Introduction to Account Reconciliation

Account reconciliation is the crucial means of evaluating your normal ledger with inner and exterior sources. Every stability ought to match its corresponding entry within the normal ledger for any supply. Matching and validating entries would imply knowledge consolidation throughout sub-ledgers, vendor invoices, financial institution statements, receipts, and account receivables to make sure well timed and correct month-end and year-end closing of the monetary books.

With disconnected knowledge sources and innumerable documentation, accounting groups can face the added job of figuring in rates of interest, alternate charges, and timing variations to reconcile balances successfully. Account Reconciliation could be a pretty guide job, particularly proper earlier than the month-to-month shut.

Automated Accounts Reconciliation software program like Nanonets can cohesively consolidate all knowledge sources on one platform, automate the matching logic throughout exterior knowledge sources and normal ledgers, successfully present an audit path, and preserve the method clear for the accounting group personnel concerned.

Varieties of Account Reconciliation

This information will show you how to perceive the totally different sub-groups of account reconciliation actions organizations encounter.

Financial institution Reconciliation

Because the title suggests, it entails evaluating the ledger balances to the financial institution statements. Financial institution service charges, deposits in transit, excellent checks, and rates of interest have to be factored into the reconciliation course of.

Vendor Reconciliation

Vendor statements are reconciled with accounts payable to make sure all of the funds are accounted for and according to the documentation.

Inter-Firm Reconciliation

Reconciliation means of transaction quantities between entities belonging to the identical dad or mum firm. Companies with many divisions, subsidiaries, and franchises usually face this kind of account reconciliation.

Credit score Card Reconciliation

Evaluating firm bank card receipts with bank card statements is essential to make sure that all transactions are precisely recorded.

Money Reconciliation

Verifying that the money stability in firm books or registers coincides with money at hand to detect worker theft and fraud.

Enterprise-Particular Reconciliation

Reconciling particular enterprise transactions, akin to price of products offered or stock valuation, to make sure that all transactions are precisely recorded and accounted for.

Why is Account Reconciliation so Vital?

Account reconciliation is crucial to making sure the accuracy and integrity of economic reporting. It additionally helps stop and detect theft and fraud earlier, helping organizations to adjust to monetary rules such because the Sarbanes-Oxley Act (SOX), which mandates that publicly traded firms set up inner controls and procedures for monetary reporting.

Account reconciliation additionally helps enhance transparency and visibility all through the monetary shut course of. It reduces the chance of misstatement, which hinders a quicker monetary shut, which is crucial for decision-making and stakeholders.

The corporate”s belongings are protected through the inner management division, which bases its work on account reconciliations. Retaining monitor of the precise documentation through the audit course of will help scale back the effort and time required for auditors to confirm monetary statements.

General, correct reconciliation is crucial for sustaining a enterprise’s monetary well being. It helps detect and proper errors, making certain dependable monetary statements and compliance with rules.

Steps within the Account Reconciliation Course of

The reconciliation course of ensures every entry of the final ledger matches the corresponding exterior documentation. Account reconciliation typically occurs on the finish of each reporting interval, which normally is month-to-month.

The crucial steps in reconciling your accounts contain:

- Decide the Accounts to Reconcile: Determine the final ledger accounts that must be reconciled, akin to money, accounts receivable, accounts payable, stock, and stuck belongings.

- Collect Needed Information: Gather all related supporting documentation, akin to financial institution statements, vendor invoices, buyer statements, and inner accounting information.

- Examine Information: Examine the final ledger balances with the supporting documentation to determine discrepancies or variations.

- Examine Discrepancies: Examine the causes of any discrepancies, akin to timing variations, lacking transactions, or errors in recording.

- Make Changes: Make mandatory changes to the final ledger to right the discrepancies and make sure the accounts are precisely reconciled.

- Doc the Course of: Doc the reconciliation course of, together with the steps taken, the discrepancies recognized, and the changes made. Retain all supporting documentation.

- Repeat Often: Carry out account reconciliations frequently, akin to month-to-month or quarterly, to make sure the continued accuracy and integrity of the monetary information.

Decide the Accounts to Reconcile

Collect Needed Information

Examine Information

Examine Discrepancies

Make Changes

Doc the Course of

Repeat Often

What Occurs With no Correct Account Reconciliation Course of?

With no correct account reconciliation course of in place, accounting groups can run into various issues; a few of them are listed down as to why account reconciliation is important.

- Inaccurate monetary statements: Your organization may face potential authorized points resulting from less-than-timely and incorrect monetary statements, which might additionally result in flawed decision-making concerning monetary knowledge.

- Issue in error decision: With no correctly documented and structured reconciliation course of in place, it may be very troublesome to resolve errors successfully.

- Elevated Time and Useful resource Necessities: As your organisation grows, extra balances are supposed to be reconciled with their exterior documentation. This could imply larger useful resource necessities and a rise within the likelihood of human guide errors.

- Delayed Fraud Detection: Unauthorised bank card exercise, duplicate checks, and different fraudulent actions may go unnoticed resulting from ineffective account reconciliation.

Therefore, well timed and correct account reconciliations are key to enabling your decision-makers and stakeholders to make correct monetary selections. They’re additionally necessary in adhering to compliance points and ensuring a clear audit path is in place for future benchmarking functions.

Challenges With Handbook Account Reconciliation and Excel

Accounting Reconciliations are the principle bottleneck within the monetary shut course of. With disconnected knowledge sources and improper documentation, guide, heavy transaction matching will be susceptible to human error. Accounting corporations usually spend 2-3 days on common doing guide reconciliations.

When many accounts should be analyzed, which suggests stability matching throughout totally different knowledge sources, it may be daunting for accounting groups when challenged with out improper supporting documentation in place.

Think about a situation the place your group has to reconcile a whole lot of transactions from numerous sources, together with financial institution statements, bank card statements, vendor invoices, and inner ledgers. Because the monetary shut deadline approaches, the group faces a number of challenges:

Quantity of Transactions: The sheer quantity of transactions is overwhelming. Every transaction have to be matched manually, which is time-consuming and tedious.

Information Discrepancies: Inconsistencies and discrepancies typically come up between totally different knowledge sources. Figuring out and resolving these discrepancies requires important effort and a spotlight to element.

Human Error: Handbook reconciliation is susceptible to human errors. Information entry, matching, or interpretation errors can result in incorrect monetary statements.

Restricted Assets: The accounting group is restricted in dimension and sources. Because the deadline approaches, the stress will increase, resulting in potential burnout and an elevated probability of errors.

Complicated Reconciliation Guidelines: Some transactions contain complicated reconciliation guidelines and a number of steps, additional complicating the guide course of.

Lack of Actual-Time Visibility: The group lacks real-time visibility into the reconciliation standing, making it troublesome to trace progress and determine bottlenecks.

Excel spreadsheets are typically thought of the go-to software on the subject of accounting reconciliations; nevertheless, when confronted with the above-mentioned points, they, too, face an absence of:

- Single supply of knowledge: No single repository for supporting calculations and feedback. Managing totally different spreadsheets and retaining monitor throughout model controls can results in errors.

- Closely guide: Excel nonetheless doesn’t have any workflow automation capabilities, audit trails, or a database to depend on. Efficient decision of errors remains to be time-consuming and outdated.

How does Automation Remodel the Account Reconciliation Course of?

Implementing an automatic reconciliation software program like Nanonets can considerably resolve these challenges.

- Effectivity and Pace: Automated methods can course of and match transactions at a a lot quicker charge than guide strategies. As quickly as ledger and supporting documentation entries are uploaded for reconciliation, the software program extracts knowledge from pdfs, arranges the information into predefined templates and tries to match every stability with its corresponding entry.

- Accuracy and Consistency: By automating guide matching of balances utilizing Machine Studying algorithms, automated software program can obtain larger accuracy on transaction matching which reduces the chance of human error. Automated account reconciliation software program use predefined guidelines to match and guarantee dependable outcomes.

- Actual-Time Processing: Retaining the reconciliation course of up-to-date can imply successfully resolving any errors that happen with immediate workflow automation capabilities. Accounting groups can scale back the workload proper earlier than the month-to-month shut by reconciling entries in actual time and assigning resolutions to entries that didn’t reconcile as and after they have been processed.

- Scalability: Automated Reconciliations are extremely scalable, which suggests as your necessities enhance the software program is ready to adapt with the upper want in demand. Versus doing this manually, it could imply hiring extra sources to do it manually. Additionally means, accounting groups can allocate their sources successfully by automating routine and repetitive duties they’ll deal with larger worth actions.

Automate Account Reconciliation on Nanonets

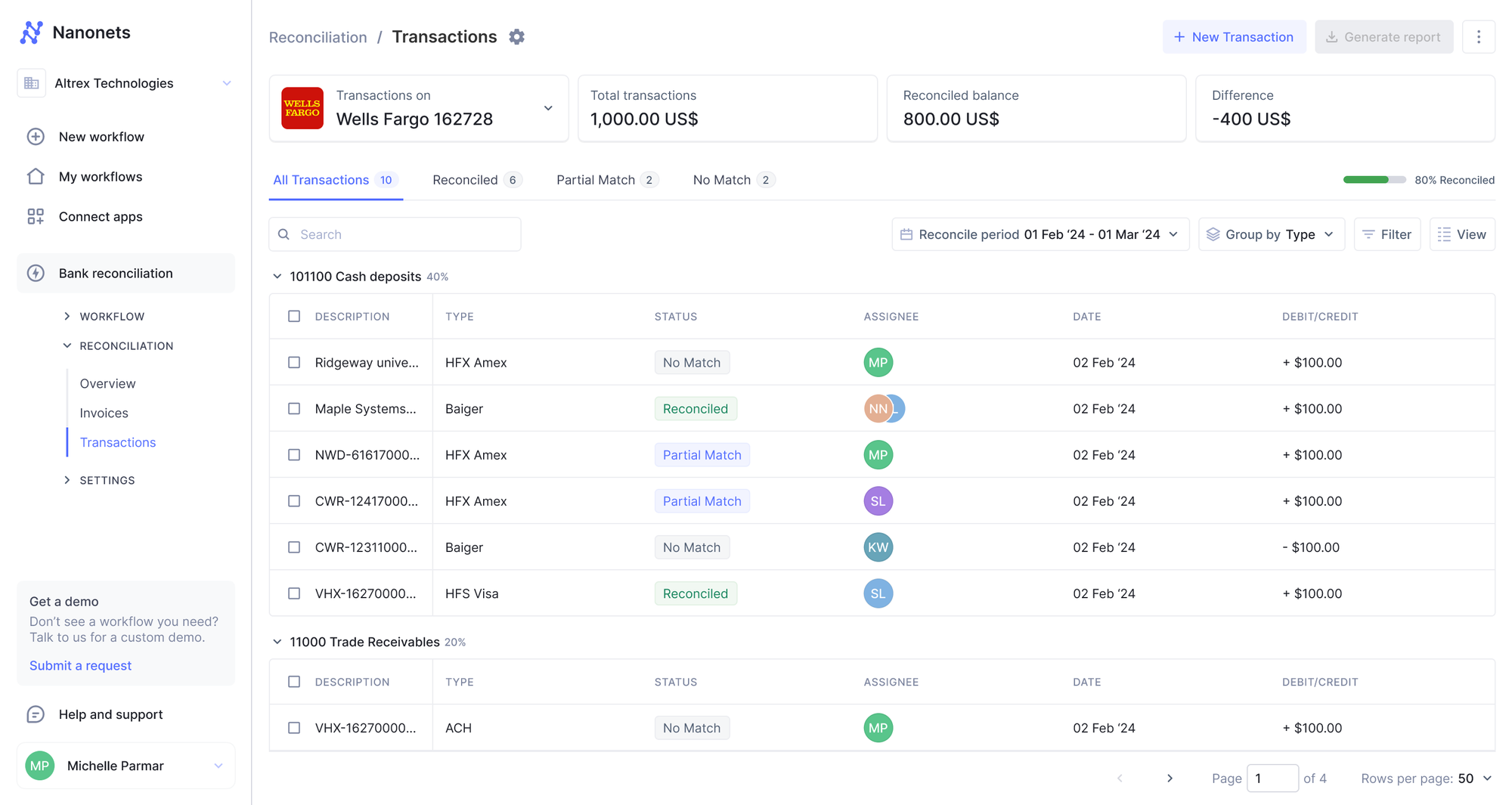

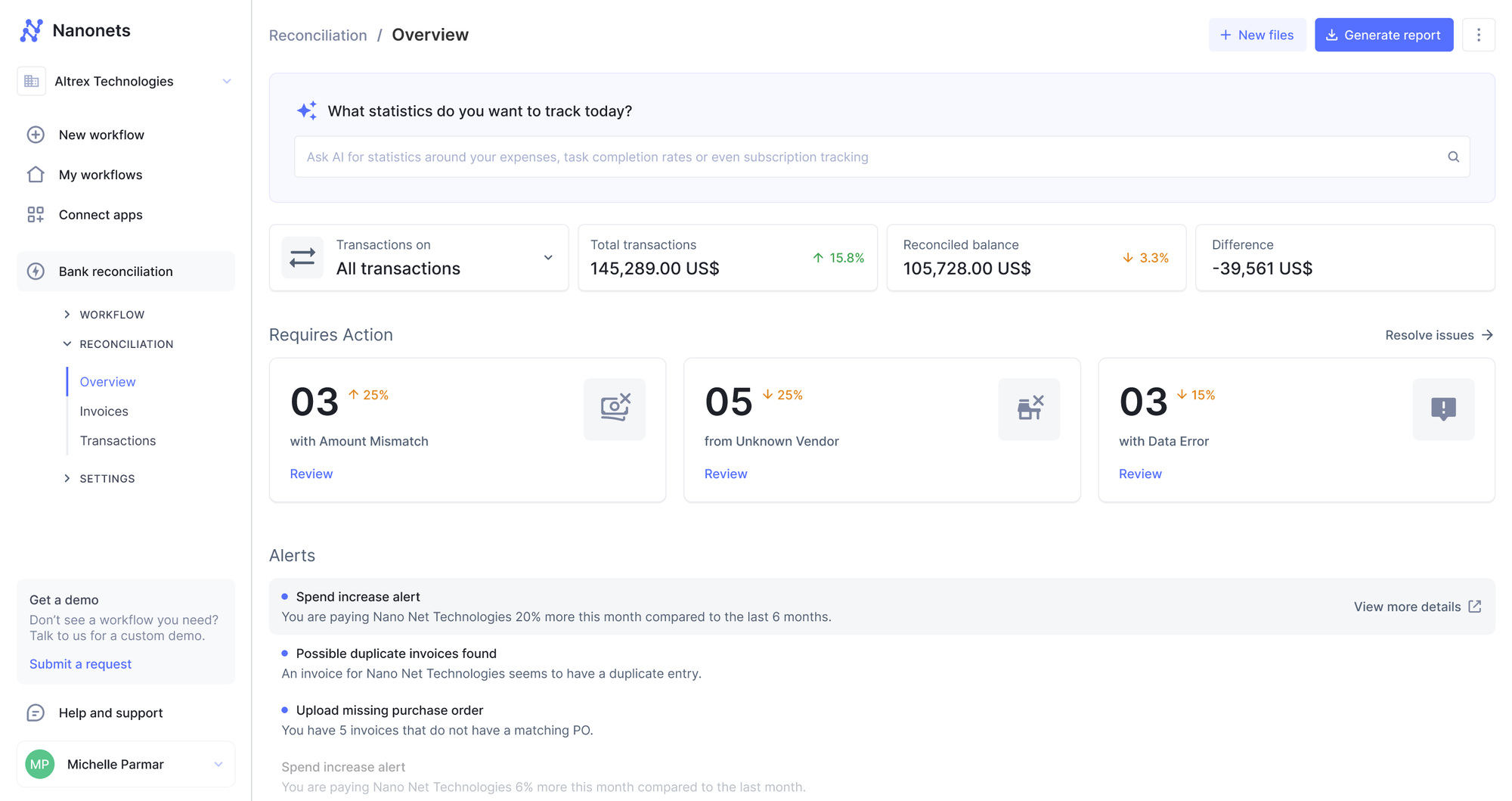

Nanonets presents a complete resolution for automating account reconciliation by addressing the important thing ache factors confronted by accounting groups. Here is how customers can leverage Nanonets to streamline their reconciliation processes:

Consolidated Information Sources in One Platform

Nanonets can combine seamlessly with numerous knowledge sources, permitting customers to consolidate all their transaction knowledge in a single platform. This consists of financial institution statements, bank card statements, vendor invoices and ledgers.

Nanonets can entry these information obtained through e-mail, integration with banks, or accounting instruments to instantly pull this knowledge on the platform.

Automated Transaction Matching Utilizing NLP Strategies

Nanonets makes use of superior Pure Language Processing (NLP) strategies to match transactions routinely. The system can:

- Determine Related Transactions: Even when the descriptions or codecs differ, NLP helps acknowledge comparable transactions throughout totally different sources.

- Deal with Variations in Information: The system can perceive and match transactions regardless of variations in descriptions, quantities, and dates.

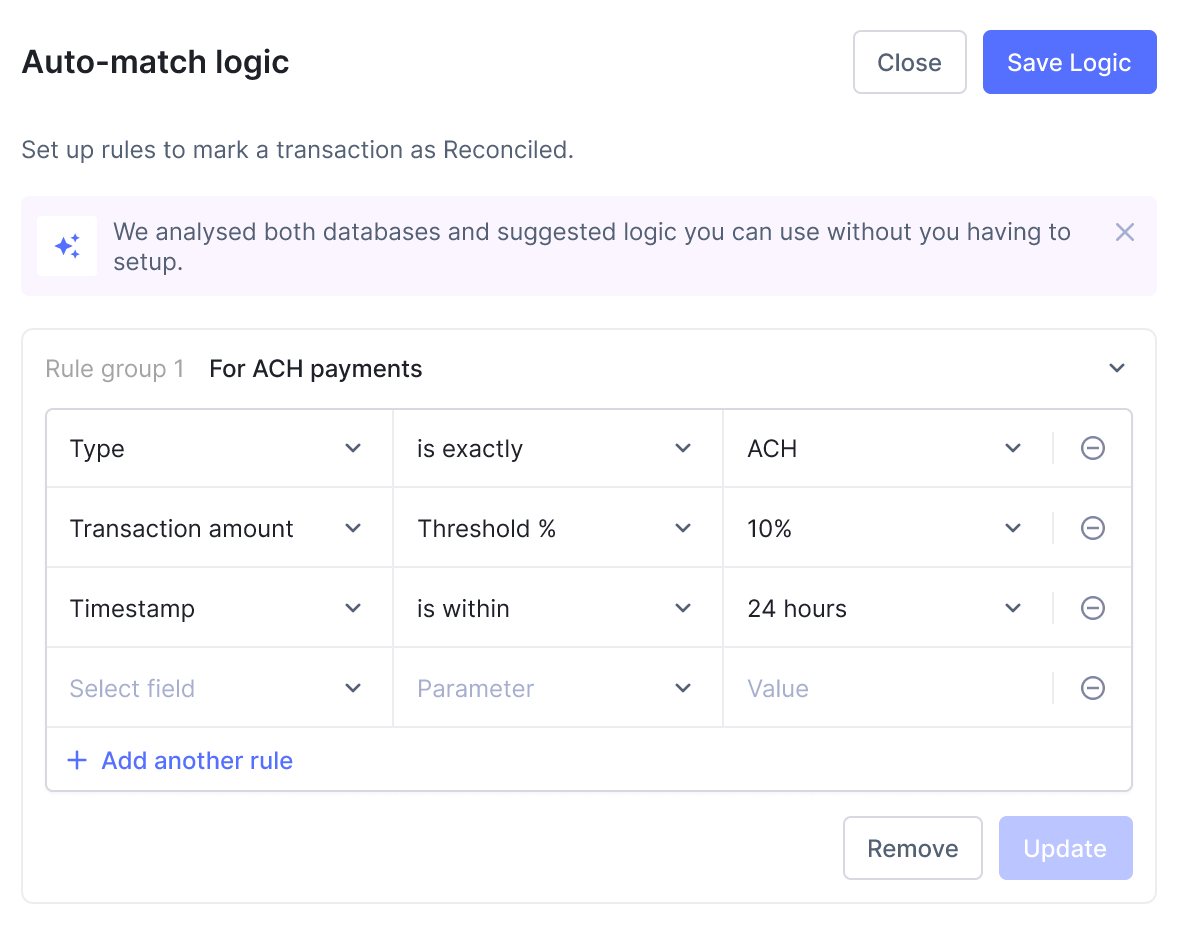

Customizable and Complicated Guidelines for Personalized Matching

Customers can outline and customise complicated reconciliation guidelines to swimsuit their particular wants. Nanonets permits:

- Rule-Based mostly Matching: Create guidelines based mostly on transaction sorts, quantities, dates, and descriptions.

- Customized Filters: Apply filters to deal with particular transactions or accounts.

- Multi-Step Matching: Implement multi-step reconciliation processes for complicated situations.

Steady Studying with AI for Increased Accuracy

Nanonets’ AI repeatedly learns from user-defined guidelines and previous reconciliation processes. This ends in:

- Improved Accuracy: The system turns into extra correct over time, decreasing the necessity for guide intervention.

- Adaptive Studying: AI adapts to modifications in transaction patterns and consumer preferences, enhancing its effectiveness.

Information Extraction Capabilities

Nanonets excels at extracting knowledge from numerous paperwork, together with:

- E-mail Attachments: Mechanically extract transaction knowledge from invoices and statements obtained through e-mail.

- Uploads: Customers can instantly add paperwork to the platform for knowledge extraction.

- Integration with Different Instruments: Seamlessly pull knowledge from different accounting instruments and methods.

Cohesive Dashboard for Abstract and Insights

Nanonets supplies a cohesive dashboard that summarizes the complete account reconciliation course of. Options embrace:

- Actual-Time Updates: Get real-time insights into the reconciliation standing.

- Abstract Views: Overview of matched and unmatched transactions.

- Detailed Reviews: Entry detailed reviews and drill down into particular transactions for in-depth evaluation.

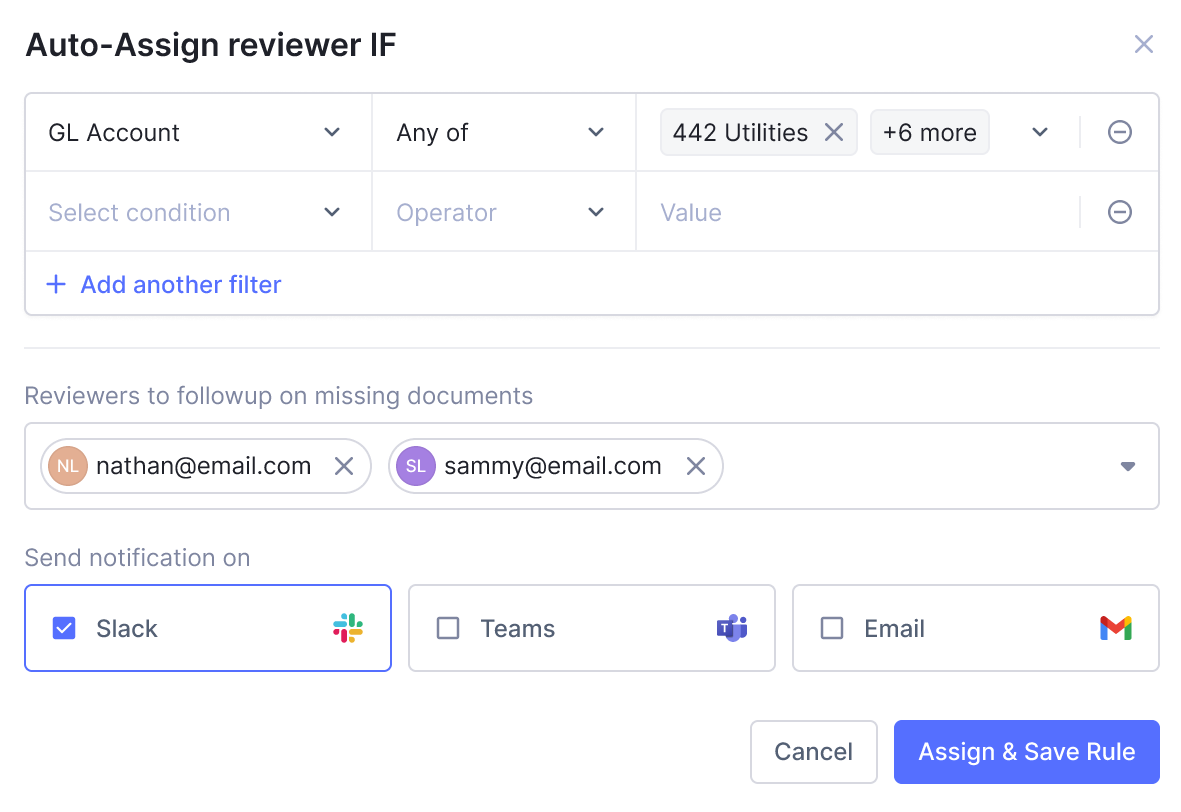

Triggering Workflows for Unmatched Balances

To make sure well timed decision of unmatched balances, Nanonets can set off automated workflows:

- Alerts and Notifications: Ship alerts for unmatched transactions to designated group members.

- Job Assignments: Mechanically assign duties to resolve discrepancies.

- Observe-Up Actions: Schedule follow-up actions and reminders to make sure discrepancies are addressed promptly.

Instance Reconciliation Workflow on Nanonets

A number one US-based retailer processing roughly 2 million transactions month-to-month confronted important challenges of their account reconciliation course of earlier than utilizing Nanonets.

The challenges they confronted have been primarily

- Extremely guide course of

- Massive accounting group

- Complicated evaluate course of

- Delayed monetary closing

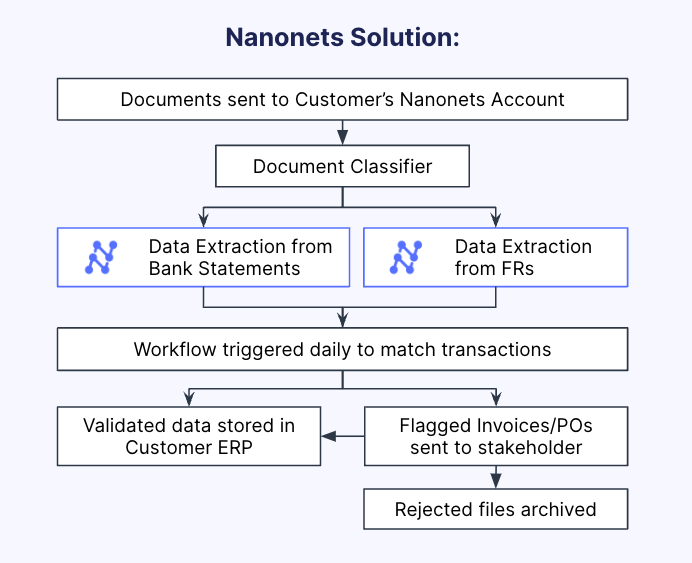

Nanonets Answer

To handle these points, the retailer carried out Nanonets’ automated reconciliation resolution. Right here’s how Nanonets remodeled their reconciliation course of:

- Information Consolidation and Extraction:

- Doc Sorts: The system dealt with financial institution statements and monetary information.

- Quantity: Effectively processed 2 million transactions per thirty days.

- Doc Classifier: Mechanically labeled and extracted knowledge from incoming paperwork, considerably decreasing guide knowledge entry.

- Automated Workflows:

- Day by day Matching: Nanonets triggered every day workflows to match transactions in opposition to financial institution statements and monetary information.

- Flagging and Notification: Invoices and buy orders (POs) that required consideration have been flagged and despatched to related stakeholders.

- Seamless Integration:

- ERP Administration: Validated knowledge was seamlessly saved within the retailer’s ERP system.

- Rejected Information: Any rejected information have been archived, making certain no knowledge was misplaced and all discrepancies have been documented for evaluate.

Buyer Impression

The implementation of Nanonets resulted in important enhancements throughout numerous metrics:

- 75% Time Saved: The Automation of the reconciliation course of saved the finance division 75% of the time beforehand spent on guide reconciliation.

- 10X Quicker Turnaround: The velocity of processing and matching transactions elevated tenfold, enabling faster monetary closings and well timed decision-making.

- 95% Discount in Handbook Effort: Automation drastically lowered the guide effort in knowledge extraction, classification, and matching, permitting the finance group to deal with extra strategic duties.

- Price Financial savings: Decreasing doc dealing with, guide knowledge entry, and error prices led to substantial effectivity good points. Whereas not quantified right here, extra advantages included larger knowledge visibility and the efficient use of structured knowledge for evaluation and reporting.

By leveraging Nanonets, the retailer not solely streamlined their reconciliation course of but additionally achieved larger accuracy, quicker turnaround instances, and important price financial savings. This case examine demonstrates the highly effective affect of automated reconciliation and the way Nanonets could be a game-changer for large-scale transaction administration within the retail trade.