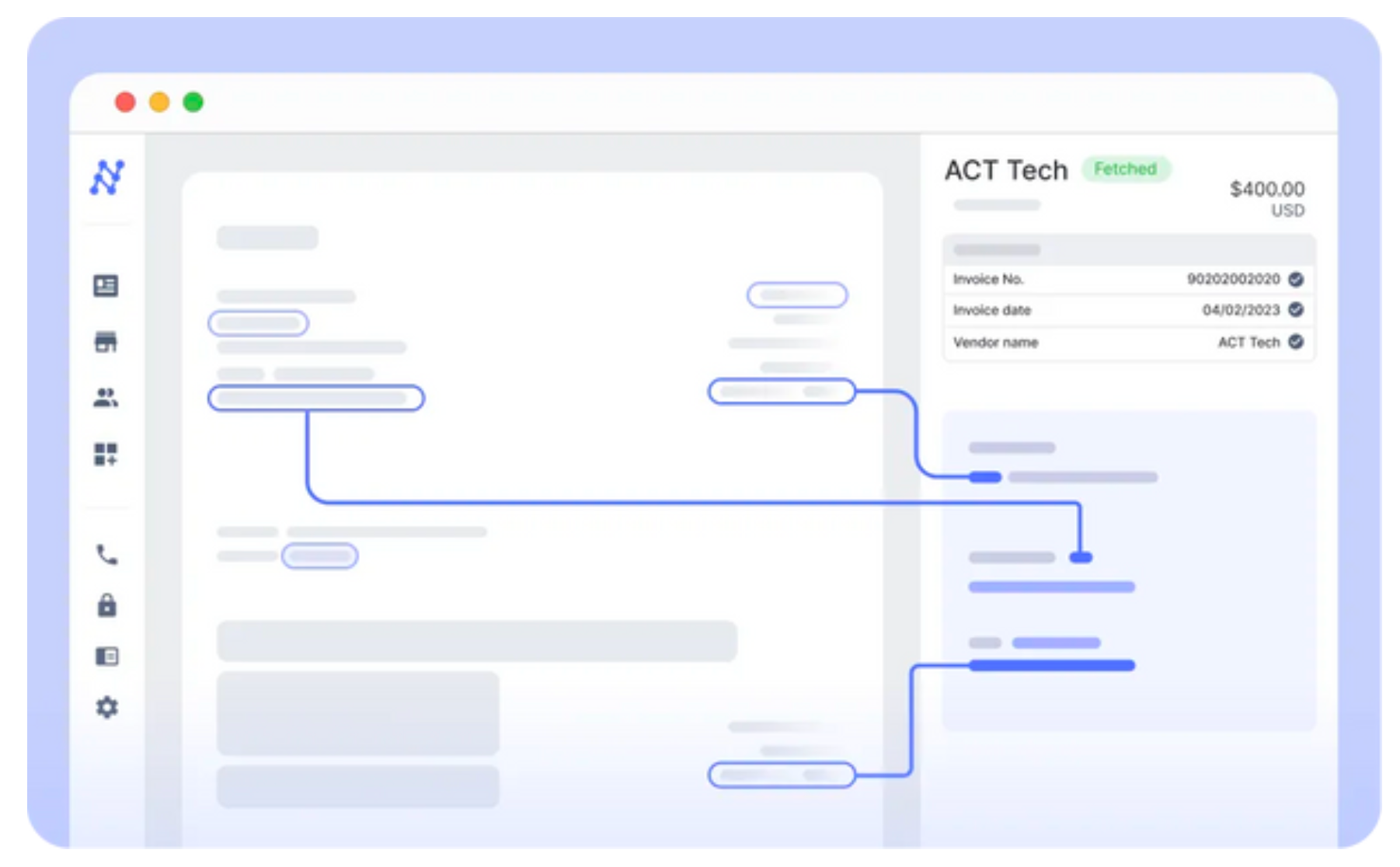

Perfecting the Artwork of Automated Information Entry

Information entry is commonly the bane of effectivity, nevertheless it would not need to be. AP Automation brings to the desk AI-powered Information Extraction that boasts a powerful 99%+ accuracy price. This implies your invoices and buy orders are learn and processed with out the painstaking effort of guide entry. The hours and even days of labor this might save your crew are invaluable. It is the form of change that makes your crew wish to come to work within the morning, realizing they’ll give attention to duties that really want their experience.

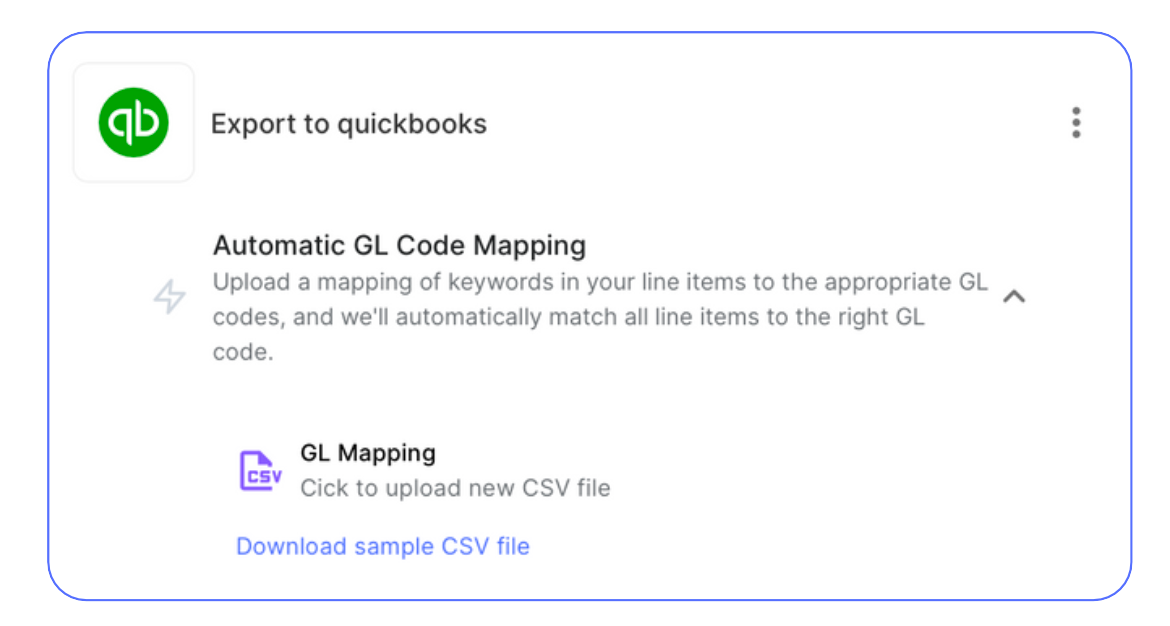

Streamlining with Automated GL Coding and Information Export

Everyone knows how tedious and error-prone bill coding may be. However with AP Automation, superior AI strategies like NLP and LLM are right here to sort out the grunt work. By automating GL coding and knowledge export, your division can work smarter, not tougher, and make sure the crew’s efforts abilities are used the place they’re most wanted.

Enhancing Accuracy with Automated Verification

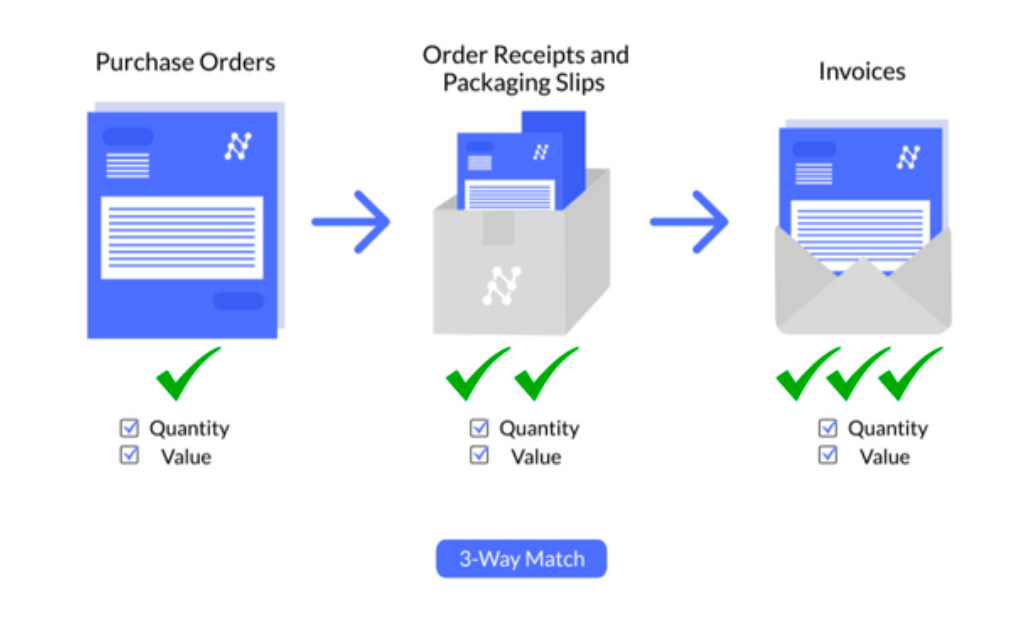

The magic of Automated 3-way matching can’t be overstated. Integrating invoices, buy orders, and supply notes reduces each the time spent and the potential for errors—no extra chasing down discrepancies or sending numerous follow-up emails. This method handles the verification course of with such precision that it appears like having an additional set of infallible eyes.

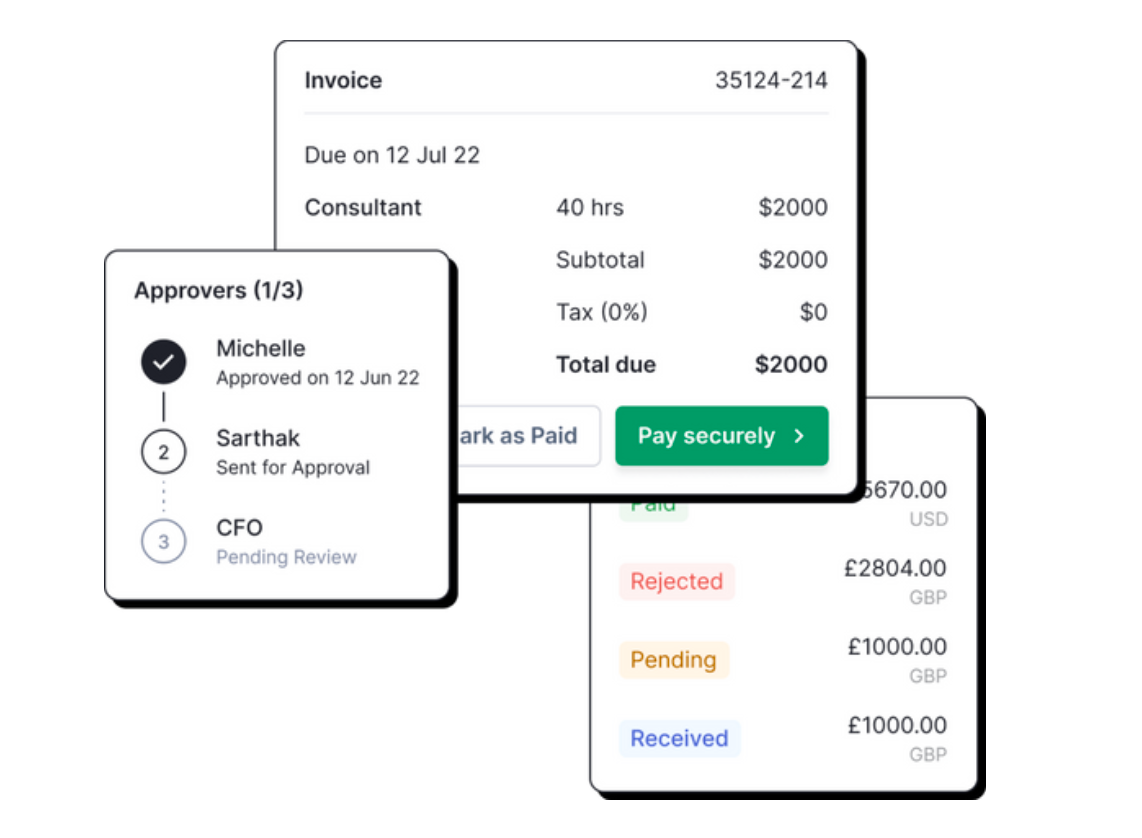

Simplifying Processes with Simple Approvals

Workflow automation means approvals are not a bottleneck. They develop into versatile and dwell the place your group does—whether or not that is on e-mail, Slack, or Groups. This eliminates the necessity for disruptive telephone calls and the all-too-familiar barrage of reminders. Your approval course of turns into as agile as your crew, adapting to the circulate of your each day operations seamlessly.

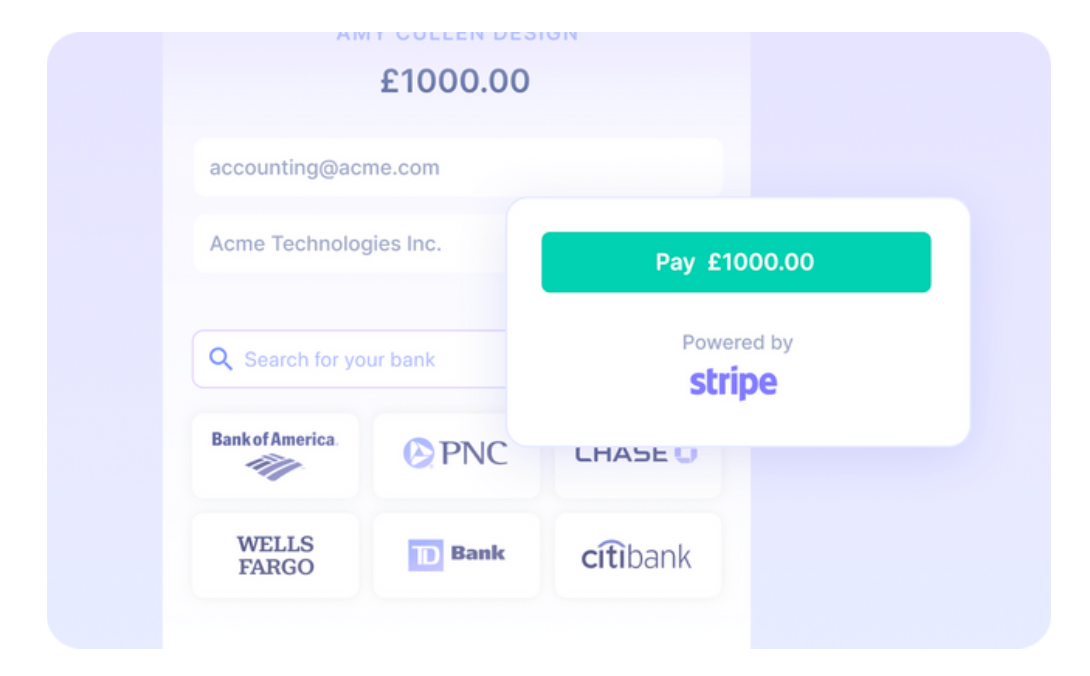

Attaining Fluidity with Seamless Funds

AP Automation isn’t nearly dealing with invoices; it’s about facilitating the cost course of too. This implies making direct international funds turns into worry-free, as you possibly can belief that the system will deal with foreign exchange costs and keep away from sudden chargebacks. This additionally means you possibly can guarantee your suppliers of well timed and correct funds, fostering higher relationships and a stronger provide chain.

Mastering Funds with Computerized Reconciliation

Lastly, let’s discuss closing the books. Computerized reconciliation transforms this typically arduous process, matching financial institution transactions with ledger entries in a fraction of the time it used to take. What as soon as took days can now be accomplished in minutes. Think about closing your month-to-month books with such velocity and precision you can virtually hear the collective sigh of aid out of your crew.

Trying so as to add AI to your Accounting course of? Ebook a 30-min dwell demo to see how Nanonets may help your crew implement end-to-end AP automation.

AP Automation is the perfect ally your finance division will ever have. It is about reworking your AP processes to be ten occasions higher not simply in effectivity however in job satisfaction and accuracy as nicely.

It induces a elementary shift in your accounts payable division, shifting from a task-oriented to a strategy-focused method. Embrace these adjustments, and you will not solely see a metamorphosis in your workflows however within the morale of your crew as they notice the potential of what they’ll obtain with ample time and the appropriate know-how at their fingertips.

Numbers Communicate

Numerous reported statistics underscore the impression of AP Automation. These numbers characterize a story of the form of success that you just and your crew can look ahead to experiencing.

Dramatic Value Reductions in Processing

Let’s begin with the monetary well being of your division. AP Automation has been proven to slash processing prices by a staggering 70%. This is not nearly saving pennies; it is about reallocating your price range in direction of development, coaching, and perhaps even that workplace espresso machine everybody’s been eyeing. Consider this as an funding in each your crew’s effectivity and their well-being.

Time is of the Essence

Now, think about lowering your bill processing time by 384%. It is not a typo, it is a revolution. This dramatic lower means your crew can course of extra invoices sooner than ever earlier than, liberating up time to give attention to strategic initiatives that really matter. With AP Automation, “I haven’t got time for that” turns into “What’s subsequent on the agenda?”

Error Discount for Peace of Thoughts

We all know errors may be extra than simply annoying—they are often expensive. With a 37% discount in bill processing errors, AP Automation brings peace of thoughts to your operations. Fewer errors imply fewer hours spent in correction cycles and extra confidence in your knowledge integrity. This additionally interprets into much less friction with distributors and stakeholders, smoothing the way in which for smoother relationships and operations.

Cultivating Vendor Relationships

Talking of relationships, let’s discuss in regards to the 76% of organizations reporting elevated vendor satisfaction. That is key. Joyful distributors imply a dependable provide chain and alternatives for negotiations and reductions down the street. Your distributors will discover and admire the punctuality and accuracy of your funds, due to AP Automation.

Money Movement Optimization by means of Early Cost Reductions

A 3% financial savings by means of early cost reductions offers your group a monetary facelift, enhancing your money circulate, and offering you with extra leverage and suppleness in your monetary operations.

Compliance With out the Problems

Lastly, the crown jewel of AP Automation: 100% stress-free compliance. In an age the place regulatory calls for are ever-increasing, attaining full compliance with out the stress is nothing in need of miraculous.

The Strategic Shift

It is very important discuss in regards to the profound shift Accounts Payable Automation brings to an AP division’s ethos and operations. This is not only a change in how duties are accomplished—it is a renaissance within the very position of accounts payable inside your group. That is marked by transitioning from a task-oriented workflow to a strategy-focused method.

- From Processing to Analyzing: Think about your employees utilizing the time saved from guide knowledge entry to conduct thorough spend evaluation, figuring out tendencies and alternatives for value financial savings. They might negotiate higher phrases with suppliers, leveraging quantity reductions or exploring early cost advantages with the newfound monetary flexibility.

- From Reacting to Planning: As a substitute of reacting to the infinite cycle of invoices and approvals, your crew can now plan proactively. With the effectivity beneficial properties from AP Automation, you might have the bandwidth to develop strong price range forecasts and have interaction in strategic monetary planning. This may contain crafting contingency plans to make sure monetary stability throughout market fluctuations or allocating sources in direction of development and growth tasks.

- From Resolving to Innovating: As a substitute of spending hours resolving errors and reconciling accounts, your crew can now give attention to innovating. This implies they’ll implement new cost applied sciences, like digital playing cards or blockchain for safe and environment friendly transactions. Or maybe they may discover sustainability initiatives, akin to transitioning to a totally paperless AP course of, which not solely reduces prices but in addition helps your organization’s environmental targets.

- From Transactions to Relationships: AP Automation shifts the main focus from transactional duties to constructing and nurturing relationships. Your crew can spend extra time working with distributors to enhance the availability chain or with inside stakeholders to grasp and meet their procurement wants higher. They’ll provoke vendor efficiency evaluations, create strategic partnerships, and collaborate on joint initiatives that carry mutual advantages.

- From Compliance to Management: Lastly, shifting away from the time-consuming compliance checks, your crew can now paved the way in finest practices for monetary governance. They’ll set up inside management frameworks that set business requirements and contribute to thought management in monetary operations. This proactive stance on compliance may also defend your group from future regulatory adjustments, positioning you as a forward-thinking and resilient division.

AP Automation Necessities

In any evolving narrative, there are non-negotiables — elements that have to be current for the story to advance. With regards to AP automation, these 3 non-negotiables are the pillars that may guarantee a stable environment friendly construction of your accounts payable course of.

1. Integration: The Bridge to the Future

This includes seamless merging of latest AP automation instruments with present ERP techniques. Choose an AP software that blends simply with present ERP techniques, offering a direct path to market and reducing time-to-value.

2. AI-Powered: The Thoughts Behind the Machine

The second pillar is the intelligence of the system, an AI-powered core that shapes the workflow, making certain that each guide course of and knowledge transformation is automated, and each human evaluate is less complicated.

3. Scalability: The Progress Crucial

Lastly, scalability speaks to the ambition of development. Select software program that meets present calls for and scales seamlessly with what you are promoting development, avoiding expensive system overhauls and licenses.

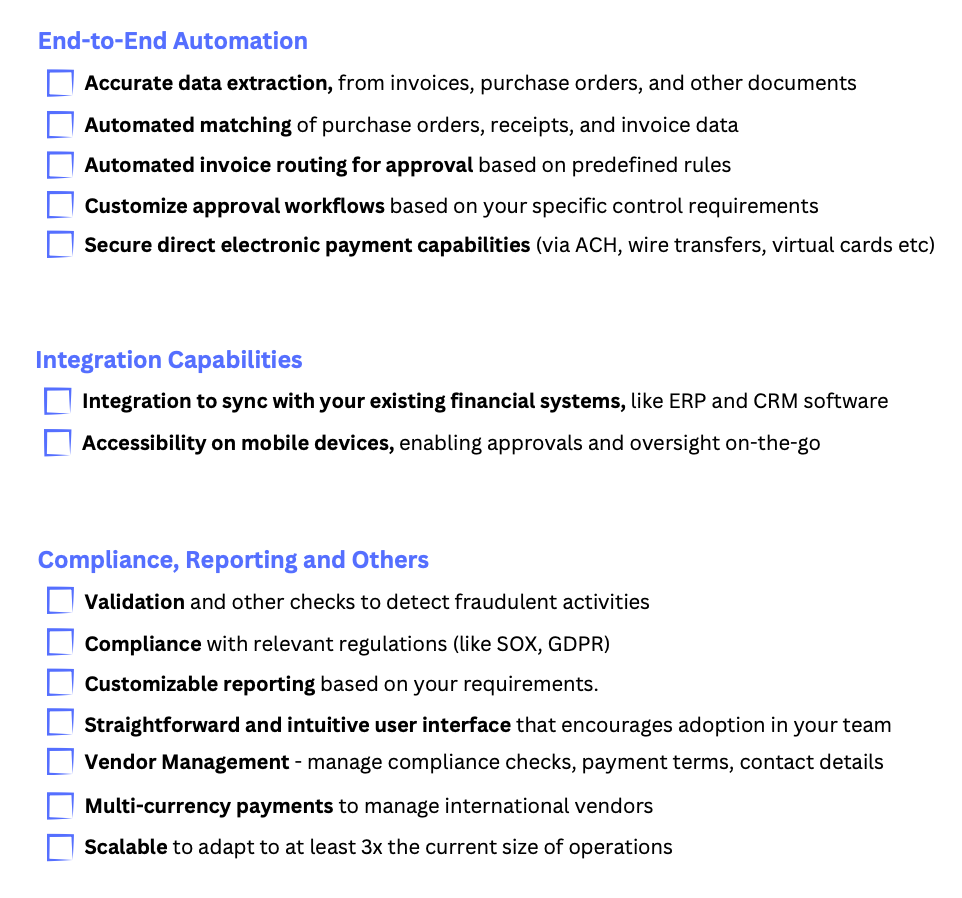

The AP Automation Guidelines

Right here’s a exhaustive record of functionalities that it’s best to think about for prioritisation.

You possibly can deal with this as a tearaway to maintain for reference.

Revolutionize Your Accounts Payable – Getting Began

Let’s discover learn how to get began with AP Automation & combine it into your accounts payable course of. Right here are some things to bear in mind.

1. Embrace the Automation Mindset: Begin with the philosophy that automation is a core technique, not an afterthought. This mindset ensures that each course of and determination maximizes effectivity and accuracy.

2. Outline Your Success Metrics: Decide clear, measurable targets to judge the success of the transition. This could possibly be lowering processing time, chopping prices, or bettering accuracy. Figuring out what success seems like is essential for monitoring progress.

3. Accomplice with a ROI-Targeted Vendor: Select a vendor who asks about your success metrics and reveals a real dedication to delivering worth.

4. Safe Stakeholder Purchase-In: Garner help from management by articulating the worth proposition of AP automation – value financial savings, improved effectivity, and stronger monetary controls.

5. Assess Present AP Processes: Conduct a radical evaluate of your present AP processes. Establish areas of inefficiency and potential for automation.

6. Make clear Necessities and Customizations: Clearly define what you want from an AP automation software, together with any particular customizations.

7. Plan for Integration and Scalability: Make sure the chosen answer integrates nicely together with your present techniques and is scalable to adapt to future enterprise development and altering wants.

8. Implement, Prepare, and Adapt: After implementation, give attention to complete coaching on your crew. Be ready to adapt processes as wanted, primarily based on suggestions and evolving necessities.

What does your AP Automation journey with Nanonets appear like?

Day 0: Begin a Dialog

Schedule a name at your comfort to debate your wants with our automation consultants, and so they’ll present a customized Nanonets demo.

Day 1: Assess your Wants

We’ll consider your present AP course of, pinpoint how Nanonets could make the most important impression, making certain our answer aligns together with your targets.

Day 2: Setup and Customization

We’ll information you on utilizing Nanonets. You may arrange & automate your accounts payable workflow suited to you primarily based on our dialogue.

Day 3: Testing

After setup, take a look at your workflow with actual knowledge throughout a typical 7-day trial (extendable on request). Our crew will help in fine-tuning your workflow.

Day 7: Buy & Go Stay

After profitable testing, we’ll suggest a tailor-made, cost-effective pricing plan. When you’re proud of it, we’ll go dwell!

Endlessly: Empowering your Workforce

We offer sources, periods, and steady customer support to make sure your crew’s adoption, proficiency and confidence.

AP Automation success tales with Nanonets

From small companies grappling with AP workflow setup, to massive companies looking for to extend effectivity of their accounts payable processes, these narratives provide a panoramic view of the tangible advantages that AP automation can carry.

SaltPay Makes use of Nanonets to Combine with SAP to Automate Accounts Payable

Based mostly in London, England, SaltPay is a cost companies and software program supplier for native European companies. Based in 2019, the corporate gives its companies to 100,000+ small and mid-size companies throughout Europe.

Problem

- SaltPay wanted to combine SAP for environment friendly vendor administration.

- Dealing with hundreds of invoices manually was impractical.

Answer

- Nanonets offered an AI-powered software for bill knowledge extraction.

- Seamless integration with SAP, enhancing knowledge accuracy and course of effectivity.

Outcomes

- Drastic discount in guide effort with 99% time financial savings.

- Efficiently managing over 100,000 distributors.

- Important enhance in productiveness and automation capabilities.

Tapi automates property upkeep invoices utilizing nanonets

Tapi’s property upkeep software program simplifies property upkeep. Based mostly out of Wellington, New Zealand, Tapi helps keep 110,000 properties and is increasing quickly.

Problem

- Guide processing of over 100,000 month-to-month invoices in property upkeep.

- Want for scalable, environment friendly bill administration.

Answer

- Nanonets AI software for automated bill knowledge extraction.

- Fast integration with present techniques, maintained by non-technical employees.

Outcomes

- Processing time decreased from 6 hours to 12 seconds.

- 70% value financial savings in invoicing.

- 94% automation accuracy.

Professional Companions Wealth automates Accounting Information Entry with Nanonets

Professional Companions Wealth, primarily based in Columbia, Missouri, focuses on wealth administration and accounting companies for veterinary house owners.

Problem

- Professional Companions Wealth wanted correct and environment friendly knowledge entry for invoicing.

- Current automation instruments had been inadequate, resulting in excessive error charges.

Answer

- Nanonets provided a customized answer with correct knowledge extraction and integration with QuickBooks.

- Enabled streamlined invoicing and automatic knowledge validation.

Outcomes

- Achieved over 95% accuracy in knowledge extraction.

- Saved 40% time in comparison with conventional OCR instruments.

- Over 80% Straight By way of Processing price, lowering guide intervention.

Augeo leverages Nanonets for Accounts Payable Automation on Salesforce

Augeō gives outsourced accounting and consulting companies, and serves as a digital accounting division for varied shoppers throughout the US. Their founder and CEO, Ken Christiansen (ex-Finance Director at Kaiser Permanente), has over 20 years of expertise in Finance and Accounting.

Problem

- Augeo wanted an environment friendly accounts payable answer on Salesforce.

- Guide processing of hundreds of invoices month-to-month.

Answer

- Nanonets offered an AI-driven platform for automated bill processing.

- Integration with Salesforce for streamlined knowledge dealing with.

Outcomes

- Decreased bill processing time from 4 hours to half-hour each day.

- 88% discount in time spent on guide knowledge entry.

- Processed 36,000 invoices yearly with larger accuracy and effectivity.

Continuously Requested Questions

What’s accounts payable automation?

Accounts payable automation is like giving your finance crew a superpower. It is using software program to remodel the normal, guide dealing with of accounts payable right into a streamlined, digital course of. By automating duties like bill processing, knowledge entry, and cost scheduling, companies can velocity up their workflows, cut back errors, and acquire real-time insights into their financials. Consider it as your monetary operations operating on autopilot, with improved effectivity and management.

How does automation impression the accuracy of accounts payable?

Think about a world the place misplaced invoices, typos, and miscalculations are issues of the previous. That is the world of automated accounts payable. By minimizing human intervention, automation considerably reduces the prospect of errors. It is like having a meticulous, tireless digital assistant who ensures each quantity is spot on, enhancing the general accuracy of your monetary operations.

Can automation combine with present monetary techniques?

Sure, and that is one among its biggest strengths! Accounts payable automation is not about changing your present techniques; it is about enhancing them. Most trendy options are designed to seamlessly combine with a variety of economic techniques and ERP platforms. It is like including a turbocharger to your automotive – boosting efficiency with out altering what’s already working nicely for you.

What are the associated fee implications of implementing automation?

There is not any sugarcoating it – implementing automation requires an preliminary funding. This could embody software program prices, integration, and potential coaching. Nevertheless, it is like planting a seed that grows right into a tree of financial savings. Over time, automation reduces labor prices, eliminates late cost charges, and improves money circulate administration. The long-term monetary advantages and ROI typically far outweigh the preliminary prices.

Learn this weblog which discusses how a lot cash accounts payable automation saves companies. https://www.nextprocess.com/ap-software/much-money-will-accounts-payable-automation-actually-save- company-future/

How safe is accounts payable automation?

In right now’s digital age, safety is not only a function; it is a necessity. Accounts payable automation options are constructed with strong safety measures like encryption, person authentication, and audit trails. They adjust to varied knowledge safety laws to make sure your monetary knowledge stays safe and confidential.

Is coaching required for workers to make use of automated techniques?

Whereas accounts payable automation instruments are designed for ease of use, some coaching is normally required to get probably the most out of the system. Nevertheless, this is not a months-long course; it is extra about familiarization and finest practices. Most distributors present complete coaching sources and help to make sure a easy transition. Consider it as a brief studying curve which may be overcome inside hours resulting in a protracted street of effectivity.

How Does AP Software program Perform?

Accounts Payable software program operates by digitizing and automating your complete bill processing workflow. At its core, it makes use of applied sciences like Optical Character Recognition (OCR) to transform bill knowledge into digital format. Superior algorithms then categorize and validate this knowledge in opposition to buy orders and supply receipts. The software program routinely routes invoices by means of a predefined approval workflow, and integrates with present monetary techniques for seamless cost processing and record-keeping.

How Does Automation Software program Facilitate AP Workforce Scaling?

AP automation software program empowers groups to handle larger volumes of invoices with out proportional will increase in headcount or guide effort. By automating routine duties, it frees up employees to give attention to strategic actions. The software program’s scalability ensures that as transaction volumes develop, the system can deal with the elevated workload with out sacrificing effectivity or accuracy.

Will AP Automation Make Sure Accounting Jobs Redundant?

Slightly than rendering jobs out of date, AP automation transforms them. It shifts the main focus from guide, repetitive duties to extra analytical and strategic roles. Professionals in accounting and bookkeeping will discover their roles evolving to incorporate managing the automation software program, analyzing monetary knowledge, and contributing to strategic decision-making.

What’s the Typical Value of AP Software program?

The price of AP software program varies primarily based on elements like the scale of the enterprise, the quantity of transactions, and the precise options required. It could actually vary from a couple of hundred to a number of thousand {dollars} monthly. Many suppliers provide customizable pricing fashions to suit completely different enterprise wants and scales.

How A lot Can a Enterprise Save with AP Automation?

Companies can notice substantial financial savings by means of AP automation. These financial savings come from decreased labor prices, elimination of late cost charges, early cost reductions, and decreased errors and fraud. Usually, firms can count on to avoid wasting anyplace from 60% to 80% of their present processing prices after implementing AP automation.

How Can Automation Enhance the Construction of an AP Division?

Automation transforms the AP division from a transaction-focused to a strategy-focused construction. With guide duties automated, employees can give attention to higher-value actions like vendor relationship administration, spend evaluation, and monetary technique. This shift not solely improves the effectivity and effectiveness of the AP division but in addition elevates its position inside the group.

How Does AP Automation Help the Bill Approval Course of?

AP automation streamlines the approval course of by routinely routing invoices to the suitable approvers primarily based on pre-set guidelines. It gives approvers with all the required info and context, facilitating faster decision-making. The system additionally tracks the progress of every bill, sending reminders and updates to make sure well timed approvals.

Can AP Automation Software program Forestall Bill Fraud and Duplicate Funds?

AP automation software program performs a major position in stopping bill fraud. It does so by implementing controls like 3-way matching, which ensures that funds are made just for verified and authorized purchases. Moreover, using digital audit trails and anomaly detection algorithms helps determine suspicious actions, lowering the danger of fraudulent transactions.

Can AP Automation deal with Multi-Foreign money and Worldwide Funds?

AP automation software program is often outfitted to deal with multi-currency transactions and worldwide funds. It could actually routinely convert currencies at present trade charges, handle foreign money fluctuation dangers, and adjust to worldwide cost protocols and tax laws, making certain environment friendly and compliant international cost processes.