In 2024, fee methods are anticipated to evolve much more as individuals and corporations require sooner, safer, and extra handy options. This change isn’t just the world’s newest whim or pattern however a revolutionary transfer in the direction of a financially built-in and holistic atmosphere.

Cell wallets and contactless funds have gotten more and more omnipresent, providing distinctive comfort and effectivity. They remove the necessity to deal with money and playing cards, decreasing theft and loss. Furthermore, these applied sciences are opening up new alternatives in safety, implementing biometric identification and excessive ranges of encryption to safe customers’ information.

With altering instances, there may be a lot to uncover about the way forward for contactless funds for eCommerce companies and clients.

Let’s talk about all these intimately.

The Present State of Cell Wallets and Contactless Funds

In 2021, the cell pockets trade processed over US $1 trillion price of transactions, a 31% year-on-year enhance in comparison with 2020. Moreover, the worth of digital pockets transactions is projected to extend from US $7.5 trillion in 2022 to US $12 trillion in 2026.

Technological innovation, altering client preferences, and evolving market dynamics form the present state of cell wallets and contactless funds. Let’s delve into these intricacies to know its nature.

1. Penetration and Utilization

Cell wallets, digital purses, or contactless funds are one other emergent pattern in 2024.

An amazing instance of that is Apple Pay. With over 2.8 billion customers worldwide, this fee gateway has change into integral to numerous monetary transactions, from on a regular basis purchases to peer-to-peer transfers and invoice funds. Nonetheless, variations are seen throughout the areas relying on creating infrastructure, tradition, and authorized necessities.

Whereas mature markets, such because the USA, UK, or Japan, provide a excessive share of customers who use digital fee methods attributable to well-developed infrastructure, there will be challenges in creating international locations to offer handy entry to smartphones and reasonably priced Web, together with the issue of economic illiteracy.

Additional, the extent of safety and authenticity in on-line funds is an important driver of adoption in numerous areas.

2. Fashionable Use Instances

The comfort of cell wallets and contactless funds has been evident within the retail, transit, and even e-commerce segments.

Contactless funds are the latest fee improvements affecting retail shops. They make the markets much less congested and remove contact between consumers and sellers.

M-Commerce has additionally benefited from the enhancement of ticketing methods, the place commuters can use their cell wallets to pay for his or her fares as an alternative of bundles of tickets.

3. Technological Improvements Shaping the Future

Cell wallets and contactless funds are the very best examples of how innovation frequently shapes the expansion of those rising applied sciences. Fingerprints and facial recognition are examples of biometric authentication strategies that make it safer and handy; then again, blockchain and cryptocurrencies are additionally on the rise for brand spanking new borderless economies.

Cell fee mixed with the IoT implies that funds shall be prompt and lengthen to sensible dwelling devices and wearables. 3D fee voice instructions, augmented actuality interfaces, and P2P Funds present how evolving and elastic cell funds are.

4. Future Market Insights and Tendencies

Corporations comparable to PayPal, Alipay, Apple Pay, Google Pay, and Samsung Pay stay main actors out there.

Cell funds have been predicted to have great futures. Digital wallets are essential in cell funds as we speak as a result of they’re handy, strong, and safe. Among the many primary traits within the coming yr are biometric authentication, the connection of fee purposes to the IoT, augmented actuality in funds, and POS methods.

Moreover, personalization with the assistance of synthetic intelligence (AI) will drive clients to get extra particular, whereas “Purchase Now Pay Later” choices will enchantment to a extra numerous group of consumers.

Advantages of Cell Wallets and Contactless Funds

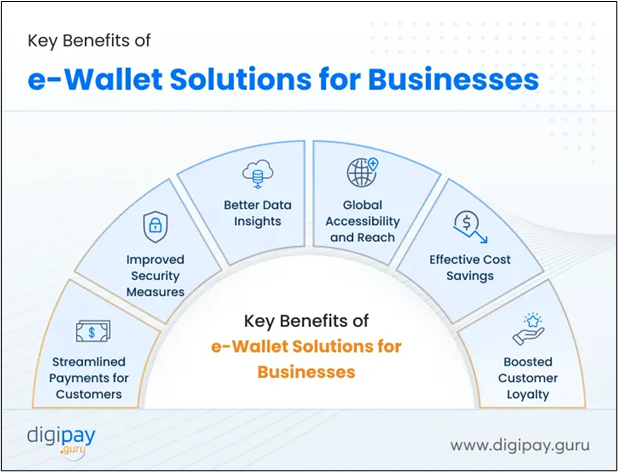

Cell wallets and contactless funds provide quite a few advantages to customers and companies, contributing to their widespread adoption and rising recognition.

Listed below are some key benefits:

1. Comfort:

Cell wallets are usually pockets apps that allow customers to save cash, credit score and debit playing cards, loyalty/bodily/barrier tokens, and even cryptographic currencies. This makes it simpler to keep away from carrying bodily wallets and sifting by playing cards when transacting, making these processes swift.

2. Accessibility:

Cell wallets allow customers to make funds at any time at any time so long as they’ve their cell phones or different units. This will increase the final purchasing expertise and makes purchasing simpler from bodily shops and on-line retailers.

3. Pace:

Applied sciences comparable to Close to Subject Communication (NFC) and Fast Response (QR) codes enhance the velocity of funds by contactless means. This manner, customers don’t have to attend for a very long time in a queue to pay for his or her services or products, as they will use their smartphones or scan code to finish the enterprise transactions in seconds.

4. Safety:

Cell wallets additionally include acceptable safety measures, specifically encryption tokenization and biometric identification (e.g., fingerprint scanning and facial recognition), which purpose to protect customers’ monetary information. The above measures assist scale back the hazards attendant to straightforward types of fee methods, comparable to card fraud.

5. Price Financial savings:

Cell wallets and contactless funds additionally imply precise price financial savings associated to money, receipt, and on-line transaction charges for companies that undertake this technique. Additionally, cell funds decrease the probabilities of making errors when dealing with many formalities in an organization, thus enhancing enterprise processes.

6. Integration with Rising Applied sciences:

Digital purses and contactless funds are deeply intertwined with progressive traits comparable to augmented actuality, voice interfaces, and the Web of Issues – which means new and thrilling prospects can be found for efficient and fascinating purchasing experiences and interactions.

Moreover, companies can streamline their operations by incorporating on-line invoicing software program, which enhances the seamless nature of contactless transactions by automating billing processes and enhancing general effectivity.

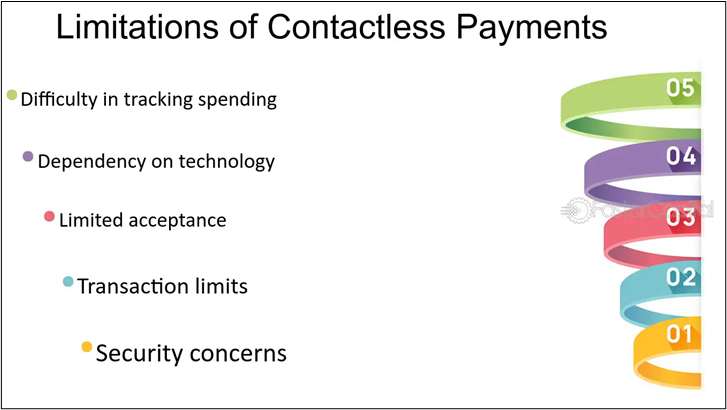

Challenges and Concerns in Contactless Funds (Statistics and World Tendencies)

Understanding the alternatives, dangers, and points associated to contactless funds requires working inside the context of this expertise.

Let’s delve into among the key challenges and issues backed by related statistics and international traits:

1. Safety Issues:

In accordance with a survey by Deloitte, 60% of respondents expressed their issues over smartphone hacking. This has poorly affected cell funds, notably amongst older adults who hardly ever change passwords.

Though many enhancements have been made to make transactions safer, comparable to tokenization and biometric authorization, individuals nonetheless fear in regards to the safety of contactless transactions being inclined to fraud and hacking.

2. Shopper Adoption and Training:

Whereas contactless fee options are more and more well-liked worldwide, notably in segments of Asia-Pacific and Europe, definitive consumer schooling campaigns nonetheless have to be improved. Some or most customers, notably the aged, may need little data of the expertise or have sure detrimental perceptions relating to security and effectivity. These campaigns embody educating customers to embrace contactless funds by highlighting the assorted benefits of the strategy and safety measures to boost its utilization.

3. Infrastructure Improvement:

The World Financial institution experiences that 1.4 billion adults worldwide stay unbanked, missing entry to formal monetary providers.

The essential downside of implementing contactless funds, together with NFC terminals and sufficiently secure connections, is creating the required infrastructure, particularly in rural areas and different areas with weak penetration. Subsequently, authorities organizations, monetary IT builders, and different expertise suppliers should handle this concern to make sure all clients have entry to contactless fee providers equally.

4. Acceptance and Service provider Adoption:

The statistics from a Visa survey revealed that 67% of all small companies have embraced contactless funds because the virus outbreak.

Whereas giant organizations and retailers have tailored and built-in digital funds, small-scale merchants might discover it difficult to acquire the suitable expertise, which includes proudly owning and putting in the appropriate instruments.

5. Privateness and Information Safety:

A research by Ipsos revealed that 84% of customers are nervous in regards to the privateness implications of contactless funds. Customs should additionally guarantee customers’ information privateness when utilizing contactless fee providers, which is very necessary when dealing with giant quantities of transactional information, and meet laws necessities comparable to GDPR.

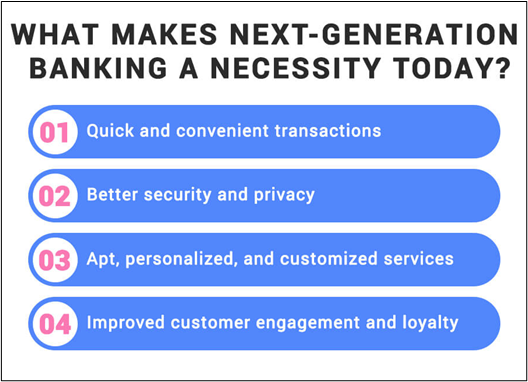

The Way forward for Subsequent-Gen Transactions: Tendencies for 2024

Subsequent-gen transactions are taking the entrance seat within the automobile with all the advantages it provide to homeowners and clients.

Nonetheless, some traits are shaping the usage of contactless funds in 2024. Let’s check out them.

1. Gen Z Main the Cell Cost Revolution

The comfort of cell funds notably appeals to youthful customers.

Cell P2P transfers have change into well-liked amongst Technology Z attributable to their proficiency in utilizing expertise and suppleness when transacting. The truth is, in accordance with eMarketer, 80.4% of recent customers adopting cell P2P transfers between 2023 and 2027 are anticipated to be from this era. This means that cell fee methods will change into a key a part of the long run as the subsequent era more and more embraces new methods of dealing with cash.

2. Contactless Funds Gaining Momentum

Cell fee options like Close to Subject Communication (NFC) and QR code expertise have elevated acceptance. A major concern for acquiring quick, protected, and clear technique of funds, notably within the post-pandemic period, has enhanced the applicability of contactless applied sciences. This pattern is transforming one of many newest frontiers of on-line and offline shops by making shopping for sooner and simpler for the buyer.

3. Biometric Authentication for Enhanced Safety:

As a result of excessive variety of cell transactions, safety is in danger. One concern is that hackers can now simply crack passwords and PINs. Biometric authentication strategies, together with fingerprint scanning and facial recognition, are among the options to those challenges. They facilitate cell funds and improve the extent of safety.

4. The Emergence of Tremendous Apps

Tremendous apps have gotten a trending matter amongst technological giants and are thought-about a brand new class for combining numerous providers.

It’s an utilized software program wherein sure actions, comparable to fee and purchasing or social interactions, are housed below single purposes, thus offering a one-stop resolution. These tremendous apps are at present massively well-liked in a number of areas, comparable to WeChat Pay in China; due to this fact, this pattern can go international.

5. Cell Wallets Changing into Multi-Useful

Providers comparable to Apple Pay, Google Pay, and Samsung Pay will not be solely fee options on the fore; they’re more and more turning into greater than that. They now include additional parts like loyalty packages, tickets, and boarding passes to change into efficient devices for every day fee within the current day.

6. The Rise of Cell Level-of-Sale (mPOS) Programs

Cell POS applied sciences are among the many most promising POS applied sciences.

Technological development has seen many developments within the subject of POS, particularly mPOS. These units present flexibility and mobility, permitting companies to course of transactions anyplace, improve buyer expertise, and combine seamlessly with different enterprise instruments like stock administration and CRM methods.

This makes mPOS notably advantageous for small and medium-sized enterprises (SMEs), which may use these methods to compete with bigger retailers. Customers additionally profit from the velocity and comfort of mPOS transactions, having fun with seamless and safe funds.

7. Cross-Border Cell Funds Streamlining Worldwide Transactions

Cell funds facilitate cross-border transactions, making them cheaper and sooner. This pattern is advantageous to customers and companies that deal in worldwide commerce or e-business and underlines the influence of globalization on cell fee expertise.

Conclusion

In 2024, one factor is evident: the way forward for finance is digital.

Having analyzed the present place and perspective of those applied sciences, it’s seen that these novelties are altering the methods of transactions, interactions, and enterprise functioning worldwide.

The introduction of cell units and fee strategies like m-commerce, contactless funds, and the appliance of tremendous apps have additionally enhanced financial growth and globalization.

Nonetheless, addressing the challenges and issues accompanying this transformation is important. 4 vital elements assist to convey cell wallets and contactless funds to the best doable extent: client consciousness, infrastructure, safety and privateness, and service provider acceptance. After you have handled these points, there isn’t any doubt that cell wallets have a promising future.

About Creator

Natasha Service provider is specialised in content material advertising and marketing and she or he has been doing it for greater than 6 years. She loves creating content material advertising and marketing maps for companies and has written content material for numerous publication web sites.

At current, she helps SaaS Purchase to enhance on-line visibility with the assistance of search engine optimization, Content material Advertising & Hyperlink Constructing. natasha@saasbuy.com