What’s Stability Sheet Reconciliation?

What’s a Stability Sheet?

A steadiness sheet is a monetary assertion that gives a snapshot of an organization”s monetary place at a selected cut-off date. Stability sheet reconciliation is a vital monetary course of that aligns the monetary statements with exterior documentation akin to financial institution statements, invoices, and basic ledger entries.

What’s Stability Sheet Reconciliation?

Stability sheet reconciliation resolves any discrepancies within the monetary statements with exterior documentation in order that firms adhere to accounting requirements and mirror their precise monetary place.

By doing common steadiness sheet reconciliations, monetary groups can tackle fraudulent exercise, detect errors, and resolve discrepancies promptly. Correct and well timed monetary reporting is essential in sustaining belief with stakeholders and making knowledgeable enterprise choices.

Challenges of Stability Sheet Monetary Shut

The reconciliation course of in the course of the monetary shut may be difficult for finance groups resulting from disconnected knowledge sources, a scarcity of automation, and the sheer quantity of transactions. When confronted with points like complicated knowledge, finance groups could make human errors and inconsistencies since handbook knowledge entry will increase errors, transposition errors, and lacking transactions. This would possibly result in potential monetary losses and incorrect reporting. It’s estimated that handbook reconciliation can result in an further 5-7 enterprise work days of error rectification and bookkeeping, issues that may be solved by way of automated reconciliation software program like Nanonets.

Guide reconciliation processes are extra complicated when steadiness sheet transactions require reconciliation throughout a number of basic ledgers, ERPs, invoices, and financial institution accounts. These contain an incredible quantity of labor to be managed on spreadsheets. There are particular checklists you can, nevertheless, observe to do handbook reconciliations throughout your steadiness sheets.

Finance groups may also observe particular templates designed to reconcile their steadiness sheets manually. These contain check-marking, the power to regulate balances, and documenting any findings in the course of the steadiness sheet reconciliation course of.

How you can Reconcile Stability Sheet Accounts

Throughout steadiness sheet reconciliation there are a number of steps that we have to guarantee out of your finish with the intention to efficiently reconcile your entries:

- Establish the accounts that should be reconciled:

First, we have to determine which accounts should be reconciled. These might be steadiness sheet accounts like money, accounts payable, accounts receivables, bank cards, and so on. - Collect Supporting Documentation:

Gathering mandatory paperwork like financial institution statements, sub-ledger entries, vendor invoices, cost schedules, and different monetary information. - Examine Balances:

Examine the balances within the steadiness sheet with the supporting monetary doc. These imply matching every quantity line by line, noting down the precise date and time of the transactions. - Categorize Variances:

Notice any variations between the steadiness sheet quantities and the supporting documentation. These variations are variances that should be investigated additional. There can 3 main kinds of variances:- Timing Variations:

These happen when transactions are recorded in several intervals within the steadiness sheet and supporting paperwork. For instance, a financial institution deposit recorded within the firm’s books on the finish of the month may not seem on the financial institution assertion till the subsequent month. - Errors:

These can embody knowledge entry errors, incorrect quantities, or misclassifications. - Unrecorded Transactions:

Transactions which have occurred however haven’t but been recorded within the steadiness sheet.

- Timing Variations:

- Resolve Points:

After you have recognized the foundation explanation for a discrepancy, take the mandatory steps to resolve it. This may increasingly contain adjusting the overall ledger, journal entries, or different accounting information. - Doc Findings:

Doc your findings and any modifications made to the overall ledger or journal entries. This helps controllers, auditors, and different professionals observe down any modifications and accelerates future reconciliations by figuring out and documenting recurring points

Stability Sheet Account Reconciliation Instance

We’ve added an instance of what reconciliation would possibly seem like for reconciliation between an organization’s financial institution assertion and its inner documentation or firm books:

Month Ended Might 31, 2024

| Merchandise | Quantity |

|---|---|

| Money steadiness as per financial institution assertion, 5/31/2024 | $20,000 |

| Add: Deposit in transit | $3,000 |

| Adjusted money steadiness | $23,000 |

| Deduct: Excellent checks | $1,500 |

| Adjusted money steadiness | $21,500 |

| Money Stability per books, 5/31/2024 | $21,500 |

| Add: Curiosity | $50 |

| Adjusted money steadiness | $21,550 |

| Deduction: Month-to-month service price | $50 |

| Adjusted money steadiness | $21,500 |

The place to begin for the reconciliation assertion is the money steadiness as per the financial institution assertion for the interval (right here 5/31/2024) – this marks the quantity that the financial institution stories on the finish of the interval. The quantity that we notice over right here is $20,000.

Notice the steadiness as per the books recorded by your organization on the finish of the interval. Profitable reconciliation implies that your organization’s books and the financial institution assertion report the identical quantity. We notice this to be $21,500 as of 5/31/2024.

Deposits in transit report entries which were marked as acquired by the corporate however have not been recorded within the financial institution but. Since these deposits are sometimes made close to the top of the interval, they’re sometimes mirrored within the subsequent interval. The adjusted financial institution steadiness right here turns into $23,000.

Excellent checks are entries issued by your organization however haven’t been deducted by the financial institution but. For the reason that financial institution has not but recorded them, we should subtract these entries. $23,000 – $1,500 = $21,500.

Any curiosity that your organization earns contained in the financial institution won’t be recorded by your books. We might want to add the curiosity to the steadiness as per the books, which comes out to $22,000.

The financial institution fees Month-to-month service charges for sustaining the account, which can not have been recorded by the corporate but. The service price must be deducted from the steadiness per the books. So ultimate adjusted money steadiness is $21,500, which implies a profitable reconciliation!

Challenges with Guide Stability Sheet Reconciliations

Finance groups are confronted with plenty of challenges once they select to manually reconcile their steadiness sheets. These result in inaccuracies and hinder the effectivity of the over reconciliation course of and poor monetary reporting. Particularly these are the problems you can come throughout:

- Human Error:

Guide reconciliations are error inclined resulting from to excessive knowledge volumes, time constraints and unintentional errors. - Scalability Points:

As your organisation grows, the volumes and complexities which contain handbook decision will increase quickly. This would possibly result in larger potential points. - Time Consumption:

Guide reconciliation entails compiling, validating and processing knowledge throughout spreadsheets which may delay instant and well timed reconciliations. - Disconnected Knowledge sources:

When confronted with a number of knowledge sources like ERPs, financial institution statements, vendor invoices and sub-ledger entries, consolidating all the info at one place may also show to be main hindrance. - Inadequate Documentation:

If the reconciliation course of lacks complete and well-documented explanations, auditors could battle to know the intricacies of the method, doubtlessly elevating doubts in regards to the accuracy of reported figures - Time Consumption:

Guide reconciliation entails in depth time spent on compiling, validating, and processing knowledge by spreadsheets, which may delay instant duties and hinder forward-looking enterprise planning - Spreadsheets throughout stakeholders:

Whereas your finance group would possibly contain high tier spreadsheet wizards, they’re error inclined and may result in inaccurate monetary knowledge. In accordance with a research by IBM, 88% of all spreadsheets include at the least one error.

Automated Stability Sheet Reconciliation with Nanonets

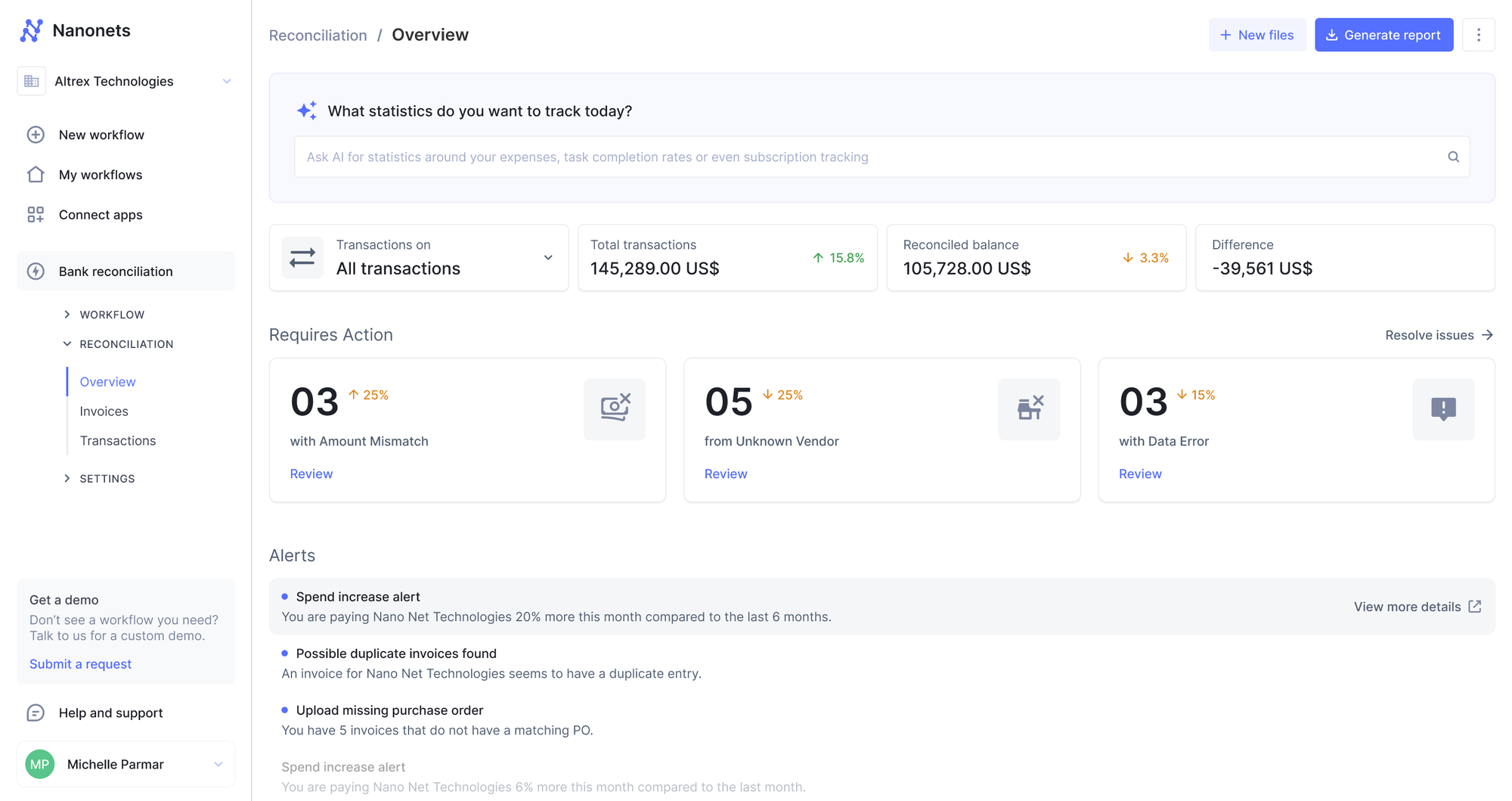

Automated Reconciliation software program like Nanonets may help seamlessly remedy the account reconciliation drawback involving steadiness sheets. Nanonets provides quite a few advantages for steadiness sheet reconciliation, making the method extra environment friendly, correct, and streamlined. Listed below are some key benefits:

Elevated Effectivity and Pace

Nanonets can course of giant volumes of transactions shortly, considerably lowering the time spent on manually reconciling every transaction entry individually.

Organizations have reported that AI knowledge entry can automate as much as 95% of repetitive knowledge duties. This frees up worker time for higher-value work.

So even when your transaction information should not imported into spreadsheets, you’ll be able to straight add them on Nanonets for knowledge extraction and consolidation.

Streamlined Workflows

Since Nanonets is a workflow automation platform, repetitive duties are automated and accounting instruments are built-in cohesively inside the Nanonets platform. This solves the problems of disconnected knowledge sources and time wasted handbook duties.

By automating the reconciliation course of end-to-end, automated reconciliation software program like Nanonets improves accuracy, reduces errors, and offers invaluable insights into an organization’s monetary well being

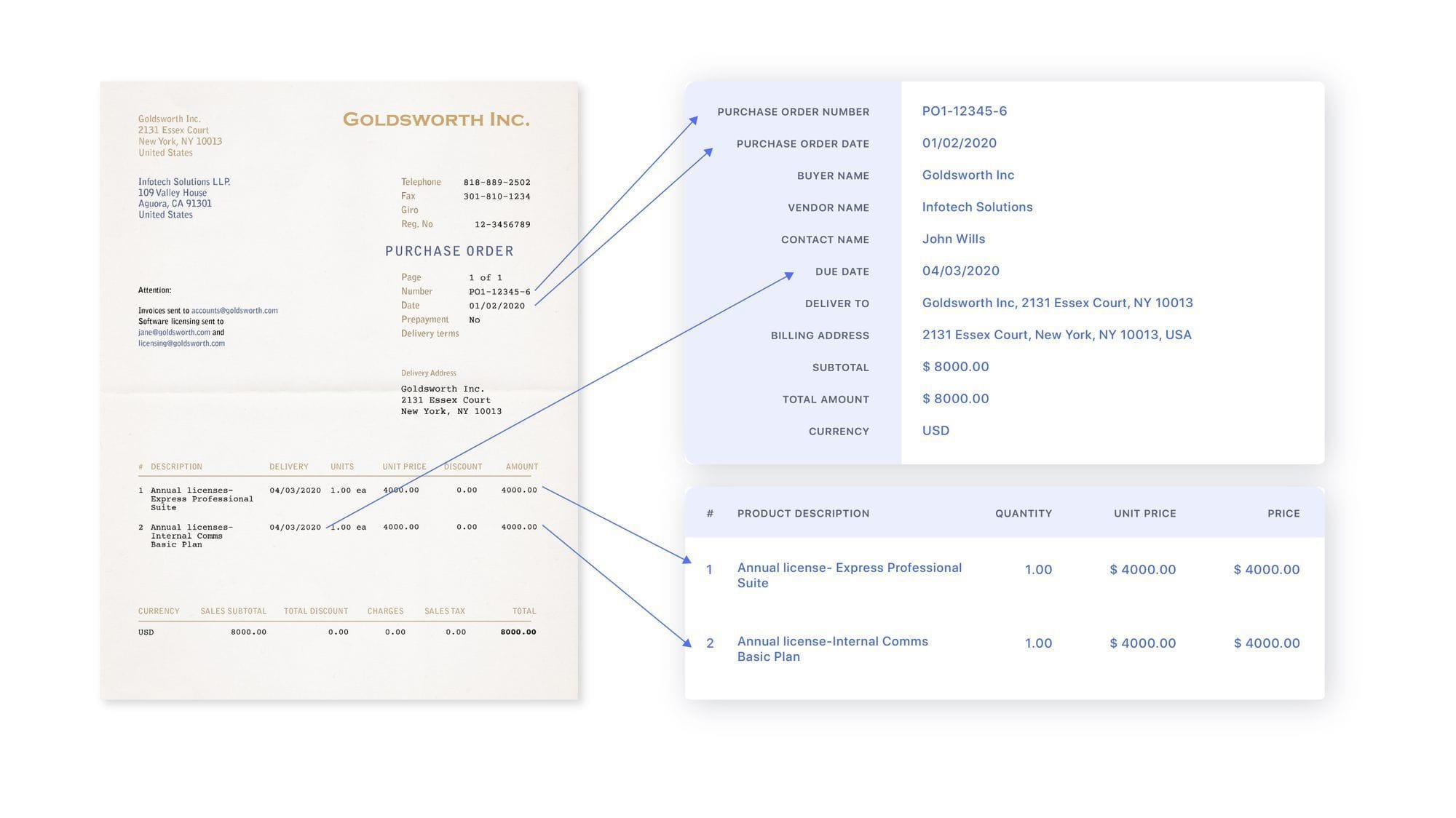

Automated Transaction Matching

Nanonets’ Clever Doc Processing is skilled on 1M+ paperwork to leverage automated matching of transaction entries. This imply these transactions are recognized as the perfect match based mostly on column names, date, quantity and so on making certain 95% accuracy. When these algorithms fail Nanonets tries to make a match utilizing fuzzy matching capabilities as a failsafe.

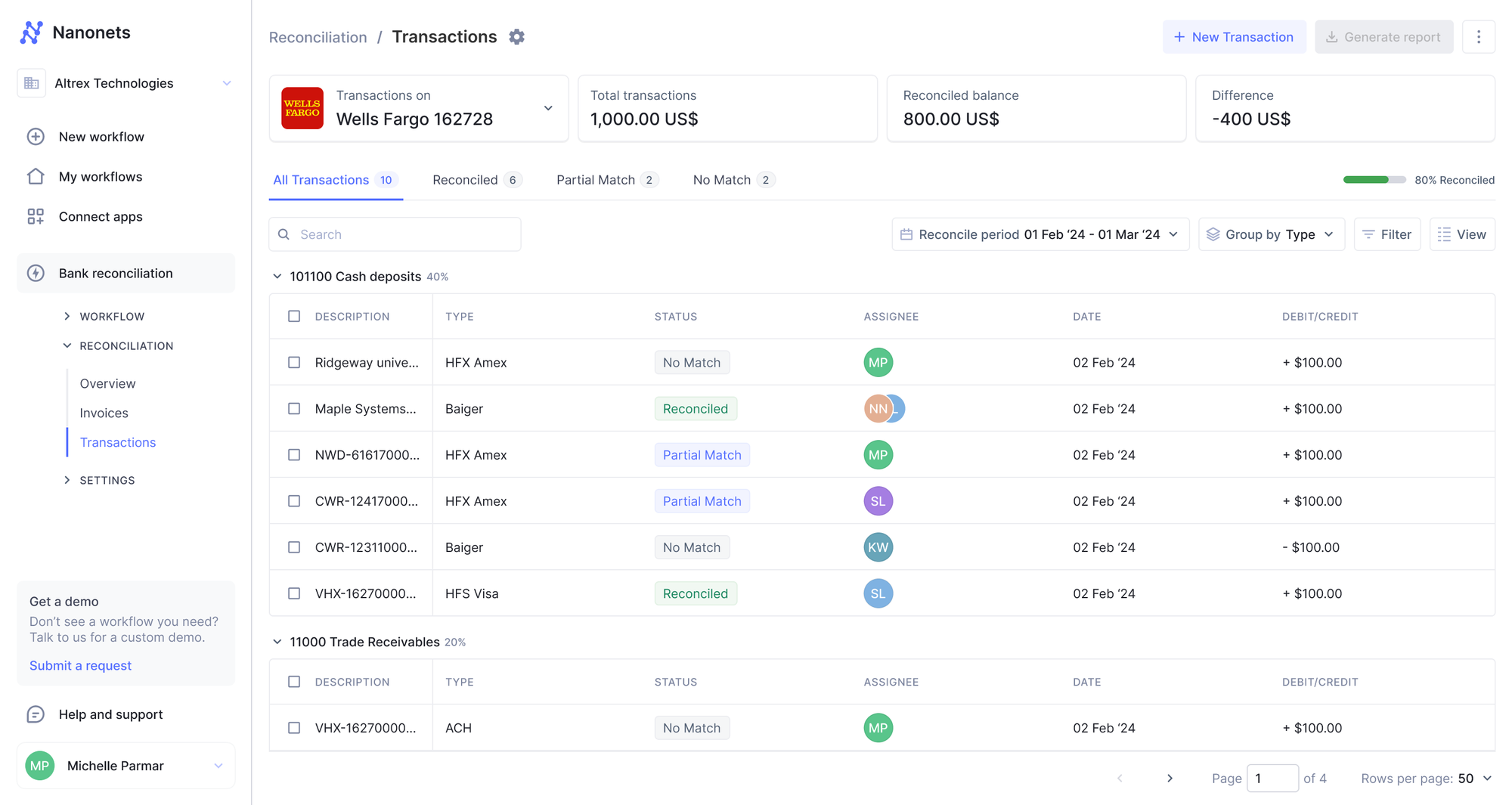

Enhanced Visibility and Management

Fixing the issue of retaining observe between a number of spreadsheets, Nanonets’ platform offers a consolidated report of all of your account reconciliation statements in a single place. This implies one report back to abstract a number of monetary paperwork like ERP’s, financial institution statements, vendor invoices and sub ledger entries.

In abstract, automated reconciliation software program like Nanonets enhances the effectivity, accuracy, and total effectiveness of the steadiness sheet reconciliation course of, offering important benefits over handbook strategies.

FAQs

Why Do We Solely Reconcile Stability Sheet Accounts?

Stability sheet accounts are reconciled extra steadily as a result of they’re thought of everlasting (or steady) accounts, that means they carry balances over from one accounting interval to the subsequent.

How Usually Ought to We Reconcile Stability Sheet Accounts?

Stability sheet accounts are often reconciled on a timeline that coincides with both the month-end shut or much less frequent monetary shut. This implies they are often executed as typically as month-to-month however are often executed quarterly or yearly

What Is the Position of Stability Sheet Reconciliation within the Monetary Shut Course of?

Stability sheet reconciliation is a necessary a part of closing the books as a result of it ensures that the Workplace of the CFO is working with correct knowledge. In any other case, you would possibly finalize your monetary statements with out accounting for essential errors that might skew the outcomes considerably