In a nutshell: The electrical car revolution kicked into greater gear within the first quarter of 2024, with international EV gross sales leaping 18% in comparison with the identical interval final yr. However whereas that double-digit progress seems spectacular on paper, there are some regarding undercurrents rumbling beneath the floor.

The most recent Counterpoint report has revealed that the largest driver of Q1’s gross sales surge is plug-in hybrid electrical automobiles (PHEVs), which mix a gasoline engine with an electrical motor and battery pack. PHEV gross sales had been up a whopping 46% year-over-year as shoppers had been lured in by their cheaper upfront prices and the flexibility to modify to gasoline for longer drives.

In the meantime, gross sales of pure battery electrical automobiles (BEVs) elevated at a way more modest 7% clip year-over-year. Demand is softening because the preliminary wave of early adopters has been largely tapped out and cost-conscious mainstream consumers get sticker shock over excessive EV costs.

The slowing BEV gross sales look like inflicting main complications for automakers who’ve sunk billions into creating the following era of electrical vehicles, vehicles, and SUVs. Regardless of the massive investments, some are nonetheless dropping eye-watering quantities of cash on every EV they promote as they wrestle to rein in manufacturing prices.

Final month, Ford’s EV division alone reported a staggering $1.3 billion loss in Q1 whereas delivering simply 10,000 automobiles – a $132,000 loss per automobile. It is no surprise Ford and others have been scaling again formidable BEV targets and pushing more durable into the extra profitable PHEV market as a stopgap resolution.

The general EV market stays closely tilted in the direction of China, which noticed gross sales spike 28% year-over-year in Q1 and now accounts for over half of world EV gross sales. Within the US, progress was a way more modest 2% as greater costs and financial jitters put a damper on demand.

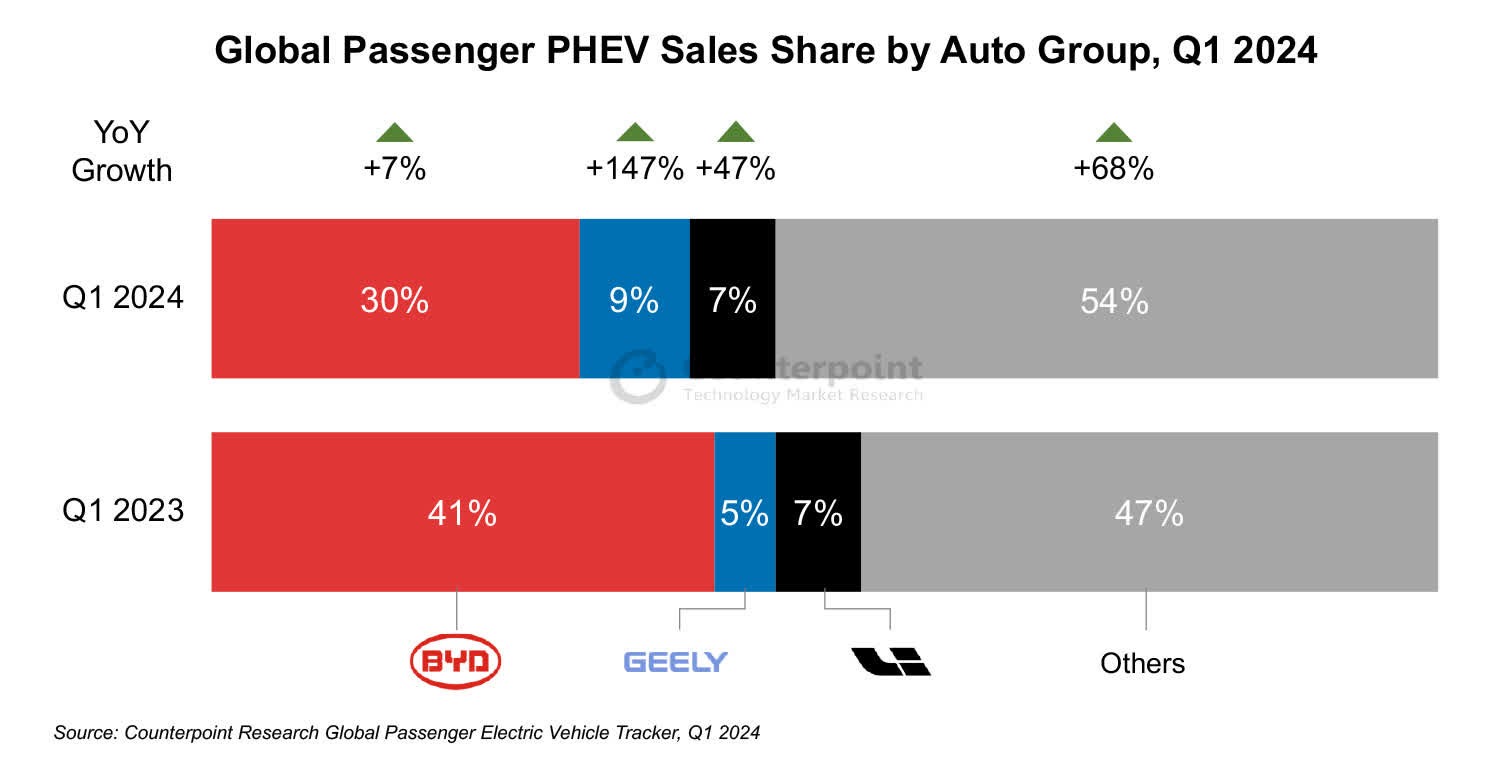

With regards to particular person automakers, there have been some particular winners and losers in Q1. BYD had an enormous quarter, posting 13% BEV gross sales progress globally whereas additionally dominating the PHEV market with an almost one-third share. The Chinese language upstart capitalized on its price benefits to seize main market share, together with exporting nearly 100,000 EVs for 152% year-over-year progress.

In distinction, EV pioneer Tesla noticed its gross sales dip 9% year-over-year regardless of regaining the general BEV gross sales crown with a 19% market share. Tesla has been aggressively slashing costs to maneuver steel, and it lately introduced main layoffs impacting over 10% of its international workforce because it seems to chop prices.

The general outlook for the remainder of 2024 stays cloudy. Whereas continued progress is predicted, analyst Liz Lee warns “indicators of a slowdown additionally loom and the annual progress might dip beneath 20%.”