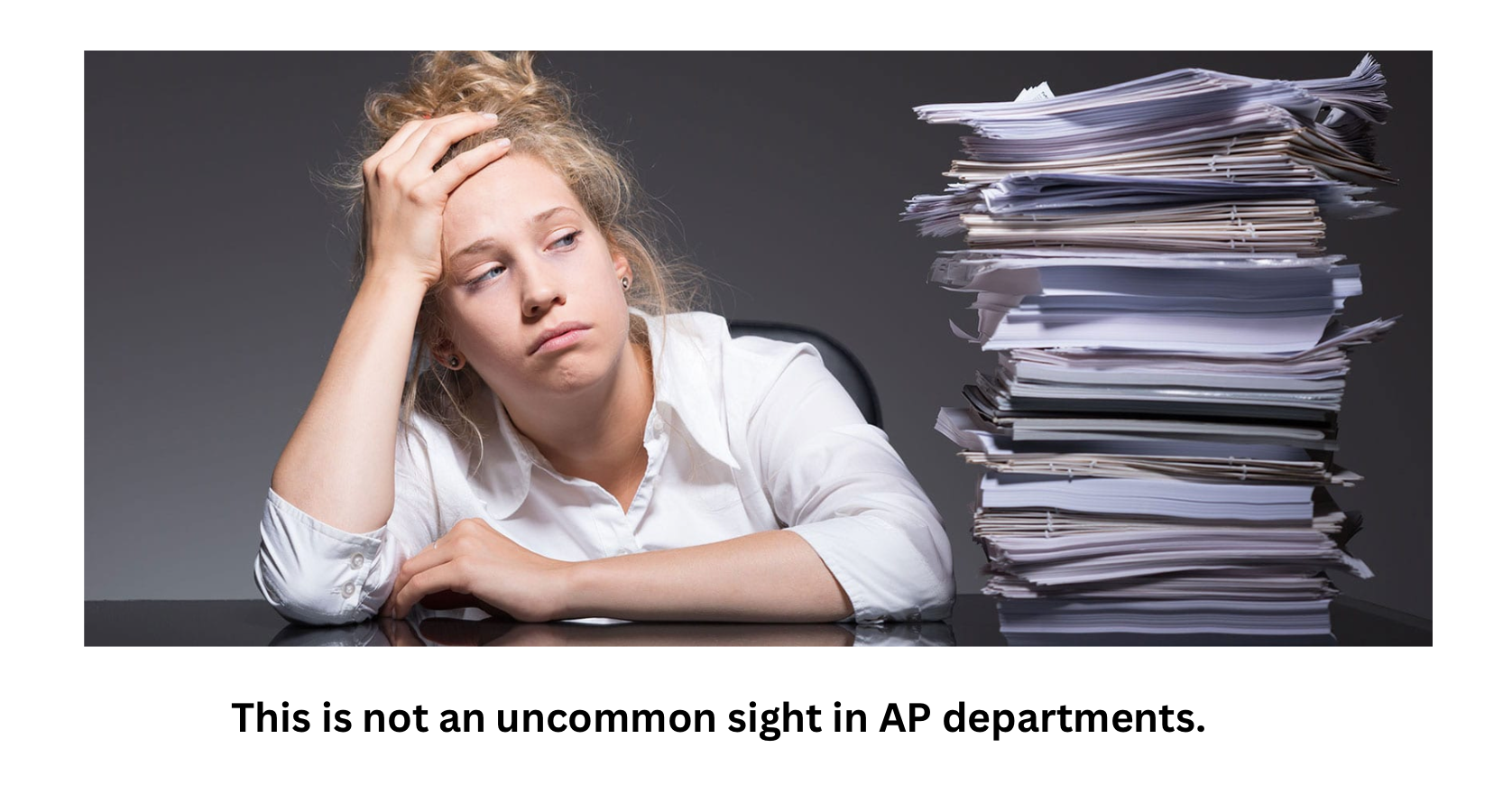

Finance groups are effectively conscious of the tedious and error-prone nature of handbook accounts payable processes. Sorting by stacks of paper invoices, reaching out to approvers individually, and mailing checks are extraordinarily tedious and error-prone. This might additionally result in late funds or in some circumstances potential vendor fraud.

At this time, you may automate these processes utilizing accounts payable automation options and optimise accounts payable to your finance groups.

Our weblog cuts by the complexity of AP processes, presenting a transparent pathway to automation in 7 steps.

We are going to focus on the next:

- What’s Accounts Payable?

- What makes Accounts Payable so difficult?

- What’s Accounts Payable Automation?

- 7 Steps to automate your Accounts Payable

- Automate your Accounts Payable with Nanonets

What’s Accounts Payable?

In easy phrases, it is the cash your enterprise owes to suppliers, distributors, or collectors for items or providers obtained however not but paid for. Consider it as your enterprise’s tab: it is a assortment of every little thing you have bought on credit score and have to pay again inside a specified interval. These AP entries are recorded in your stability sheet below present liabilities, and embody a wide range of bills, from stock purchases to utility payments.

💡

Think about you personal a espresso store. You order espresso beans out of your provider, who offers you a 30-day credit score interval. When the beans arrive, you do not pay money upfront; as an alternative, the quantity you owe for these beans is recorded below accounts payable. Inside the subsequent 30 days, you will have to pay your provider the agreed quantity. After getting paid, the quantity is faraway from accounts payable. This method permits your espresso store to function easily without having to have all of the money available in the mean time of receiving the products.

Now, why does accounts payable matter?

- Money Stream Administration: Correct administration of accounts payable ensures that an organization can meet its obligations with out compromising its money place, essential for operational continuity.

- Vendor Relationships: Well timed and correct cost processes strengthen relationships with suppliers, resulting in potential reductions, favorable cost phrases, and a dependable provide chain.

- Monetary Reporting Accuracy: Accounts payable performs a crucial position in guaranteeing the accuracy of economic statements, reflecting the corporate’s monetary well being and obligations.

- Budgeting and Forecasting: It aids in finances administration by offering clear insights into upcoming bills, facilitating extra correct monetary planning and forecasting.

- Regulatory Compliance: Adhering to the phrases of accounts payable helps in complying with monetary rules and avoiding penalties related to late funds or monetary misreporting.

In essence, accounts payable types the spine of your finance operations. It includes staying on high of your obligations, fostering belief together with your suppliers, and finally, maintaining your enterprise working easily.

What makes Accounts Payable so difficult?

It is a query that has lengthy plagued one of the best of finance professionals. Accounts Payable is often seen as a price operate inside firms, and the reason being easy – nobody needs to spend time paying payments and coming into knowledge about invoice funds!

Nevertheless, it’s nonetheless (very a lot) a vital enterprise operate.

The explanation AP is difficult to optimise is de facto as a result of nature of the beast.

The important thing actions in an AP course of (Knowledge extraction, bill coding, ERP sync) are primarily knowledge transformation actions. Automating these can be easy.

Nevertheless, extra importantly, AP work additionally includes human intervention – for overview, approvals and monetary controls.

It’s this combine of information transformation and human enter, that makes AP a notoriously advanced and troublesome course of to optimize.

What precisely are these challenges?

Right here’s a extra detailed have a look at every step of the AP course of, and the place the inherent challenges lie inside every a part of the workflow.

Bill Assortment: Inefficiencies in managing a mixture of digital and paper invoices, resulting in misplaced paperwork and delayed processing.

Knowledge Entry: Guide knowledge entry causes inaccuracies and delays in monetary data and reporting.

Verification: Time-consuming strategy of cross-checking invoices towards POs and supply notes, usually resulting in delayed funds.

Approval: Cumbersome approval course of with challenges in offering context to approvers, monitoring bill standing and guaranteeing well timed authorizations.

Funds: Issue in managing a number of cost phrases, schedules and currencies whereas guaranteeing well timed funds.

Reconciliation: Labor-intensive strategy of matching financial institution transactions with ledger entries.

Dispute Decision: Time-consuming and complicated decision course of for disputes, affecting vendor relationships and operational effectivity.

Guide Accounts Payable is a Confirmed Impediment to Organizational Progress

Using a handbook course of for your enterprise slows its progress by instantly impacting the accuracy, effectivity and bills related to the AP course of –

- Pointless Operational Prices: Guide bill processing prices escalate from $13 to $50, prolonging accounts payable for as much as three weeks.

- Penalties and Strained Provider Relations: Practically half of suppliers face late funds, straining vendor relations and incurring late charges or penalties.

- Money Stream Chaos: 74% of mid-market and early-enterprise CFOs acknowledge that digitization of AP cost processes improves stability sheets.

- Fraud and Compliance Danger: A research by the ACFE discovered that 14% of fraud cases originated in accounting departments, with a median lack of $200,000 per occasion.

- Misplaced Productiveness: The common bill processing time in a handbook atmosphere can attain as excessive as 45 days. This represents misplaced time and useful human assets higher spent on extra impactful initiatives.

💡

What’s Accounts Payable Automation?

At its core, Accounts Payable Automation is the technology-driven strategy of changing the handbook duties concerned in managing an organization’s accounts payable into automated workflows. This encompasses every little thing from the preliminary receipt of an bill to the ultimate cost of the invoice.

By leveraging cutting-edge applied sciences equivalent to Synthetic Intelligence (AI), Deep Studying (DL), and Robotic Course of Automation (RPA), AP automation options are designed to attenuate human intervention, scale back errors, and speed up the processing time of transactions.

💡

AP Automation appears at answering one explicit query – how can every step of the accounts payable course of be 10x higher?

By automating the AP course of, companies can obtain:

- Elevated Effectivity and Productiveness: Automation considerably reduces the time required to course of invoices. Duties that after took days can now be accomplished in minutes, releasing up workers to deal with extra strategic, value-added actions.

- Value Financial savings: Automation reduces labor prices and helps keep away from late cost charges whereas maximizing early cost reductions.

- Improved Accuracy: AP automation minimizes human errors equivalent to duplicate funds and incorrect knowledge entry, thereby enhancing the accuracy of economic data and reporting.

- Enhanced Visibility and Management: Automated AP options present real-time insights into monetary knowledge, permitting for higher money movement administration and monetary decision-making. Corporations achieve a clearer view of their liabilities and may extra successfully handle their working capital.

- Compliance and Fraud Prevention: With built-in compliance checks and audit trails, AP automation instruments assist companies adhere to regulatory necessities and scale back the chance of fraud.

💡

Does AP automation work with different accounting methods?

AP automation methods can work with different accounting methods; many methods have varied integration choices, equivalent to API or middleware, to supply seamless knowledge switch between the completely different methods. This manner, AP automation software program can retrieve knowledge equivalent to invoices and buy orders from different accounting methods, course of them after which replace the data within the exterior accounting platform.

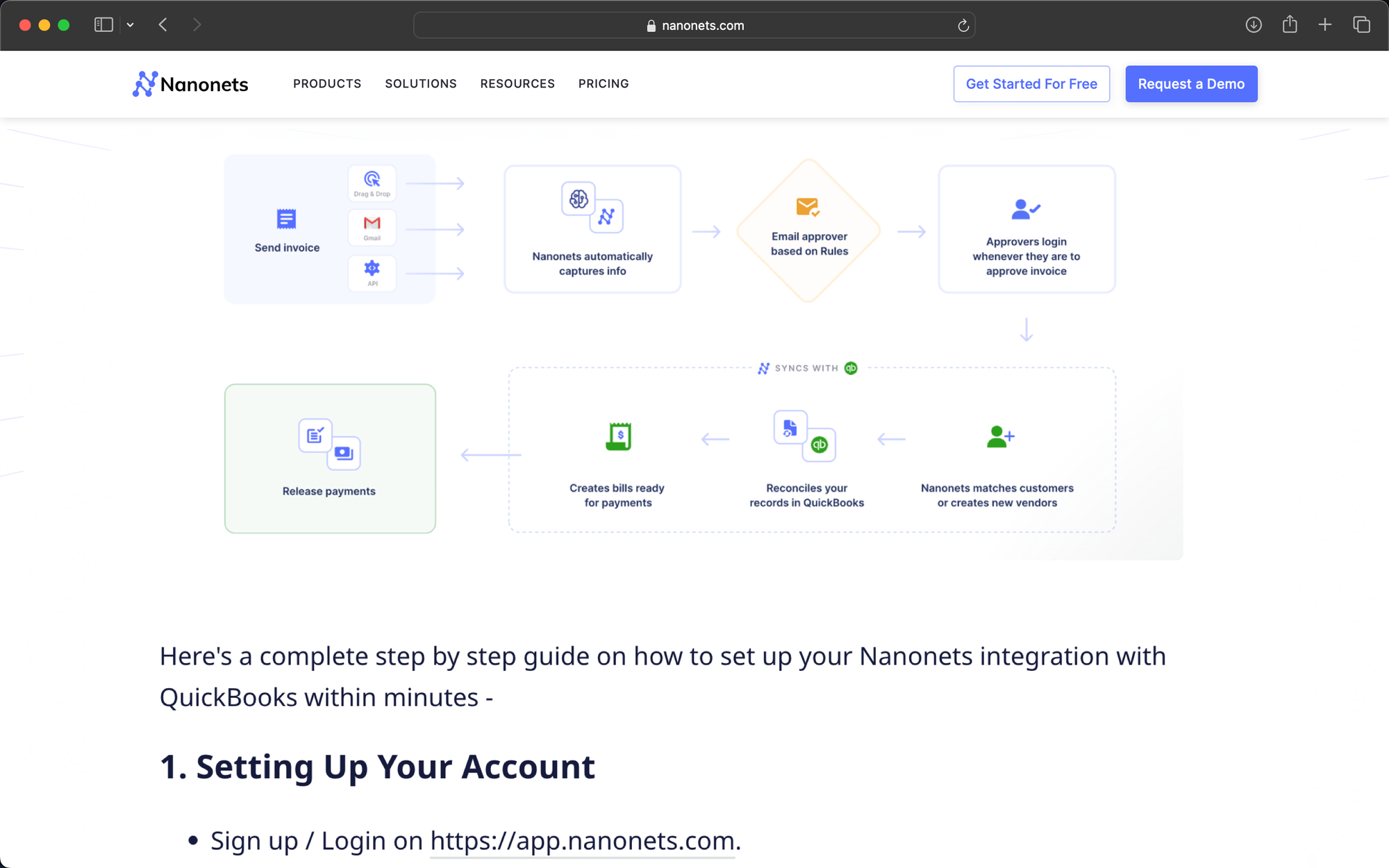

With the combination, companies can reap the benefits of the AP automation software program’s options and automation capabilities, whereas nonetheless utilizing the accounting software program that they’re snug with. Nanonets’ AP automation software program, for instance, could be built-in with different accounting methods, equivalent to QuickBooks and Sage.

7 Steps to automate your Accounts Payable

Automating your accounts payable means unlocking a brand new stage of effectivity and precision in your monetary operations. This journey includes seven crucial steps, every designed to streamline and improve the accounts payable course of from finish to finish.

Let’s undergo every step one after the other and perceive this.

You possibly can both select

and combine together with your ERP or accounting software program to implement the beneath steps and begin automating your accounts payable.

1. Centralize Your Bill Assortment

Motion Steps:

1. Select AP automation software program that helps automated bill import from sources the place you obtain invoices.

2. Configure the system to robotically import invoices from emails, google drives, vendor portals, and many others., right into a single repository.

Advantages: Invoices do not get mismanaged and begin getting processed as quickly as they arrive.

2. Implement Automated Knowledge Entry

Motion Steps:

1. Select AP software program with AI-powered OCR for knowledge extraction by testing which one is most correct in your invoices.

2. Guarantee it gives an integration together with your ERP / accounting software program.

3. Automate knowledge enter from invoices current within the central repository.

Advantages: Saves important handbook labor time and will increase knowledge entry accuracy.

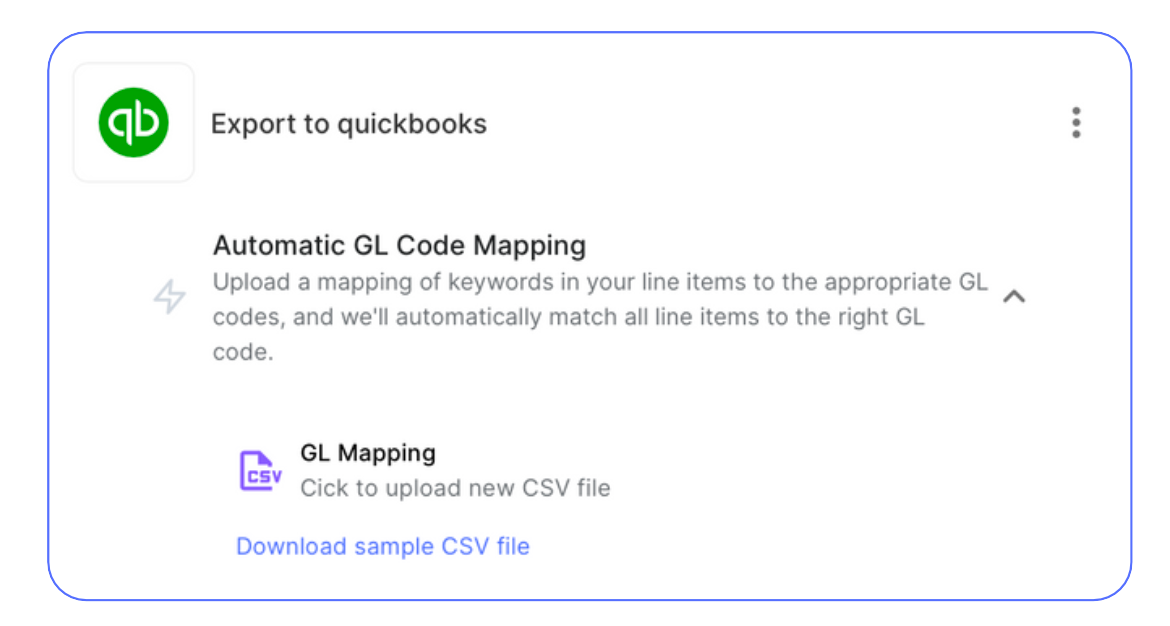

3. Automate GL Coding:

Motion Steps:

1. Choose your OCR instruments such that they make the most of NLP and LLM for GL coding.

2. Arrange the system to robotically code invoices after knowledge extraction utilizing OCR is full.

3. Export the GL codes together with the extracted knowledge into your ERP / accounting software program.

Advantages: Reduces handbook coding effort, enhances accuracy, and permits workers to deal with extra crucial duties.

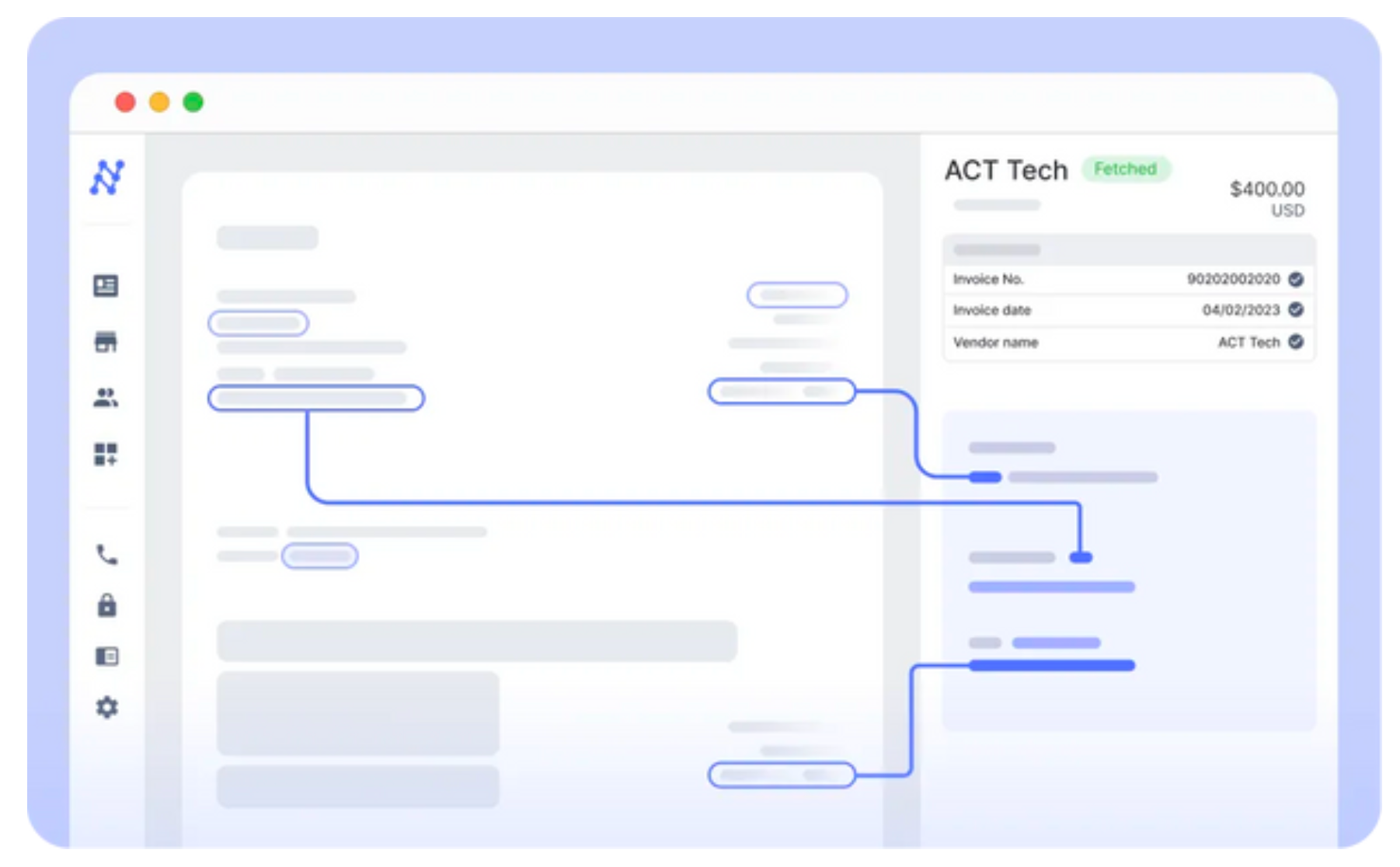

4. Set Up Automated Bill Verification:

Motion Steps:

1. Combine a system that helps 3-way matching by utilizing OCR to confirm invoices towards buy orders and supply notes.

2. Be sure that knowledge extraction OCR works effectively to your buy orders and supply notes along with your invoices.

3. Robotically flag discrepancies.

4. Create a course of to course of flagged invoices.

Advantages: Saves time spent verifying invoices and reduces errors, and the workforce can now discover time to successfully clear discrepencies.

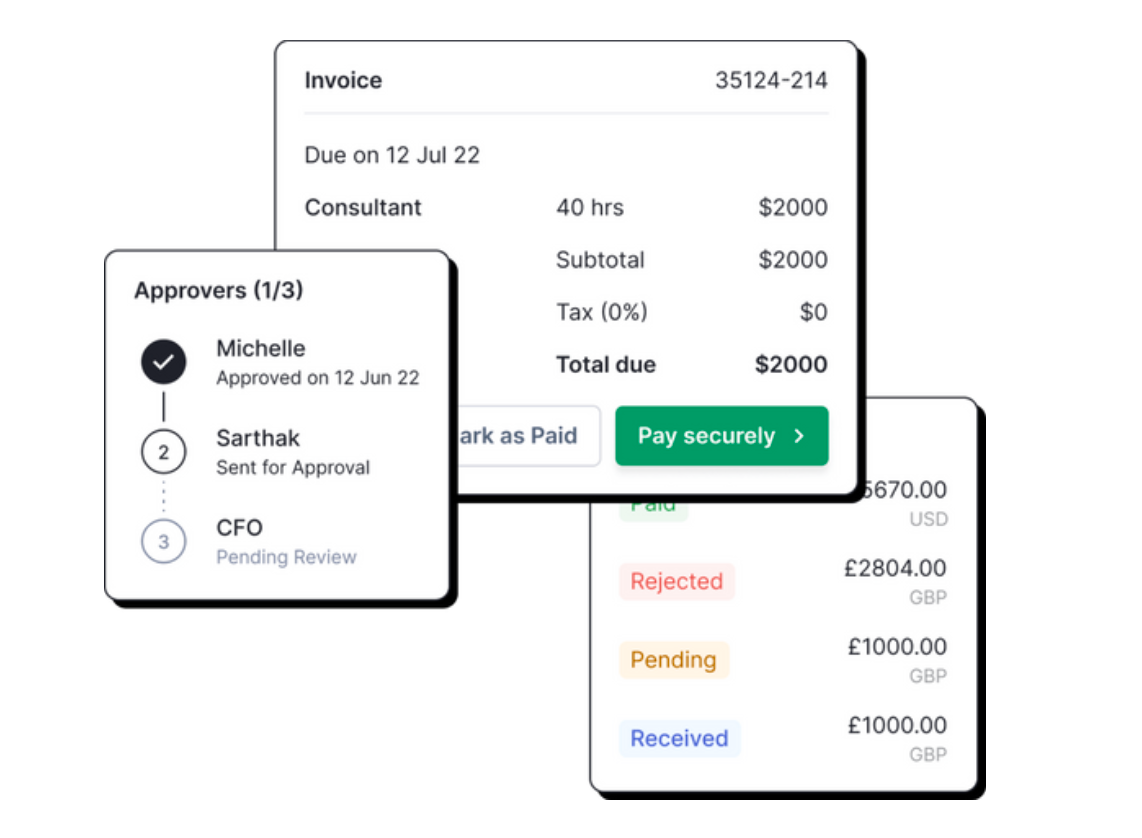

5. Streamline Approval Workflows:

Motion Steps:

1. Select software program the place approval processes dwell the place your group does (e.g., e-mail, Slack, Microsoft Groups).

2. Make sure the software program permits you to create a streamlined approval workflow primarily based in your wants.

Advantages: Accelerates approval occasions, reduces interruptions, and adapts to your operational movement.

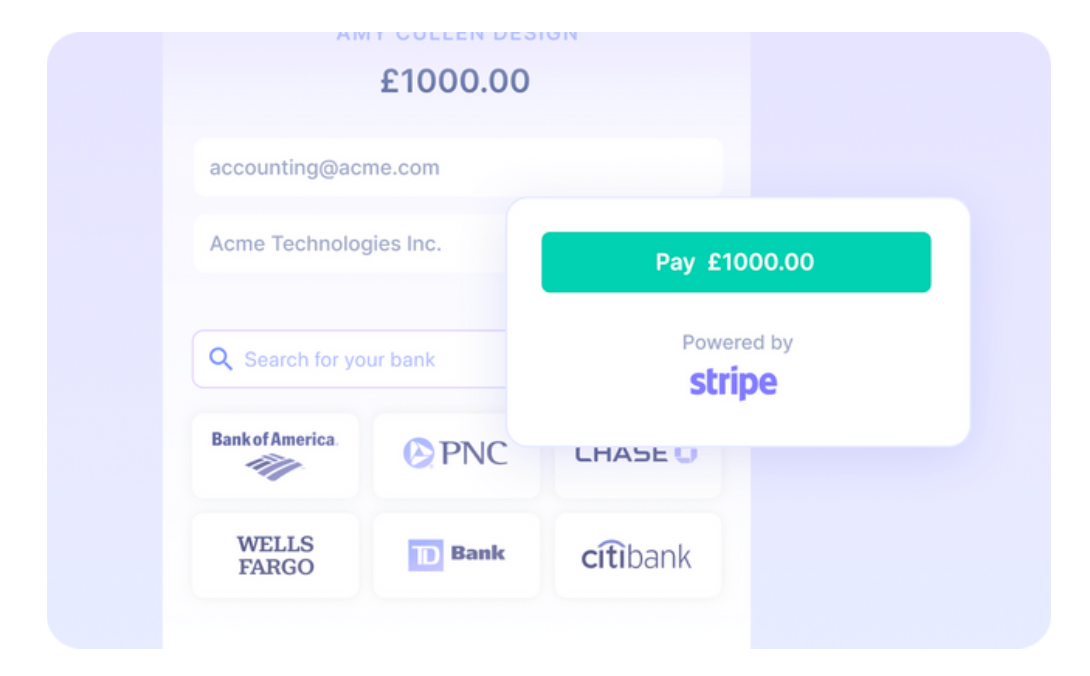

6. Facilitate Seamless Funds:

Motion Steps:

1. Guarantee your AP automation / ERP answer contains efficient direct cost processing capabilities, or make use of an applicable cost answer.

2. Configure the system to deal with foreign exchange and mitigate chargebacks.

Advantages: Improves provider relationships by dependable funds and handles forex conversions effortlessly.

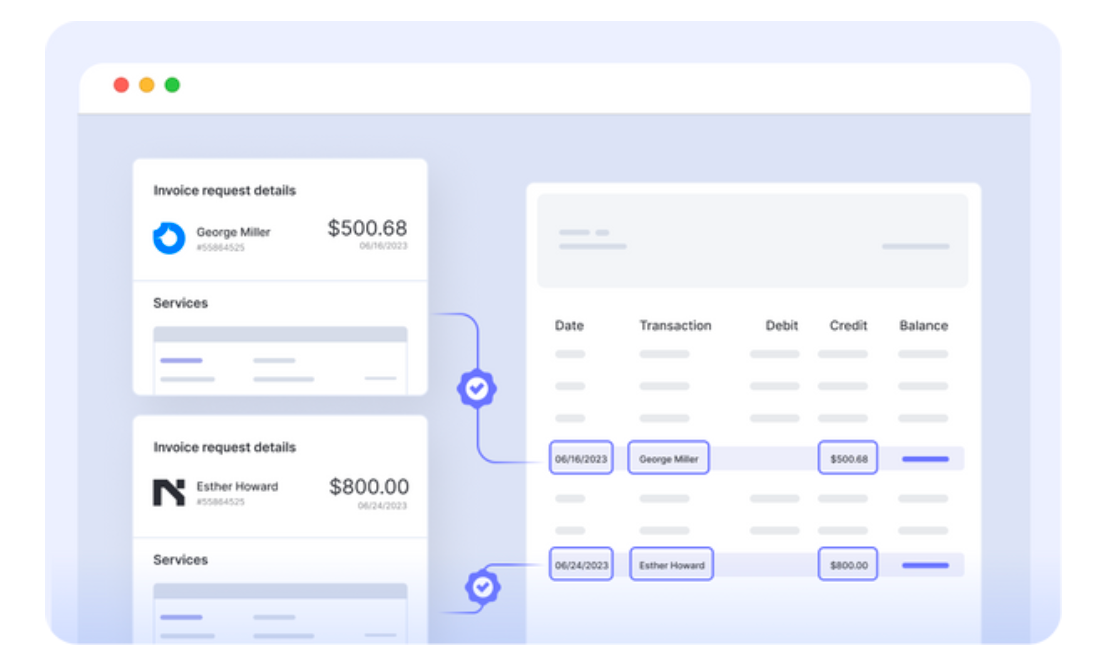

7. Automate Reconciliation Processes:

Motion Steps:

1. Select software program that provides computerized financial institution reconciliation and imports your financial institution statements.

2. Add your statements, and the system matches transactions with ledger entries robotically.

Advantages: Dramatically reduces the time wanted for closing books.

Automate your Accounts Payable with Nanonets

Even in the event you implement just some of the above steps, the impression in your accounts payable course of could be substantial.

Nanonets provides a dynamic AP automation suite that may be tailor-made to suit your enterprise’s distinctive wants. Integration with present ERP and accounting software program is seamless, guaranteeing a easy transition and minimal disruption to your operations. With our superior AI and state-of-the-art workflow automation, Nanonets can automate the tedious and error-prone duties related to managing accounts payable, releasing up your finance workforce to deal with extra strategic actions.

Getting Began with Nanonets

Automating AP automation with Nanonets is easy.

Enroll on app.nanonets.com.

Now, you may –

Day 0: Begin a Dialog

Schedule a name at your comfort to debate your wants with our automation consultants, and so they’ll present a personalised Nanonets demo.

Day 1: Assess your Wants

We are going to consider your present AP course of, pinpoint how Nanonets could make the largest impression, guaranteeing our answer aligns together with your targets.

Day 2: Setup and Customization

We’ll information you on utilizing Nanonets. You may arrange & automate your accounts payable workflow suited to you primarily based on our dialogue.

Day 3: Testing

After setup, check your workflow with actual knowledge throughout a normal 7-day trial (extendable on request). Our workforce will help in fine-tuning your workflow.

Day 7: Buy & Go Reside

After profitable testing, we’ll suggest a tailor-made, cost-effective pricing plan. When you’re proud of it, we’ll go dwell!

Ceaselessly: Empowering your Crew

We offer assets, periods, and steady customer support to make sure your workforce’s adoption, proficiency and confidence.

Buyer Tales

From small enterprises to multinational companies, these tales showcase the transformative impression of AP automation with Nanonets throughout industries.

SaltPay: Streamlining Vendor Administration with SAP Integration

Business: Fee Providers and Software program

Location: London, England

Problem: SaltPay confronted the daunting activity of manually dealing with 1000’s of invoices, which was each impractical and inefficient for managing their in depth vendor community.

Resolution: Nanonets stepped in with its AI-powered device for bill knowledge extraction, seamlessly integrating with SAP. This integration not solely enhanced knowledge accuracy but additionally considerably improved course of effectivity.

Outcomes: The implementation led to a 99% discount in handbook effort, enabling SaltPay to handle over 100,000 distributors effectively. This drastic enchancment has additionally led to a major enhance in productiveness and automation capabilities.

Tapi: Automating Property Upkeep Invoicing

Business: Property Upkeep Software program

Location: Wellington, New Zealand

Problem: With over 100,000 month-to-month invoices, Tapi wanted a scalable and environment friendly answer for bill administration in property upkeep.

Resolution: Using Nanonets’ AI device, Tapi automated bill knowledge extraction, facilitating fast integration with present methods that might be maintained by non-technical workers.

Outcomes: The method time was decreased from 6 hours to simply 12 seconds per bill, alongside a 70% price saving in invoicing and attaining 94% automation accuracy.

Professional Companions Wealth: Automating Accounting Knowledge Entry in Quickbooks

Business: Wealth Administration and Accounting

Location: Columbia, Missouri

Problem: Professional Companions Wealth sought to enhance the accuracy and effectivity of information entry for invoicing, as present automation instruments fell quick.

Resolution: Nanonets provided a tailor-made answer with exact knowledge extraction and integration capabilities with QuickBooks, enabling streamlined invoicing and automatic knowledge validation.

Outcomes: The accuracy of information extraction exceeded 95%, with a 40% time saving in comparison with conventional OCR instruments and an over 80% Straight By way of Processing price, minimizing the necessity for handbook intervention.

Augeo: Advancing Accounts Payable Automation on Salesforce

Business: Accounting and Consulting Providers

Location: United States

Problem: Augeo wanted an environment friendly accounts payable answer that would combine seamlessly with Salesforce, to handle 1000’s of month-to-month invoices with out the heavy burden of handbook processing.

Resolution: Nanonets supplied an AI-driven platform tailor-made for automated bill processing, facilitating simple integration with Salesforce for environment friendly knowledge administration.

Outcomes: The answer decreased bill processing time from 4 hours to half-hour every day, achieved an 88% discount in handbook knowledge entry time, and processed 36,000 invoices yearly with heightened accuracy and effectivity.

These buyer tales illustrate the broad applicability and important advantages of AP automation with Nanonets. By leveraging AI-powered instruments and seamless integrations, firms should not solely optimizing their accounts payable processes but additionally paving the best way for broader operational excellence. The journey of those organizations underscores the potential of AP automation to revolutionize monetary operations, driving effectivity, accuracy, and progress throughout industries.

Takeaway

The automation of the accounts payable operations streamlines the method of dealing with invoices, funds and different monetary transactions, thus enabling companies to enhance their effectivity, scale back prices, and enhance accuracy.

AP automation software program like Nanonets runs on AI and allows creation of AP workflows that may robotically collect information and paperwork from varied sources, equivalent to e-mail, scanned paperwork, digital information/photos, cloud storage, and ERP methods.

Aside from good seize, good AP automation instruments can even match and reconcile bills, handle all expense workflows, from creating expense studies to acquiring supervisor approvals, and seamlessly combine the month-to-month accounting shut course of with any ERP, accounting software program, or enterprise device desired.

AP automation software program equivalent to Nanonets can considerably help AP groups in:

- decreasing prices by 80% for companies

- growing the velocity of processing invoices by as much as 10 occasions

- optimizing AP days

- eliminating inaccuracies attributable to handbook checks and verifications

- figuring out and intelligently dealing with exceptions and routing them to the suitable particular person

- and figuring out/eliminating fraud, theft, double funds, and different inefficiencies.

Seeking to automate your handbook AP Processes? Ebook a 30-min dwell demo to see how Nanonets might help your workforce implement end-to-end AP automation.

Stream by Nanonets: Automate your Account Payable Course of